News

Interswitch In Huge Mess Over N33 billion Fraud

Interswitch Limited, one of the Nigeria payment platforms, is currently engulfed in a whooping N33 billion fraud.

Interswitch Limited, in a bid to recover the huge loss, has instituted a suit against Access Bank Plc and 53 others before a Federal High Court, Lagos.

Named as defendants alongside Access Bank Plc in the suit marked FHC/L/CS/2140/2023, are: Baines Credit Microfinance Bank Ltd; Bank Of Industry; Bluridge Microfinance Bank Limited; Branch International Financial Services; Credit Direct Limited; Ecobank Plc; Eartholeum Networks Limited; Fairmoney Microfinance Bank; Fewchore Finance Company Ltd; Fidelity Bank Plc; First City Monument Bank Plc; First Bank Of Nigeria Limited; Globus Bank Plc; Guaranty Trust Bank Plc; Hasal Microfinance Bank Ltd; Heritage Bank Plc; Infinity Trust Mortgage Limited; Izon Microfinance Bank Ltd and Jaiz Bank Plc.

Others include; Keystone Bank Plc; Kuda Microfinance Bank Ltd; La Fayfttee Microfinance Bank Ltd; Lapo Microfinance Bank Ltd; Links Microfinance Bank Ltd; Lotus Bank Plc; MIM Finance Company Ltd; New Edge Finance Limited, 29, Nigerian Navy Microfinance Bank Limited; Nirsal Microfinance Bank Limited; Opay Digital Services Limited 32. Pagatech Limited; Palm Pay Limited; Paralex Bank Plc; Polaris Bank Plc; Providus Bank Plc; Renmoney Microfinance Bank Limited; Rolez Microfinance Bank Limited; Smartcash Payment Services Bank Limited; Sparkle Microfinance Bank Limited; Stanbic Ibtc Bank Plc; Standard Chartered Bank Plc and Sterling Bank Plc.

Also listed as defendants in the suit are: Suntrust Bank Plc; Taj Bank Limited; Tangerine Money Microfinance Bank Ltd; Touchgold Microfinance Bank Ltd; Union Bank Of Nigeria Plc; United Bank Of Africa Plc; Unity Bank PIc; Vale Finance Limited; VFD Microfinance Bank Limited; Wema Bank Plc and Zenith Bank Plc.

Interswitch’s suit filed by its lawyer, Emmanuel Okorie, said it’s motion on notice is pursuant to Order 3 Rules 1, 6 and 9 of the Federal High Court, (Civil Procedure) Rules 2019, and under the court’s inherent jurisdiction.

The payment platform, Interswitch in a bid to recover the money is asking the court to determine the followings: “whether having regards to the Central Bank Guidelines Nos BPS/DIR/GEN/CIR/02 004 of 2015, BPS/ DIR/GEN/CIR/05/011 of 2018, any sum/monies to the extent of the sums Illegally received (following the system glitch of the Plaintiff’s server) of the respective Customer bank’s accounts of the 1,7, 8, 11-15, 20, 21, 34, 35, 41, 43, 48,49, 50, 53 and 54 defendants’ Customers Account Holder (1st level beneficiaries) listed in the document marked exhibits A1 -A20 attached herewith and domiciled with the stated defendants should not be blocked and or placed a No Debt restrictions by the aforementioned Defendants

“Whether having regard to the Central Bank guidelines Nos BPS/DIR/GEN/CIR/02.004 of 2015; BEY DIR/GEN/CIR/US/011 of 2018, a sum/monies to the extent of the sum is illegally received following the system glitch in the Plaintiff’s server) into the respective Bank accounts of the 1, 7, 8, 9, 11-15, 20, 21, 34, 35, 41, 43, 48, 49, 53 and 54 defendants’ Customers Account Holders (1st level beneficiaries) as listed in the document marked EXHIBITS A1- A30 attached herewith and domiciled with the aforementioned Defendants should aut be retumed to the Plaintiff?

“Whether having regard io the Central Bank Guidelines Nos. BPS/DIR/GEN/CIR/02.004 of 2015; BEY DIR/GEN/CIR/US/011 of 2018, any sum monies to the extent of the sums illegally received (following the system glitch in the Plaintiff’s server) into the respective customers bank accounts of the 1, 9, 12-14, 48 and 48 defendants customers’ account Holder (2nd level beneficiaries) as listed in the document marked EXHIBITS C attached herewith and domiciled with the aforementioned Defendants Respondents should not be blocked and or placed a ‘No Debit restrictions by the aforementioned defendants.

