News

17-year-old Transformer Cable Thief Electrocuted

By Kayode Sanni-Arewa

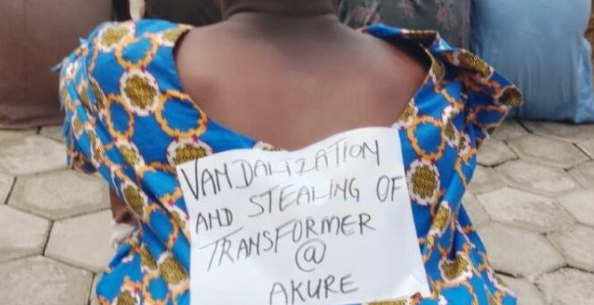

A 17-year-old boy identified Sunday Adegbulu narrowly escaped death after being electrocuted while attempting to steal armoured cables from a transformer in Akure, Ondo State capital.

Adegbulu, known for his involvement in vandalizing and stealing electric installations, suffered severe burns on half of his body during the failed theft.

The JSS 3 student at Commercial Secondary School in Akure, who confessed to the crime while being paraded at the headquarters of Amotekun Corps in the state, was rescued by his gang members.

However, the gang members escaped and are currently on the run.

According to the teenager, the operation was his second, and he planned to sell the armoured cable for N25,000.

“It happened on April 28, and only three of us went to the transformer. I never knew that there was going to be an electricity supply.

“It’s the handwork of the devil that pushed me to the crime.”

Amotekun boss, Adetunji Adeleye, stated that the other gang members who are currently on the run had hatched a plot to eliminate the teenager.

According to Adeleye, the gang members are afraid that Adegbulu might reveal incriminating information to Amotekun detectives who were on their trail.

News

Benue boils again as gunmen abduct 4 female varsity students

By Kayode Sanni-Arewa

Four female students of the Joseph Saawuaan Tarka Federal University, Makurdi, formally known as Federal University of Agriculture, Makurdi, Benue State, have been kidnapped by gunmen.

Confirming the incident, the State Police Public Relations Officer, CSP Sewuese Anene, said that investigation and rescue efforts had begun.

Also speaking on the situation, a senior staff member in the school said the students were going for night study when they were kidnapped between their hostels and the reading point at the North Core area of the school campus.

Meanwhile, the news of the kidnap of the female students sparked wild protests from students.

The students in their numbers marched around the school with tree branches in their hands, demanding immediate action from the school authorities.

The institution’s Vice Chancellor, Professor Isaac Itodo, had yet to respond to any inquiry as of press time.

