News

CBN Issues Approved Guidelines For BDCs, Operators Get December Deadline To Reapply

The Central Bank of Nigeria (CBN) has issued its approved guidelines to regulate the activities of Bureau de Change (BDC) operators in the country.

In its new circular released on Wednesday, the minimum capital base for Tier-1 BDCs is N2bn while that of Tier-1 is set at N500m. Also, the mandatory caution deposit of N200m for tier-1 BDC licence holders was removed while the N50m for tier-2 licence holders was waived.

In the circular to BDCs, CBN’s Director of Financial Policy and Regulation, Haruna Mustafa, said the approved guidelines take effect from June 3, 2024.

The apex bank directed existing BDCs to reapply for new licenses and meet the minimum capital requirements for the license category applied for within six months from June 3, 2024.

The CBN banned BDC operators from street trading, international outward transfers, financing of political activities, dealing in gold or other precious metals, dealing in crypto assets or any other virtual assets, amongst others.

The CBN insisted that BDCs must channel their transactions through digital means once it is above USD500.

“As part of reforms to re-position the Bureau De Change (BDC) sub-sector to play its envisioned role in the foreign exchange market in Nigeria, the Central Bank of Nigeria (CBN) issued the Draft Operational Guidelines for BDC Operations in Nigeria in February 2024, for stakeholder comments/inputs,” the circular partly read.

“Following the conclusion of the stakeholder consultations and in the exercise of the powers conferred on it by Section 56 of the Banks and Other Financial Institutions Act (BOFIA) 2020, the CBN hereby issues the attached Regulatory and Supervisory Guidelines for Bureau De Change Operations in Nigeria 2024 for compliance by all operators and promoters of proposed BDCs in Nigeria.

“The guidelines, amongst others, introduce new licensing requirements and categories of BDCs as well as revise the permissible activities, financial requirements, corporate governance requirements and AML/CFT/CPF provisions for BDCs.

“All existing BDCs shall: Re-apply for a new license according to any of the Tiers or license categories of their choice as provided in the Guidelines.

“Meet the minimum capital requirements for the license category applied for within six (6) months from the effective date of the Guidelines.

“Applicants for New BDC License Applicants for a new BDC license are required to meet the conditions for the grant of license in accordance with the Tier or category of BDC chosen as stipulated in the Guidelines. Receipt and processing of applications for license shall commence from the effective date of the Guidelines.”

The CBN insisted that BDCs must channel their transactions through digital means once it is above USD500.

The regulations stated: “The following conditions shall apply for the sourcing of foreign currencies by BDCs:

“i. Sellers of the equivalent of USD10,000 and above to a BDC are required to declare the source of the foreign exchange and comply with all AML/CFT/CPF regulations and foreign exchange laws and regulations.

“ii. Customers may sell foreign currencies in their individual domiciliary accounts with Nigerian banks to BDCs. All such sales shall be credited to the BDC’s Nigerian domiciliary account.

“iii. Payments for all digital/transfer purchases of foreign currency by a BDC shall be by transfer to the customer’s Naira account. If the customer is non-resident (whether Nigerian or not), a BDC may issue the customer a prepaid NGN card. Where such a card is issued, relevant maximum credit and cumulative limits, in line with relevant Know Your Customer (KYC) requirements, shall apply.

“iv. Payments to customers for cash purchases of foreign currency, the equivalent of above USD500, shall be by transfer to the customer’s Naira bank account. If the customer is non-resident (whether Nigerian or not), a BDC shall issue the customer a prepaid NGN card.

“v. Payments to customers for cash purchases of foreign currency of the equivalent of USD500 and below may be made in cash.”

The Nigerian currency has experienced an unprecedented volatility in the last one year since the assumption of President Bola Tinubu. The Naira, which was around N700/1$ in May 2023, descended to an all-time low of about N1,900/1$ in February 2024 before it climbed in April to about N1,100/$1 and then embarked on a sudden descent to N1,600/$1 in May 2024.

CBN Governor, Olayemi Cardoso, on Tuesday, attributed the instability in the foreign exchange market to “seasonal demands”.

News

Insecurity! Bandits k!ll 7 farmers, burn 50 bags of maize in Niger state

Bandits have k!lled seven farmers, including a vigilante, and burnt 50 bags of maize inside a truck in Bangi, Mariga Local Government Area of Niger State.

Sources on Saturday, November 23, told Daily Trust that the victims had gone to bring the harvested maize home from their farm when the bandits ambushed them, k!lled all the occupants in the truck and set the truck.

Bandits have killed seven of our farmers who had gone to farm to bring the maize they had harvested home. The attackers hid and waited until after the victims had loaded the 50 bags of maize into the truck and were about to take off to return home when they opened fire on them. After k!lling the victims, they also set the truck and the 50 bags of maize already loaded ablaze,” a source said.

He said it was difficult for farmers in Mariga to harvest their crops this year due to k!llings and kidnappings by bandits.

