News

N319.8 Million Fraud: Court turns down Ecobank’s request to restrain NSA from arresting staff

By Francesca Hangeior

Justice Inyang Ekwo of the

Federal High Court sitting in Abuja has dismissed a suit instituted by Ecobank Nigeria Limited, seeking to restrain the National Security Adviser from carrying out its threat to use the law enforcement agencies to arrest and harass members of its staff on the allegations of fraudulent disbursements of N319,830,000 from the federal government’s Niger Delta Amnesty Programme.

Delivering his judgement on the

the fundamental rights suit filed by the bank against the Attorney General of the Federation, the National Security Adviser (NSA), and the Federal Government regarding the Niger Delta Amnesty Programme, Justice Ekwo held that fundamental rights applications cannot be used to shield the allegations

Dismissing the suit, Justice Ekwo held that the banker-customer relationship remains a civil transaction as long as there is no element of criminality involved.

The bank had asked the court to declare that the continuous invitations, intimidation, harassment, and threats to arrest and detain its staff by the respondents, in order to force it to pay N849,408,000—allegedly lost by the Amnesty Programme due to purported negligence—were unlawful, unconstitutional, and in breach of the applicant’s rights to operate as a corporate entity and maintain its corporate dignity.

Oladipupo, Regional Operations Head of FCT, Ecobank Nigeria Limited, testified in suit no: FHC/ABJ/CS/469/2023 that on January 19, 2023, commercial banks, including Ecobank, were summoned to a meeting by the ONSA regarding the amnesty scheme.

At the meeting, he stated that the NSA informed bank representatives that some beneficiaries of the amnesty scheme had been receiving double payments by opening multiple accounts in several banks, and that the program had been paying funds to unknown individuals.

He said that afterward, the NSA sought the banks’ support in addressing these challenges and ensuring that the leakages were blocked.

Oladipupo added that to the bank’s surprise, the NSA Permanent Secretary, Mr. Aliyu Mohammed, informed the banks that the Federal Government had purportedly lost N13 billion due to the leakages and demanded that Ecobank refund N849,408,000 within two weeks.

Oladipupo said the amnesty program’s solicitors later demanded the payment of N319,830,000 from the bank.

“Shocked by the demand and threat of arrest, the applicant requested time to audit their records and verify the claims of multiple payments in line with the instructions given by the Amnesty Programme.”

“The applicant refuted the allegations and denied liability for the said sum in its letter dated February 23, 2023. The applicant did not engage in any fraudulent activity regarding the funds paid to its customers either before or after opening the accounts,” Oladipupo submitted.

The bank stated that the amnesty program, specifically the NSA, had been continually inviting its staff to pressure the bank into making the payment.

“The Amnesty Programme specifically threatened to use the DSS and Police to arrest, harass, and intimidate the top executives of the bank to force the applicant to comply with the unlawful request for payment of N849,408,000.

“The fundamental rights of the applicant, its directors, staff, or agents to liberty, freedom of movement, and the right to own movable property, especially its standing with the Central Bank of Nigeria, are likely to be infringed by the respondents,” he said.

However, Mr. Melvin Obiakor, a Reintegration Officer in the Presidential Amnesty Office, countered the bank in a deposition on behalf of all the respondents.

Obiakor stated that under the Stipend Programme, each ex-agitator is entitled to one payment per month into their respective accounts opened and maintained with local Nigerian banks, including Ecobank, effective from 2010/2011.

He said that in September 2022, following an audit by the Presidential Amnesty Programme Office on the payment of stipends from the commencement to September 2022, irregularities and suspected fraudulent activities concerning stipend payments and operations of related accounts opened and maintained with the banks were discovered.

“Initial investigations by the Amnesty Office revealed multiple accounts linked to different beneficiaries with variations of their names. Hence, the need to inquire from the banks where these accounts were held for explanations and clarifications.

“From its internal audit of payments made to agitators, the Amnesty Office discovered that the sum of N849,408,800.00 was paid through Ecobank to eighty persons who had multiple account numbers linked to one particular BVN, contrary to existing CBN guidelines and protocols on the operation of bank accounts,” the deponent added.

The deponent argued that the bank’s application is mischievous and, if granted, would cause grave injustice and hinder the ability of the respondents and law enforcement agencies to conduct full investigations into the wrongful and illegal payments under the Amnesty Programme.

The deponent accused the bank of attempting to thwart the Amnesty Programme’s efforts in resolving issues surrounding the fraudulent payments of stipends into flagged accounts.

However, Justice Ekwo in his judgement held that where there is any criminality in the transaction between a bank and its customer, the nature of the banking relationship changes, and the parties become subject to criminal liability.

According to the judge, the fundamental rights applications cannot be used to shield allegations of fraud between a banker and its customer.

“It is my opinion that if a party intends to assert that the matter in contention is contractual in nature and that law enforcement should not be involved, that party has the obligation to substantiate the claim that the subject matter remained contractual throughout the relationship,” the judge stated.

The judge subsequently held that Ecobank failed to provide the court with sufficient grounds to support its allegation of a potential violation of its fundamental rights and that of its officers.

