News

SAD! Bandits Storm Zamfara Hajj Chairman’s Home, K!ll Son, Abduct Relatives

By Kayode Sanni-Arewa

A large number of bandits with heavy weapons on Thursday stormed the home of Zamfara State Hajj Commission Chairman, Musa Mallaha, in Gusau, the state capital, and killed his son, watchman and abducted three relatives.

It was learnt that the incident happened around 1:30pm on Thursday as the bandits shot sporadically in the area.

A resident in the area, Malam Aminu Sani, who spoke with Vanguard, said the bandits wanted to abduct the Chairman, but their mission failed, and they killed his son, the watchman and abducted some people living in the house.

Sani stated that the bandits also attacked some residences in the area during the invasion and abducted an undisclosed number of people.

He said, “We heard heavy shooting sporadically by the hoodlums but after they left, we discovered that they killed Abdulmunaf his son and kidnapped his brother Muawiya Lawali Mallaha and his watchman.”

News

Oil Trade Sector Flags Key Concerns Over Tax Reform Restrictions

…as manufacturers association call for fair implementation

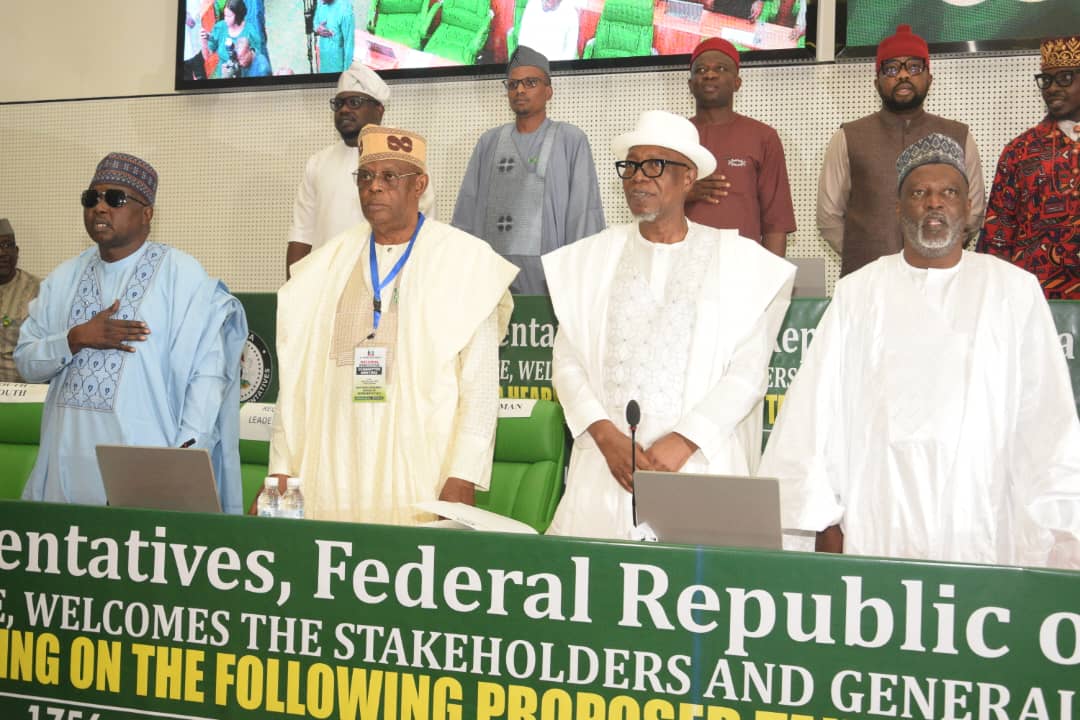

By Gloria Ikibah

The Oil Producing Trade Sector (OPTS) has raised concerns over four key tax reform restrictions: limited access to tax incentives, increased effective tax rates, exclusion of recently announced incentives, and contract stabilization issues.

Speaking at the resumed 3-day public hearing on the Tax Reform Bills in Abuja, OPTS representative Oluwole Oladimeji highlighted specific concerns regarding Sections 57 and 85 of the proposed law. He emphasized the need for clarity on the minimum effective tax rate and investment utilization under the new framework.