News

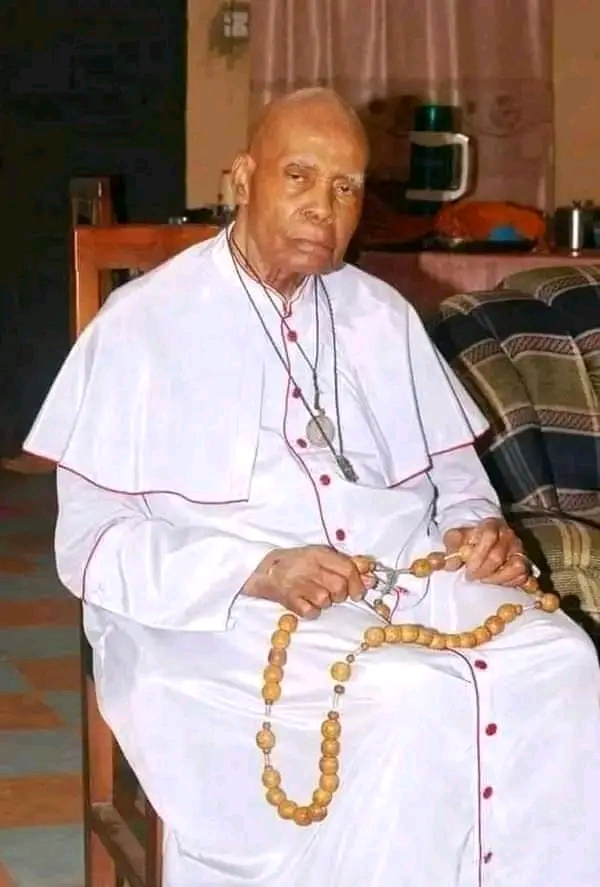

SAD! Roman Catholic Oldest Priest Monsignor Thomas Oleghe dies at 103

The Bishop of the Catholic Diocese of Auchi, most Rev. Dr. Gabriel Ghieakhomo Dunia announces the passing unto eternal glory of Rt. Rev. Monsignor Thomas Oleghe, at the Immaculate Conception Cathedral Auchi, during the solemnity of Christ the King

Rev. Monsignor is the oldest Catholic Priest in Nigeria.

Monsignor Oleghe death is very remarkable as the centenarian died during the feast of Christ the King.

The demise of the priest of the order of Melchizedek should be best described as (TRANSITION TO GLORY)

News

NECO accredits more foreign schools for SSCE, BECE

The National Examinations Council (NECO) has given accreditation to more foreign schools to write the Senior School Certificate Examination (SSCE) and the Basic Education Certificate Examination (BECE).

The Acting Director, Information and Public Relations, Mr. Azeez Sani, disclosed this in a statement.

The newly accredited schools are in Niger Republic and Equatorial Guinea.

“NECO Accreditation Team visited the Schools to assess their readiness to write the SSCE and BECE.

“The Accreditation Team inspected classrooms, laboratories, libraries, computer laboratories, workshops, examination halls and sport facilities to determine their adequacy and suitability for NECO Examinations.

“After a thorough evaluation and comprehensive assessment, the schools were granted full SSCE and full BECE accreditation status,” the statement said.

The statement added that the accreditation of additional foreign schools is a testament to NECO’s commitment to providing quality education and assessment beyond the shores of Nigeria.

“With its expanding global presence, NECO is poised to become a leading examination body in Africa, offering opportunities for students worldwide to benefits from its expertise, thus contributing to the advancement of education in Africa and beyond.”

In another development, the statement disclosed that candidates are participating in the on-going NECO SSCE External in Diffa, Niger Republic.

“The UNHCR School, Diffa, Niger Republic is the first NECO SSCE External Centre outside Nigeria.”

NECO examinations are now written by candidates in Benin Republic, Togo, Cote’ d’Ivoire, Niger Republic, Equatorial Guinea and Saudi Arabia.

-

News10 hours ago

News10 hours agoSimon Ekpa: FG’s attempt to extradite self acclimated freedom fighter may hit brickwall

-

News19 hours ago

News19 hours agoNUJ-FCT Elections: Comrade Ike To Flag-Off Campaign With Free Medical Checks, Treatment

-

News24 hours ago

News24 hours agoAngry mob sets two revenue collectors ablaze in Anambra

-

Metro20 hours ago

Metro20 hours agoAnambra Police arrest native doctor, one other for armed robbery, kidnapping

-

News21 hours ago

News21 hours agoPolice rescue abducted Emirates Airlines Airport Services Manager

-

News21 hours ago

News21 hours agoHoR to lead historic march, other Key initiatives against gender-based violence

-

News21 hours ago

News21 hours agoPresident Tinubu Leaves Brazil After G20 Summit

-

News22 hours ago

News22 hours agoWike Aide to Ugochinyere : You’re a political misfit in Hushpuppi’s mode