News

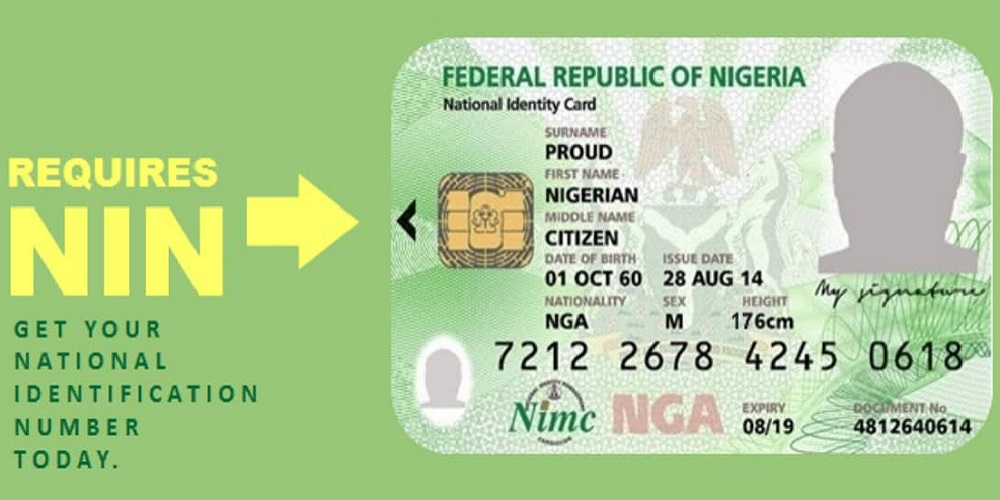

Deadline on NIN/account linkage: Most banks yet to implement directive

As the deadline given to banks to link all bank accounts to NIN elapsed last Thursday, many banks in the country are yet to implement the directive.

Recall that the Central Bank of Nigeria, CBN had issued a directive to all commercial banks in the country last year to restrict tier-1 accounts without proper Biometric Verification Number, BVN and National Identity Number, NIN link by Thursday, March 1st, 2024. And as at that date, approximately 91 million bank accounts faced the risk of being frozen by their respective banks.

Vanguards’ investigation has revealed that against expectations that banks will start blocking accounts not linked to NIN/BVN, few banks were only focused on blocking accounts without BVN but allowed customers that are yet to link their NIN unhindered access to their accounts.

Further investigation also revealed that some customers that have not linked their SIM cards to their NIN were barred by their network providers from using the SIM cards, which consequently affected the mobile transactions of such customers.

Vanguard’s visit to some of the new generation banks around Old Ojo Road at Abulado axis in Lagos State showed partial compliance to the CBN’s directive.

Out of the four banks (Zenith Bank, Ecobank, Access Bank, and Stanbic IBTC Bank) visited by Vanguard only Zenith Bank has started implementation of the directive.

When Vanguard visited Zenith Bank branch around the axis, some customers who visited the bank to rectify blockage were seen trying to fill NIN update form in order to have their accounts unblocked.

An official of the bank told our correspondent that several accounts have been blocked as a result of non-linkage of customers’ account to NIN.

“Several accounts that are not linked to NIN, especially corporate accounts, have been blocked. People who are affected have been coming in to sort it out. Once you fill the NIN update form and submit, the account will be unblocked,” he said.

A customer of Zenith Bank, who simply identified herself as Ngozi, told Vanguard that two separate transfers she made did not go through even though she was debited.

“When I came to the bank to find out what happened, they said that I have to link my NIN to my account,” she said.

However, a customer relations staff at Stanbic IBTC Bank told Vanguard that no account has been blocked in the bank due to non-compliance.

“I am not aware of any customer’s that has been as a result of failure to link their account to NIN. Nobody has complained about it today” she said.

Our findings also revealed that Ecobank has not started implementation of the directive as well. An official of the bank, who spoke with our correspondent, simply said that no account has been blocked and she isn’t aware of when the bank would start implementing the directive.

