News

NIN linkage: Banks may block 70 million accounts

Over 70 million bank customers are at risk of losing access to their accounts when the Central Bank of Nigeria’s directive on restricting accounts without Bank Verification Numbers and National Identification Numbers goes into effect.

The CBN had on December 1, 2023, in a circular directed that a ‘Post no Debit’ restriction be placed on all bank accounts without the BVN and NIN from Friday, March 1, 2024.

‘Post No Debit’ is a term used to describe a restriction imposed by banks on specific accounts, preventing customers from making withdrawals, transfers, or any other debits from such accounts. This measure effectively freezes the funds in the account, rendering them inaccessible for the duration of the restriction.

The circular, jointly signed by the Director, Payments System Management Department, Chibuzo Efobi; and Director, Financial Policy and Regulation Department, Haruna Mustapha, read, “It is mandatory for all Tier-1 bank accounts and wallets for individuals to have BVN and/or NIN. It remains mandatory for Tiers 2 & 3 accounts and wallets for individual accounts to have BVN and NIN.

“For all existing Tier-1 accounts/wallets without BVN or NIN: Effective immediately, any unfunded account/wallet shall be placed on ‘Post No Debit or Credit’ until the new process is satisfied. Effective March 1, 2024, all funded accounts or wallets shall be placed on ‘Post No Debit or Credit’ and no further transactions permitted. The BVN or NIN attached to and/or associated with all accounts/wallets must be electronically revalidated by January 31, 2024.”

The circular went on to warn banks in the country that a “comprehensive BVN and NIN audit shall be conducted shortly and where breaches are identified, appropriate sanctions shall be applied.”

As the deadline approached, some banks sent out messages to their customers to regularise their accounts in line with the new CBN directive. While some asked customers to visit their physical branches, others made provisions for customers to update their accounts online.

FirstBank Nigeria in an email to customers said, “Please ensure that your Bank Verification Number and National Identification Number are linked to your account number on or before February 29, 2024.

“You can seamlessly update your account information with your BVN and NIN by visiting any FirstBank branch close to you. Please note that the Central Bank of Nigeria through its circular: PSM/DIR/PUB/CIR/001/053 dated December 1, 2023, has directed that effective March 1, 2024, all funded accounts without BVN shall be placed on ‘Post No Debit or Credit’ and no further transactions permitted.”

Ecobank Nigeria wrote, “Please be informed that the Central Bank of Nigeria through its circular dated December 1, 2023, has announced that all accounts without Bank Verification Number and/or the National Identity Number would not be able to carry out transactions from March 1, 2024.

“Consequently, you will be required to update your account information with your National Identification Number and Bank Verification Number if you have not done so already.” It, however, offered an online solution.

Fintech firm, OPay, also called on its customers to complete the regularisation of their accounts by linking their BVN or their NIN as mandated by the apex bank, offering them both online and offline options.

A Tier-1 account refers to a bank account that can be opened with minimal or no form of documentation. Such an account can be opened with a passport photograph and has a limit of N50,000 deposit and an operating balance of N200,000 and is mostly not linked to the BVN and is targeted at the unbanked population.

This space is dominated by fintech firms and there are concerns that the lax Know Your Customer requirements are loopholes that are being used to perpetuate fraud.

The National President of the Association of Mobile Money and Bank Agents in Nigeria, Sarafadeen Fasasi, who called for an extension of the deadline, said while the policy was a good move to improve banks’ KYC requirements, its implementation was worrisome.

He said, “We are all aware that it is a good policy for the system for us to have good KYC, but unfortunately, what we have a challenge with is the implementation. This is another wrong implementation. Before you give a deadline, you must have provided the access points. As of today, we have about 104 million NINs out of 200 million people expected to have NINs. So, there is a gap of about 100 million.

“It is the same thing with the BVN, which as of the last report was about 59.9 million out of 134 million expected bank accounts. That means we have over 70 million accounts, which will be affected.”

According to data from Statista, as of 2021, the number of active bank accounts in the country was around 133.5 million, with savings accounts making up about 120 million.