“How do you work with Section 57? It introduces a minimum effective tax rate, but clarity is needed on how it will be computed,” Oladimeji stated.

He also pointed to the need for further explanation on three-year tariff limits and the application of tax credits in investment calculations.

“If I move on to another section of concern, on the three-year tariff limits, section 85, subsection 4, it talks about the three-year tariff limit on recouped tax credits. And this, if implemented, will reduce the benefits of the non-associated tax, as well as the due potential consequential fiscal derivatives.

“The third element on that list has to do with clarity that is needed with respect to section 85, subsection 1b, that says that the tax credit will not be applicable after the 10th year, i.e., before the 11th year. Our request regarding this is, one, that if we are going to have an even minimum effective tax rate at all, all taxes should be included in the basis for determining this. Secondly, that all tax credits will be utilized before the issue of any minimum tax, effective tax rate, will even arise at all.

“And then, with respect to the 11th year, that the current provision in section 85, subsection 1b should be extended by putting provision except carried forward from the 10th, so that if we are going to utilize tax credits in the 10th year, it will not be lost at all when we have only tax allowance that is also applicable. Then, another thing we would like to talk about is related to section 85, subsection 2, which provides that the incentives, tax incentives, will only be applicable to companies under the PIM. This will be the use of section 78, which covers section 78 through 88, and here we have the map incentives in there.

“So the way the thing is now, it will be only available to companies that are converted to PIM. And to cure this, we propose that there should be a remapping of the current section 78 to chapter 8, that includes incentives, so that one would not think that it is particularly restricted to companies under the particular tax regime. Because if this is not done, it will be introducing a limitation that is not in the executive order signed by the President in 2024.

“Another area of concern is section 92, subsection 3, which as currently drafted, says that the company shall be excluded from other incentives if it has utilized associated gas incentives. Now, gas incentives have typically determined a project, not a company. And the exclusion clause currently existing is overly broad and can give us other incentives.

“Another element of concern under this restriction on utilization of tax incentives has to do with section 104, which today knocks off investment tax credits enjoyable, allowable under section 4 of the deep offshore and inland leasing production sharing contract. What section 104 talks about today is only investment tax allowance.

“It has removed the investment tax credit that is currently a trade dispute. So our request is that there should be a retention of the current provision of section 4 of the deep offshore act that we are proposing. I will give you a second indicator to look at now, which has to do with increase in effective tax rates”.

In section 146, Oladimeji observed a sharp increase in the heat rate, rising from 7.5% to a progressive 15% in 2013. Additionally, sections such as 21, 27, 69, 94, and 97, along with sections 1–4, introduce penalties when P80 is due—whether on an expense or an asset that is not charged. This results in the affected expense or asset being non-deductible for tax purposes.

He furthermore noted that, the current wording of the law lacks clarity on how P80 will be treated, raising concerns that businesses might face penalties simply because of unclear payment terms. “The issue of P80 penalties has already been addressed in the Nigerian Tax Acquisition Regulations, particularly in Sections 64 and 121, which outline penalty conditions for unpaid P80.

“It is important to note that Nigeria already has a well-established legal framework for determining capital allowances and utilizing SAFE under existing laws, such as the Petroleum Profits Tax Act, the Petroleum Industry Act, the Deep Offshore and Inland Basin Production Sharing Contract Act, and CITA. The aim of the Tax Committee should be to simplify these laws, not introduce unnecessary complications.

“The oil and gas industry operates in collaboration with multiple government agencies, including the ATD, CDMA, FRS, and CBA, as well as partnerships with the NNPC. These collaborations involve project reviews, performance assessments, and audits. Therefore, tax reforms must prioritize simplification and efficiency, ensuring that regulatory burdens do not make doing business more difficult. Overloading companies with excessive tax obligations will ultimately increase costs and hinder economic growth”, he added.

