News

Cooking gas price jumps to N1,500/kg

As Nigerians struggle with the high cost of petrol, the price of Liquefied Petroleum Gas, also known as cooking gas, has also increased to N1,500/kg.

But the Managing Director/Chief Executive Officer of NIPCO Plc, Suresh Kumar, said the Dangote refinery and other domestic refineries would bring down the price of cooking gas, expressing concerns that over 60 per cent of cooking gas consumed in Nigeria is being imported.

Checks by our correspondent confirmed that the prices of cooking gas peaked at N1,500/kg in some retail outlets in Ogun and Lagos States as of Sunday.

In Abuja, the average price for refilling a 12.5kg cylinder of cooking gas has increased by 41.6 per cent to N17,000 in different areas.

The PUNCH reports that the same commodity sold for N12,000 in July and N11,735 in January 2024.

This sharp price rise reflects ongoing trends in the market and may have implications for consumers, many of whom rely on LPG for their daily cooking needs.

In August, the Minister of State for Petroleum Resources (Gas), Ekperikpe Ekpo, promised to ensure a reduction in the rising cost of a kilogram of cooking gas.

Ekpo noted that he would invite the regulators and the gas producers to find ways to bring down the cost.

However, a new market survey conducted by our correspondent on Sunday revealed that the price has not decreased; instead, it has risen even further.

An analysis showed that the product currently sells for N17,000 in Lokogoma area of the FCT, an increase of 41.6 per cent from N12,000 vendors sold to customers three months ago. This means one kilogram of gas was sold for N1,400.

In Kubwa, the product was sold between N16,200 and N16,500 from N12,000 previously charged. But in the outskirt area of Bwari, Kurudu and Jikwoyi, the product sold for N1,300.

Some major distributors still sell the product between N1,300 and N1,400 depending on the location.

The Commissioner for Environment in Ogun State, Ola Oresanya, once told one of our correspondents that many might resort to charcoal for cooking if the price of LPG continues to rise.

However, speaking at the just-concluded National Conference of the Nigerian Association of Liquefied Petroleum Gas Marketers 2024, held in Lagos, Kumar, revealed that local production of LPG remains inadequate, urging the Federal Government to encourage Chevron to convert more of its propane output into propane.

“Currently, less than 40 per cent of the 1.5 million metric tonnes consumed domestically is produced locally. This is why the government must encourage companies like Chevron to convert more of their propane output into butane, which is more suitable for domestic use,” he explained.

Responding to questions about the rising cost of LPG amid a blend of local and imported supply, the managing director expressed optimism that prices would decline as domestic production improves, especially as the local refineries source crude oil locally.

“With the Dangote refinery and other refineries now sourcing crude oil in local currency, the volume of LPG produced locally is expected to increase, which will, in turn, drive down the price of the commodity,” the MD explained.

He added, “There is hope that the reliance on imported LPG will decrease, which will positively influence the prices at which the product is sold domestically. Greater local production will make LPG more affordable since it reduces exposure to foreign exchange fluctuations and international pricing dynamics.”

According to him, boosting local production would attract further investments in pipelines, storage, and bottling facilities, as well as expand retail outlets and LPG depots across Nigeria.

“Our latest assessments show that the existing downstream infrastructure is capable of handling up to 5 million MT annually. This means we are ready to accommodate increased production from both associated and non-associated gas fields within the country,” the MD said.

He urged the government to introduce incentives to encourage investments in gas processing.

According to him, NIPCO, which has been operational since 2004, initially entered the industry as a marketer of white products (petroleum fuels).

He, however, emphasised that the company’s long-term vision has always been to become a leader in the marketing and distribution of LPG.

Kumar said, “Our strategy was driven by the fact that Nigeria has over 200 trillion cubic feet of gas reserves. We believe that the country’s gas consumption must be optimised through the promotion of both LPG for domestic use and CNG for the industrial and transportation sector.”

He further emphasised the company’s investments in infrastructure, noting that NIPCO has expanded its LPG operations significantly over the years.

