Economy

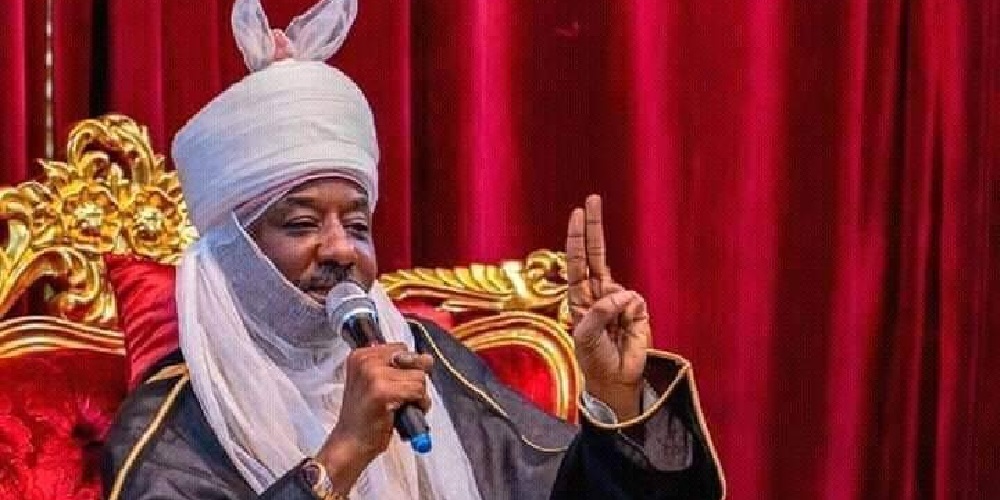

‘Blame Buhari for hardship in Nigeria’ – Ex-Emir of Kano Sanusi

The former Emir of Kano, Muhammadu Sanusi, has blamed the current hardship in Nigeria on former President Muhammadu Buhari.

Sanusi said it would be unfair to blame President Bola Tinubu for the hardship Nigerians are experiencing.

Speaking on Sunday during a virtual religious event, the former Governor of the Central Bank of Nigeria, CBN, said Buhari’s administration failed to heed his counsel on how to salvage the country from economic woes.

The former Emir also vowed to criticise Tinubu if he sees any wrong economic policy in the future.

According to Sanusi: “If I am to be fair and just to President Bola Tinubu, he is not to blame for the current hardship; for eight years, we were living a fake lifestyle with huge debt from foreign and domestic debts.

“I can’t join other Nigerians criticising Tinubu on the current economic hardship, and I am not saying he is a saint free from wrongdoing, but in this current economic situation, President Tinubu is not to be blamed.”

He insisted that there was no other alternative than to remove the subsidy on fuel.

Economy

CBN Report reveals Nigerian economy fall short of its revenue targets for 2024

Data released by the Central Bank of Nigeria in its economic report for fourth quarter 2024, has revealed that the President Bola Tinubu-led Nigerian government failed to meet revenue targets for the quarter.

According to the document “federally collected revenue saw a 5.31% increase compared to the previous quarter, though it still fell short of the benchmark by 19.67%.”

The report further noted that the “FGN retained revenue was 10.40% higher than in the preceding quarter but remained significantly below the target, standing 48.57% short of the expected figure.”

“On the expenditure side, aggregate expenditure increased by 2.22% compared to Q3 2024, though it was 22.09% lower than the quarterly target. As a result, the fiscal deficit narrowed by 3.61% when compared to the previous quarter, but widened by 34.44% relative to the proportionate quarterly target,” the report read.

It was further noted that “in terms of gross federation account earnings, the period saw an improvement, largely driven by higher receipts from oil revenue. The provisional gross federation account receipts stood at ₦7.23 trillion, reflecting a 5.31% increase from the preceding quarter, but still 19.67% below the benchmark.”

According to the CBN Report, oil revenue specifically saw a significant rise of 53.59%, reaching ₦2trillion compared to Q3 2024. Despite this increase, it fell short of the quarterly target by 62.19%.

Nigeria has struggled to fund its budget overtime, relying heavily on loans which has overtime led to high debt servicing figures.

The CBN report had highlighted the challenge of debt by Nigeria.

“At end-September 2024, public debt stock remained within the 70.00 per cent threshold for Market-Access Countries,” the report read

“Total public debt outstanding stood at ₦142.32 trillion (51.29% of GDP), at end-September 2024, and was 5.97 per cent, higher than the level.”

Economy

World Bank approves fresh $500m loan for Nigeria

The World Bank has approved a $500 million loan to Nigeria to support the country’s Community Action for Resilience and Economic Stimulus Program.

