News

Banks begin implementation of new ATM transaction fee

By Kayode Sanni-Arewa

Banks have commenced implementation of the new Automated Teller Machine (ATM) transaction fee charge on customers following the Central Bank of Nigeria (CBN’s) directive.

The News Agency of Nigeria (NAN) correspondent who monitored some banks’ ATM gallery in Abuja and environs on Sunday, reports that some customers were lamenting about the increase.

All the banks’ ATM visited had monies loaded in them.

Mr Luke Abudu, a customer seen at First Bank along Nyanya-Jikwoyi road, said the implementation would only affect the poor masses who were struggling to make a living.

Abudu said the move would discourage customers from lodging monies in the banks.

”I came to withdraw N20,000 but I found out that I was charged N100 for the withdrawal.

‘”This is too much for a small business owner like me,” he said.

Another customer, Mrs Victoria Adejo, seen at Zenith Bank, Mararaba branch said that withdrawal from Point of Sale (PoS) agent was now cheaper than using an ATM.

”It is unfortunate that our government formulate policies without feeling the pulse of the people.

”I read that the CBN said the decision is in response to rising cost and to improve efficiency of ATM services but banks still bill us for service charge.

”They (banks) declare profit in billions and trillions from our monies and the CBN does not consider that.

”This is not good enough at all, ” she said.

Mr Nurudeen Ehimotor, a customer at Guaranty Trust Bank (GTB), Asokoro, said he was at the bank to use the ATM due to the bank’s poor online network.

”I came to use ATM because I tried to transfer money from my bank using USSD since yesterday but it didn’t go through.

”I have an issue with my app, so I have been using USSD codes for my transfer.

”I think they (the bank’s) are trying to make people use ATM now for them to make more money,” he said.

Ehimotor appealed to banks to reduce incessant charges on customers account.

NAN reports that the CBN had on Feb. 10, released a circular to all banks and other financial institutions to apply the fees with effect from March 1.

CBN in the circular with title ‘Review of ATM transaction fees’ said the move was in response to rising cost and the need to improve efficiency of ATM services in the banking industry.

On-Us (customers withdrawing at the ATM of the customer’s financial institution) in Nigeria, no charge.

”Not-on-Us ( withdrawal from another institution’s ATM) in Nigeria; On-site-ATMs: A charge of N100 per N20,000 withdrawal.

”Off-site ATMs: A charge of N100 plus a surcharge of not more than N500 per N20,000 withdrawal.

”The income which is an income of the ATM acquirer/deployer, shall be disclosed at point of withdrawal to the consumer,” it said.

Meanwhile, banks had informed their customers through various electronic mails (e-mails) of the increase.

GTB told its customers in addition to the ATM transaction fee, that the free monthly withdrawals usually enjoyed by them would no longer be applied.

”Please note that the three free monthly withdrawals at other banks’ ATMs (for GTBank customers) and GTBank ATMs ( for other bank customers) will no longer apply,” the bank said.

Also, Access Bank in their official X handle told customers that ”All Access Cards now work seamlessly across all ATMs and POS machines, so you can make payments without hassle”.

News

Zed-Faith Foundation Donates Food, Medical Supplies to Orphanage, Elderly Homes in FCT

By Kayode Sanni-Arewa

In a bid to ease the impact of rising food prices and economic hardship, the Zed-Faith Foundation International has donated food items and medical supplies to Ark of Refuge Orphanage and Old People’s Home in Kado, Abuja.

The items were distributed over the weekend by representatives of the Foundation on behalf of its Founder and Chairman, Amb. Daniel Onyeka Newman, a UK-based Nigerian and Chief Executive Officer of SBI.

The Foundation’s Media Consultant, Amb. Victor Atewe, who led the delegation, said the donation was a personal initiative by the Chairman and not funded by government or external bodies.

“These items are intended to directly support the children and elderly, and we trust they will be used solely for that purpose,” Atewe said.

He added that the Foundation plans to continue its outreach efforts across the country, noting that the economic situation has made daily survival increasingly difficult for vulnerable groups.

The Foundation also used the occasion to urge the federal government to collaborate more with credible non-governmental organisations in supporting disadvantaged populations, especially as inflation and food insecurity worsen.

