News

February 29 birthday celebrants celebrate leap year

*Says, they are mysterious, special beings

By Francesca Hangeior

A leap year occurs once every four years to account for the extra time it takes for the Earth to complete its orbit around the Sun.

This adjustment is necessary to keep the calendar year synchronised with the astronomical year.

Individuals born on Feb. 29, also known as leap day, have a unique birthday that only comes around every four years.

They often refer to themselves as ‘special breeds’ or ‘special beings’ due to the rarity of their birthdate.

Some of these celebrants express joy and gratitude for the opportunity to celebrate their birthdays in a way that sets them apart from others.

For those born on Feb. 29, celebrating birthdays can be a mixture of joy and occasional challenges.

While some see their unique birthdate as a blessing, others see it as awkward when comparing their birthday celebrations to those who have annual birthdays.

Some Lagos residents, born Feb. 29, while expressing their views about the day said, they are unique and special.

15-year-old Damilare Ijiwade, born Feb.29, 2009, described the day as “unique”.

“For this rare and special opportunity, my daddy has planned a little get-together for me with my friends because of the uniqueness of the celebration.

“I give thanks to God for the benefit of seeing another birthday after four years.

“I feel great because my birthday is a very peculiar one that is being celebrated every four years. There is no need for me to be worried about it. I only put my mind on the fourth year,” Ijiwade said.

According to Shadrach Akowonjo, a 24 -year-old Civil Engineer, born Feb. 29, 2000, he feels awkward when others talk about celebrating their birthdays every year.

Though it’s not funny at all but all the same, I thank God, I will be visiting the orphanage.

“When others talk about birthday other years, I feel awkward but who am I to question God, that’s our faith, we accept it, ” he said.

For Favour Thompson, a student born Feb. 29, 2008, described Feb.29 as a day for ‘mysterious and special beings’.

“I feel and believe being born on such a date is a misery, I am glad and honoured having to celebrate this year.

“Though people always mocked me every year, but it’s our turn to demonstrate God’s grace in our lives,” he said.

Meanwhile, a priest, Rev. Father Clement Odiah, of the Seat of Wisdom Catholic College, Alagbaka, Akure, Ondo State, said individuals born Feb.29 are called ‘leapling babies’.

“They didn’t choose to be born on that date, however, they found themselves to be born on such day.

“There are so many things in life that we just have to find a way round it, we can’t deny or push them away. It’s not that they sinned or did anything wrong.

“Having birthdays annually is an opportunity to thank God to celebrate birthday every year, some don’t have such an opportunity.

“Some break relationships or cause animosity for their birthdays not been celebrated. Tell them to calm down, if they have nothing to celebrate this year, another year will come. After all, some celebrate just once in four years, yet heaven hasn’t fallen,” he said.

Another Catholic Cleric, of Saints Gregory Major Seminary, Ogun, Rev. Fr. Paul Amenaghawon, said that those born Feb. 29 had the liberty to celebrate on other closer days.

“As long as those born on Feb. 29 increase in age every year, they can celebrate on either Feb. 28 or March 1, as they choose.

“What matters is that they remember they are increasing in age every year, regardless of having Feb. 29 or not,” he said.

Also speaking, Rev. Fr. Anthony Afariogun, Chaplain, Our Lady Queen of Peace Catholic Chaplaincy, Adeyemi Federal University of Education, Ondo State, said celebrating once in four years is ‘divine’.

“Celebrating birthday once in four years is divine. They have opportunity of saving money for the next four years and prepare very well. It gives them also opportunity to reflect on their lives and see how to serve God better.