The story was the same at Access Bank where customers have full access to their accounts without any form of hindrance.

A customer relations officer at the bank told our correspondent that only accounts without BVN are being denied access.

Meanwhile, a visit to GT Bank located along Lasu-Igando road showed that the bank is yet to commence implementation.

Speaking on the development, Mrs Ibekwe Onyedikachi, a customer of GT Bank said: “The reason I came to the bank for assistance is not because my GTB account was blocked but because my sister’s GTB account in Nigeria was affected. She cannot carry out any bank transactions because her Nigeria phone number has been barred due to her not linking NIN to her SIM.

Also speaking, Mr Babs who banks with First Bank said: “For some time now I have been receiving messages from my network company that I should link my NIN to my SIM, I have linked my NIN and SIM before, but when the messages kept coming often and often, I decided to go and link my SIM and that was successful.

“It was hectic, trying to link or do anything in Nigeria is always stressing, you will go through hassles to achieve what you would have achieved ordinarily. But I have a First Bank account that I am using, but I cannot use the account for any transaction for now because when I wanted to do a transaction they instructed me to go and link because that account has been barred.”

Meanwhile, a visit to Fidelity Bank in Alaba International Market shows that the bank is yet to implement the directive to block bank accounts that are not linked to NIN.

However, a staff of the bank told Vanguard that the Bank could commence implementation of the directive by the middle of March.

Speaking on the condition of anonymity she said: “For now, our customers are still carrying out their banking transactions without hassles as we are yet to implement the directive. However, information reaching us is that our bank can commence in the middle of the month.”

Also the Alaba International branch of Union Bank is also yet to implement the directive as the bank customers were seen going about their banking transactions unhindered.

Although, the customer care section was crowded with customers wanting to link their NIN to their bank accounts.

Meanwhile in Abuja, some commercial banks have begun implementation of the policy of freezing defaulting accounts.

Checks by Vanguard revealed that some of the banks have already commenced the implementation of the policy, restricting noncompliant customers from accessing their accounts.

When our reporter visited Fidelity bank branch at Federal Housing Estate, FHA, Lugbe, Abuja, staff of the bank confirmed that the policy had commenced and that affected customers were being directed to provide all the necessary information before their accounts could be defrozen.

The banker who pleaded for anonymity said, “Yes we have started implementing the policy, we freeze any account not linked to BVN and NIN, and for us to defreeze such account, the affected customers have to present their NIN, evidence of birth certificate, and make sure that the same names in BVN is what is on the NIN.”

When our reporter visited Wema Bank also in FHA, Lugbe, the story was the same. The bank officials who spoke to our reporter said, “We have started since last week to freeze accounts that were not linked to BVN and NIN. We are a responsible bank and we try as much as possible to follow the CBN directives.”

When asked on the remedy for the affected customers, the banker said, “We have two options for them, either they come to us with their valid identity cards, that is NIN to link their account to BVN or they download the available app and link their NIN to their BVN on their own, they do not necessarily need to come to the bank.”

Some of the bank customers, who spoke to our reporter, confirmed the implementation of the policy by the bank. One of them, Janet Agbo said, “Yes, they have started blocking accounts, they have frozen my own account, I tried to access it few minutes ago and I could not.”

Another bank customer, Uchenna Ekele, who also spoke to our reporter said his account had been frozen but he was going to provide them with all the needed documents to unfreeze it.

Another visit to UBA in the same vicinity showed that the bank is yet to commence the implementation. The head of Customer Care Unit, who spoke to our reporter said, we have not started blocking any account because we have not been given such directive. I am aware that the deadline was last Thursday but we have to be instructed before we can take action on that policy.”

When we paid a similar visit to Polaris bank, the bank officials said, “We have not been given directive to start freezing customers’ accounts that have not been linked to BVN and NIN. We are still receiving customers willing to link their accounts to their BVN and NIN. Until we receive an instruction from the authorities we cannot do otherwise.”

Meanwhile, the World United Consumer Organisation, WUCO, has urged the Central Bank of Nigeria, CBN, to create remote access methods and alternative procedures for Nigerians in diaspora to be able to link their National Identity Number, NIN, and Bank Verification Number, BVN.