“In 2008, we invested in an LPG facility in Apapa with a capacity of 5,000 metric tonnes. Today, that same facility has grown to over 20,000 metric tonnes, thanks to strategic partnerships with our subsidiaries.

“We have also deployed LPG tankers and established multiple stations across Nigeria to ensure easy access to cooking gas for households nationwide,” Kumar revealed.

He further explained that while LPG is essential for homes, CNG will play a key role in powering industries and transforming the transportation sector.

The managing director added, “At the time NIPCO entered the market, Nigeria’s domestic LPG consumption was around 50,000 metric tonnes annually,” he stated.

“However, the past 16 to 17 years have been a remarkable journey. Today, the market has grown from 50,000 MT to approximately 1.5 million MT per year.”

Despite the growth, Kumar pointed out that significant potential remains untapped, saying less than 60 per cent of Nigeria’s 200 million population has embraced the use of LPG.

“Our vision is to harness these opportunities and grow the country’s LPG consumption from 1.5 million MT to levels more appropriate for a population of over 200 million people.

“We must work with the Nigerian Midstream and Downstream Petroleum Regulatory Authority and other stakeholders to end gas flaring in the country. Substantial investments are needed to capture and process flared gas to increase domestic supply beyond the current 1.5 million MT to at least 5 million MT annually,” he stressed.

The NIPCO boss acknowledged that demand for LPG in Nigeria has been relatively stagnant due to the high cost of the product.

“The current high prices have limited consumption growth, but this situation is only temporary. With more players entering the gas processing sector, we anticipate a market correction soon,” he stated, believing that the market would stabilise in the long run.

He urged the Federal Government to support local refineries, including the Dangote Refinery, to boost domestic gas production.

“It is crucial for the government to back these refineries in their efforts to significantly increase LPG output. This will drive down retail prices and make the product more accessible to Nigerians,” he posited.

Credit: PUNCH

News

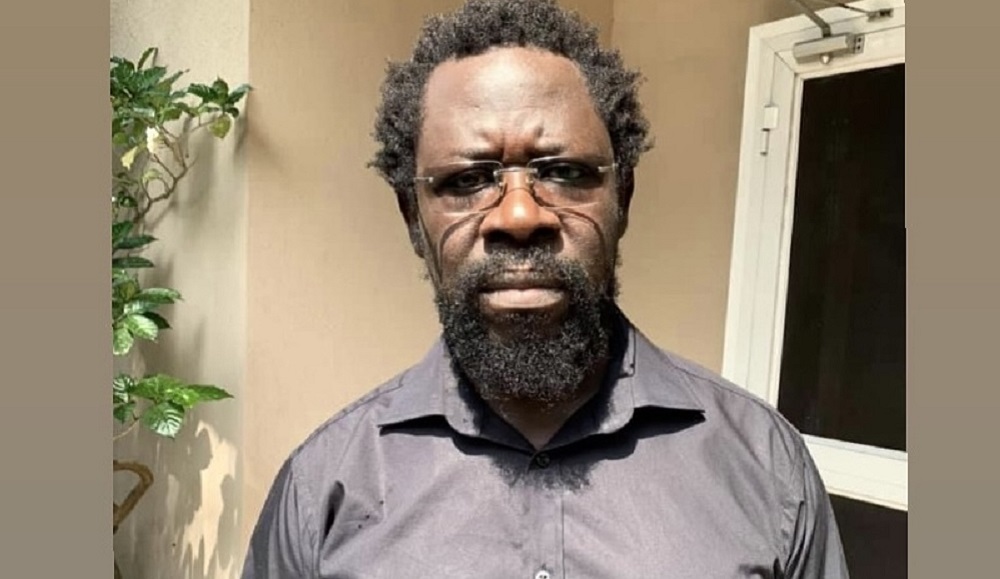

Afenifere demands for unconditional release of Farotimi

The pan-Yoruba socio-political organisation, Afenifere, has intervened in the ongoing face-off between legal luminary, Chief Afe Babalola and activist, Dele Farotimi, calling for unconditional release of the activist.