The President of the Manufacturers Association of Nigeria (MAN), Otunba Francis Meshioye commended the federal government for adopting a structured and consultative approach to tax reforms. He noted that this method would facilitate early revenue generation and drive inclusive economic growth.

Meshioye expressed confidence that the proposed reforms under the Constitutional Reconciliation Bill would effectively tackle the long-standing issue of multiple and excessive taxation.

However he highlighted the growing concern over arbitrary levies imposed by regulatory bodies at various levels of government, as well as the unlawful collection of taxes and fees by non-state actors, which continue to create an unpredictable business environment.

“We look forward to the implementation of these reforms to address the persistent challenges of high taxation and restrictive policies. It is our hope that this will usher in a new era where the National Assembly refrains from approving arbitrary levies on businesses to finance government agencies,” he stated.

He cited a recent instance where businesses were required to contribute a percentage of their market capitalization to sustain certain financial indices. He warned against such measures, emphasizing that they place undue strain on businesses.

Meshioye welcomed the planned reduction of the Corporate Income Tax (CIT) rate from 30% to 27.5% in 2025 and 25% in 2026, aligning with global trends toward lower income tax rates. He described this move as a positive step that would ease financial pressure on manufacturers, attract investment, and reinforce the government’s commitment to reducing the cost of doing business in Nigeria.

Addressing concerns related to tax rates in free trade zones, he stressed the importance of maintaining clarity and ensuring that tax policies align with existing laws. He argued that rather than undermining the incentives for businesses operating within the zones, a fair tax structure would create a level playing field between companies within and outside these zones, particularly in relation to sales into the customs territory.

Meshioye underscored the need for a balanced approach to taxation, ensuring that Nigeria’s trade policies remain competitive while protecting the country’s tax base.

He pointed to Section 16 of the Real Tax Clause as a crucial reference for maintaining fairness and economic stability.

The hearing continues on Friday when the Nigerian National Petroleum Company Limited will present their observations.

News

It’s absolutely necessary to establish FMC Gembu-Stakeholders (Photos)

Critical stakeholders from Gembu in Taraba State, on Thursday at the National Assembly during Public Hearing on 50 FMC Bills, declared that the establishment of Federal Medical Centre, (FMC) in Gembu is absolutely necessary.

The Bill which scaled second reading last year was sponsored by Senator Manu Haruna representing Taraba Central Senatorial District.

Speaking while presenting the memoranda on FMC, Gembu, Alhaji Abubakar Jarau who represented stakeholders from Taraba noted that:

“The establishment of Federal Medical Centre, Gembu, through this amendment, will be a historic milestone in Nigeria’s quest for universal healthcare coverage, economic development and national security.

” It will save lives , reduce healthcare inequalities, create jobs, and position Gembu as a strategic healthcare hub for both Nigeria and the West African sub region.

“We therefore urge the National Assembly to pass this amendment with the necessary legislative backing for its immediate and sustainable implementation.

“We appeal to all stakeholders, policy makers and development partners to support this amendment to ensure that the people of Gembu and surrounding communities receive the healthcare services they deserve.

Key Reasons for the Amendment1. Addressing Geographical Health Disparities •

“The Mambilla Plateau is distant from other tertiary healthcare facilities in Taraba State and the nearest FMCs are several hours away over challenging terrain. •

“The high-altitude climate and unique environmental factors of the area exacerbate health challenges, making a dedicated medical centre essential for specialized treatments and emergency response.2. Reduction in Healthcare Inequality and Medical Tourism •

“The people of Gembu and surrounding communities are forced to travel to Jalingo, Yola, Gombe, or even Cameroon for advanced medical services, leading to financial strain and high mortality rates due to delays. •

“Establishing FMC Gembu will significantly reduce these inequalities, ensuring that no Nigerian is deprived of quality healthcare due to their location.3. Strengthening Emergency Medical Response and Pandemic Preparedness •

“Gembu and its environs are prone to seasonal disease outbreaks, including respiratory infections, waterborne diseases, and zoonotic illnesses due to its unique topography and climate. •

” A well-equipped FMC in Gembu will improve disease surveillance, containment, and response capabilities in line with the National Health Emergency Preparedness Strategy.4. Boosting Economic Growth and Employment Opportunities •

“The establishment of FMC Gembu will create employment opportunities for medical professionals, administrative personnel, and auxiliary workers. •

“It will stimulate the local economy by attracting healthcare investments, medical tourism, and private-sector partnerships.5. Medical Research and Training Hub •

“The FMC will serve as a training center for medical students, resident doctors, nurses, and allied health professionals. •

“It will encourage collaborative research in partnership with universities, medical institutions, and international health organizations, particularly in tropical medicine, high-altitude health conditions, and public health interventions.

