Economy

FG announces incentives for Nigerians to repatriate foreign funds

The federal government has launched an amnesty initiative that allows individuals to deposit foreign currencies into banks without penalties or taxes — provided the funds are not proceeds of crime.

Announcing the initiative in a statement on Thursday, the ministry of finance said the programme is called the ‘Disclosure Scheme’.

Mohammed Manga, the ministry’s director of information and public relations, said the scheme, starting October, is for nine months.

The public relations officer said the initiative is designed to enhance transparency in the financial sector and boost Nigeria’s economic resilience, growth, and development.

He said by facilitating the voluntary disclosure, depositing, repatriation, and investment of internationally tradable foreign currency held by Nigerians, both within and outside the country, “the scheme aims to integrate these legitimate foreign currency assets into the formal economy”.

“The federal government of Nigeria is pleased to announce the commencement of the foreign currency voluntary disclosure, depositing, repatriation, and investment scheme, known as the disclosure scheme, in pursuance of Executive Order No. 15 of 2023 titled ‘Disclosure, Depositing, Repatriation, and Investment of Eligible Foreign Exchange Assets and Related Matters Order, 2023’ and the ‘Foreign Currency Disclosure, Deposit, Repatriation, and Investment Scheme Guidelines, 2024’, issued by the Honourable Minister of Finance and Coordinating Minister of the Economy, on October 25th, 2024,” the statement reads.

“Key objectives of the disclosure scheme: enhance financial transparency: Promote transparency in the financial sector by formalising legitimate foreign currency assets held outside the Nigerian banking system by Nigerians within or outside of Nigeria.

“Bolstering AML and CFT capabilities: The scheme specifically targets weaknesses in the existing framework by promoting cashless and legitimate transactions within the formal financial system.

“This strengthens regulatory enforcement while also encouraging financial practices that reduce the likelihood of illicit cash transactions.”

‘FUNDS WILL INCREASE RESERVES’

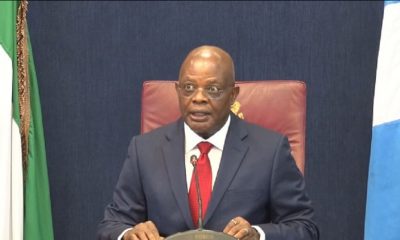

Speaking on the scheme, Wale Edun, minister of finance and coordinating minister of the economy, said the initiative would enhance financial security and contribute positively to the economy by increasing reserves and stabilising exchange rates.

“The disclosure scheme is a bold initiative aimed at integrating foreign currency outside the formal financial system into the formal economy,” Edun said.

“It strengthens transparency and economic resilience, setting us on a path to rapid economic growth.

“The scheme offers a secure, confidential channel for people to reintegrate their legitimate foreign currency funds, promoting stability and growth for our nation.

“Guided by President Tinubu’s leadership and supported by the Central Bank of Nigeria (CBN) and Ministry of Justice, we are building a transparent and inclusive economy, aligned with best practices in anti-money laundering and countering the financing of terrorism.”

Edun encouraged Nigerians holding legitimately earned foreign currency to participate.

Economy

Crude prices slump to $65 first time since 2021

Oil prices plunged this week to $65 per barrel as the United States import tariffs and an unexpected OPEC+ supply hike erased $10 per barrel from global benchmarks.

The price appreciated last week when US President Donald Trump imposed tariffs on any country that buys crude from Venezuela.

However, oil prices turned around the corner as of Friday, with Brent falling to $65, the first time since 2021.

According to oilprice.com, the combined effect of Trump’s import tariffs, OPEC+’s inopportune decision to speed up the unwinding of production cuts, and China’s retaliatory actions wiped off $10 per barrel from global oil prices, “with ICE Brent falling below $65 per barrel for the first time since August 2021.”

The US West Texas Intermediate crude futures lost $4.96, or 7.4 per cent to end at $61.99.

“Seeing backwardation barely change compared to the beginning of the week, one could assume that US tariffs are the defining factor for the price change. Nevertheless, this week will not go down well in the history of oil markets,” oilprice.com reports.

China’s retaliatory tariffs on US goods have escalated a trade war that has led investors to price in a higher probability of recession.

China, the world’s top oil importer, announced it will impose additional tariffs of 34 per cent on all US goods from April 10.

According to Reuters, nations around the world have readied retaliation after Trump raised tariffs to their highest in more than a century.

Aside from the tariffs, another factor that further pressured oil prices was the Organisation of the Petroleum Exporting Countries and Allies’ decision to advance plans for output increases.

The group now aims to return 411,000 barrels per day to the market in May, up from the previously planned 135,000 bpd.

Economy

CBN allocates $197.71m into FX market to support naira

The Central Bank of Nigeria has injected $197.71m into the foreign exchange market on Friday, April 4, 2025, as part of its commitment to ensuring adequate liquidity and maintaining orderly market functioning.