He declared that the respondents are entitled to investigate allegations of fraudulent disbursement of N319,830,000.00 by multiple illegal beneficiary accounts maintained and operated with the bank.

The judge added that “respondents may engage any relevant law enforcement agency to conduct investigations into the fraudulent disbursement of N319,830,000.00.”

“I therefore make an order dismissing this case on those grounds”.

News

Afenifere demands for unconditional release of Farotimi

The pan-Yoruba socio-political organisation, Afenifere, has intervened in the ongoing face-off between legal luminary, Chief Afe Babalola and activist, Dele Farotimi, calling for unconditional release of the activist.

The organisation at a World Press Conference held at the residence of its leader, Chief Ayo Adebanjo in Lagos said while it was not talking about the merit or demerit of the case, the procedure and manner of arrest of the activist was condemnable.

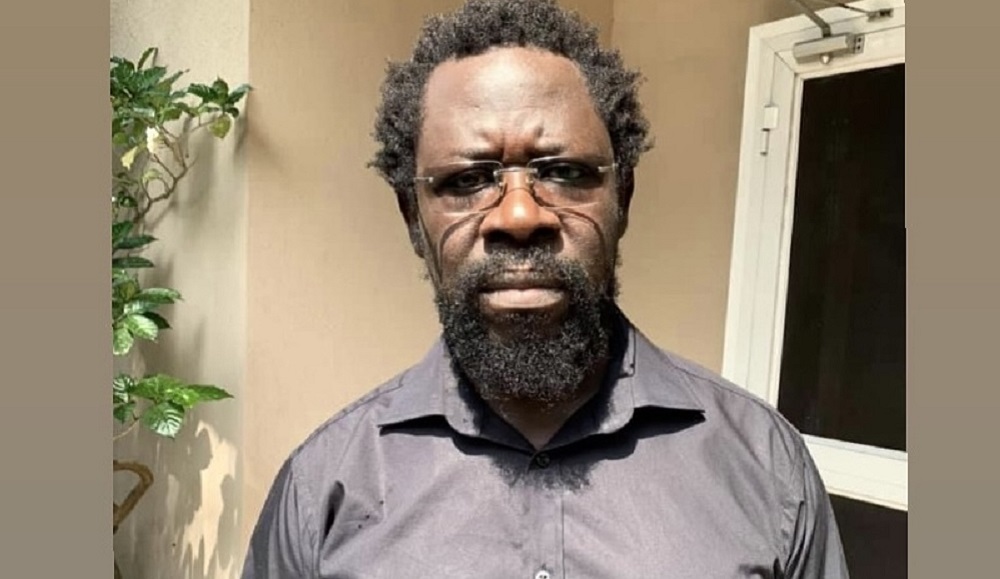

Deputy Leader of the Group, Oba Oladipo Olaitan who addressed the press conference expressed concern over the continued incarceration of Farotimi over a bailable offence.

Farotimi, a member of the National Caucus of Afenifere, was arrested on Tuesday December 3, 2024 in his office in Lekki Lagos by plain-clothed police officers from Ekiti State Police Command over a petition by Babalola.

Babalola had claimed he was defamed in the book written by Farotimi titled, “Nigeria and its Criminal Justice System.”

The Chief Magistrate Court in Ekiti has reserved a ruling on his bail application until December 20.

But Afenifere Deputy Leader criticised the chief magistrate, Abayomi Adeosun, for denying bail, describing the charges as bailable.

He stated that what is happening to Farotimi represented a script playing out as the charges are bailable and should have been granted bail on self-recognisance.

“It is Dele Farotimi today, it could be you tomorrow,” the Deputy Leader added.

“Afenifere believes that Chief Afe Babalola, like every citizen, has a right to defend his reputation if injured to the full extent of the law but not outside the strictures of the law. Therefore, Dele Farotimi must have his day in court. He cannot be unjustly incarcerated. His rights must be similarly protected,” he said.

The group called for an end to using the police from other states to arrest citizens, saying, “The increasing practice of arresting people in a state and transporting (rendering) them out of state often without the knowledge of the relatives of those arrested and also charged in a state other than the state of normal residence of the suspect need to be stopped.

“The practice exerts undue mental agony and expense on the accused person and their families who are often left wondering for hours or days about the safety and whereabouts of their loved ones. The Police must stop this practice.

“It is a loophole that can be exploited by criminals who may be tempted to disguise their crimes by acting out their nefarious activities by imitating the rogue police operations.”

Oba Olaitan added that the delay in granting bail to Mr. Farotimi “has confirmed the fears of well-meaning people all over the world that these processes are driven by extraneous considerations outside the facts and laws in respect of the petition on which the Police and the Chief Magistrate in Ekiti are hinging their actions.”

News

Just In: FCT High CourtG admits ex Gov. Bello to N500m bail

The Federal Capital Territory High Court, on Thursday, granted the immediate past Governor of Kogi State, Yahaya Bello, bail in the sum of N500 million with three sureties in like sum.

Justice Maryann Anenih had, on December 10, refused the ex-governor’s bail application, saying it was filed prematurely.

While delivering the initial ruling, she said, having been filed when the 1st defendant was neither in custody nor before the court, the instant application was incompetent.