News

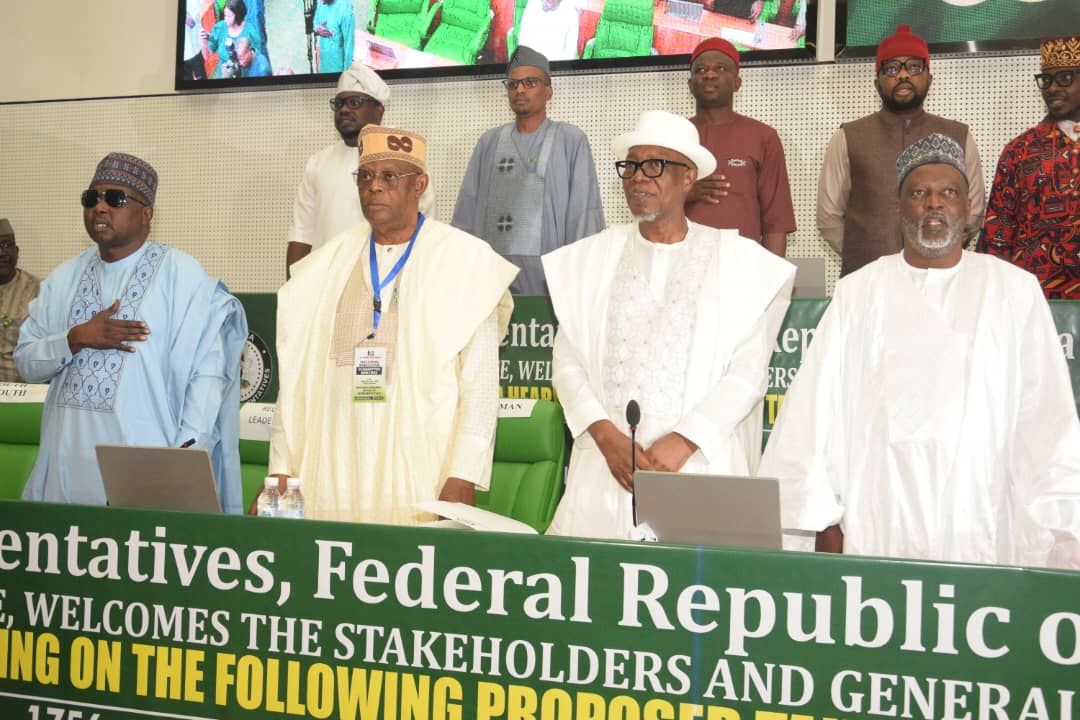

Kano Govt, Customs Raise Concern Over Sections In Tax Reform Bills

The Kano State Government has raised concerns over sections of the proposed tax reform bills that extend the Federal Government’s control over state and local tax agencies.

The Permanent Secretary in the Office of the Secretary to the State Government, Umar Mohammed Jalo, stated the government’s position, at a 3-day public hearing organised by the House of Representatives Committee on Finance on Wednesday in Abuja.

Jalo urged the House Committee to amend the bill by eliminating provisions that place it above other laws.

On the proposed reduction in the funding of key national agencies, like the Tertiary Education Trust Fund (TETFUND), Nigeria Information Development Agency (NITDA), and National Agency for Science and Engineering Infrastructure (NASENI), that are critical to the nation’s education, technology, and engineering sectors.

Jalo also also expressed concerns over the planned increase in Value-Added Tax (VAT) from 7.5% to 15% by 2030, warning that such a move would worsen the hardship faced by Nigerians amid the rising cost of living. The government cautioned that higher VAT rates would further strain households and deepen economic difficulties.

As an alternative, the Kano State Government advocated for improved tax collection mechanisms rather than raising VAT.

“There is significant potential to enhance tax coverage and collection efficiency, as weak compliance remains a major challenge,” he noted.

While supporting the need for fiscal reforms, the government emphasized key concerns regarding the Federal Government’s ongoing tax restructuring. It also underscored the urgency of expanding Nigeria’s revenue base, stating that current public earnings—around 10% of GDP—are inadequate to meet the country’s growing development needs.

News

Senate committee on health invites stakeholders to a one-day public hearing on 3 major Bills

The Senate Committee on Secondary and Tertiary Health has invited critical stakeholders in the health sector to brainstorm on three major Bills on Thursday.

The three Bills namely: A Bill to amend the Federal Medical Centres Act, 2022 to establish the Federal Medical Centre Gembu sponsored by Senator Manu Haruna representing Taraba Central Senatorial District.

Other Bills are:A Bill for an Act to amend the Federal Orthopaedic Hospitals Management Board Act,

CAP, 010 Laws of the Federation of Nigeria, 2004 (Amendment) Bill to establish an

additional Orthopaedic Hospital in Obokun, Osun State, 2025 (SB.582) Sponsor: Senator

Fadahunsi, Francis Adenigba (Ogun East);

National Eye Centre Jimeta Adamawa State (Establishment) Bill, 2025 (SB.524) Sponsor:

Senator Abass, Aminu lya (Adamawa Central)

The public hearing is scheduled to hold at the Senate Conference Hall 022 by 2pm on Thursday, 27th February, 2025.

-

News20 hours ago

News20 hours agoNigerian Professional Footballer Abubakar Lawal Dies in Uganda

-

Metro15 hours ago

Metro15 hours agoSHOCKING! Auto crash claims lives of groom, bride’s sister

-

Sports19 hours ago

Sports19 hours agoChelsea emphatic win against Southampton gives them hope of top four finish

-

News20 hours ago

News20 hours agoSouth-East Caucus Urges NAFDAC to Reopen Onitsha Medicine Market, Target Offenders

-

News20 hours ago

News20 hours agoUnrelenting Senator Natasha drags Akpabio to court, demands N1.3bn for alleged defamation

-

News20 hours ago

News20 hours agoReps Push for National Security Trust Fund to Boost Intelligence Funding

-

News15 hours ago

News15 hours agoSenate votes to send Natasha to face Ethics committee over seat reallocation palaver

-

News14 hours ago

News14 hours agoUK court orders NLNG to pay $380m over undelivered products