News

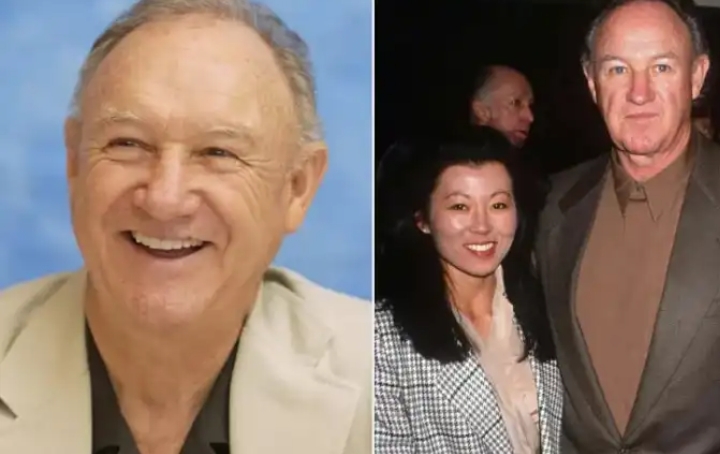

Sad! Actor Gene Hackman, wife, dog found lifeless in Santa Fe home, says Sheriff

By Kayode Sanni-Arewa

Mendoza added there was no immediate indication of foul play in the deaths, the outlet added.

The actor and his wife, classical pianist Betsy Arakawa, were found dead at their home in Santa Fe Summit on Wednesday, Feb. 26, reported the Santa Fe New Mexican, citing County Sheriff Adan Mendoza, who confirmed to the outlet that the couple had died, along with their dog

Mendoza added there was no immediate indication of foul play in the deaths, the outlet added.

He also did not provide a cause of death or say when the couple, who were married for over 30 years, might have died.

Born Eugene Allen Hackman in San Bernardino, California, in 1930, he moved frequently with his family, eventually landing in Danville, Illinois, where his father worked for a newspaper press.

As a boy, Hackman often found himself escaping to movie theatres, where he idolized stars like Erroll Flynn, Edward G. Robinson and his favourite, Jimmy Cagney.

When Hackman was 13, his father left the family, waving a hand to his son as he left.

“It was so precise. Maybe that’s why I became an actor,” Hackman once told Vanity Fair in 2013 of that parting gesture.

“I doubt I would’ve become so sensitive to human behaviour if that hadn’t happened to me as a child — if I hadn’t realized how much one small gesture can mean.”

Three years later, after a night in jail for stealing candy and soda, Hackman enlisted in the Marines, serving until he was 19.

After his discharge, he bounced around, living in New York, Florida, and his childhood home, Danville, and marrying his girlfriend, Faye Maltese, in 1956. (They would divorce 30 years later.)

The pair later moved to California, where Hackman joined the famed Pasadena Playhouse.

While there, Hackman forged a friendship with another aspiring actor, Dustin Hoffman.

Hackman, however, was kicked out of the Playhouse and, deciding to prove them wrong, headed to New York City, where he was determined to make it as an actor.

He landed a small part in a two-week production of Arthur Miller’s play: “A View from the Bridge.”

In New York, Hackman kicked around for years, hanging out with Hoffman and Robert Duvall, taking small parts as they came.

It wasn’t until he was in his mid-thirties that Hackman finally landed a role that got him noticed, playing Warren Beatty‘s brother in Bonnie and Clyde (1967).

