Economy

Now investors are mocking us –Obasanjo Blasts Tinubu Over Nigeria’s Economy

By Kayode Sanni-Arewa.

Former President Olusegun Obasanjo says President Bola Tinubu’s policies on fuel subsidy removal and exchange rates have adversely affected the Nigerian economy.

Obasanjo spoke via a statement issued by his media aide, Kehinde Akinyemi, on Sunday to assess the performance of the current government in the past one year.

He said the effects of the policies which he said were “wrongly implemented are pushing foreign investors away from Nigeria”.

He argued that “the present administration has not found the right way to handle the economy to engender confidence and trust for investors to start trooping in”.

Obasanjo continued: “Today, the government has taken three decisions, two of which are necessary but wrongly implemented and have led to the impoverization of the economy and of Nigerians. These are removal of subsidy, closing the gap between the black market and official rates of exchange and the third is dealing with a military coup in Niger Republic.

“The way forward is production and productivity which belief and trust in government leadership will engender. No shortcut to economic progress but hard work and sweat.

“Economy does not obey orders, not even military orders. I know that. If we get it right, in two years, we will begin to see the light beyond the tunnel. It requires a change of characteristics, attributes and attitude by the leadership at all levels to gain the confidence and trust of investors who have alternatives.

“Total Energy has gone to invest 6 billion dollars in Angola instead of Nigeria. If the truth must be stated, the present Administration has not found the right way to handle the economy to engender confidence and trust for investors to start trooping in.

“They know us more than we know ourselves. And now they are laughing at us, not taking us seriously. We have to present ourselves in such a way that we will be taken seriously. If the existing investors are disinvesting and going out of our country, how do we persuade new investors to rush in. We can be serious if we choose to be but we need to change from transactional leadership in government to transformational and genuine servant leadership.

“With change by us, the investors will give us the benefit of doubt, and security being taken care of on a sustainable long-term basis, they will start to test the water. With the right economic policies, attributes of integrity and honesty of purpose, all should be well with all hands on deck and the government becoming a catalyst for development, growth and progress.”

Obasanjo added that “tinkering with the exchange rate is not the answer” to the economic problems.

He said, “The answer is consistency and continuity in policy to ensure stability and predictability. That way, we will be sure of incentivizing domestic and foreign investment. There must be honesty and transparency in government dealings and contracts and not lying with deception about these issues. When the government is seen as pursuing the right policy, the private sector will go for production and productivity.

“With change by us, the investors will give us the benefit of doubt, and security being taken care of on a sustainable long-term basis, they will start to test the water. With the right economic policies, attributes of integrity and honesty of purpose, all should be well with all hands on deck and the government becoming a catalyst for development, growth and progress.

Economy

Mobile Money transactions hit $1.68trn in one year

Mobile money platforms processed about 108 billion transactions valued at $1.68 trillion in 2024, according to GSMA’s ‘State of the Industry Report on Mobile Money 2025’ report released Tuesday.

GSMA’s mobile money programme works to advance the mobile money ecosystem of communities that lack access to more traditional banking services. The global body for telecom operators stated that mobile money transaction volumes increased by 20 percent year-on-year, while transaction values grew by 16 percent, up from a 13 percent increase in 2023.

“Transaction volumes and values for mobile money accounts experienced robust double-digit growth in 2024. Approximately 108 billion transactions, totalling over $1.68 trillion, were processed through mobile money accounts in 2024,” the report said.

Vivek Badrinath, director general of GSMA, said mobile money has emerged as a powerful driver of financial inclusion and economic growth. “Its continued success depends on supportive regulatory environments that promote innovation, accessibility, and help unlock the full socio-economic potential.

“To ensure mobile money remains accessible, affordable, and safe, it is vital for governments and regulators to work with financial service providers to support financial literacy programs, empowering underserved populations and opening new opportunities for financial decision-making,” he said.

The report stated that the GDP of countries with mobile money services increased by approximately $720 billion by 2023, reflecting a 1.7 percent increase. In Sub-Saharan Africa, mobile money added about $190 billion to GDP in the same year.

“The region remains the leader in mobile money, with active accounts increasing notably in East and West Africa. East Africa was highlighted for its growth in active accounts in 2024, followed by Southeast Asia and West Africa. Countries in East Asia-Pacific, including Cambodia, Fiji, the Philippines, and Vietnam, also demonstrated growth, attributed to favorable regulatory conditions.”

