News

Speaker Abbas Reiterates Commitment Of 10th House To Support Tinubu’s Economic Reforms

…says Nigeria’s VAT collection, lowest in Africa

By Gloria Ikibah

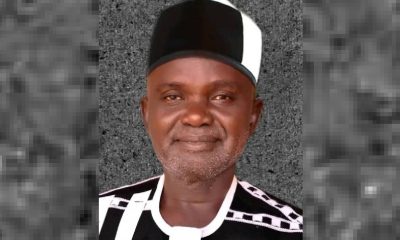

The Speaker of the House of Representatives Rep. Abbas Tajudeen, has said that Nigeria’s efficiency in the collection of Value Added Tax (VAT) is the lowest among its African peers, indicating significant inefficiencies in its tax system.

He expressed the preparedness of the 10th House to support the economic policies and programmes of President Bola Tinubu led-administration.

This, Speaker Abbas who stated this on Tuesday in Abuja while delivering his keynote address at the opening of a two-day retreat for members of the House, also noted that the support includes engagement with stakeholders on laws governing finance, tax, and oil sub-sectors of the economy, with the aim of causing positive reforms.

The legislative retreat on Economic Transformation and Development was organised by the House in collaboration with the Federal Inland Revenue Service (FIRS) and the Konrad Adenauer-Stiftung Foundation (KAS), with the theme: ‘Navigating Change: Legislative Strategies for Economic Transformation.’

Speaker Abbas noted that the House made a deliberate decision to focus on tax reforms and modernisation as well as a review of the implementation of the Petroleum Industry Reform Act (2021). “The overarching objective is to discuss and identify concrete legislative strategies for economic transformation,” he said.

He expressed his pleasure that the legislative retreat was taking place “at a point in our nation’s economic landscape when the current administration is diligently implementing policies and initiatives to steer our economy towards recovery, growth, and sustainable development.”

He stated that the commitment and foresight shown by the government in addressing economic challenges “deserve commendation, and it is imperative that we, as legislators, align our efforts to support and enhance these endeavours.”

He said: “As a critical arm of government, the legislature has a crucial role in shaping our nation’s economic transformation and development. Part of our law-making powers is the authority to enact tax reforms and strengthen resource governance mechanisms. By designing and implementing progressive tax policies, we strive to ensure a fair and efficient tax system that boosts revenue while fostering economic growth and equity. This involves not only broadening the tax base and simplifying tax codes but also enhancing compliance and minimising loopholes that benefit only the wealthy.

“Furthermore, the legislature’s oversight function is central in the governance of natural and financial resources. It ensures transparency and accountability in the exploitation and management of resources, which is essential for sustainable development. By holding government and private sectors accountable, the legislature helps prevent the mismanagement and corruption that can often undermine economic progress.”

He added that the retreat aimed to foster stakeholders’ engagement, ensure constructive dialogue, exchange ideas and offer insights on legislative strategies that will contribute to the economic transformation of our country.

“Accordingly, this forum allows us to take a deep dive into the tax reforms instituted by President Tinubu and undertake a review of the implementation of the Petroleum Industry Act (2021). We consider these two initiatives vital in our nation’s quest for economic recovery, transformation and growth. The two areas speak to both the oil and non-oil sectors of the Nigerian economy,” he said.

While stating that Nigeria’s tax revenue struggles are primarily due to narrow bases for indirect taxes, low compliance rates among taxpayers, substantial tax exemptions, and generally low tax rates, the Speaker added that the situation was compounded by “a lack of enthusiasm and morale for tax compliance, contributing to the nation’s underwhelming fiscal performance.”

He stressed: “Comparatively, Nigeria’s efficiency in collecting Value Added Tax (VAT) is the lowest among its African peers, indicating significant inefficiencies in its tax system.

“This trend of low tax revenue, coupled with a continued dependency on the increasingly unstable oil revenue, presents a major risk to Nigeria’s fiscal sustainability. It also highlights an important area for potential reform to boost revenue and stabilise the country’s economic framework.

“The lack of growth in non-oil revenue sources and the volatile nature of oil income underscore the urgent need for Nigeria to diversify its revenue base and enhance its fiscal management to ensure economic stability and growth.”

Speaker Abbas noted that several empirical studies had shown that Nigeria has the potential to further increase revenue if priority tax reforms are implemented. He stated that “the House stands ready to support the Executive to achieve its overall goal of reversing the negative trend.”

He also noted that this is in keeping with the Legislative Agenda of the House, which prioritises economic growth and development, focusing on economic restructuring, diversification and agricultural development and enacting tax reforms that will simplify our tax codes, expand the tax base and strengthen mechanisms for compliance.

