News

New capital base : 26 banks to shop for N4tn

The apex bank on Thursday announced new guidelines on its recapitalisation policy for banks in the country. In a statement signed by its acting Director of Corporate Communications, Sidi Ali, the CBN directed commercial banks with international authorisation to increase their capital base to N500bn and national banks to N200bn.

According to the acting CBN director, commercial banks with national licences must meet a N200bn threshold, while those with regional authorisation are expected to achieve a N50bn capital floor.

Similarly, non-interest banks with national and regional authorisations will need to increase their capital base to N20bn and N10bn, respectively.

The CBN’s move came two days after the Monetary Policy Committee hinted that it would change the capital base of the banks.

Based on the CBN circular on recapitalisation, only the share capital and premium capital of the shareholders’ fund portion of the balance sheet will be recognised.

The circular read, “For existing banks (a) The minimum capital specified above shall comprise paid-up capital and share premium only. For the avoidance of doubt, the new capital requirement shall NOT be based on shareholders’ funds. (b) Additional Tier 1 capital shall not be eligible for the purpose of meeting the new requirement. (c) All banks are required to meet the minimum capital requirement within a period of 24 months commencing from April 1, 2024, and terminating on March 31, 2026. (d) Notwithstanding the capital increase, banks are to ensure strict compliance with the minimum capital adequacy ratio requirement applicable to their licence authorisation. (e) In line with extant regulations, banks that breach the CAR requirement shall be required to inject fresh capital to regularise their position.”

For proposed banks, the CBN said their minimum capital requirement shall be paid-up capital and applicable to all new applications for banking licences submitted after April 1, 2024.

It added that for proposed banks whose applications it was processing, “it shall continue to process all pending applications for banking licences for which capital deposit had been made and/or Approval-in-Principle (AIP) had been granted. However, the promoters of such proposed banks shall make up the difference between the capital deposited with the CBN and the new capital requirement not later than March 31, 2026.”

But according to an analysis of the latest financial statements of 26 out of the 30 operating banks, most, if not all of the financial institutions must fashion out strategies and methods to reach the new standards.

However, bankers have voiced opposition to the central bank’s decision to omit retained earnings from the share capital calculation.

Anonymously expressing their views in chats with our correspondents, they said the decision to exclude retained earnings from share capital calculations was flawed.

According to Saturday PUNCH findings, while the 26 banks will need over N3.972tn combined, the tier 1 banks have to raise the highest amount of N2.569tn.

These tier 1 banks include the largest bank in Nigeria, Access Bank, whose parent company, Access Holdings, earlier on Thursday during an investor call, said that it planned to raise about $1.8bn to expand its operations over the next four years as it targets becoming one of the continent’s largest lenders.

Access Bank said that it would raise $1.5bn or the naira equivalent through the issue of shares, bonds or other instruments to fund a five-year growth plan that began last year. It also revealed plans to raise as much as N365bn ($257m) through a rights issue.

Based on the audited results of 2023, AccessCorp has N251.81bn for share capital and share premium. To meet the new CBN requirements of N500bn, it will need about N248.19bn.

Apart from Access Bank, other banks with international operating licences include Union Bank of Nigeria, Zenith Bank, which is transitioning to a holding company, United Bank for Africa, Guaranty Trust Holdings Company Plc, Fidelity Bank, FCMB Group and FBN Holdings Plc, which will need about N351.91bn, N229.26bn, N384.19bn, N361.81bn, N370.3bn, N374.71bn, and N248.66bn, respectively.

News

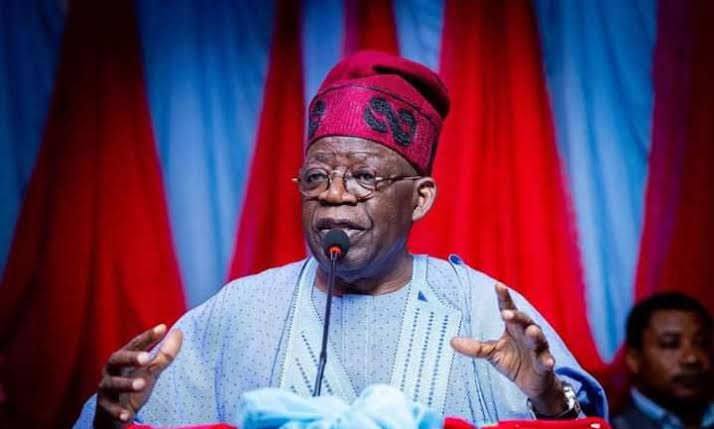

Just in: Tinubu exposes those behind deadly stampedes

President Bola Tinubu has accused organisers for the deadly stampedes that occurred during the distribution of relief materials in three states.