The global advocacy group which is dedicated to ensuring equitable access to essential services for consumers worldwide, equally urged the apex bank to reconsider its deadline for NIN/BVN linkage.

In a statement issued on Tuesday, WUCO, through its President and human rights lawyer, Mr. Clement Osuya, stressed that though the CBN’s directive may be well intentioned, “It fails to consider the unique challenges Nigerians living abroad face.”

Credit: Vanguard

News

Oba of Benin to withdraw suit as Okpebholo restores rights

The Oba of Benin, Oba Ewuare II, and the Benin Traditional Council may withdraw the suits they filed against the state government as Governor Monday Okpebholo, on Sunday, restored the full statutory rights of the Oba and reversed the policies of the previous administration that impacted the Benin Traditional Council.

A statement on Sunday by Okepebholo’s Chief Press Secretary, Fred Itua, said the governor abolished the new traditional councils in Edo South created by the immediate-past governor, Godwin Obaseki.

Okpebholo also backed the Federal Government’s recognition of the Oba’s palace as the custodian of repatriated Benin artefacts looted during the 1897 British colonial expedition.

Providing an insight into the governor’s gesture, the state Attorney General and Commissioner for Justice, Dr Samson Osagie, said it signaled the resolution of the crisis between the Oba of Benin and the Edo State government leading to lawsuits duringt the Obaseki’s administration.

Osagies said, “The cases in court are cases which the Oba of Benin himself and the Benin Traditional Council instituted against the state government, and they are all civil matters. And you know that in civil suit or in any suit, parties are encouraged to settle amicably.

“So, if the parties are already settling and one side is already meeting the condition of settlement, the next step you are going to hear is that the party who went to court, which is the Oba of Benin, and the Benin Traditional Council, will instruct their counsel to withdraw the cases from court and that will be the end of the matter.

“The two parties are now settling for harmony and peace to reign, so the government is doing its own side of it.

“This statement is a prelude to discontinuing all legal proceedings with respect to the twin issues of the concession of the Oba Akenzua Cultural Centre by government to the Benin Traditional Council for 30 years and the creation of additional councils.”

The statement by Okepebholo’s Chief Press Secretary outlined the administration’s commitment to restoring the dignity and authority of the Benin monarch.

“This administration also hereby abolishes the new traditional councils in Edo South, created by the last administration,” the statement noted.

Additionally, Governor Okpebhol revoked the decision of the Obaseki’s administration to convert the Oba Akenzua II Cultural Centre into a motor park.

The government announced plans to restore the cultural centre to its original purpose.

“This administration is restoring the Oba Akenzua Centre to a suitable condition for its original purpose,” the statement added.

The governor also reinstated the financial entitlements of the Benin Traditional Council, ordering that the status quo before the creation of the abolished councils be maintained.

According to the statement, Okpebholo affirmed support for the Federal Government’s official gazette, which recognizes the Oba of Benin as the rightful owner and custodian of the repatriated Benin artefacts.

He also distanced his administration from the Museum of West Africa Art, instead backing the Benin Royal Museum project to house the artefacts.

“The Federal Government has also issued a gazette for the recognition of ownership and custody of the repatriated Benin artefacts to the Oba of Benin, Oba Ewuare II,” the statement explained. “Governor Okpebholo respects the rights and privileges of the traditional ruler of Benin kingdom… and pledges the support of his administration to ensure the monarch plays his role as the custodian of the rich cultural heritage of the Benin people.”

Okpebholo reiterated his administration’s respect for traditional institutions and vowed to avoid interference in the internal affairs of the Benin Traditional Council. “The Oba of Benin, as the father of all Benin people, is the sole custodian of the customs and traditions of the Benin people, and my administration respects customs and traditions in the land,” he stated, emphasising the government’s efforts to uphold the cultural and historical integrity of the Benin Kingdom.