GSMA noted that mobile money providers in East Asia-Pacific have evolved to offer comprehensive financial services, with 44 percent providing credit services by June 2024. However, challenges persist, particularly for women, as eight of the 12 surveyed countries reported disparities in mobile money ownership based on gender.

“Nearly 60 percent of mobile money providers are addressing these gaps by implementing digital literacy initiatives,” the report said.

Mobile money reached two significant milestones in 2024, surpassing two billion registered accounts and over half a billion active monthly users across the globe. The industry took 18 years to achieve one billion registered accounts and 250 million active users from 2001, but this has doubled in the last five years.

Economy

SEE Black Market Dollar To Naira Exchange Rate In Lagos, FCT, April 7th 2025

The local currency (abokiFx) opened at ₦1,560.00 per $1 at the parallel market, otherwise known as the black market, today, Monday, 7 April 2025, in Lagos, Nigeria, after it closed at ₦1,550.00 per $1 on Sunday, 6 April 2025.

Black market dollar to naira exchange rate today, 7 April 2025, also known as Aboki forex, can be accessed below.

NOTE: The exchange rate changes hourly. It depends on the volume of dollars available and the Demand. What this means is that…you can buy or sell 1 dollar at a certain rate and the price can change (high or low) within hours.

The official naira black market exchange rate in Nigeria today, including the Black Market rates, Bureau De Change (BDC), and CBN rates. Please note that the exchange rate is subject to hourly fluctuations influenced by the supply and demand of dollars in the market. As of now, you can purchase 1 dollar at a certain rate now however, it’s important to remember that the rate can shift (either upwards or downwards) within hours.

Economy

Crude prices slump to $65 first time since 2021

Oil prices plunged this week to $65 per barrel as the United States import tariffs and an unexpected OPEC+ supply hike erased $10 per barrel from global benchmarks.

The price appreciated last week when US President Donald Trump imposed tariffs on any country that buys crude from Venezuela.

However, oil prices turned around the corner as of Friday, with Brent falling to $65, the first time since 2021.

According to oilprice.com, the combined effect of Trump’s import tariffs, OPEC+’s inopportune decision to speed up the unwinding of production cuts, and China’s retaliatory actions wiped off $10 per barrel from global oil prices, “with ICE Brent falling below $65 per barrel for the first time since August 2021.”

The US West Texas Intermediate crude futures lost $4.96, or 7.4 per cent to end at $61.99.

“Seeing backwardation barely change compared to the beginning of the week, one could assume that US tariffs are the defining factor for the price change. Nevertheless, this week will not go down well in the history of oil markets,” oilprice.com reports.

China’s retaliatory tariffs on US goods have escalated a trade war that has led investors to price in a higher probability of recession.

China, the world’s top oil importer, announced it will impose additional tariffs of 34 per cent on all US goods from April 10.

According to Reuters, nations around the world have readied retaliation after Trump raised tariffs to their highest in more than a century.

Aside from the tariffs, another factor that further pressured oil prices was the Organisation of the Petroleum Exporting Countries and Allies’ decision to advance plans for output increases.

The group now aims to return 411,000 barrels per day to the market in May, up from the previously planned 135,000 bpd.

-

News13 hours ago

News13 hours agoOERAF held memorial lecture on conflict resolution, security/safety of community in Nigeria

-

News23 hours ago

News23 hours agoJust in: Founder of Diamond Bank and ex-chairman of MTN, Paschal Dozie is dead

-

News19 hours ago

News19 hours agoTRADE WAR! U.S. angry over Nigeria’s import ban on 25 products

-

Sports23 hours ago

Sports23 hours agoReal Madrid keeping tabs on Victor Osimhen

-

News19 hours ago

News19 hours agoINTERVIEW: Introduction of Child Rights Curriculum In Nigerian Universities Will Take CRA to Families – Dr Obiorah Edogor

-

News23 hours ago

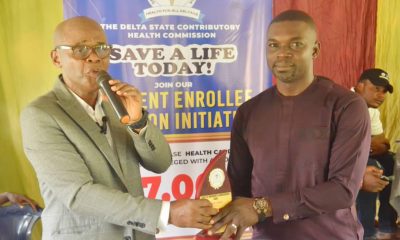

News23 hours agoOERAF Executive Director Dr Akpodiete, Held Memorial lecture on Essence and benefits of health insurance+Photos

-

News13 hours ago

News13 hours agoHoR Minority Caucus decries killings in Plateau, Benue states, urges immediate presidential decisive actions

-

News6 hours ago

News6 hours agoBandits have seized control of 64 communities in Plateau – Gov Muftwang