Recall in the past week, chaotic scenes in Ibadan, Anambra and Abuja led to the deaths of over 60 people, including children, as crowds scrambled for food items.

During a Presidential Media Chat on Monday, Tinubu described the events as a critical failure in planning and execution.

Condolences to those who lost a family member, but it is good to give. I have been giving out food stuff, commodities, etc. in Bourdillon.

“I am an organized person and that’s why I have been giving people food for the past 25 years and no incident has happened.

“Let this tragedy not affect us”, the Nigerian leader said.

The president also said he has no plans to reduce his cabinet or sack more ministers.

For the controversial tax reform bills, he said it has come to stay.

He also revealed he has no regrets removing fuel subsidy.

He declared utmost confidence in his security chiefs saying over the past decades, wanton killings has reduced drastically.

News

Tinubu To Hold Maiden Presidential Media Chat Tonight

President Bola Tinubu will hold first presidential chat since assuming office on Monday night.

Accoding to a statement released by presidential spokesperson, Bayo Onanuga, the chat will be broadcast at 9 p.m. on the stations of Nigerian Television Authority (NTA) and Federal Radio Corporation of Nigeria (FRCN).

All television and radio stations are requested to hook up to the broadcast.

“The first Presidential Media Chat with President Bola Ahmed Tinubu will be broadcast at 9 p.m. on Monday, December 23, on the Nigerian Television Authority and Federal Radio Corporation of Nigeria.

“All television and radio stations are requested to hook up to the broadcast,” the statement.

News

‘Putin waiting to meet me as soon as possible’ to end Ukraine war – Trump

The US President-elect took to the stage AmFest in Phoenix to talk about his contact with the Russian leader.

He told the crowd: “President Putin has said he want to meet with me as soon as possible.”

Trump went on to brand the war “horrible” and stated it needed to end. It is not known whether or not this meeting will take place in person. His comments at the event in the US come as Putin met with another world leader.

Putin held talks in the Kremlin today (December 22) with Slovakia’s prime minister, Robert Fico, in a rare visit to Moscow by an EU leader since Russia’s all-out invasion of Ukraine in February 2022.

Fico arrived in Russia on a “working visit” and met with Putin one-on-one. Kremlin spokesman Dmitry Peskov told Russia’s RIA agency that the talks would focus on “the international situation” and Russian natural gas deliveries.

Visits and phone calls from European leaders to Putin have been rare since Moscow sent troops into Ukraine, although Hungary’s PM Viktor Orban visited Russia in July. Orban’s visit drew condemnation from Kyiv and European leaders.Fico’s views on Russia’s war on Ukraine differ sharply from most other European leaders. The Slovakian PM returned to power last year after his leftist party Smer (Direction) won parliamentary elections on a pro-Russia and anti-American platform. Since then, he has ended his country’s military aid for Ukraine, hit out at EU sanctions on Russia, and vowed to block Ukraine from joining NATO.

-

News22 hours ago

News22 hours agoTinubu’s 50% transport reduction scheme may begin Tuesday

-

Economy22 hours ago

Economy22 hours agoPetrol to sell at N935 per litre from today-IPMAN

-

News17 hours ago

News17 hours agoBREAKING: FG declares Wednesday, Thursday public holidays for Christmas, New Year

-

News16 hours ago

News16 hours agoNigerian Man Who Rained Curses On President Tinubu Nabbed

-

Foreign23 hours ago

Foreign23 hours agoThere will be no same sex marriage again -Trump vows to end ‘transgender madness ‘

-

News22 hours ago

News22 hours agoNigerian Govt promises support for stampede victims’ families

-

Metro22 hours ago

Metro22 hours agoWife flees after setting Ogun cop ablaze during dispute

-

Metro22 hours ago

Metro22 hours agoWhy I Was Sentenced To Death – Osun ‘boy’ convicted of fowl theft