Speaking on behalf of the Country Representative, Mr. Chinnaya Dominic Chikwado, the Foundation’s Administrative Officer, Mr. Udodirim Okorie, called on well-meaning Nigerians to support charitable causes and contribute to alleviating the burden on those most affected by the country’s economic crisis.

Representatives of the Old People’s Home and Ark of Refuge Orphanage expressed appreciation for the gesture, describing it as timely and impactful. They noted that such support helps bridge the gap in essential services for the elderly and children in their care.

“This donation will go a long way in meeting our daily needs.”

“We thank the Foundation for its continued support, especially during such challenging times.”

“Even the smallest gesture makes a big difference to those who have no one else to turn to.”

“We hope others are inspired to follow suit and remember those most in need.”

News

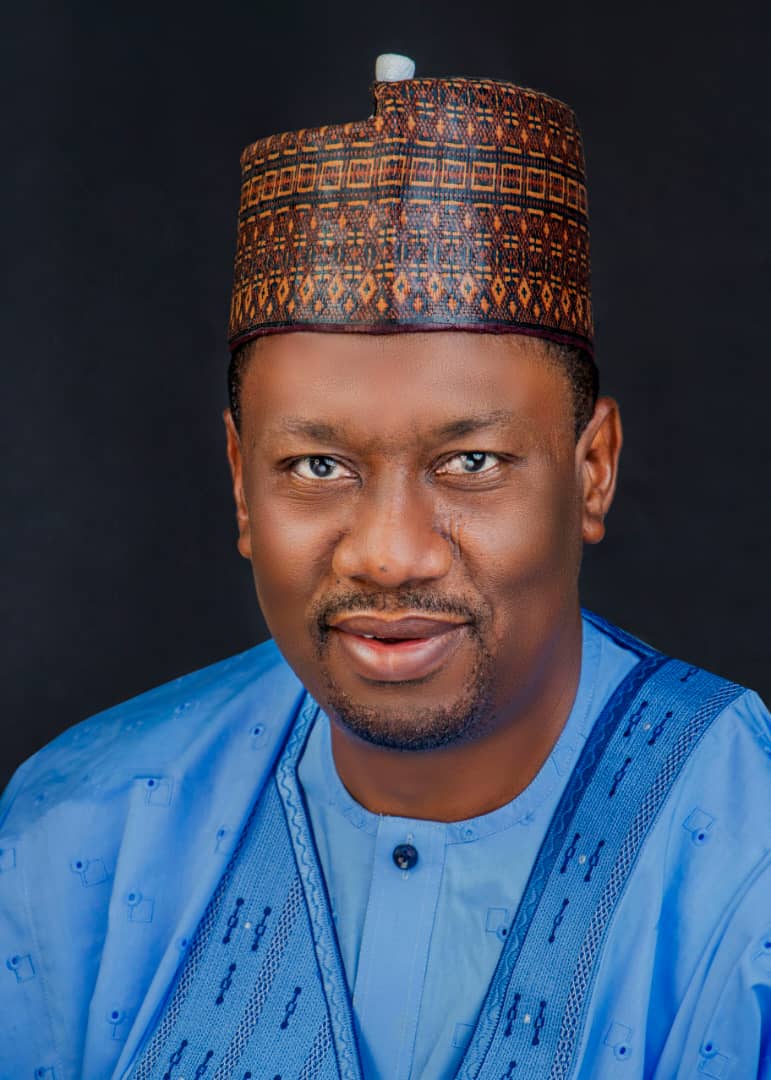

May Day: Senator Manu celebrates with Nigerian workers

The Senator representing Taraba Central Senatorial District, Manu Haruna celebrates May Day with Nigerian workers in Taraba and across Nigeria.

Senator Manu in a congratulatory letter to all Nigerian workers said:

“Your labour towards building a virile nation shall never be in vain as you celebrate May Day today in Nigeria and across the globe.

The former Taraba State Deputy Governor acknowledged the invaluable contributions of workers across various sectors and emphasized their crucial role in driving the nation’s development and progress.

He encouraged continued solidarity among workers while advocating for better working conditions, fair wages, and enhanced opportunities.