This was disclosed in a statement on Saturday by the Director of the Financial Markets Department, Dr Omolara Omotunde-Duke, reiterating the bank’s stance on maintaining market integrity and operational transparency.

The statement read, “In line with its commitment to ensuring adequate liquidity and supporting orderly market functioning, the CBN facilitated market activity on Friday, April 4, 2025, with the provision of $197.71m through sales to authorised dealers. This measured step aligns with the bank’s broader objective of fostering a stable, transparent, and efficient foreign exchange market.”

The CBN said the intervention was in line with its broader objective of fostering a stable, transparent, and efficient foreign exchange market.

It added that it remained focused on sustaining liquidity levels to support smooth market operations amid ongoing global economic adjustments.

The apex bank said the decision to boost liquidity in the FX market came against the backdrop of significant shifts in the global macroeconomic landscape, which had affected many emerging markets and developing economies, including Nigeria.

It noted that the recent introduction of new import tariffs by the United States on goods from several economies had triggered adjustments across global markets.

It added that crude oil prices—a major revenue source for Nigeria—had dropped by over 12 per cent, settling at approximately $65.50 per barrel.

The CBN said the downturn posed challenges for oil-exporting countries, influencing exchange rate dynamics and market sentiment.

The CBN stressed that it would continue to monitor both global and domestic market conditions. It expressed confidence in the resilience of Nigeria’s foreign exchange framework, which it said was designed to adjust appropriately to changing economic fundamentals.

The bank also urged all authorised dealers to strictly adhere to the principles outlined in the Nigerian FX Market Code, promoting transparency and upholding the highest standards in their transactions with clients and market counterparties.

Meanwhile, Nigeria’s official exchange rate fell to N1,600/$1 at the end of trading on April 4, 2025, as the tariffs imposed during the Trump era continued to impact global markets.

Data from the CBN showed that the naira closed at N1,600/$1, marking a 1.9 per cent depreciation compared to the N1,569/$1 recorded the previous day.

The figure also marked the weakest level the naira had reached since December 4, 2024, when it closed at N1,608/$1. The exchange rate has now weakened by 3.9 per cent in the first four days of April, after closing March at N1,537/$1.

According to the CBN, the exchange rate closed at N1,600/$1 on Friday, marking a 1.9 per cent drop from the previous day.

The intra-day highs and lows were reported as N1,625 and N1,519 to the dollar, respectively. The intra-day high of N1,625 is also one of the highest levels recorded this year, indicating that traders priced the naira at significantly weaker levels.

Conversely, the intra-day low of N1,519/$1 suggests that some traders still priced the naira stronger, possibly betting on short-term interventions.

The NFEM rate, which represents the average exchange rate, closed at N1,567, the weakest the naira has traded this year and since December 4, 2024.

Economy

Trump gives TikTok extra 75 days to find US buyer

President Donald Trump has given TikTok a 75-day extension, staving off a ban on the Chinese-owned app just as its April 5 deadline loomed.

In a Friday post on Truth Social—his social media platform- the US President trumpeted an executive order to extend negotiations, a move he cast as a lifeline for a deal he’s keen to seal.

“My Administration has been working very hard on a Deal to SAVE TIKTOK, and we have made tremendous progress,” Trump wrote.

“The deal requires more work to ensure all necessary approvals are signed, which is why I am signing an Executive Order to keep TikTok up and running for

an additional 75 days.”

The ban, initially deferred on his first day back in office in January, had been barrelling toward an April 5 cutoff—now pushed out once more.

TikTok’s parent company, ByteDance, has been under pressure to divest its US business following bipartisan legislation passed in 2024 that mandates the app’s separation from Chinese ownership.

Trump laced his announcement with a jab at China, irked, he said, by his reciprocal tariffs. “We hope to continue working in good faith with China,” he added, calling tariffs “the most powerful economic tool” and vital for national security.

“We do not want TikTok to ‘go dark,’” he insisted, eyeing a resolution that keeps the app alive.

We look forward to working with TikTok and China to close the deal. Thank you for your attention to this matter!”

-

Politics10 hours ago

Politics10 hours agoTinubu Gives Fani Kayode, Others New Appointments (See Full List)

-

News10 hours ago

News10 hours agoDANGER! Ex-Soldier Abubakar Affan Vows to Kill VeryDarkMan ‘Like Deborah Samuel’

-

News13 hours ago

News13 hours agoWhy NYSC maybe extended by FG- Minister

-

News23 hours ago

News23 hours agoVOA Halts Operations In Nigeria, Others Over President Trump

-

News13 hours ago

News13 hours agoIbas moves to rehabilitate damaged Rivers LG secretariats

-

News10 hours ago

News10 hours agoJust in: Ex-Oyo governor, Olunloyo is dead

-

Economy13 hours ago

Economy13 hours agoCBN allocates $197.71m into FX market to support naira

-

News13 hours ago

News13 hours agoWike commissions another solar-powered market in Abuja