As Buck Barrow in the incendiary film, Hackman earned his first Oscar nomination in 1968 out of five.

Three years later, Hackman was nominated for a second Best Supporting Actor Oscar for his role in the 1970’s I Never Sang for My Father. But it was his leading role in 1971’s The French Connection that solidified his status as a Hollywood leading man and earned him the Oscar for Best Actor in 1972.

Hackman pursued more diverse roles in 1972’s The Poseidon Adventure, Francis Ford Coppola’s 1974 film The Conversation (1974) where Hackman plays a surveillance expert who thinks a couple is about to be murdered.

He also portrayed a hard-charging coach in 1986’s Hoosiers, the war-mongering submarine captain in Crimson Tide (1995).

And he was Lex Luthor in the 1978 film Superman, which may have seemed an odd choice of vehicle for a man bent on making his bones as a serious actor, but with more than 80 movies on his resume, Hackman made room for silliness.

For every bit of fun like the animated film Antz (1998) or The Birdcage (1996) with Robin Williams and Nathan Lane, there were indelible turns in Mississippi Burning, which earned Hackman his fourth Academy Award nomination in 1989, and Clint Eastwood’s Unforgiven, for which Hackman took home his second Oscar in 1993, as a loathsome sheriff.

Hackman retired from acting after starring in the 2004 comedy Welcome to Mooseport. Just a few years before, he’d once again thrilled audiences in Wes Anderson’s The Royal Tenenbaums as the dying patriarch of a family of kooky geniuses (including Anjelica Huston, Gwyneth Paltrow, Ben Stiller and Luke Wilson). But after a career that spanned cinema’s rebirth in the late ’60s to the new century, Hackman decided he’d done enough.

In 2004, Hackman told Larry King in an interview that his career was “probably all over,” and that he had no new scripts in front of him. Confirming his retirement in 2008, he expanded on his thoughts several years later, telling GQ in 2011 that it would take a lot for him to make another film.

“I don’t know. If I could do it in my own house, maybe, without them disturbing anything and just one or two people,” he said, later telling the outlet that he just hopes to be remembered “as a decent actor.”

While on a book tour for his novel Escape from Andersonville in 2008, Hackman told the Raleigh News & Observerhe didn’t want to “keep pressing” and risk “going out on a sour note. “I feel comfortable with what I’ve done,” he said.

Hackman turned to painting and did voice-over work and writing books. He penned the old west story Payback at Morning Peak (2011) and the police thriller Pursuit (2013), as well as co-authoring three works of historical fiction with undersea archeologist Daniel Lenihan.

He has since narrated two documentary films: The Unknown Flag Raiser of Iwo Jim (2016) and We, the Marines (2017).

In addition to one of the most staggering filmographies in the business, his writing, theater notices and his painting, Hackman leaves behind his three children who he shared with his first wife, Maltese: Christopher Allen, Elizabeth Jean and Leslie Ann Hackman.

Asked by GQ in 2011 as to how he would like to be remembered, Hackman humbly replied, “As a decent actor. As someone who tried to portray what was given to them in an honest fashion. I don’t know, beyond that.” [People]

-

News22 hours ago

News22 hours agoThey’re after my life i – NAFDAC DG raises alarm

-

News22 hours ago

News22 hours agoNaira again falls against Dollar – February 26

-

News22 hours ago

News22 hours agoSAD! Billionaire Folorunso Alakija Reportedly Goes Blind

-

Metro16 hours ago

Metro16 hours agoBoko Haram reportedly raze villages in Adamawa communities, loot property

-

News22 hours ago

News22 hours agoPolice Halt Attempt To Invade Kano Emir’s Palace, Nab 17 Suspects

-

News23 hours ago

News23 hours agoKyari to Present NNPCL’s Position Thursday On Tax Reform Bills

-

News22 hours ago

News22 hours agoBillionaire Otedola Hosts Burna Boy, Wizkid, At Lagos Residence (Photos)

-

News8 hours ago

News8 hours agoJust in: Police restore Obasa’s security details, withdraw Meranda’s as ex-Lagos speaker set for return