Fasasi claimed that the National Identity Management Commission lacked the capacity to deliver 100 million NINs within the required timeframe.

He said, “The question is, can the NIMC deliver the gap of about 100 million NINs within the deadline? The answer is no, so why should this drive Nigerians into another problem? For BVNs, we have a huge gap to deliver and only bank branches can enrol BVN as of today.

“Based on our research, about 300 local government areas out of the 774 LGAs in Nigeria have no bank branches; so, who are those who are going to provide BVN enrolment at those LGAs? It means that people are going to run into trouble.

“Also, the highest that the banks have done is 500,000 enrolment per month. We are not ready for this. Why the rush? Why not plan that every month, this is what we want to achieve based on our capacity and access points?”

He lamented that this was coming at the same time as the National Communications Commission had directed telecom companies to bar mobile lines without the NIN.

“Who is pursuing us in Nigeria in this critical period where everyone is groaning under adverse economic conditions? They want to add extra trauma; I think we need to reconsider this,” he concluded.

The Chairman, Consumer Rights Awareness, Advancement and Advocacy Initiative, Moses Igbrude, said the apex bank ought to assess the level of compliance before wielding the big stick.

He said, “You must check the challenges and the parties who are responsible for the NIN and BVN. What of Nigerians in the Diaspora? They should give more time for this linkage so that they will not disrupt the banking system.

“It is a multifaceted issue involving many players. What is the infrastructure required for them to work? Otherwise, they will use a legal way to disenfranchise a lot of people.”

The President, Bank Customers Association of Nigeria, Dr Uju Ogubunka, called for an extension of the deadline to enable more bank customers regularise their accounts in line with the CBN directive.

Ogubunka told the pres “We know that some of our members have linked their accounts with the BVN/NIN as directed by the CBN. At this point, I think it will be wise to give an extension, because the telecom network has been a bit inclement and, then of course, you talk about power; some of us were unable to charge our phones for some time because there was no power. And these things are happening almost everywhere.

“People are willing to do what they’re supposed to do, but conditions within the environment are a bit difficult. So, I will personally suggest that we consider what is happening and give some extension.”

He went on to suggest that a test run where restrictions would be placed on some affected accounts might be of help in sensitising people to the importance of the directive.

“Another thing that they can do is maybe do a test run so that people will know that it is something that can be done. Some people may not even believe that it is possible to restrict transactions. So, if you do a test run for one day or even a few hours, you announce that those who have not linked up will be unable to access their accounts temporarily, maybe for 24 hours or 12 hours, then give an extension. That should help,” Ogubunka added.

He stated that there had been no reports that banks had started to restrict bank accounts without the BVN and NIN.

“No one has reported that to us yet. But then, they may not know until they want to make use of the accounts. It is not as if they are using the bank accounts every minute of the day. It is only when they want to make use of it and then see that they can’t get through, that is when they have an issue. So far, we don’t have any report on that,” he said.

Multiple bankers, who spoke with journalists on condition of anonymity, said the banks had not yet started to restrict accounts without the BVN and NIN.

They said directives had been issued from their headquarters to create a seamless linking process to avoid account deactivation.

A bank official said, “No one is deactivating accounts yet. They have been sending emails to customers to calm down so that a more seamless linking process will be communicated to customers. They will be reached via text and email. Some people used the NIN to open or update their accounts already so they won’t need to do it again.”

On the number of possible affected customers, the official stated, “We haven’t got the affected number yet. It has to be spooled by our IT team from the backend.”

Another official confirmed the directive to assist more customers via email.

“The deadline still stands; however, not all accounts are blocked because some opened theirs with the national ID from the inception. But we will be reaching out via email and text,” the official wrote to one of our correspondents.

A News Agency of Nigeria report on Friday revealed that customers continued to besiege various bank branches in Lagos to meet the CBN deadline for linking BVN and NIN to their accounts.

The customers also asked the CBN to extend the deadline for them to link their BVNs and NIN with their accounts.

With the implementation of the directive, there was a significant gathering of customers at various banks as early as 8am on Friday to link their NINs with their bank accounts.

