Economy

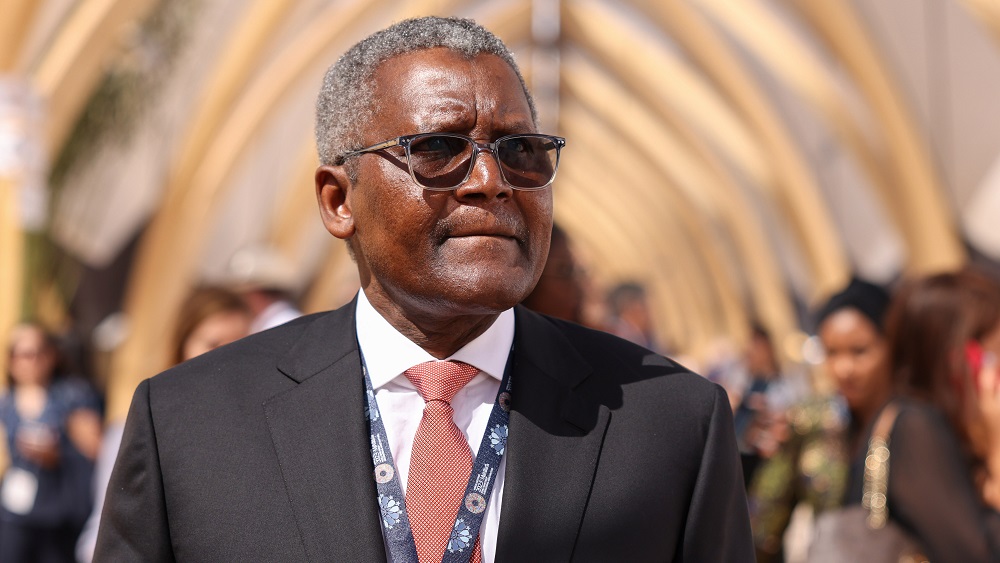

Why no new refinery in other African countries in 35 years – Aliko Dangote

Aliko Dangote, the owner of the $20 billion Dangote Refinery, has blamed beneficiaries of fuel importation in other African countries for the absence of new refineries in the continent in the past 35 years.

Dangote disclosed this statement during a recent conversation with CNN’s reporter, Eleni Giokos, at his refinery in Lagos, Nigeria.

According to Dangote, other reasons for the absence of new refineries in Africa include a lack of loan facilities for investors, attributed to weak financial institutions among others.

“There are other countries in Africa who have been trying to build refineries but have been unable to. There has not been a new refinery in Africa in the last 35 years.

“There are so many issues regarding this such as money, political will, and also people who are benefitting from this whole system of importing petroleum products into Africa are discouraging their governments from building a refinery.

“Also, they won’t get loans anyway because they don’t have very strong banks. The international banks will not support anything like this,” Dangote said.

In April 2024, Dangote Refinery commenced the supply of diesel and aviation jet fuel to the Nigerian market months after it was commissioned last year.

The development comes as the Secretary-General of the African Petroleum Producers Organisation (APPO), Omar Farouk Ibrahim said 75 percent of crude oil produced in Africa is exported to other countries.

Economy

States face allocation cuts as agency demands N100bn monthly

The monthly statutory allocations to state governments from the federation account may decline in the coming months following an official request by the Nigeria Sovereign Investment Authority to boost the nation’s residual funds with the support of N100bn monthly.

The request, which was presented by the Managing Director and Chief Executive Officer of NSIA, Aminu Umar-Sadiq, is aimed at unlocking large-scale investments to drive Nigeria’s economic growth.

He made the request at the March revenue-sharing meeting of the Federation Account Allocation Committee held between April 14 and 15, 2025. Our correspondent obtained a copy of his presentation during the meeting on Friday.

Umar-Sadiq appealed to the committee, which includes state commissioners of finance, to consider and approve the request, with funding proposed to commence from the March FAAC allocation.

The presentation was titled, “Activating Residual Funding for the Nigeria Sovereign Investment Authority – Unlocking Opportunities for Large-Scale Investments to Drive Nigeria’s Economic Growth.”

According to the document, the NSIA is requesting a structured monthly disbursement of N100bn from Residual Funds—revenues in the Federation Account beyond projected hydrocarbon income—to establish a Naira-based investible capital pool.

The move, the authority says, will enhance its capacity to finance critical domestic infrastructure projects.

The MD said, “The funding would position the authority as a leading sovereign wealth fund globally, promoting responsible and strategic investments for Nigeria’s economic development and enhancing its threefold mandate to build a savings base for the country, enhance the development of infrastructure, and provide stabilisation support.”

