News

Saraki Connection, 127 Branches, 202 Automated Banking Centers, Over 350 ATM and 4000 Workers – Here’s what to know about Heritage Bank

Many customers of Heritage Bank woke up on Monday to the shocking news of revoked licence of Heritage Bank by the Central Bank of Nigeria (CBN).

Before the regulatory hammer on Heritage Bank, the CBN said the bank had continued to suffer and had no reasonable prospects of recovery, thereby making the revocation of the license the next necessary step.

Heritage Bank traces its roots to the late 1970s, when it was founded as Societe Generale Bank (Nigeria), by the late Olusola Saraki.

In January 2006, the Central Bank closed down Societe Generale on account of failure to meet new minimum capital requirements of N25billion for a national bank. Societe Generale successfully challenged the closure in court.

In 2012, the core investor in Heritage Bank, IEI Plc, through IEI Investments Limited, acquired the Societe Generale Bank of Nigeria license from the Central Bank of Nigeria.

In December 2012, the Central Bank re-issued Societe Generale’s banking license, but as a regional bank. Having acquired the banking license, the new ownership re-branded the bank as Heritage Banking Company Limited and opened for business under the new name on March 4, 2013.

As of September 2013, the bank’s stock was publicly owned by the following corporate entities and individuals: Heritage Investment Services Limited (80percent); Priority shareholders (9percent), other minority shareholders (11percent).

In October 2014, Heritage Banking Company Limited successfully met the requirements of the Asset Management Corporation of Nigeria (AMCON) and the Central Bank of Nigeria toward owning 100 percent shares in Enterprise Bank Limited.

In October 2014, Heritage Bank acquired 100percent shareholding in Enterprise Bank Limited, a nationalised financial services provider with over 160 branches and $1.6 billion in assets. Heritage paid AMCON $340 million (N56.1 billion), in cash, for the acquisition.

On January 27, 2015, AMCON officially transferred ownership of Enterprise Bank Ltd to Heritage Bank Plc.

Heritage Investment Services Limited, the investment arm of Heritage Banking Company Limited, was the winning bidder out of 24 Nigerian and International companies who competed for the acquisition of Enterprise Bank.

Heritage Bank has 127 branches and 202 automated banking centres with over 350 ATMs in all states of the federation and the Federal Capital Territory. Heritage Bank has 4000 employees.

Jani Ibrahim, a non-executive director, serves as the acting chairman of the seven-person board of directors. The managing director and chief executive officer is Akinola George-Taylor.

Following the revocation of its licence, the Nigeria Deposit Insurance Corporation (NDIC) has also been appointed as the Liquidator of the bank in accordance with Section 12 (2) of BOFIA, 2020, the CBN said in the statement signed by Hakama Sidi Ali, acting Director, Corporate Communications.

Headquartered in Lagos, Nigeria, Heritage Bank was one of the commercial banks licensed by the Central Bank of Nigeria with a national operating license, that offered retail banking, corporate banking, online/internet banking, investment banking and asset management services.

Having fulfilled all required criteria then, the bank returned 100percent of existing Societe Generale account holders’ money to their owners. As of December 2015, the total asset valuation of the bank was estimated at over $1.7billion (N483.4 billion). Its shareholders’ equity was worth at least $88 million (N25 billion), the minimum capital requirement by the Central Bank of Nigeria, for national banks.

The CBN said the licence revocation action it took on Heritage Bank reflects its continued commitment to take all necessary steps to ensure the safety and soundness of Nigeria’s financial system.

“The Central Bank of Nigeria (CBN), in accordance with its mandate to promote a sound financial system in Nigeria and in exercise of its powers under Section 12 of the Banks and Other Financial Act (BOFIA) 2020, hereby revokes the licence of Heritage Bank Plc with immediate effect.

“This action has become necessary due to the bank’s breach of Section 12 (1) of BOFIA, 2020. The Board and Management of the bank have not been able to improve the bank’s financial performance, a situation which constitutes a threat to financial stability. This follows a period during which the CBN engaged with the bank and prescribed various supervisory steps intended to stem the decline.

