News

Controversy As Nigerian Petrol Company, NNPCL 2022 Audited Report Shows It Paid 20% Shares In Dangote Refinery

The Nigerian National Petroleum Corporation Limited (NNPCL) Audited Report for 2022 has shown it paid for 20% shares in the Dangote Refinery.

The revelation came despite Dangote’s denial that the what the corporation paid was only 7.2%.

A report by Afrisagacity shared on X handle analysed that under President Muhammadu Buhari’s regime, the NNPC committed to invest $2.7bn and buy 20% shares in the Dangote Refinery.

According to the report, in January, the NNPC, after intense pressure, released its Audited Financial Report for 2022. In the report, they stated that they purchased 20% shares in the Dangote Refinery for $2.7billion.

They claimed to have obtained $1.036 billion (as part of the funding) from Lekki Refinery Funding Limited. $1 billion was paid to Dangote Refinery – which is about 37% of $2.7 billion they claimed to have invested.

Of course, the remaining amount of $36 million was for just transaction costs.

Tinubu took over from Buhari and, in December, he set up a new NNPC Board, where he made his longtime friend and ally, Pius Akinyelure the NNPC Board Chairman and reappointed Malam Mele Kyari as NNPC Group CEO.

In a sudden turn, the NNPC that had committed to buy 20% shares, backed down. Dangote had given them an extension period (till June) to complete the $2.7 billion for the shares. But they couldn’t.

Meanwhile, the public still believed that they had a 20% shares in the Dangote Refinery – not until Sunday, when Dangote himself, revealed that the NNPC had invested only 7.2%.

Shortly after Dangote broke the news, the NNPC rushed to react. In its defence, it said “NNPC Limited periodically assesses its investment portfolio to ensure alignment with the company’s strategic goals.”

“One, what exactly are the NNPC “strategic goals?” They say it’s “to ensure access to affordable, reliable, sustainable and modern energy for all”.

“How and when did the NNPC 20% equity investment in the Dangote Refinery go against its “strategic goals” as highlighted above?

“Two, in its statement, the NNPC validated what Dangote said that they invested only 7% of the $2.7 billion they initially committed to pay.

“This sharply contrasts and invalidates their claim of paying $1 billion to Dangote Refinery (for the shares) in 2022 – which is about 37%.

“So, if the NNPC confirmed that they had paid $1 billion to Dangote Refinery – which is about 37% – how did they come about the 7%?

“Also, where is the balance? Did Dangote Refinery refund it?

“Three, why exactly did the NNPC back down on their initial commitment of investing 20% on the Dangote Refinery shares?

“Is it truly true that they realigned their “investment portfolio, according to their strategic goals” or is it a grand plan that’s wrapped in a scam deal?” the report queried.

News

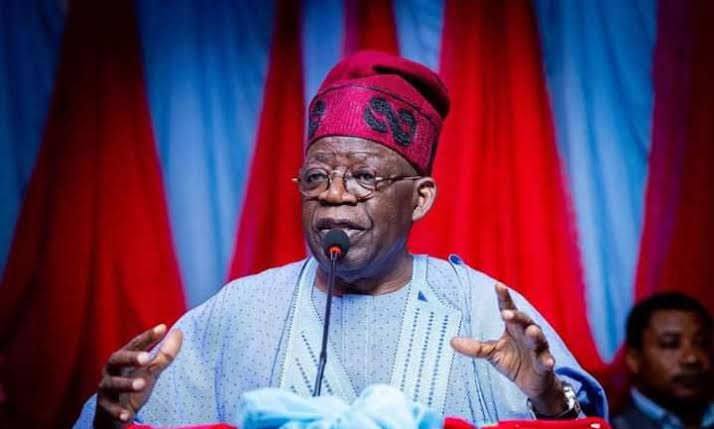

Just in: Tinubu exposes those behind deadly stampedes

President Bola Tinubu has accused organisers for the deadly stampedes that occurred during the distribution of relief materials in three states.