He explained that residual funds are a legitimate source of funds transferred to the authority, provided that the derivation portion of the revenue allocation formula shall not be included as part of this funding.

Economy

More Nigerians to experience poverty by 2027 – World Bank

The World Bank’s latest Africa’s Pulse report has projects a grim future for Nigeria, with poverty expected to rise by 3.6 percentage points by 2027.

Released during the IMF and World Bank Spring Meetings in Washington, DC, the report cites Nigeria’s reliance on oil, economic fragility, and governance challenges as key drivers.

It highlights the country’s structural economic weaknesses, dependence on oil revenues, and national fragility as key barriers to meaningful poverty reduction.

“Poverty in resource-rich, fragile countries, including large economies like Nigeria and the Democratic Republic of Congo, is projected to increase by 3.6 percentage points between 2022 and 2027,” the report stated.

Despite recent growth in Nigeria’s non-oil sector during the last quarter of 2024, the World Bank warns that this progress is unlikely to translate into widespread poverty alleviation due to ongoing fiscal and institutional challenges.

The report emphasizes that Sub-Saharan Africa remains the world’s poorest region, with an overwhelming 80% of the globe’s 695 million extreme poor residing there in 2024.

Within the region, half of the 560 million extremely poor people were located in just four countries, including Nigeria.

In stark contrast, South Asia accounted for 8% of the world’s extremely poor population, East Asia and the Pacific 2%, the Middle East and North Africa 5%, and Latin America and the Caribbean 3%.

The World Bank attributes the rising poverty in Nigeria and similar economies to weakening oil prices and fragile governance structures, noting: “This follows a well-established pattern whereby resource wealth combined with fragility or conflict is associated with the highest poverty rates, averaging 46% in 2024, which is 13 percentage points higher than in non-fragile, resource-rich countries.”

Meanwhile, non-resource-rich countries in Africa are experiencing stronger economic growth and faster poverty reduction, buoyed by high agricultural commodity prices and more resilient fiscal policies.

To reverse Nigeria’s downward poverty trend, the World Bank recommends reforms that prioritize inclusive economic growth and stronger public financial management.

It calls on the government to focus on “improving fiscal management and building a stronger fiscal contract with citizens to promote inclusive economic development and long-term poverty alleviation.”

Economy

SEE current exchange rate of the Dollar to Naira

What Is the Dollar to Naira Exchange Rate at the Black Market (Aboki FX)?

Here is the Dollar to Naira exchange rate at the parallel market, popularly known as the black market (Aboki fx), for Tuesday, April 23, 2025.

You can exchange your dollars for naira at the following rates:

Black Market Exchange Rate (Lagos – April 23, 2025):

According to sources at the Bureau De Change (BDC), the exchange rate at the Lagos parallel market saw traders buying at ₦1610 and selling at ₦1620 per US dollar.

It’s important to note that the Central Bank of Nigeria (CBN) does not recognize the black market. The CBN advises individuals seeking foreign exchange transactions to do so through their banks.

Dollar to Naira Exchange Rates

Market Type Buying Rate Selling Rate

Black Market ₦1610 ₦1620

CBN Official Rate ₦1591 (Low) ₦1606 (High)

Note: Forex rates vary across dealers and regions, and actual rates may differ from those listed.

Meanwhile, the Nigeria Customs Service (NCS) has announced the seizure of 298 smuggled items worth ₦7.6 billion between January and March 2025. The NCS also disclosed that it generated a total revenue of ₦1.75 trillion in the first quarter of the year.

-

News16 hours ago

News16 hours agoDSS arrests Army major for planning unrest in Delta

-

News9 hours ago

News9 hours agoGunmen abduct two senior LG workers, three others

-

News17 hours ago

News17 hours agoFCT minister, Wike announces new appointments

-

Politics17 hours ago

Politics17 hours agoSee list of APC Delta stakeholders holding meeting in Abuja on power sharing formula with Oborevwori

-

News17 hours ago

News17 hours agoCOVID-19 Vaccine Killed Pope Francis, says Pastor Oyakhilome

-

News10 hours ago

News10 hours agoNDLEA storms Lagos hotel, recovers N1.042billion illicit drug consignments(Photos)

-

News10 hours ago

News10 hours agoArmy Chief condemns beating, harassing civilians in military uniform says, it’s wrong

-

News18 hours ago

News18 hours agoUK Tories mull replacing Badenoch as party leader after poor ratings