A security officer at a Guaranty Trust Bank branch in the Abule Egba area, while addressing customers who were eager to gain entry into the banking hall, said the message sent out by the bank to its customers concerning the directive was a random one.

He said not all customers that got the message were affected by the directive. This got the customers infuriated, as they said the bank should have sent out messages to only those affected. At another GTB branch in Egbeda, the bank advised customers to register online using specified codes displayed on the walls outside the banking hall.

However, at Polaris Bank, the crowd was not allowed to converge, and those who went into the banking hall were told by the customer service desk to produce their NIN slips.

Those without the slips were turned back. Customers who explained their mission to the bank’s security officers before entering the banking hall were told to get the slips.

Two bank employees used mini computers to do the first registration at the entrance before the security guards allowed the customers into the banking hall.

At Providus Bank on Nnamdi Azikiwe Road, customers were given forms and were assisted with registration simultaneously. The situation was similar at Wema Bank on Broad Street and other banks visited on Lagos Island.

Meanwhile, calls and text messages sent to the CBN spokesperson, Hakama Sidi, yielded no response as of the time of filing this report.

News

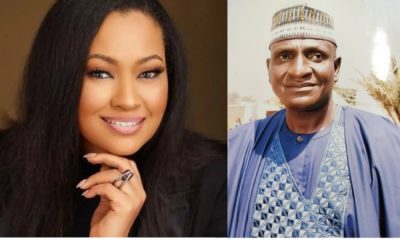

There’s valid evidence of Akpabio sexually harassing me; I’ll release it, Natasha Akpoti-Uduaghan declares

Kogi Senator Natasha Akpoti-Uduaghan has vowed to release evidence of Senator Godswill Akpabio sexually harassing her at the right time.

Mrs Akpoti-Uduaghan disclosed this in an interview with Channels TV on Thursday night when told that Mr Akpabio said she has no evidence to back up her sexual harassment allegation against him.

“At the right time and at the right space, I will present the evidence that I have,” Mrs Akpoti-Uduaghan said.

Aniete Ekong, spokesperson for Mr Akpabio, could not be reached for comment on Mrs Akpoti-Uduaghan’s statement. A WhatsApp message sent to him was not replied to.

Mrs Akpoti-Uduaghan’s statement comes after the Independent National Electoral Commission dismissed the recall petition filed against her on Thursday.

The Kogi Central lawmaker was suspended from the Senate on February 28 after she accused Mr Akpabio of sexual harassment and abuse of office.

The Senate suspended her for six months, withheld her salaries, and withdrew her security detail, citing unruly behavior during plenary.

News

Delta issues 21-day ultimatum to unapproved schools

The Delta State Government has vowed to shut down all unapproved nursery and primary schools across the state.

The measure is being taken “to sanitise the private sector participation in the primary education sector in the state.”

This was contained in a government special announcement signed by the Director of Public Communication/Functioning Permanent Secretary in the State Ministry of Information, Theresa Adiabua Oliko.

Copies were made available to journalists in Warri on Thursday.

The government, however, advised owners of all unapproved primary schools across the state to “upgrade” within the 21-day ultimatum or risk being shut down.

The public announcement partly reads, “It is hereby announced for the information of the public, particularly owners of private nursery and primary schools in Delta State, that the government, pursuance to its responsibility to sanitise the private sector participation in the primary education sector in the state, that all unapproved primary schools in the state are hereby given a 21-day ultimatum to upgrade their infrastructure and formalise their status with the ministry of primary education with immediate effect.

“Failure to comply with this directive will attract severe sanctions, including outright closure of all such schools.

“The 21-day ultimatum has become imperative as a result of the proliferation of unapproved private schools whose poor infrastructural facilities, unqualified teachers and unhealthy operational environment have become worrisome to the state government.”