There was, however, room for the governor’s lawyers to file a fresh application for bail and apply for hearing date.

The former governor is facing an alleged money laundering trial to the tune of N110bn, along with two others.

He had pleaded not guilty to the 16-count charges brought against him by the Economic and Financial Crimes Commission.

When the case was called for hearing, on Thursday, Counsel for the former governor, Joseph Daudu, SAN, informed the court that the defence counsels had filed a further affidavit in response to the counter affidavit filed and served by the prosecution counsels.

He, however, applied to withdraw the further affidavit, saying, “We do not want to make the matter contentious.”

There was no objection from the prosecution counsel, Olukayode Enitan, SAN. The court, therefore, granted the application for withdrawal, striking out the further affidavit.

Daudu, SAN, also informed the court that discussions had taken place with the leader of the prosecution counsels, resulting in an agreement to ensure a speedy trial.

In light of this understanding, Daudu urged the court to grant the bail application.

He further requested that if the court would graciously grant the Defendant bail, the court should kindly review the bail conditions for the 1st, 2nd, and 3rd defendants.

He urged the court to broaden the scope of property to be used as bail sureties to include locations across the Federal Capital Territory (FCT), rather than limiting the location solely to Maitama.

The prosecution counsel, Enitan SAN, acknowledged that Daudu SAN had been in talks with the prosecution team.

In accordance with the Rules of Professional Conduct (RPC), the EFCC Counsel gave assurance of their cooperation in expediting the trial.

He said, “I confirm the evidence given by the distinguished member of the bar that is leading the Defence, J.B. Daudu, SAN, that he has been in conversation with the leader of the prosecuting team.

“As with the legal tradition that we should cooperate with members of the bar when it does not affect the course of justice, we have decided not to make this contentious, bearing in mind that no matter how industrious the defence counsel might be in pushing forward the application for bail and no matter how vociferous the prosecution counsel can argue against the bail application, your lordship is bound by your discretion to grant or not to grant the application.

“We are therefore leaving this to your lordship’s discretion.”

Delivering her ruling, Justice Anenih acknowledged that the offence the 1st Defendant was charged with was a bailable one and granted the ex-governor bail in the sum of N500 million, with three sureties in like sum.

The sureties must be notable Nigerians with landed property in Maitama, Jabi, Utako, Apo, Guzape, Garki, and Asokoro.

The 1st Defendant was also asked to deposit his international passport and other travel documents with the court.

He is to remain at Kuje Correctional Centre until the bail conditions are met.

The court also granted the application to vary the bail conditions for the 2nd and 3rd Defendants, Umaru Oricha and Abdulsalami Hudu, respectively.

They were granted bail in the sum of N300 million, with two sureties who must own landed property in Maitama, Jabi, Apo, Garki, Wuse, or Guzape. The location was initially restricted to Maitama.

They are to deposit their international passports and other travel documents with the court.

The 2nd and 3rd Defendants are to remain at the Kuje Correctional Centre pending the fulfilment of their bail conditions. [Daily Review Online]

News

SEE NAIRA Rates Against The USD, GBP, EURO Today December 19, 2024

WHEN we look at this month, USD was traded at ₦ at the beginning of this December on Monday, December 2, 2024. As at today with USD being traded at ₦1,665 we see a % for United States Dollar to Naira exchange rate for this month.

On this page, we are primarily focusing on the Black Market Dollar To Naira Exchange Rate Today, the USD to Naira currency pair are the most traded currency in the FX market.

Black Market Exchange Rates

Buying Rate

Selling Rate

Dollar to Naira 1665 1650

Pounds to Naira 2120 2090

Euro to Naira 1725 1690

Canadian Dollar to Naira 1176 1158

Rand to Naira 52 43

Dirham to Naira 0 0

Yuan to Naira 62 62

G.Cedi to Nair 70 50

CFA F. (XOF) To Naira 0.83 0.81

CFA F. (XAF) To Naira 0.74 0.74

Having full knowledge how much USD to NGN black market exchange rate today will give you a better opportunity to plan and make informed decisions.

Nairatoday.com

-

News22 hours ago

News22 hours agoNetizens Slam Lawmakers As They Sing Tinubu’s Anthem At Budget Presentation

-

News19 hours ago

News19 hours agoFinally, PDP Flushes Out Suspended National Vice Chairman, Ali Odefa

-

News16 hours ago

News16 hours agoReps Call for Revival of NAPAC to Boost Transparency, Accountability

-

News16 hours ago

News16 hours agoReps Recommends Delisting NECO, UI, Labour Ministry, 21 Others From 2025 Budget

-

News9 hours ago

News9 hours agoLawmaker laments over 2023, 2024, 2025 budget running in one circle

-

News9 hours ago

News9 hours agoVideo: Tinubu Arrives Lagos, Meets Old ‘Friend’ Papa Ajasco

-

News22 hours ago

News22 hours agoPRESIDENT BOLA AHMED TINUBU TEXT OF THE 2025 BUDGET

-

News16 hours ago

News16 hours agoNigeria Needs Comprehensive Reforms To Expand Its Tax Base – Speaker Abbas