“Whether having regard with the Central Bank guidelines Nos. Bry/DIR/GEN/CIR/2 004 of 2015; BPS/DIR GEN/CIR/05/011 of 2018, any sum monies to the extent of the sums Illegally received (following the system glitch in the Plaintiff’s server) into the respective Bank accounts of the 1, 9, 12-15, 48 and 54 Defendants Customers Account Holders (2nd level beneficiaries) as listed in the document marked Exhibits C attached herewith and domiciled with the aforementioned Defendants should not be returned to the Plaintiff.

“Whether having regard to the Central Bank of Nigeria’s Regulatory Framework for Banking Verification (BVN) Operations and Watchlist for the Nigerian Banking Industry October 2017 the 1-40 defendants should not be mandated to block, freeze place a lien and or placing Post No Debit restriction on the 1- 54 Defendants Customers Account holders as listed in the document marked EXHIBIT B! – BY attached herewith and domiciled with the aforementioned defendants, until the illegal sums monies received from the respective Customer Account Holders as listed in the document marked EXHIBITS A’ A™ attached herewith are fully retumed

“Whether having regard to the Central Bank of Nigeria’s Regulatory Framework for Banking Verification (BVN) Operations and Watchlist for the Nigerian Banking industry October 2017 the sums monies to the extent of which illegally entered into the accounts ash ted in Exhibits A A™(1st level beneficiaries found in all the accounts Linked to the Bank Verification Numbers of the 1- 54 Defendants Customers/Account Holders as listed in the document marked EXHIBITS B’ – B™ attached herewith and domiciled with the 1- 54 defendants should not be immediately returned to the plaintiff hereof

The Plaintiff said if the above is determined in its favour, seeks the following reliefs: “a declaration that by the Provisions of the Central Bank of Nigeria Act 2007 and Central Bank guidelines now BPS/DIR/GEN/CIR/02.004 of 2015; BEY DIR/GEN/CIR/US/011 of 2018, the 1st–54th Defendant as Deposit Money Banks Switches and Payment Service Providers in the Nigerian Banking Financial and Payment industry, have a duty and obligation to protest the banking and payment industry from abuse by dishonest user and to take reasonable steps to forestall any damages of the banking and payment system whenever any abuse fraud is within its knowledge or has been brought to its attention

“An order of Mandatory Injunction directing the 1, 7, 8, 9, 11-15, 20, 21 34 35, 41, 43, 48, 49, 53 and 54 defendants to comply with the Central Bank guidelines Nos. BPS/DIR/GEN/CIR/12/004 of 2015, BPS/DIR/GEN CIR/08/011 of 2018 and the Central Bank of Nigeria’s Regulatory Framework for Banking Verification (BVN) Operation and Watchlist for the Nigerian Banking Industry October 2017 by blocking or placing ‘No Debit restriction on the sum monies to the extent of the sums illegally received (following the system glitch in the Plaintiff’s server) into the respective bank accounts of the aforementioned Defendants’ Customers Account Holders (1st level beneficiaries), domiciled with the aforementioned defendants, pending the complete full refund, reversal of the entire sum Unlawfully and illegally transferred to the said accounts.

“An order of Mandatory Injunction directing the 1st to 54 defendants to comply with the Central Bank guidelines numbers; BPS/DIR/GEN/CIR/02.004 of 2015; BEY DIR/GEN/CIR/US/011 of 2018 and the Central Bank of Nigeria’s Regulatory Framework for Banking Verification (BVN) Operations and Watchlist for the Nigerian Banking industry, October 2017 by blushing freezing, placing a lien and or placing Post No Debit restriction on the 1 to 54 defendants Customers Account holders, domiciled with the aforementioned Defendants Respondents, pending the complete/full refund reversal of the entire sum unlawful y and illegally transferred to the account numbers listed in the document marked EXHIBITS A1 – A20.