News

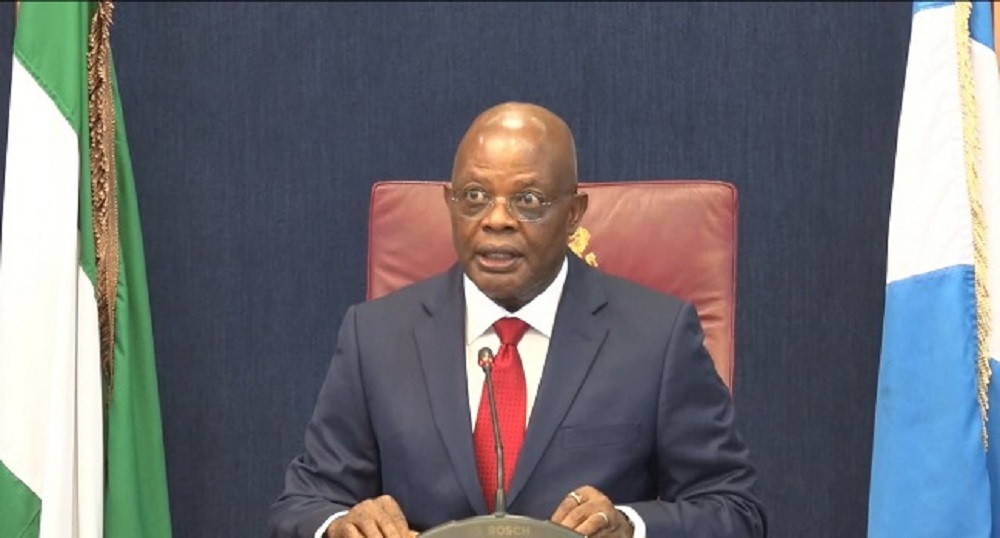

Ibas Pledges Commitment to Workers’ Welfare

The Administrator of Rivers State, Retired Vice Admiral Ibok-Ete Ibas, has reaffirmed his commitment to improving the welfare of workers across the state.

This assurance was given during a meeting with the leadership of organised labour unions held at the Government House in Port Harcourt.

According to a statement issued by the Senior Special Adviser on Media to the Administrator, Hector Igbikiowubo, the meeting served as a platform for open and constructive dialogue on critical labour matters.

The statement outlined key areas of intervention currently being addressed by the government.

These, he said, included the timely payment of salaries and pensions, as well as the resolution of salary arrears, with approval already granted for the payment of newly employed workers at the Rivers State University Teaching Hospital and the judiciary.

Similarly, he said medical workers in the local government areas would receive their proper wages.

He said the minimum wage was being implemented for all local government employees across the state.

The administrator also noted that his administration was currently reviewing challenges related to the contributory pension scheme, ahead of the July 2025 implementation deadline.

Ibas disclosed that plans were underway to expand the fleet of intervention buses reintroduced to ease the transportation burden of workers.

On capacity building, the administrator announced that specialised leadership training for senior civil servants would begin within the next two weeks.

He also revealed that the government was actively considering the implementation of the N32,000 consequential pension adjustment, along with measures to clear outstanding gratuities owed to retirees.

While commending workers for their dedication to service, he called for continued collaboration with labour unions to ensure lasting industrial harmony in the state.

According to the statement, the State Chairman of the Nigeria Labour Congress (NLC), Alex Agwanwor, expressed appreciation to the administrator for the steps already taken to promote workers’ welfare.

Agwanwor also lauded the government’s openness to dialogue and pledged the sustained support and cooperation of labour unions in achieving shared goals.

Meanwhile the NLC has directed its members in the state to observe the International Workers’ Day as a peaceful rally, which is expected to be held within the premises of the union, involving all affiliate unions, and would focus on advocating for the restoration of democratic governance in the state.

-

News15 hours ago

News15 hours agoA Chat with Janet Odio Okolo: A Mother’s Journey Raising a Child with Down Syndrome

-

News21 hours ago

News21 hours agoAlleged money laundering: EFCC produces Aisha Achimugu in court

-

News23 hours ago

News23 hours agoJUST IN: Major General Paul Ufuoma Omu Rtd, dies at 84

-

News23 hours ago

News23 hours agoTinubu hails Dangote’s World Bank appointment

-

News17 hours ago

News17 hours agoHon. Dennis Agbo Resigns From Labour Party

-

News17 hours ago

News17 hours agoJust in: Osun PDP receives defectors from APC, others

-

News21 hours ago

News21 hours agoCBN announces revised documentation requirements for PAPSS transactions

-

News21 hours ago

News21 hours agoReps Set Stage for Nigeria’s First Legislative Conference on Renewable Energy