News

Bill to ban foreign currency for transactions scales first reading

A bill seeking to ban the use of foreign currencies for payments and transactions in Nigeria has passed its first reading in the Senate.

The proposed legislation aims to restore confidence in the Naira, eliminate discriminatory payment practices, and bolster the country’s monetary sovereignty.

The bill, titled “A Bill for an Act to Alter the Central Bank of Nigeria Act, 2007, No. 7, to Prohibit the Use of Foreign Currencies for Remuneration and for Other Related Matters,” is sponsored by Senator Ned Munir Nwoko, Chairman of the Senate Committee on Reparations and Repatriation.

Senator Nwoko criticized the widespread use of foreign currencies in Nigeria, describing it as a colonial relic that undermines the value of the Naira and perpetuates economic challenges.

“The use of the Dollar, Pound Sterling, and other foreign currencies for domestic transactions is a colonial relic that continues to hinder Nigeria’s economic independence,” he said.

The bill proposes that all salaries, including those of expatriates, be paid in Naira. It also seeks to make the Naira mandatory for export transactions, requiring international buyers to purchase the currency, which would drive up its demand and value.

Additionally, the legislation aims to address unethical practices in the informal currency market, strengthen industrial growth through affordable loans, and safeguard Nigeria’s economic sovereignty by storing foreign reserves domestically.

Clarifying concerns over domiciliary accounts, Senator Nwoko explained that transitioning their balances to Naira would be voluntary. “As the Naira strengthens, the need to hold foreign currencies would diminish, making the transition seamless,” he said.

He also assured Nigerians that access to foreign exchange for legitimate purposes, such as travel and medical needs, would be streamlined through banking reforms, alleviating concerns over access to Basic Travel Allowance (BTA) and other forex requirements.

Citing Morocco as an example, Nwoko noted the stability of the Moroccan Dirham, which has maintained consistent value against major currencies for over 35 years.

“With Nigeria’s vast resources and vibrant population, we have the potential to surpass Morocco’s achievements, but only if we embrace a paradigm shift in how we use and perceive the Naira,” he added.

The bill also envisions a future where Nigerian banks expand globally, offering innovative financial tools to simplify international transactions.

It seeks to address existing challenges, such as the inability of Nigerian debit cards to facilitate online payments, while reducing reliance on domiciliary accounts.

If enacted, the bill could mark the beginning of a transformative era for Nigeria, fostering economic growth, cultural pride, and sustainable development anchored in the strength of the Naira.

News

IGP Egbetokun orders his men to resume issuance of tinted glass permits

The Inspector-General of Police, Kayode Egbetokun, the Nigeria Police Force has directed his men to resume the issuance of tinted glass permits across the country.

This development was announced in a statement released on Wednesday by the Force Public Relations Officer, Olumuyiwa Adejobi.

According to the Force spokesperson, the move comes in response to rising concerns and complaints from the public over the harassment of vehicle owners by law enforcement agents for using factory-fitted tinted windows.

“The Nigeria Police Force, under the directive of the Inspector-General of Police, IGP Kayode Adeolu Egbetokun, Ph.D., NPM, has reactivated the issuance of Tinted Glass Permits (TGP) nationwide through a secure and user-friendly digital platform.

“This initiative comes in response to widespread public complaints about the harassment of motorists over the use of tinted windows and reflects the need for a clear, transparent, and accountable process for regularising factory-fitted tinted glass on vehicles”, the statement partly read.

Highlighting the prevalence of modern vehicles designed with tinted windows for comfort and aesthetics, the police emphasised the importance of having a formal system to regulate usage.

“With modern automobiles increasingly manufactured with tinted windows, it has become essential to provide a standardised system that accommodates legitimate use while ensuring public safety.

“Tinted vehicles have often been exploited for criminal purposes, including kidnapping, armed robbery, ‘one-chance’ scams, and other forms of banditry”, Adejobi explained.

According to the statement, the abuse of tinted windows by criminals creates operational challenges for law enforcement and compromises national security.