“An order of Mandatory injunction directing the 1, 9, 12-14, 41 and

48″ defendants to comply with the Central Bank guidelines Nos. BPS/DIR/GEN/CIR/02/004 of 2015, BPS/DIR/CIR/05/011 of 2018 and the Central Bank of Nigeria’s Regulators Framework for Banking Verification (BVN) Operations and Watchlist far the Nigerian Banking industry October 2017 by blocking of placing No Debit restriction on the sum montes to the extent of the sums illegally received (following the system glitch in the Plaintiff’s server) into the respective Bank accounts of the aforementioned Defendants Customer/Account Holders (2nd level beneficiaries) as listed in the document marked F Exhibits C attached herewith and domiciled with the aforementioned Defendants pending the complete full returned) rev ena of the entire sum Unlawfully and illegally transferred to the said accounts

“An order of Mandatory Injunction directing the 1, 7, 8, 11-15, 20, 21, 34, 35, 41, 43, 48, 49, 50, 53 and 58 Defendants/Respondents to Freeze Place a lien and Post No Debit on any and all accounts belonging to and in the name of the 8 Defendant hereof Eartholeum Networks Limited to the extent of the sum illegally received (following the system glitch in the Plaintiff’s sever) into the said accounts of the 8 defendant (Eartholeum Networks Limited), domiciled with the aforementioned defendants pending the returned/reversal of the entire sum Unlawfully and illegally transferred to the said accounts

“An order against the 1,7 8, 11-15, 20, 21, 41, 43, 48 49, 50, 53 and 54 Defendants (1st level beneficiaries) to reverse and pay to the Plaintiff all sums wrongfully, illegally and illicitly debited from the Plaintiff Settlement/ Collection Account and Illegally transferred into the aforementioned Defendants’ various customers bank accounts to the sum, domiciled with the aforementioned Defendant

“An order against of the 1st to 54th defendants, to reverse, refund and to pay to the Plaintiff all sum illegally and illicitly debited from the Plaintiff settlement/collection account as listed in EXHIBITS A1- A20 (11” level beneficiaries) standing in credit in all the accounts linked to the Bank Verification Numbers (BVN} 54th Defendant its Customers Account Holders, domiciled with 1st to 54th defendants.

Interswitch Limited, in an affidavit in support of the motion on notice, deposed to by its divisional Head, Engineering Department, Abdul Hafiz Ibrahim, states among others: “That following system glitch in the Plaintiff’s system, some service merchants agents of the plaintiff carrying on business as digital financial services agents with accounts domiciled with the 1, 7, 8, 11-15, 20, 21, 34, 35, 41, 43, 45, 49, 50, 53 and 54 defendants, took advantage of the said glitch and unlawfully initiated multiple refunds for successful card transaction. The said multiple refunds were erroneously settle into these respective bank accounts domiciled with the 1, 7, 8, 11-15, 20, 21, 34, 35, 41, 43, 45, 49, 50, 53 and 54 defendants.

“That the plaintiffs agents upon unlawfully received credits in excess of the successful card transactions in their accounts domiciled with the 1,7, 8, 11-15, 20, 21, 34 38, 41, 43, 45, 49, 50, 53 and 54, defendants proceeded to dissipate the monies by unlawfully transferring the monies to other customers, accounts (2nd level beneficiaries) domiciled in 1, 9, 12, 13, 14, 41 and 48 defendant.

“That the plaintiffs service’s agents took advantage of this system glitch to carry out over 200 transactions exposing the plaintiff to humongous liability to the tune of N33, 792, 703,656 (Thirty-Three Billion, Seven Hundred and Ninety-Two Million, Seven Hundred and Three Thousand, Six Hundred and fifty-Six Naira) received in various accounts domiciled with the 1st- 54th defendants and other financial institutions

“That by virtue of Exhibit C hereof, the Plaintiff’s Service agents/Merchant proceeded to illicitly transfer the sum/monies illegally received to various accounts domiciled with the (7, 9th, 12th, 13”, 14th, 41st and 48th Defendants to the tune of N924, 308, 819.000 (Nine Hundred and Twenty Four Million, Three Hundred and Sixty Eight Thousand Eight Hundred and Nineteen Naira) Attached and marked Exhibit C is the list of the unlawful 2nd beneficiaries accounts showing the amounts received upon complaint by the plaintiff

“That upon realizing this glitch an immediate complaint was made to the defendants and the said defendants placed a temporarily no-debit freeze on the affected accounts to avoid further dissipation of the Plaintiffs monies, as the lst of the unlawful 1st beneficiaries accounts showing the amounts received upon complaint by the plaintiff .