News

Oyedepo’s jet can’t leave private airstrip without clearance – Keyamo

The Minister of Aviation and Aerospace Development, Festus Keyamo, on Sunday said there was no way the private plane of privileged Nigerians, including the Founder and Presiding Bishop of Living Faith Bible Church Worldwide, Bishop David Oyedepo, can leave the country directly from their airstrips without first securing clearance from relevant authorities.

Keyamo made the clarification when he was featured as a guest on Channels Television’s Politics Today.

His statement comes barely two months after members of the House of Representatives called for a revocation of airstrip licences issued to certain individuals and private organisations, citing security reasons.

The House also called for an immediate halt to new airstrip licences for individuals and organisations.

But Keyamo insisted that there was no way a plane or drone, even if it belongs to the military, can leave or come into the country without first getting a nod from the agency.

When asked if the airstrip of Oyedepo also passed through the same due process, Keyamo nodded.

He said, “Oh yes, absolutely. That’s no problem. They were only concerned about the fact that they thought that somebody can take off from a private airstrip and fly out of Nigeria or fly into Nigeria. It is not possible.

“You must land in an international airport first. Then the Customs, immigration and NDLEA will process you before you take off from there to your private airstrip. If you are also flying out, you must land at an international airport. You will go through Customs, immigration and all the normal process before flying out.

“So nobody uses an airstrip for any such purpose without seeking clearance. At every point in time, the authorities must approve.”

When quizzed on how many airstrips the country is operating at the moment, Keyamo said they are in the range of 40.

“We have a number of them, more than 40. For the federal airport, we have 23. The state airport has about eight or nine now.

“And then the airstrips are about 40 or thereabouts. I have been there myself,” he stated.

News

Abia bans unauthorised free medical outreaches

The Abia State Ministry of Health has reacted to the hospitalisation of some persons who attended a free medical outreach in Abiriba, Ohafia LGA, on Saturday, saying that the distribution of drugs to the public by uncertified persons was without the authorisation of the state government.

The Commissioner for Health, Professor Enoch Ogbonnaya Uche, who said this in a press release on Sunday, said that the organisers of the medical outreach did not obtain approval from the state government before embarking on the exercise.

He therefore announced that any medical outreach without authorisation from the Ministry of Health is illegal and can put the health of Abia people in jeopardy, warning that those who do so would be made to face the full wrath of the law.

DAILY POST recalls that many people were rushed to the hospital on Saturday at Abiriba after developing some medical emergencies on return from the medical outreach organised by a group.

According to Processor Uche, preliminary reports indicated that medications distributed during the outreach may have caused adverse drug reactions among unsuspecting recipients, even as he said that the identified victims of these untoward medical events are currently receiving medical attention at designated public health facilities within the state.

“Our dedicated healthcare personnel are working assiduously to stabilise and treat affected people. The Abia State Ministry of Health is deeply concerned by the dire consequences and high risk posed by unauthorised healthcare activities. We wish to hereby warn the public to be cautious of individuals and groups organising unapproved healthcare events,” said the health commissioner.

-

News16 hours ago

News16 hours agoJust in: Dangote Refinery reduces price of petrol to N970 per litre

-

Metro18 hours ago

Metro18 hours agoNDLEA nabs businessman at Enugu airport for ingesting 90 wraps of cocaine +Photos

-

News12 hours ago

News12 hours agoObasanjo narrates how he escaped becoming drug addict

-

News18 hours ago

News18 hours agoSAD! Roman Catholic Oldest Priest Monsignor Thomas Oleghe dies at 103

-

Politics18 hours ago

Politics18 hours agoParty Crisis Escalates: PDP NEC Meeting Delayed for the Fourth Time

-

News17 hours ago

News17 hours agoInsecurity! Bandits k!ll 7 farmers, burn 50 bags of maize in Niger state

-

News15 hours ago

News15 hours agoJoint Security Patrol Team wastes Kidnapper in gun duel along Enugu/Ukwu Road

-

Metro14 hours ago

Metro14 hours agoBREAKING: UK Court Fines Popular Journalist David Hundeyin £95000 for Libel