“Consequently, the CBN has taken this action to strengthen public confidence in the banking system and ensure that the soundness of our financial system is not impaired. The Nigeria Deposit Insurance Corporation (NDIC) is hereby appointed as the Liquidator of the bank in accordance with Section 12 (2) of BOFIA, 2020,” CBN said.

News

26 Nigerian Soldiers Feared Dead In Boko Haram IED Blast In Borno, 20 Others Wounded

Tension as no fewer than 26 soldiers were reportedly killed when their truck hit an improvised explosive device in restive Borno State, Northeast Nigeria.

Another 20 soldiers were also reported to have been seriously wounded and taken to the 7 Division of the Nigerian Army hospital in Maiduguri, the state capital.

Military sources on Tuesday evening revealed that the incident occurred when a military truck conveying soldiers from Damboa to Maiduguri hit a landmine.

According to the source, “Twenty-six Nigerian soldiers were killed today (Tuesday) as they were moving from Damboa to Maiduguri, Borno State capital. The incident happened when their truck hit a landmine, killing 26 soldiers on the spot. Twenty other soldiers were equally wounded and have been taken to the 7 Division, Nigerian Army Hospital for treatment.”

The deadly blast one of sources who pleaded anonymity said occurred while the handing over ceremony of the former General Officer Commanding 7 Division of the Nigerian Army, Major General Haruna, to the new GOC for the Division, Brig-Gen. V. I. Una Nwachukwu, was taking place.

The incident comes amid increasing violence in northeast Nigeria in recent days, with the death toll rising to at least 50 people.

The region has been plagued for decades by armed groups, including the ISIL affiliate in West Africa Province (ISWAP) and Boko Haram, with violence flaring up in recent days.

The Islamic State’s West Africa Province (ISWAP) has reportedly claimed responsibility for the attack in a statement on Telegram on Tuesday.

Borno State Governor, Babagana Umara Zulum, had earlier told Nigeria’s defence minister and military chiefs that Boko Haram and ISWAP were entrenching themselves in Lake Chad islands, Sambisa Forest, and Mandara mountains on the border with Cameroon due to “military setbacks.”

Meanwhile, the military has yet to confirm the incident as efforts to speak with the Acting Director, Nigeria Army Public Relations, Lieutenant Colonel Apolonia Anele were unsuccessful as she could not be reached on telephone as at the time of filing this report.

SAHARA REPORTERS

News

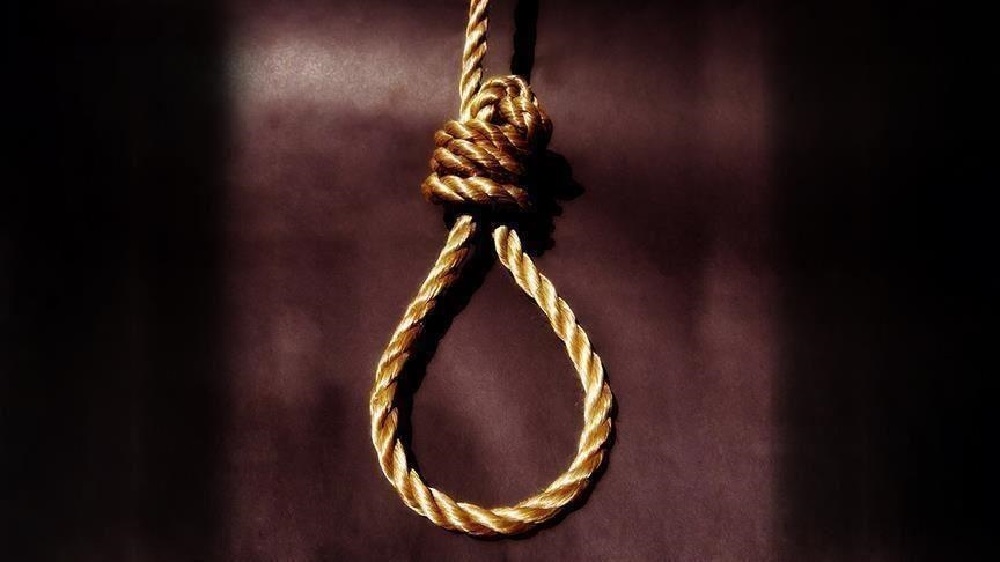

SAD! Professor’s son takes own life inside varsity staff quarters

Rilokwah Jatau, a 23-year-old student of Nasarawa State University, Keffi (NSUK), was found dead in an apparent suicide in the university’s senior staff quarters.