“That in compliance with the Central Bank of Nigeria Regulatory Framework for Banking Verification (BVN) Operations and Watchlist for the Nigerian Banking Industry, the account numbers into which the said funds were transferred through the Nigeria Inter-Bank Settlement database and the Bank Verification Numbers (BVN) of the said accounts holders/customers revealed that the perpetrators of this fraud and owners of the said accounts numbers also own several other accounts in other financial institutions with which they perpetrate their fraud Attached and marked EXHIBITS B1-B5 is the list showing the Bunk Verification Numbers of afl the unlawful 1st level beneficiaries accounts showing the names and several account’ numbers linked to the perpetrators of this humongous fraud

“That the perpetrators of this humongous fraud will illicitly transfer the said funds ito their other respective accounts domiciled with the same or other bank or financial institution and unless all the accounts linked to there respective BVNs are blocked or placed on post no debit, they will continue to unlawfully dissipate the said funds, using their other accounts.

“That if all the accounts linked to the BVN of the perpetrators of this fraud are not urgently blocked of placed on No Debit restriction and the salvaged amount unlawfully obtained reversed, they will continue in their spending spree and further dissipation of monies belonging to investors and shareholders of the Plaintiff.

“That the Central Bank of Nigeria being the apex bank in Nigeria is empowered and pursuant to Section 2(d) of the Central Bank of Nigeria Establishment Act has regulatory oversight functions over financial institutions in Nigeria, and is responsible for maintaining and promoting efficient and secured financial system in Nigeria, aimed at ensuring the safety of depositors funds in the financial institutions in Nigeria.

“That the Plaintiff has been greatly affected by the resultant effect of the system glitch and unless this application is granted, the Plaintiff will be further subjected to untoward hardship and dire financial loss.

“That the Plaintiff undertake to pay compensation to 1st to 54th defendants and the beneficiaries as to damages in the event of the reliefs and orders sought ought not to be granted.

“That the balance of convenience is in the favour of the grant of the reliefs and orders sought by the Plaintiff

“That the Plaintiff will not be able to recover the these monies from these secondary beneficiaries of these illicitly transfer sums of the reliefs and orders sought for are not granted.”

Meanwhile, Access Bank and other 53 defendants have filed their various responses to the suit.

News

Lawyer Arraigned For Alleged N7.25m Land Fraud

The police have arraigned a 33-year-old legal practitioner, Luka Linus Yabagi, at the Life Camp Chief Magistrates’ Court, Abuja, for allegedly cheating his client of N7.25 million.

The police charged Yabagi of Dakwa Abuja, who claimed to be a doctor of law, with cheating, criminal breach of trust, forgery and using as genuine documents.

The defendant pleaded not guilty to the charge levelled against him.

The prosecutor, Mrs Charity Nwachukwu, told the court that one Mr Mukhtar Isah of No.4 Goodluck Jonathan Street, Dakwa, Abuja, reported the matter at the Gwarinpa Police Station on Dec. 9, 2024.

Nwachukwu said that the defendant dishonestly and deceitfully made the complainant believe he had the capacity at FCDA to process and secure a land allocation for him.

She said that the defendant deceived the complainant into thinking he was going to use his application for the Statutory Right of Occupancy acknowledgement he secured with File No: 62024, in which he demanded payment.

She told the court that the defendant deceived the complainant into paying N7.25 million into his Access Bank account 1466739589, bearing Linus Befiyo Luka.

Nwachukwu said the defendant fraudulently and dishonestly gave the complainant an offer of statutory right of occupancy, a statutory right of occupancy bill, a site plan and a certificate of occupancy No. FCT/MZTP/LA/CUS/2047.

She said all the documents were bearing Paiamist Nig. Ltd as the allottee with plot No. 2233 located at Guzape II.

Nwachukwu told the court that the defendant deceitfully presented the forged document to the complainant and converted the N7.25 million he had spent on the land process and documentation to his personal use.

She also informed the court that the defendant absconded to an unknown destination, and all efforts to reach him proved abortive. However, he was later tracked and apprehended.

She said that during the police investigation, it was discovered that the purported document the defendant issued to the complainant was altered and forged and did not emanate from the Department of Land Administration.

The prosecutor told the court that the defendant could not give a satisfactory account of his actions.

Nwachukwu said that the case contravened the provisions of Sections 322, 312, 364 and 366 of the Penal Code.

The chief magistrate, Musa Jobbo, admitted the defendant to bail in the sum of N1 million and two sureties in like sum.