News

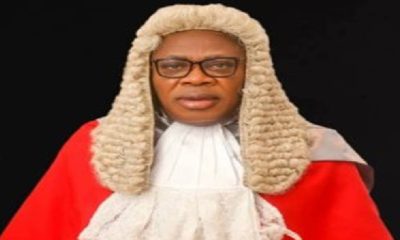

I’m not behind Elisha Abbo’s sacking from Senate – Akpabio

The Senate President, Senator Godswill Akpabio on Thursday, berated former lawmaker representing Adamawa North Senatorial District, Elisha Abbo, saying he has no hand in his removal from the National Assembly.

The clarification was made in a statement issued in Abuja by Akpabio’s media aide, Eseme Eyiboh.

Abbo was sacked by the Court of Appeal sitting in Abuja on October 16, 2023.

The judgment delivered by a three-member panel presided over by Justice C.E. Nwosu-Iheme ordered the Independent National Electoral Commission to issue a Certificate of Return to Amos Yohanna of the Peoples Democratic Party as the duly elected lawmaker representing the area at the Senate.

The appellate court vacated the tribunal judgment which had earlier affirmed Abbo of the All Progressives Congress as the winner of the senatorial election.

But speaking on a live programme on Arise Television on Wednesday, Abbo blamed Akpabio for his predicament.

The Adamawa politician also accused the Senate President of running the Red Chamber like an emperor.

This was even as he condemned the suspension of the senator representing Kogi Central, Natasha Akpoti-Uduaghan, who is presently battling to retain her mandate.

Reacting, Akpabio said he was shocked to hear Abbo blame him again for his ouster from the Senate barely two years after apologising to him.

He said, “It is sad and regrettable that despite publicly retracting a similar allegation in 2023—after admitting that his earlier accusation was premature and based on the available information at our disposal—Mr. Abbo has once again embarked on a campaign of misinformation and blame transfer.

“Following a discussion with the Senate President last year, Mr. Abbo himself acknowledged that Senator Akpabio had ‘no involvement’ in the judicial process that led to his removal. It is puzzling that he would now return to the same baseless allegations he once renounced.”

Continuing, Akpabio emphasised that it was the court and not him that determined his fate before he was consequently removed.

The former governor asserted that he, therefore, found it illogical and irresponsible that Abbo could turn around and allege that he influenced the judgment that he accepted at the time.

“It is there in the papers (see PUNCH Newspaper of 18th October 2023). Mr Abbo has also sought to create the impression that he was unjustly denied official benefits following his ouster. He claims entitlement to salaries, allowances, and even an official vehicle, despite the court’s declaration that his tenure was null and void ab initio.

“If any of Abbo’s claims for payment did not reach the desk of the Senate President, it is because they failed to meet these lawful standards—not because of any personal or political vendetta. It is unfortunate that instead of accepting the consequences of his legal and political failings, Abbo continues to resort to media theatrics and reckless finger-pointing.

“Akpabio remains focused on the noble task of nation-building, providing purposeful leadership in the Senate, and strengthening democratic institutions—especially the independence of the judiciary. He will not be distracted by the antics of individuals who seek to rewrite history to mask personal failures.

“We urge Mr Abbo to reflect deeply, respect the rule of law, and focus on rebuilding the confidence of his constituents if he hopes to return to public life. Nigeria’s democracy can only thrive when its actors show maturity, responsibility, and an abiding respect for the truth,” the statement added.

-

News22 hours ago

News22 hours agoNatasha: Kogi PDP hammers Ododo, reiterates unfeigned support for her

-

Economy21 hours ago

Economy21 hours agoSEE Black Market Dollar To Naira Exchange Rate Today 3rd April 2025

-

News17 hours ago

News17 hours agoJust in: “Ignore rumour mongers, there was no time I collapsed “-Wike asserts

-

News17 hours ago

News17 hours agoCJ transfers Natasha’s case to Justice Nyako

-

News20 hours ago

News20 hours agoJust in: INEC dumps recall petition against Sen Natasha

-

News6 hours ago

News6 hours agoHow I Got Helicopter Idea To Visit Kogi State – Senator Natasha

-

Entertainment6 hours ago

Entertainment6 hours agoWhy I didn’t sleep with Bobrisky – Portable

-

News5 hours ago

News5 hours agoRivers CJ directs High Court judges to proceed on break