The Speaker stressed: “Of particular interest to the House is increasing government revenues without unduly burdening the citizens, especially the vulnerable.”

Another important thematic area at the retreat, Speaker Abbas noted, was the potential of digitalisation and technology to transform tax administrations by enhancing the efficiency, transparency, and fairness of tax systems. He said these advancements enable tax authorities to collect, process, and utilise information more effectively, leading to improved operational capacities.

For taxpayers, he said integrating digital tools could simplify compliance, making it a more seamless part of everyday personal and business activities, thereby reducing friction and increasing ease of engagement with tax systems.

The Speaker noted that the second leg of the retreat centred on the Petroleum Industry Act (PIA), which represents a legislative milestone passed by the 9th Assembly. “This Act is not just a piece of legislation but a transformative blueprint designed to overhaul the petroleum industry, which is the backbone of our economy,” he said, adding that, “It’s an opportunity to align our actions with our aspirations, ensuring that this vital sector operates efficiently, transparently, and, most importantly, beneficially for every Nigerian.”

Speaker Abbas stated that the National Assembly is vital in ensuring continuous review of the PIA to ensure its effectiveness in a rapidly evolving industry landscape. This, he said, involves meticulously monitoring the implementation of the Act, analysing its impacts, and identifying areas where modifications may be necessary.

“For this reason, we are actively engaging various stakeholders at this retreat, including government bodies, industry experts, and community representatives.

“Today’s sessions are designed to gather diverse perspectives and insights, which will be essential for making informed amendments that address emerging challenges and ensure that the Act meets its intended objectives.

“This iterative process will not only help in fine-tuning the Act but also ensure that it remains aligned with the broader economic and environmental goals of Nigeria,” he said.

News

Edo guber: APC’s Okpebholo wins at Tribunal

By Kayode Sanni-Arewa

Edo State Governor, Monday Okpebholo has been confirmed as Governor by the Edo Petition Tribunal in Abuja.

He had earlier won on September 21, 2024 on the political cum electoral turf when he clinched the first prize.

He defeated Asue Ighodalo of the Peoples Democratic Party, PDP, his closest competitor, who was banking on the power of incumbent PDP administration in the state to win.

Ighodalo and the PDP had filed their petition at the Tribunal challenging Okpebholo and APC’s victory at the poll.

But delivering its judgement in the petition on Wednesday, the Edo Governorship Election Petitions Tribunal ruled that PDP petition failed for lack of competent witnesses

The Tribunal said that the PDP petition challenging the outcome of the 2024 governorship election also failed, because of insufficient evidence to substantiate claims of electoral malpractice.

The petitioners had alleged that the failure to properly record electoral materials prior to the election had affected the results.

However, the Tribunal found that while documents were submitted, no witnesses were called to properly authenticate them, rendering the evidence inadmissible.

Of the 19 witnesses presented by the petitioners, 14 were ward and local government agents, while their star witness, who claimed to be a director of strategy, played no direct role in the conduct of the election.

The Tribunal noted that none of these witnesses provided testimony on the alleged failure of prior recording of electoral materials, deeming them incompetent to testify on the matter.

Furthermore, the Tribunal emphasized that for allegations of over-voting to be proven, petitioners must provide oral evidence, in line with the precedent set by the Supreme Court.

It stressed that it was bound to adhere strictly to the Supreme Court’s roadmap in adjudicating election disputes.

News

Nigerian Immigration Operatives Nab 51 Illegal Migrants From Mali In Nyanya, Abuja

According to the statement, the arrests took place on Monday, March 31, 2025, following credible intelligence.

The Nigeria Immigration Service (NIS) has said that its officers arrested 51 illegal migrants from Mali in New Nyanya, Karu Local Government Area of Nasarawa State.

The NIS made this known in a statement issued on Wednesday by its Public Relations Officer, ACI A.S. Akinlabi.

According to the statement, the arrests took place on Monday, March 31, 2025, following credible intelligence.

A breakdown of the arrested migrants revealed that 11 were female, while 40 were male, with ages ranging between 16 and 19 years.

Akinlabi stated that preliminary investigations revealed that the arrested illegal migrants may have been victims of Trafficking in Persons (TIP) and Smuggling of Migrants (SOM), as they were found without valid travel documents or residence permits.

“Preliminary investigations conducted by the Service suggest that the migrants may have been victims of Trafficking in Persons (TIP) and Smuggling of Migrants (SOM), as they were found without valid travel documents or residence permits,” Akinlabi stated.