The organisation at a World Press Conference held at the residence of its leader, Chief Ayo Adebanjo in Lagos said while it was not talking about the merit or demerit of the case, the procedure and manner of arrest of the activist was condemnable.

Deputy Leader of the Group, Oba Oladipo Olaitan who addressed the press conference expressed concern over the continued incarceration of Farotimi over a bailable offence.

Farotimi, a member of the National Caucus of Afenifere, was arrested on Tuesday December 3, 2024 in his office in Lekki Lagos by plain-clothed police officers from Ekiti State Police Command over a petition by Babalola.

Babalola had claimed he was defamed in the book written by Farotimi titled, “Nigeria and its Criminal Justice System.”

The Chief Magistrate Court in Ekiti has reserved a ruling on his bail application until December 20.

But Afenifere Deputy Leader criticised the chief magistrate, Abayomi Adeosun, for denying bail, describing the charges as bailable.

He stated that what is happening to Farotimi represented a script playing out as the charges are bailable and should have been granted bail on self-recognisance.

“It is Dele Farotimi today, it could be you tomorrow,” the Deputy Leader added.

“Afenifere believes that Chief Afe Babalola, like every citizen, has a right to defend his reputation if injured to the full extent of the law but not outside the strictures of the law. Therefore, Dele Farotimi must have his day in court. He cannot be unjustly incarcerated. His rights must be similarly protected,” he said.

The group called for an end to using the police from other states to arrest citizens, saying, “The increasing practice of arresting people in a state and transporting (rendering) them out of state often without the knowledge of the relatives of those arrested and also charged in a state other than the state of normal residence of the suspect need to be stopped.

“The practice exerts undue mental agony and expense on the accused person and their families who are often left wondering for hours or days about the safety and whereabouts of their loved ones. The Police must stop this practice.

“It is a loophole that can be exploited by criminals who may be tempted to disguise their crimes by acting out their nefarious activities by imitating the rogue police operations.”

Oba Olaitan added that the delay in granting bail to Mr. Farotimi “has confirmed the fears of well-meaning people all over the world that these processes are driven by extraneous considerations outside the facts and laws in respect of the petition on which the Police and the Chief Magistrate in Ekiti are hinging their actions.”

News

Just In: FCT High CourtG admits ex Gov. Bello to N500m bail

The Federal Capital Territory High Court, on Thursday, granted the immediate past Governor of Kogi State, Yahaya Bello, bail in the sum of N500 million with three sureties in like sum.

Justice Maryann Anenih had, on December 10, refused the ex-governor’s bail application, saying it was filed prematurely.

While delivering the initial ruling, she said, having been filed when the 1st defendant was neither in custody nor before the court, the instant application was incompetent.

There was, however, room for the governor’s lawyers to file a fresh application for bail and apply for hearing date.

The former governor is facing an alleged money laundering trial to the tune of N110bn, along with two others.

He had pleaded not guilty to the 16-count charges brought against him by the Economic and Financial Crimes Commission.

When the case was called for hearing, on Thursday, Counsel for the former governor, Joseph Daudu, SAN, informed the court that the defence counsels had filed a further affidavit in response to the counter affidavit filed and served by the prosecution counsels.

He, however, applied to withdraw the further affidavit, saying, “We do not want to make the matter contentious.”

There was no objection from the prosecution counsel, Olukayode Enitan, SAN. The court, therefore, granted the application for withdrawal, striking out the further affidavit.

Daudu, SAN, also informed the court that discussions had taken place with the leader of the prosecution counsels, resulting in an agreement to ensure a speedy trial.

In light of this understanding, Daudu urged the court to grant the bail application.

He further requested that if the court would graciously grant the Defendant bail, the court should kindly review the bail conditions for the 1st, 2nd, and 3rd defendants.

He urged the court to broaden the scope of property to be used as bail sureties to include locations across the Federal Capital Territory (FCT), rather than limiting the location solely to Maitama.

