News

Our Decision Was Deliberate, NNPCL To Dangote Over Equity Stake

By Kayode Sanni-Arewa

The Nigerian National Petroleum Company Limited (NNPCL) has replied Aliko Dangote, over his statement that the NNPC’s equity in the Dangote over $20bn refinery is now 7.5 per cent as against 20 per cent being widely believed.

A statement by the company’s Chief Corporate Communications Officer, Femi Soneye, on Sunday, said its decision to reduce its investment in the refinery was well thought out.

It said, “Several months ago, we made a commercial decision to cap our investment at the amount already paid. This decision was taken by NNPC Ltd and has no impact on our business.”

“NNPC Limited periodically assesses its investment portfolio to ensure alignment with the company’s strategic goals,” said a spokesman for the company.

“The decision to cap its equity participation at the paid-up sum was made and communicated to Dangote Refinery several months ago,

Dangote had on Sunday, said NNPCL no longer owns a 20 per cent stake in the Dangote Petroleum Refinery.

Speaking during a press briefing at the refinery on Sunday, Dangote said NNPCL now owns 7.2 per cent of the refinery over failure to pay the balance of their share, which was due in June.

According to Aliko Dangote, NNPC’s stake dropped to 7.2 per cent over the company’s failure to pay the balance of its share, which was due in June. The 20 per cent interest in the $20bn Dangote refinery is valued at $2.76 billion.

“NNPC no longer owns a 20 per cent stake in the Dangote refinery. They were met to pay their balance in June, but have yet to fulfil the obligations. Now, they only own a 7.2% stake in the refinery,” Dangote said

Last December, Dangote commenced operations at his $20bn facility in Lagos with 350,000 barrels a day. The refinery hopes to achieve its full capacity of 650,000 barrels per day by the end of the year. The refinery has begun the supply of diesel and aviation fuel to marketers in the country while petrol supply is expected to commence in August.

The controversy comes as Nigerians have hoped the start of Premium Motor Spirit or petrol refining at the facility, would help Nigeria cut down on petrol importation, thereby reducing the local price of the product.

However, Dangote had expressed frustration about getting Nigerian crude for his facility. A Bloomberg report said the Lagos-based refinery bought about 24 million barrels of crude from the United States.

While responding to the importation of crude oil by Dangote, the Minister of State for Petroleum Resources (Oil), Heineken Lokpobiri, had in May, said the decision by the Lagos-based refinery to import US crude could be based on its business model.

However, Dangote disclosed on Sunday, that his refinery would roll out petrol from August 2024, having resolved its crude oil supply issues with the NNPCL and the Federal Government.

News

FCT minister uncovers company behind Highway Manhole theft , ‘Stolen Items’ Recovered As Investigation Unfolds

The Minister of the Federal Capital Territory, Nyesom Wike, has accused an iron smelting company, Abuja Steel Company, of being one of the receivers of stolen manhole covers in Nigeria’s capital territory.

It was reported that some suspected criminals removing sewage manhole covers on highways in Abuja had been arrested by security agencies.

Lere Olayinka, Senior Special Assistant (Public Communications and New Media) to the FCT Minister, in a statement on Sunday, said efforts were being made to apprehend their collaborators, especially buyers of the manhole covers.

However, Lere Olayinka in a statement on Monday accused the recycling company located along Abuja – Kaduna Road of receiving metal stolen from Abuja, stressing that ‘exhibits of interest’ have been recovered from the company and are in custody of the police.

“One iron smelting company, Abuja Steel Company, has been identified as one of the alleged receivers of the stolen manhole covers,” he said.

“Further investigations going on as to the company and others’ involvement in the removal, purchase and melting of the manhole covers,” he added.

He recalled that it was made public on Sunday that arrests and recoveries were made by both the police and the Nigerian Security and Civil Defence Corps (NSCDC).

“The arrested persons are helping the security agencies with useful information about the buyers of the vandalized infrastructure.

“Also, as directed by the FCT Minister, Nyesom Wike, replacement of the manhole covers that were removed by the vandals commenced yesterday,” the statement added.

News

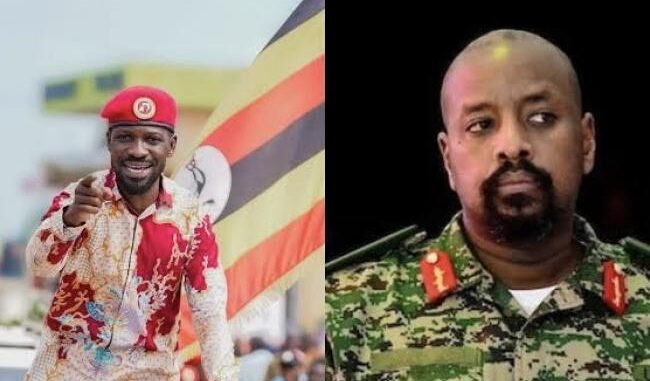

Democracy in wrong hands: Museveni’s Son, Gen. Kainerugaba, Threatens To Behead Ugandan Opposition Leader Bobi Wine

Muhoozi Kainerugaba, head of Uganda’s military and son of President Yoweri Museveni, has threatened to behead opposition leader Bobi Wine.