The statement further noted that the detained individuals have been taken into the custody of the Service for further profiling and investigation.

“The arrested individuals have been taken into the custody of the Service for further profiling and investigation to determine the circumstances of their migration and any potential involvement of trafficking or smuggling networks or syndicates,” Akinlabi added.

Akinlabi further stated that the NIS would determine the circumstances surrounding their migration and uncover any potential involvement of trafficking or smuggling syndicates.

The statement added, “The Nigeria Immigration Service remains committed to ensuring that Nigeria’s borders are protected against illegal migration while upholding the rights of migrants who comply with the country’s immigration laws.

“The Service continues to work closely with relevant authorities and stakeholders to combat smuggling of migrants and counter trafficking in persons effectively.

“The NIS reassures the general public of its unwavering commitment to National Security and Migration Management while encouraging citizens to report suspicious migration activities to the nearest NIS Commands and Formations.”

News

Police Exhume Engineer’s Body From Shallow Grave In Delta Community

The remains of an engineer, Chigozie Udalu, have been exhumed from a shallow grave in Akwukwu-Igbo, the headquarters of Oshimili North Local Government Area in Delta State.

Recall that the engineer, who was contracted to construct offices in Akwukwu-Igbo, was murdered and buried in a shallow grave.

Though the incident occurred in December 2024, details only emerged recently after two suspects were arrested in connection with the crime.

Assailants Murder Construction Engineer In Delta State Community, Bury In Shallow Grave

A community source revealed that the suspects, identified as Tiv youths from Benue State, allegedly killed the engineer and concealed his body on a farm.

“Two Tiv boys from Benue State have been arrested in connection with the crime. They buried the engineer’s remains in a shallow grave on a farm,” the source stated.

The Delta State Police Command confirmed the incident, with spokesman Edafe Bright acknowledging that an investigation was ongoing.

“We are aware of the incident, and our men are working to ensure others involved are apprehended,” Bright revealed.

On Wednesday, the remains of the victim were exhumed by the police and the Delta State government.

A police source revealed that the arrested suspects alleged the engineer owed them money and often verbally abused them.

“They had also intended to steal cement from the site but perceived the engineer as an obstacle. On December 10, 2024, they planned to strike him with a 2×2 plank but assumed he was physically strong and might overpower them.

“On December 11, the Tiv boys put a rope around his neck from behind, causing strangulation. Upon his death, they buried him in a shallow grave on the farm,” the source explained.

“Following the murder, the suspects reportedly completed their contract at the site and stole the victim’s phone, making several attempts to transfer money via a mobile app.

“Additionally, the landlord of the construction site was accused of being involved in money rituals. In an attempt to clear his name, he was taken to shrines to swear an oath before the victim’s family.

“The landlord recounted his ordeal, stating that he nearly gave up on the case due to the challenges he faced with the State Criminal Investigation Department (SCID) in Asaba.

“However, a police officer suggested he visit Ekpan Divisional Police Officer (DPO), CSP Aliyu Shaba. The officer assured him that within 30 days, the truth would be uncovered.

“Upon arrival at Ekpan, the landlord briefed the DPO, who assembled his team and employed sophisticated investigative techniques, leading to the arrest of two suspects.

“One of the suspects later confessed to knowing the location where the engineer was buried,” the source said.

A young man was also arrested and transferred to the SCID for openly threatening the victim in the presence of the landlord, further highlighting the brutality of the crime.

Of the four individuals arrested, two are considered principal suspects. Meanwhile, a manhunt is ongoing for the remaining suspects who are still at large.

-

News17 hours ago

News17 hours agoTinubu Sacks NNPC Board, Appoints New Leadership

-

News17 hours ago

News17 hours agoHe came to propose to me, and died in my hostel

-

News11 hours ago

News11 hours agoVideo: Watch Dr Nwambu of CCLCA analyse ex-River HoS allegations against suspended Gov Fubara

-

News17 hours ago

News17 hours agoAkpabio, Yahaya Bello Conspired To Assassinate Me – Senator Natasha Makes Fresh Allegation

-

Business6 hours ago

Business6 hours agoBank stops transfer fees on online transactions

-

Sports17 hours ago

Sports17 hours agoSuper Eagles Must Defeat South Africa to qualify for 2026 World – Eric Chelle

-

News17 hours ago

News17 hours agoWike sympathies with Ortom over younger brother’s death

-

Sports18 hours ago

Sports18 hours agoSaka scores as Arsenal beat Fulham to close gap on Liverpool