The discovery was made on April 27, 2025, by Emmanuel Gyawo, a security officer at the university, who was directed by Professor Shedrack Jatau to check on his son.

Upon arriving at the residence, Gyawo found Rilokwah hanging from the ceiling.

Professor Jatau, who was reportedly out of state at the time, was informed of the incident. A team of police detectives, led by the Divisional Crime Officer (DCO) of Angwan Lambu, was dispatched to the scene.

The body showed no signs of violence, and no suicide note was found. Rilokwah was rushed to the Federal Medical Centre (FMC) in Keffi, where he was confirmed dead by a medical doctor. His body has been deposited in the hospital morgue.

Police sources say investigations are ongoing to determine the circumstances surrounding the incident.

News

FG cancels scholarship programmes abroad

The Minister of Education, Dr Tunji Alausa, has announced the discontinuation of the Bilateral Education Agreement (BEA) scholarship programme.

Alausa made this known on Tuesday in Abuja during a courtesy visit by newly elected officials of the National Association of Nigerian Students (NANS).

He described the BEA programme as an inefficient use of public resources, noting that many of the courses pursued abroad under the scheme were readily available in Nigerian universities.

“I was asked to approve N650 million for 60 students going to Morocco under the BEA programme when I assumed office in 2024.

“I refused. It’s not fair to the majority of Nigerian students,” Alausa said.

The minister expressed dissatisfaction with the behaviour of some beneficiaries, who he claimed had resorted to “blackmail” on social media over delayed allowances.

The News Agency of Nigeria (NAN) reports that several BEA scholars had previously accused the Federal Government of abandoning them and failing to pay their entitlements.

However, the government recently clarified that all supplementary allowances had been paid up to December 2024.

Established through diplomatic partnerships, the BEA programme enabled Nigerian students to study in countries such as China, Russia, Algeria, Hungary, Morocco, Egypt, and Serbia.

Alausa said the government would now redirect BEA funds toward domestic scholarship schemes to benefit a larger number of students.

“I reviewed the courses, some students were sent to Algeria, a French-speaking country, to study English, Psychology, and Sociology, programmes we offer better here in Nigeria,” he said.

He criticised the lack of academic oversight, revealing that scholars received free annual travel without proper performance monitoring.

“In 2025 alone, the government planned to spend N9 billion on just 1,200 students.

“That’s unjust when millions of students in Nigeria receive no support. Every single course these students are studying abroad is available in Nigerian universities,” he said.

Alausa stressed that while current beneficiaries would be allowed to complete their programmes, the BEA scheme would not continue beyond 2025.

“We are cancelling the BEA. It is not the best use of public funds. The money will now be used to fund local scholarships and support more Nigerian students,” he said.

Earlier, the newly elected NANS President, Olushola Oladoja, commended the minister for reforms and progress achieved since assuming office. (NAN)

-

News22 hours ago

News22 hours agoJust in: Popular Nigerian billionaire, E-Money nabbed by EFCC

-

News22 hours ago

News22 hours agoKing Sunny Ade’s family opens up over his whereabouts after daughter’s alarm

-

Politics18 hours ago

Politics18 hours agoJust in: Ex- Gov Okowa accepts betraying Southern Nigeria, laments running with Atiku

-

Metro6 hours ago

Metro6 hours agoGunmen storm University of Benin teaching hospital, kill doctor

-

News23 hours ago

News23 hours agoEx-DIG,Olofu debunks online newspaper report, says ” I retired from NPF meritously after 35yrs service

-

News18 hours ago

News18 hours agoBoko Haram Kill Mourners, Kidnap Others In Borno

-

Metro6 hours ago

Metro6 hours agoFCTA destroys 601 motorbikes over violations

-

News6 hours ago

News6 hours agoJust in: FG declares tomorrow public holiday