Recall in the past week, chaotic scenes in Ibadan, Anambra and Abuja led to the deaths of over 60 people, including children, as crowds scrambled for food items.

During a Presidential Media Chat on Monday, Tinubu described the events as a critical failure in planning and execution.

Condolences to those who lost a family member, but it is good to give. I have been giving out food stuff, commodities, etc. in Bourdillon.

“I am an organized person and that’s why I have been giving people food for the past 25 years and no incident has happened.

“Let this tragedy not affect us”, the Nigerian leader said.

The president also said he has no plans to reduce his cabinet or sack more ministers.

For the controversial tax reform bills, he said it has come to stay.

He also revealed he has no regrets removing fuel subsidy.

He declared utmost confidence in his security chiefs saying over the past decades, wanton killings has reduced drastically.

News

Tinubu To Hold Maiden Presidential Media Chat Tonight

President Bola Tinubu will hold first presidential chat since assuming office on Monday night.

Accoding to a statement released by presidential spokesperson, Bayo Onanuga, the chat will be broadcast at 9 p.m. on the stations of Nigerian Television Authority (NTA) and Federal Radio Corporation of Nigeria (FRCN).

All television and radio stations are requested to hook up to the broadcast.

“The first Presidential Media Chat with President Bola Ahmed Tinubu will be broadcast at 9 p.m. on Monday, December 23, on the Nigerian Television Authority and Federal Radio Corporation of Nigeria.

“All television and radio stations are requested to hook up to the broadcast,” the statement.

News

‘Putin waiting to meet me as soon as possible’ to end Ukraine war – Trump

The US President-elect took to the stage AmFest in Phoenix to talk about his contact with the Russian leader.

He told the crowd: “President Putin has said he want to meet with me as soon as possible.”

Trump went on to brand the war “horrible” and stated it needed to end. It is not known whether or not this meeting will take place in person. His comments at the event in the US come as Putin met with another world leader.

Putin held talks in the Kremlin today (December 22) with Slovakia’s prime minister, Robert Fico, in a rare visit to Moscow by an EU leader since Russia’s all-out invasion of Ukraine in February 2022.

Fico arrived in Russia on a “working visit” and met with Putin one-on-one. Kremlin spokesman Dmitry Peskov told Russia’s RIA agency that the talks would focus on “the international situation” and Russian natural gas deliveries.

Visits and phone calls from European leaders to Putin have been rare since Moscow sent troops into Ukraine, although Hungary’s PM Viktor Orban visited Russia in July. Orban’s visit drew condemnation from Kyiv and European leaders.Fico’s views on Russia’s war on Ukraine differ sharply from most other European leaders. The Slovakian PM returned to power last year after his leftist party Smer (Direction) won parliamentary elections on a pro-Russia and anti-American platform. Since then, he has ended his country’s military aid for Ukraine, hit out at EU sanctions on Russia, and vowed to block Ukraine from joining NATO.

-

News22 hours ago

News22 hours agoTinubu’s 50% transport reduction scheme may begin Tuesday

-

Economy23 hours ago

Economy23 hours agoPetrol to sell at N935 per litre from today-IPMAN

-

News17 hours ago

News17 hours agoBREAKING: FG declares Wednesday, Thursday public holidays for Christmas, New Year

-

News16 hours ago

News16 hours agoNigerian Man Who Rained Curses On President Tinubu Nabbed

-

Foreign23 hours ago

Foreign23 hours agoThere will be no same sex marriage again -Trump vows to end ‘transgender madness ‘

-

News22 hours ago

News22 hours agoNigerian Govt promises support for stampede victims’ families

-

Metro22 hours ago

Metro22 hours agoWife flees after setting Ogun cop ablaze during dispute

-

Metro23 hours ago

Metro23 hours agoWhy I Was Sentenced To Death – Osun ‘boy’ convicted of fowl theft