Kainerugaba, widely regarded as the heir apparent to his father, is no stranger to controversy, frequently making provocative posts on social media.

In 2022, he faced backlash after threatening to invade Kenya, a statement he later apologised for, claiming some posts were intended ironically.

On Sunday evening, Kainerugaba took to X, asserting that his father, whom he called Mzee, was the only one preventing him from acting against Wine.

“Kabobi knows the only person protecting him from me is my father. If Mzee was not there, I would cut off his head today!” he wrote.

Wine, whose real name is Robert Kyagulanyi, responded in a post on X that he did not take the threat lightly, saying, “The threat by Museveni’s son (who also heads Uganda’s military) to behead me is not something I take lightly, given that many have been killed by him and his father, and considering their several attempts at my life. I refuse to be intimidated by the cowardly regime. The world is watching.”

Kainerugaba further replied, “Finally! I woke you up? Before I behead you, repay us the money we loaned you.”

Wine, a popular musician-turned-politician and President Yoweri Museveni’s strongest opponent, has made some serious accusations against the regime.

He accused the government of engaging in ballot stuffing and intimidation tactics during the 2021 presidential election. But Wine isn’t the only one speaking out – human rights groups have also criticized Museveni’s administration for alleged abuses, including torture and arbitrary detention. The government, however, denies these claims.

The 2021 election was marked by several irregularities, including internet shutdown and social media blockage on the day before the election.

News

Ibadan Stampede: Suspects Must Be Prosecuted– Gov Makinde Declares

Governor Seyi Makinde has again restated the commitment of his government to ensure the prosecution of all the suspects involved in the tragic stampede at Islamic High School, Bashorun, Ibadan, which claimed the lives of at least 35 children.

The stampede occurred during a children funfair organized by Ooni of Ife’s former wife, Naomi Ogunseyi. Olori Naomi, media personality Hamzat Oriyomi. Naomi, Hamzat and the principal of the school have been remanded in prison custody.

On Monday January 6, at the 2025 Annual Inter-faith Service for state workers, Governor Makinde addressed calls for leniency, stating that the rule of law will be upheld in Oyo State. He revealed that some individuals have argued that similar incidents in Anambra and the Federal Capital Territory (FCT) did not lead to prosecutions, questioning why Oyo State should proceed differently.

“In the outgone year, we faced challenges. 2024 started for us here in Oyo State almost on a tragic note. On 16th January 2024, we had an explosion here in Bodija. It affected even my office. The impact was felt all around Ibadan. We’re closing it out.

And then, towards the end of the year, we had the stampede at Islamic High School, Bashorun. 35 innocent souls were lost; may we not see such again in Oyo State.

Quite a number of people have been reaching out to me, saying, ‘Oh, this incident happened in Anambra State. It also occurred in the FCT. Nobody went to jail. Why is it that in Oyo State, some people are going to jail?’ I said, ‘Well, Oyo State is not Anambra State, and no matter how highly placed, justice must be done.’

The judiciary is here. It’s in their court. If you think you can grant bail pending trial, I have nothing against it. But for the trial, the people must go on trial.

So, people come to me, and I’ve been saying to them, ‘Oyo State, even if this entire country decides not to follow the rule of law, in Oyo State, we will follow; we will dare to be different.”

-

News18 hours ago

News18 hours agoSAD ! Sokoto SSG loses daughter, three grandchildren to fire outbreak

-

News22 hours ago

News22 hours agoJust in: Unidentified Gunmen K!ll APC Chieftain in Ondo

-

News22 hours ago

News22 hours agoWAEC to now allow students resit failed subjects

-

News21 hours ago

News21 hours agoJust in: Boko Haram launch attack against military base, k!ll soldiers

-

Metro8 hours ago

Metro8 hours agoSAD: Five siblings pass away in auto crash after condolence visit

-

News19 hours ago

News19 hours agoReps to Pass 2025 Budget by January Ending, Commences Defence Tuesday, January 7

-

Metro8 hours ago

Metro8 hours agoPolice personnel dies few days after converting to Islam

-

News12 hours ago

News12 hours agoMy life now under heavy threat after my new year message – Obi alleges