Jobbo ordered that the sureties must produce a reliable means of identification before the court registry.

He said that one of the sureties must be a property owner and must reside within the court’s jurisdiction.

Jobbo ordered the defendant to deposit N2 million in the FCT High Court Registry and adjourned the matter until June 19 for a hearing.

News

Zamfara Imam, three children killed after N11m ransom

Fresh waves of violence continued to sweep across parts of Nigeria on Tuesday, with reports of brutal killings in Zamfara and Benue states.

In Zamfara, bandits killed the Chief Imam of the Maru Jumu’at Mosque, Alkali Salihu Suleiman, along with his three children—despite receiving N11m of the N20m ransom they had demanded.

The tragic incident, which occurred two months after their abduction, has plunged the Maru community into mourning.

The late Imam and his children were abducted from Maru, the headquarters of Maru Local Government Area—a community long plagued by persistent bandit attacks.

A resident, Shehu Mani, told The PUNCH that the family had struggled to raise the ransom, managing to gather only N11m.

“After collecting the money, the bandits still held onto their victims,” Mani said. “Later, they demanded a new motorcycle and food items in place of the outstanding N9m. Even that could not be provided. Today, we received word from another abductee who escaped that the Imam and his children have been killed.”

While the victims’ remains had not yet been recovered, funeral prayers were already being planned in accordance with Islamic customs.

Efforts to reach the spokesperson for the Zamfara State Police Command, Yazid Abubakar, were unsuccessful as he did not respond to calls at the time of filing this report.

In a similarly disturbing development, suspected armed invaders beheaded a farmer, Felix Suega Ukir, in Tse Orkpe village, Nanev, within the Mbawa Council Ward of Guma Local Government Area in Benue State.

The community, which had previously been displaced by armed herders, is once again living in fear.

A local resident, speaking anonymously, confirmed the gruesome murder occurred on Monday.

“We found the body, but his head was missing. People are abandoning their farms again,” he said.

Former Security Adviser of Guma LGA, Christopher Waku, confirmed the incident to The PUNCH via telephone, but police spokesperson Catherine Anene stated that the command had not yet received a formal report.

As insecurity escalates across Nigeria’s North-West and North-Central regions—with renewed Boko Haram activity in the North-East and the emergence of a new terror group, Mahmdua, in Kwara and Niger States—Kwara State Governor AbdulRahman AbdulRazaq has begun ramping up local security measures.

On Tuesday, the governor met with first-class traditional rulers to strengthen grassroots security and prevent further cross-border incursions, particularly from areas like Kainji National Park, where military operations have intensified.

“We’re adopting a multi-agency approach to enhance development and protect lives,” the governor said in a statement issued by his Chief Press Secretary, Rafiu Ajakaye. “We urge royal fathers to rally their communities and assist security agencies with credible intelligence.”

The Vice Chairman of the State Council of Chiefs and Etsu Patigi, Alhaji Ibrahim Umar Bologi, commended the governor’s efforts.

“We will always support your administration. You’re doing a commendable job,” he said.

News

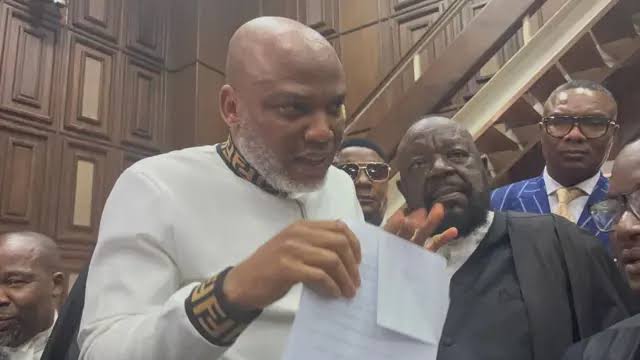

Kanu’s trial: DSS submits Radio Biafra devices in court

The terrorism and treason trial of the leader of the separatist Indigenous People of Biafra, Nnamdi Kanu, opened on Tuesday before the Federal High Court in Abuja with the proseuction tendering several exhibits, including Radio Biafra equipment.

At the trial, Kanu maintained that he is not a violent person as alleged by the Federal Government.

Instead, he claimed that his fight is solely for the emancipation of the people in the South-East, South-South, and parts of Benue and Kogi states.

Kanu made the statement in a written document submitted to the Department of State Services on October 15, 2015, in Lagos.