In addition, he explained that law enforcement will begin active implementation after the grace period, and the police warn that officers who misuse the enforcement process will be sanctioned.

“Enforcement will commence at the end of this period. Officers found engaging in unprofessional conduct, such as extortion or harassment, in the course of enforcement will be decisively dealt with in accordance with extant disciplinary procedures”, he said.

News

Spokesperson Warns Nigerians Against Fake Ministry Of Foreign Affairs Recruitment Scam

By Gloria Ikibah

News

CBN announces revised documentation requirements for PAPSS transactions

The Central Bank of Nigeria (CBN) has announced a revised documentation requirement for transactions conducted through the Pan-African Payment and Settlement System (PAPSS) in Nigeria.

This was disclosed in a statement issued by the apex bank’s acting Director, Corporate Communications, Mrs. Hakama Sidi Ali

The CBN said the new initiative is part of its ongoing commitment to foster seamless intra-African trade, financial inclusion, and operational efficiency for Nigerians engaging in cross-border payments within Africa.

Launched by Afreximbank in partnership with the African Union and the African Continental Free Trade Area (AfCFTA) secretariat in January 2022, PAPSS serves as a centralized payment and settlement platform that enables instant, secure, and efficient cross-border transactions throughout Africa.

By facilitating payments in local currencies, PAPSS minimizes reliance on third-party currencies, reduces transaction costs, and supports the rapid expansion of trade under the AfCFTA.

In a recent circular referenced TED/FEM/PUB/FPC/001/006 issued on April 28, 2025, CBN outlined the key changes to the documentation requirements associated with PAPSS transactions.

The key changes it added take effect immediately and include simplified documentation for low-value transactions, which allows customers to now use basic KYC and AML documents provided to their authorized dealer banks for low-value transactions of up to $2,000 and $5,000 equivalent in naira for individuals and corporate bodies, respectively.

“For transactions above the thresholds, all documentation as stipulated in the CBN foreign exchange manual and related circulars remains mandatory,” the bank said.

Also, the CBN added that applicants are responsible for ensuring all regulatory documents are available to facilitate the clearance of goods, as required by relevant government agencies.

“Authorized dealer banks may now source foreign exchange for PAPSS settlements through the Nigerian foreign exchange market, without recourse to the CBN.

“All export proceeds repatriated via PAPSS shall be certified by the relevant processing banks.

“The Central Bank of Nigeria urges all banks to adopt PAPSS and commence originating transactions in line with this new policy.

“In addition, CBN encourages exporters, importers, and individuals to familiarize themselves with the new requirements and leverage PAPSS for cross-border transactions within Africa,” the statement said.

-

Metro12 hours ago

Metro12 hours agoGunmen storm University of Benin teaching hospital, kill doctor

-

Metro12 hours ago

Metro12 hours agoFCTA destroys 601 motorbikes over violations

-

News12 hours ago

News12 hours agoJust in: FG declares tomorrow public holiday

-

News4 hours ago

News4 hours agoAlleged money laundering: EFCC produces Aisha Achimugu in court

-

News24 hours ago

News24 hours agoDeputy Speaker Leads Defection of PDP Stalwart Chris Igwe, 13,000 Followers to APC In Abia

-

News5 hours ago

News5 hours agoJUST IN: Major General Paul Ufuoma Omu Rtd, dies at 84

-

News8 hours ago

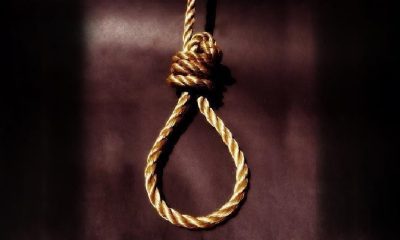

News8 hours agoSAD! Professor’s son takes own life inside varsity staff quarters

-

News12 hours ago

News12 hours agoFull list: FG approves N110bn to rehabilitate medical schools 18 institutions