The prosecution counsel, Enitan SAN, acknowledged that Daudu SAN had been in talks with the prosecution team.

In accordance with the Rules of Professional Conduct (RPC), the EFCC Counsel gave assurance of their cooperation in expediting the trial.

He said, “I confirm the evidence given by the distinguished member of the bar that is leading the Defence, J.B. Daudu, SAN, that he has been in conversation with the leader of the prosecuting team.

“As with the legal tradition that we should cooperate with members of the bar when it does not affect the course of justice, we have decided not to make this contentious, bearing in mind that no matter how industrious the defence counsel might be in pushing forward the application for bail and no matter how vociferous the prosecution counsel can argue against the bail application, your lordship is bound by your discretion to grant or not to grant the application.

“We are therefore leaving this to your lordship’s discretion.”

Delivering her ruling, Justice Anenih acknowledged that the offence the 1st Defendant was charged with was a bailable one and granted the ex-governor bail in the sum of N500 million, with three sureties in like sum.

The sureties must be notable Nigerians with landed property in Maitama, Jabi, Utako, Apo, Guzape, Garki, and Asokoro.

The 1st Defendant was also asked to deposit his international passport and other travel documents with the court.

He is to remain at Kuje Correctional Centre until the bail conditions are met.

The court also granted the application to vary the bail conditions for the 2nd and 3rd Defendants, Umaru Oricha and Abdulsalami Hudu, respectively.

They were granted bail in the sum of N300 million, with two sureties who must own landed property in Maitama, Jabi, Apo, Garki, Wuse, or Guzape. The location was initially restricted to Maitama.

They are to deposit their international passports and other travel documents with the court.

The 2nd and 3rd Defendants are to remain at the Kuje Correctional Centre pending the fulfilment of their bail conditions. [Daily Review Online]

News

SEE NAIRA Rates Against The USD, GBP, EURO Today December 19, 2024

WHEN we look at this month, USD was traded at ₦ at the beginning of this December on Monday, December 2, 2024. As at today with USD being traded at ₦1,665 we see a % for United States Dollar to Naira exchange rate for this month.

On this page, we are primarily focusing on the Black Market Dollar To Naira Exchange Rate Today, the USD to Naira currency pair are the most traded currency in the FX market.

Black Market Exchange Rates

Buying Rate

Selling Rate

Dollar to Naira 1665 1650

Pounds to Naira 2120 2090

Euro to Naira 1725 1690

Canadian Dollar to Naira 1176 1158

Rand to Naira 52 43

Dirham to Naira 0 0

Yuan to Naira 62 62

G.Cedi to Nair 70 50

CFA F. (XOF) To Naira 0.83 0.81

CFA F. (XAF) To Naira 0.74 0.74

Having full knowledge how much USD to NGN black market exchange rate today will give you a better opportunity to plan and make informed decisions.

Nairatoday.com

-

News22 hours ago

News22 hours agoFinally, PDP Flushes Out Suspended National Vice Chairman, Ali Odefa

-

News19 hours ago

News19 hours agoReps Call for Revival of NAPAC to Boost Transparency, Accountability

-

News19 hours ago

News19 hours agoReps Recommends Delisting NECO, UI, Labour Ministry, 21 Others From 2025 Budget

-

News12 hours ago

News12 hours agoLawmaker laments over 2023, 2024, 2025 budget running in one circle

-

News12 hours ago

News12 hours agoVideo: Tinubu Arrives Lagos, Meets Old ‘Friend’ Papa Ajasco

-

News19 hours ago

News19 hours agoNigeria Needs Comprehensive Reforms To Expand Its Tax Base – Speaker Abbas

-

Sports12 hours ago

Sports12 hours agoI Failed In Front of the World Four Years Ago — Lookman’s Touching Speech After Winning CAF Award

-

News22 hours ago

News22 hours agoTALL Forcast: 2025 Budget will bring down inflation to 15%, dollar to N1,500-Tinubu