The loan was granted on March 28, 2025, according to report, marking a significant step in addressing Nigeria’s economic challenges through expanded access to livelihood support, food security services, and grants for poor and vulnerable households and businesses.

The project officially titled the NIGERIA: Community Action (for) Resilience and Economic Stimulus Program, aims to provide essential support to households affected by economic downturns and to bolster community resilience.

It will target vulnerable populations, offering grants to both households and small businesses to mitigate the impact of economic hardships.

The loan approval is expected to significantly enhance Nigeria’s efforts to stimulate the economy through grassroots support, particularly amid ongoing challenges such as inflation and high living costs.

The stimulus package will focus on improving food security and economic opportunities for communities hit hardest by recent economic fluctuations.

Daily Trust reports that in addition to the fresh loan, the World Bank is expected to give approval to other facilities later this week, the development which would significantly increase the country’s debt profile.

Economy

SEE Dollar to Naira Exchange Rate Today, Friday, March 28, 2025

The exchange rate between the U.S. Dollar (USD) and the Nigerian Naira (NGN) remains a crucial topic for businesses, travelers, and investors.

As of today, Friday, March 28, 2025, the exchange rates in both the official and parallel markets have experienced fluctuations, reflecting ongoing economic trends.

Official Dollar to Naira Exchange Rate The Central Bank of Nigeria (CBN) sets the official exchange rate, which is significantly lower than the parallel market rate. According to the latest data: Dollar to Naira exchange rate for today, Friday, March 28, 2025, is approximately ₦1,519 to ₦1,542 in the official market.

Source Exchange Rate (₦ per $1) Date CBN ₦1,532.39 March 25, 2025 Yahoo Finance (Opening) ₦1,531.50 March 27, 2025 Yahoo Finance (Closing) ₦1,533.52 March 27, 2025 The official exchange rate is the rate at which commercial banks and financial institutions trade forex under CBN regulations.

However, due to forex scarcity, many individuals and businesses turn to the black market.

Black Market Dollar to Naira Exchange Rate The parallel market (black market) offers a different exchange rate, often higher than the official rate.

Reports from the Lagos parallel market on March 27, 2025, indicate: In the black market, the Dollar to Naira exchange rate as of today, March 28, 2025, is approximately ₦1,560 for buying and ₦1,570 for selling. –

Transaction Type Exchange Rate (₦ per $1) Buying Rate ₦1,555 Selling Rate ₦1,560 Other reports suggest an average black market rate of ₦1,540 per USD, reflecting the fluctuations observed throughout the week.

Recent Dollar to Naira Fluctuations Over the past week, the exchange rate has varied significantly: Date Lowest Rate (₦) Highest Rate (₦) March 24, 2025 ₦1,566.29 ₦1,566.29 March 27, 2025 ₦1,514.92 ₦1,533.52 These fluctuations highlight the volatility in the forex market, influenced by factors such as inflation, forex reserves, and government policies.

Government’s Stance on Forex Exchange The CBN does not officially recognize parallel market rates and advises individuals to conduct foreign exchange transactions through authorized financial institutions.

The apex bank has implemented policies to stabilize the naira, including forex interventions and restrictions on certain transactions.

Experts recommend businesses and individuals monitor the forex market closely and use official channels to avoid excessive rates and fraud in the black market. What you Should Know The dollar to naira exchange rate remains a key economic indicator in Nigeria.

With ongoing market fluctuations, staying informed about both official and parallel market rates is crucial for businesses and individuals making financial decisions. For real-time updates on exchange rates, consult financial institutions, forex trading platforms, or the Central Bank of Nigeria.

-

News16 hours ago

News16 hours agoTinubu Sacks NNPC Board, Appoints New Leadership

-

News16 hours ago

News16 hours agoHe came to propose to me, and died in my hostel

-

News10 hours ago

News10 hours agoVideo: Watch Dr Nwambu of CCLCA analyse ex-River HoS allegations against suspended Gov Fubara

-

News16 hours ago

News16 hours agoAkpabio, Yahaya Bello Conspired To Assassinate Me – Senator Natasha Makes Fresh Allegation

-

Business5 hours ago

Business5 hours agoBank stops transfer fees on online transactions

-

Sports16 hours ago

Sports16 hours agoSuper Eagles Must Defeat South Africa to qualify for 2026 World – Eric Chelle

-

News16 hours ago

News16 hours agoWike sympathies with Ortom over younger brother’s death

-

Metro17 hours ago

Metro17 hours agoPolice uncover ‘yahoo’ training school in Lagos, arrest suspects