News

Vehicle importers wants FG to lift restrictions on land borders

Vehicle importers wants FG to lift restrictions on land borders

By Francesca Hangeior

The Association of Motor Dealers of Nigeria (AMDON) has appealed to the Federal Government to lift the restriction on imported vehicles through land borders.

The chairman of the group in Sokoto State, Alhaji Manaur Zagi, who made this appeal during a workshop organised by the Nigerian Customs Service, Sokoto/Zamfara area command to sensitise members on the ongoing 90-day window period to regularise import duties on specific categories of vehicles.

The chairman emphasised that the closure has caused untold hardship and loss of means of livelihood to hundreds of people working in the vehicle importation chain thereby contributing to the insecurity in the Northwest.

“The restrictions have caused a lot of damage to the economy by causing untold hardship to many Nigerians, hundreds of people working in the vehicle importation chain have lost their means of livelihood which is one of the major causes of insecurity especially in Northwest.

“The lift on the restriction we believe will bring ease of doing business and encourage compliance thereby discouraging smuggling”

Speaking, Comptroller of the Command, Kamal Mohammad, explained the momentous role the association play in the importation and sales of vehicles in the country.

He said the choice of AMDON members as participants in the work is in consideration of the critical role they play in the vehicle business.

The Controller further stated that the 90-day window period which commenced on the 4th of March 2024 to the 5th of July 2024, is the service effort under the leadership of Comptroller General of Customs, Bashir Adewale Adeniyi to enhance compliance.

“Let me commend your association for your roles in the importation and sales of vehicles in the country.

“The 90-day window period given to Nigerians to regularise vehicles without duty which commenced on the 4th of March 2024 will lapse on 5th July 2024.

“We want you to make use of the windows which is part of the efforts of the service under the leadership of Comptroller General, Bashir Adewale, aimed at enhancing compliance ”

Comptroller Kamal further submitted that the restriction of vehicle importation through land borders is a government fiscal policy, but promised to escalate the request of the AMDON, on lifting of restriction on land borders to the Headquarters.

The participants were sensitised on the two categories of vehicles covered by the window period which include vehicles imported into Nigeria where the requisite Customs Duty has not been fulfilled or vehicles detained due to undervaluation excluding vehicles seized and condemned.

Participants and other Nigerians intending to regularize import duties on their vehicles are expected to apply through a Customs licensed Agent to any of the Zonal Coordinators (A, B, C, D) with the necessary papers.

News

Tension In Edo Community As Gunmen Abduct Catholic Priest, Seminarian

By Kayode Sanni-Arewa

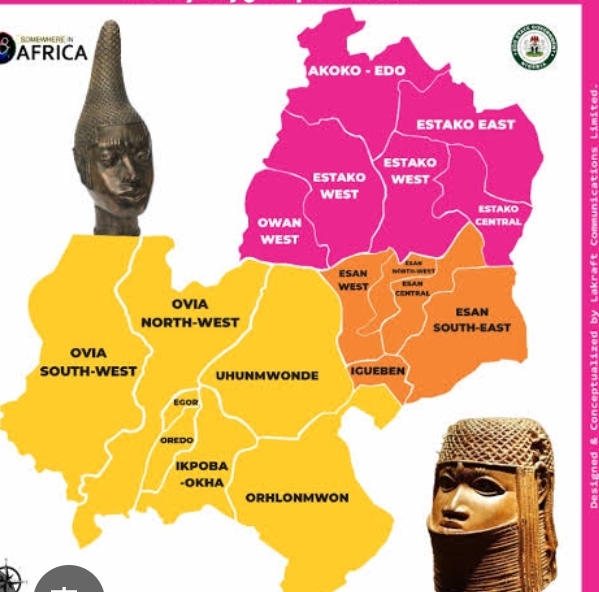

There’s fear in Iviukhua community, Etsako East Local Government Area of Edo State following the abduction of a Catholic priest and a seminarian by unidentified gunmen.