News

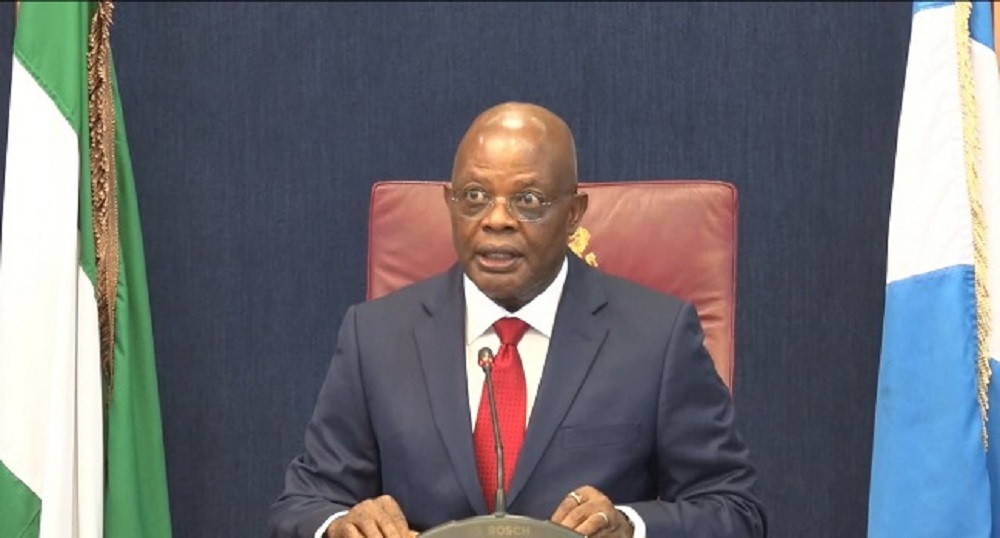

JUST IN: Rivers Sole Administrator Ibas Shun Reps Panel

News

FCT Flags Off One-Week Free Holiday Vocational and Entrepreneurship Training

In a move to foster skills acquisition and promote economic empowerment, the Federal Capital Territory (FCT) Education Secretariat through the Department of Mass Education has flagged off a one-week free holiday vocational and entrepreneurship training program.

The program is a collaborative initiative of the FCT Department of Mass Education, The Potter’s Wheel Foundation, and the Nigerian Non-Governmental Association for Literacy Support Services (NOGALSS).

Speaking at the flag-off ceremony, the FCT Mandate Secretary for Education, Dr. Danlami Hayyo emphasized the Importance of skills acquisition and entrepreneurship in today’s world describing it as imperative to be self reliant , empowered and resourceful.

He highlighted the Wike- led FCT Administration’s commitment to championing the Renewed Hope Agenda adding that the initiative is a critical strategy for reducing unemployment and building resilience among Abuja residents through practical skill acquisition and entrepreneurship training.

He commended the Department on the synergy between the government and non-governmental organizations noting that it will further empower the people of the FCT with skills and knowledge that lead to viable income-generating opportunities.

He urged the participants to fully utilize the opportunity, network actively and apply themselves diligently to the various training sessions.

In her welcome address,Dr. Favour Edem -Nse,the Director, FCT Department of Mass Education said,the training aligns with Sustainable Development Goals ( SDGs) and contributes significantly to reducing the number of out- of- school children, unskilled youths and unemployed women in the Federal Capital Territory.

She added that, the Department goal is not just to train but to guide participants towards becoming self – sufficient and successful entrepreneurs .

She noted that the one week free training program is a manifestation of the Department ‘s broader vision of literacy and lifelong learning.

She revealed that the Department in collaboration with The Potter’s Wheel Foundation and the Nigerian Non- Governmental Association for Literacy Support Services( NOGALSS) will train them hands on session in production of laundry soap,bleach , liquid soap, toilet and car wash , disinfectant,air freshener,snack among others as well as key entrepreneurship modules on Bookkeeping and financial management, marketing and branding with social media management.

She expressed her gratitude to the Mandate Secretary for Education and the Management for the massive support of the life changing opportunity program targeted at women,youths, children and other community residents to equip them with tools for economic self reliance .

The well attended program which drew partner organizations, staff of the Department of Mass Education and enthusiastic participants will run throughout the week with facilitators providing continued support beyond the training period.

News

Sad! Electrician electrocuted in Oyo

A 28-year-old electrician, whose name has not been revealed, has been electrocuted in Oyo State at Eruwa in Ibarapa East of Oyo State.

The victim was electrocuted at the Odo Babaode area of the town.

The man was electrocuted on a high-tension cable belonging to the Ibadan Electricity Distribution Company (IBEDC).

The incident occurred when the victim was trying to rectify an electrical fault on the active power lines without being shut down from the feeder.

The General Manager of Oyo State Fire Service, Mr Yemi Akinyinka, who confirmed the development, said a distress call was received by the agency Wednesday afternoon.

He said, “The distressed call was reported at 15:29hrs on Wednesday, 23rd April, 2025.

“The fire personnel led by PFS1 Peluola Babatunde quickly followed the caller and on arrival at the place, we met the victim already electrocuted, and all necessary precautionary measures were observed so as to safeguard the citizens within the vicinity.

“The man was recovered and handed over to a team of police from Eruwa police Station. The incident occurred when the victim (electrician) was trying to rectify an electrical fault on the active power lines without shutting down the feeder.”

-

News23 hours ago

News23 hours agoDelta to transform into complete APC state as 25 PDP Local Government Chairmen set to defect

-

News12 hours ago

News12 hours agoINSECURITY! Enough is enough, Tinubu tells security chiefs, NSA

-

News12 hours ago

News12 hours agoJust in: Air Peace suspends all scheduled flights nationwide

-

News11 hours ago

News11 hours agoINEC moves to legalise voting without PVC

-

News23 hours ago

News23 hours agoMoji Danisa to Be Honoured by NUJ FCT for Her Impact in Tabloid Journalism

-

News7 hours ago

News7 hours agoJust in: PDP can never die over gale of defection -Hon Teejay Yusuf insists

-

News23 hours ago

News23 hours agoFinally, FG Releases N50bn to ASUU, Varsity Unions for Earned Allowances

-

News17 hours ago

News17 hours agoLegacy Honoured in Ede as Leadership Centre Opens in Memory of Isiaka Adeleke+PHOTOS