The statement was read aloud in open court during the resumed hearing of his terrorism trial.

Kanu is facing seven counts of terrorism brought against him by the Federal Government.

He was first arrested on October 14, 2015, upon his return to Nigeria from the United Kingdom. He was granted bail in 2017 on health grounds after being detained at the Kuje Correctional Centre.

However, Kanu fled to the United Kingdom after his release, only to be re-arrested in Kenya in 2021 and brought back to Nigeria, where he was detained by the DSS.

Initially facing 15 counts of terrorism and treason, eight charges were dropped by the trial court on April 8, 2022, for lack of merit.

In 2022, the Court of Appeal in Abuja ruled in Kanu’s favor, vacating the charges and ordering his release.

However, the Federal Government appealed to the Supreme Court, which, on December 15, 2023, reversed the Court of Appeal’s ruling and directed Kanu to return to trial on the remaining seven counts.

At Tuesday’s hearing, Federal Government counsel, Adegboyega Awomolo (SAN), requested that the identities of witnesses be kept confidential due to security concerns and the sensitive nature of the case.

The court ruled that while Kanu must be able to see the witnesses, they would testify behind a screen to protect their identities.

Kanu’s defence team, led by Kanu Agabi (SAN) and supported by four senior advocates, did not object to the request.

They, however, sought reciprocal cooperation from the Federal Government regarding Kanu’s bail application.

The prosecution’s first witness, identified as Mr. A.A.A., an 18-year DSS operative, testified behind a screen, recounting the events of Kanu’s arrest at the Golden Tulip Hotel in Lagos on October 14, 2015.

He described how the DSS, acting on intelligence, initially had difficulty locating Kanu, as the hotel staff claimed he was not a guest.

After receiving an order from their director, the DSS conducted a room-to-room search and found Kanu in Room 303 with a woman named Maria Ibezimakor.

Mr. A.A.A. stated that Kanu resisted arrest, head-butting one of the officers.

During the search, the DSS found a room resembling a broadcasting studio, containing various broadcasting equipment.

The items recovered, which included laptops, flash drives, microphones, mixers, pamphlets, and other materials linked to IPOB, were brought to court in four suitcases.

Kanu confirmed ownership of the equipment during interrogation, which was also admitted as evidence.

Mr. A.A.A. further testified that while they did not initially recover Kanu’s passport, the hotel manager brought the passports to their office the following morning.

The passports, bearing the name “Okwu-Kanu Nwannekaenyi Nnamdi Ngozichukwu,” were also admitted as evidence.

The witness also revealed that Kanu had checked in under the name “Nwannekaenyi Ezebuiro” and that two other women were found in another room with the same name.

The DSS also played a CD of Kanu’s interrogation, which was recorded the following day.

In the video, Kanu confirmed that he was involved in the struggle for self-determination and that he had set up Radio Biafra.

He acknowledged that he had not registered the radio station with the National Broadcasting Commission because he did not expect to receive a license.

Kanu stressed that his actions were not violent and that freedom fighting is a fundamental right, as recognised by the United Nations Charter.

He emphasised that he had never been involved in any violent activity and had been interrogated by the DSS without legal representation, as required by law.

The court admitted both the statement and video clips as evidence.

The trial was adjourned to May 2 for cross-examination and to hear testimony from a second prosecution witness.

-

Opinion21 hours ago

Opinion21 hours agoTHOUGHTS ON CONSTITUENTS DEVELOPMENT IN OBIO-AKPOR

-

News16 hours ago

News16 hours agoJust in: Popular Nigerian billionaire, E-Money nabbed by EFCC

-

News17 hours ago

News17 hours agoKing Sunny Ade’s family opens up over his whereabouts after daughter’s alarm

-

Politics13 hours ago

Politics13 hours agoJust in: Ex- Gov Okowa accepts betraying Southern Nigeria, laments running with Atiku

-

News18 hours ago

News18 hours agoEx-DIG,Olofu debunks online newspaper report, says ” I retired from NPF meritously after 35yrs service

-

News13 hours ago

News13 hours agoBoko Haram Kill Mourners, Kidnap Others In Borno

-

News13 hours ago

News13 hours agoDeputy Speaker Leads Defection of PDP Stalwart Chris Igwe, 13,000 Followers to APC In Abia

-

News13 hours ago

News13 hours agoSpeaker Abbas Raises Alarm on Workplace Safety in Nigeria