Rev. Fr. Philip-Mario Ekweli, the Parish Priest of St. Peter’s Apostle Catholic Church, and Bro. Peter Andrew, a seminarian, were reportedly kidnapped Monday night when assailants stormed the church premises.

The attack, which occurred around 10:30 pm, has left residents in a state of fear and anxiety.

As of Tuesday morning, no group has claimed responsibility of the incident, and there has been no word from the kidnappers regarding their demands.

Reports say local authorities and security forces have launched an investigation and are actively working to secure the release of the victims.

The abduction has ignited widespread concern among the Christian community and beyond, with many decrying the worsening security situation in the community.

According to a source, due to this negative incident, members of the Catholic Diocese of Auchi, to which the parish belongs, have intensified prayers for the safe return of the clergymen, while community leaders have called for urgent intervention by security agencies.

Contacted, the Edo State Police Public Relations Officer, (PPRO), Moses Yamu said a press statement would be released soon regarding the incident.

News

Police clarifies on death of ex-NIS boss, says his body was found in hotel

By Kayode Sanni-Arewa

hotel after receiving a female.

The police further explained that he did not die in the hands of kidnappers as widely reported by the media.

This was contained in a statement signed by SP Josephine Adeh, spokesperson of the command stating that:

“In light of the recent reports alleging that retired Comptroller General of the Nigerian Immigration Service, David Shikfu Parradang, was kidnapped and subsequently killed, we wish to clarify the facts surrounding this incident to ensure accurate information is disseminated to the public.

On March 3, 2025, at approximately 12:00 PM, Mr. Parradang arrived at Joy House Hotel, Area 3 Junction, driving a black Mercedes Benz. He checked into the hotel, paying a sum of Twenty two thousand naira (N22,000) for one night’s stay.

Shortly thereafter, he directed the hotel room attendant to escort a female guest who had come to visit to his room.

This lady left the hotel premises around 04:00PM of the same day.

Mr. Parradang did not exit his room after the lady left. Around 04:00 AM of 04 March 2025, a friend who is a military officer, concerned for his wellbeing, traced him to the hotel.

Upon arrival, the hotel receptionist and the officer proceeded to his room, where Mr. Parradang was found deceased, seated in a chair.

The Durumi Police Station was notified and officers promptly arrived at the scene, secured the area, took photographs, and collected all relevant evidence to preserve the integrity of the crime scene.

The body has been transferred to the National Hospital for necessary procedures, and hotel staff are currently cooperating with Police investigations.

Effort is in top gear to effect the arrest of the lady.

We urge the public and media outlets to refrain from spreading unverified information, including claims of kidnapping, that may incite fear or panic.

The FCT Police Command is committed to conducting a thorough investigation to uncover the circumstances surrounding Mr. Parradang’s death. We appreciate your cooperation and understanding as we work to ensure justice is served.

News

Reps Summon Labour Minister Over Failure To Constitute NSITF Board

-

Politics21 hours ago

Politics21 hours agoLP snubs NLC interference, turns down merger

-

News11 hours ago

News11 hours agoS#exual harassment: Akpabio has no right to intimidate elected female senators

-

Metro21 hours ago

Metro21 hours agoPolice rescue abducted officer in Abuja

-

News21 hours ago

News21 hours agoUS based foundation offers detained Anambra witch doctors legal services

-

Entertainment11 hours ago

Entertainment11 hours agoSad! Dolly Parton’s husband Carl Dean is dead

-

News11 hours ago

News11 hours agoPDP’s failure, Tinubu’s reforms have paved way for APC in Delta, says Omo-Agege

-

News10 hours ago

News10 hours agoInsecurity ! Kidnappers k!ll ex-Immigration CG in Abuja

-

Foreign21 hours ago

Foreign21 hours agoPope suffers two respiratory crises, undergoes emergency treatment