News

Emir Sanusi’s son weds partner in Abuja

It was case of different strokes for different folks as the son of the Emir of Kano, Muhammadu Sanusi II, Ashraf Adam, and his partner, Sultana Nazif, tied the nuptial knot in Abuja yesterday amid nationwide protest.

The ceremony took place at the national mosque in Abuja and was followed by a glamorous reception.

The groom later took to his Instagram page to share photos and videos from the event depicting his transition from babanriga and cap into a two-piece black and white suit.

The bride on her part spotted a heavily beaded white dress matched with a veil and lots of pearls.

The pre-wedding photos the couple released on their social media handles had attracted massive congratulatory messages from other users.

Sultana is the daughter of Suleiman Mohammed Nazif, a politician from Bauchi State.

Ashraf, on the other hand, is one of the sons of Muhammad Lamido Sanusi II, the recently restored Emir of kano who is also a former governor of the Central Bank of Nigeria (CBN) from 2009 to 2014 when he was suspended by ex-President Goodluck Jonathan in controversial circumstances.

He later became the Emir of Kano in 2020 but was deposed by Abdullahi Ganduje administration in the state for allegedly “disrespecting lawful instructions.”

He was, however, reinstated by Governor Abba Kabir Yusuf on May 23.

News

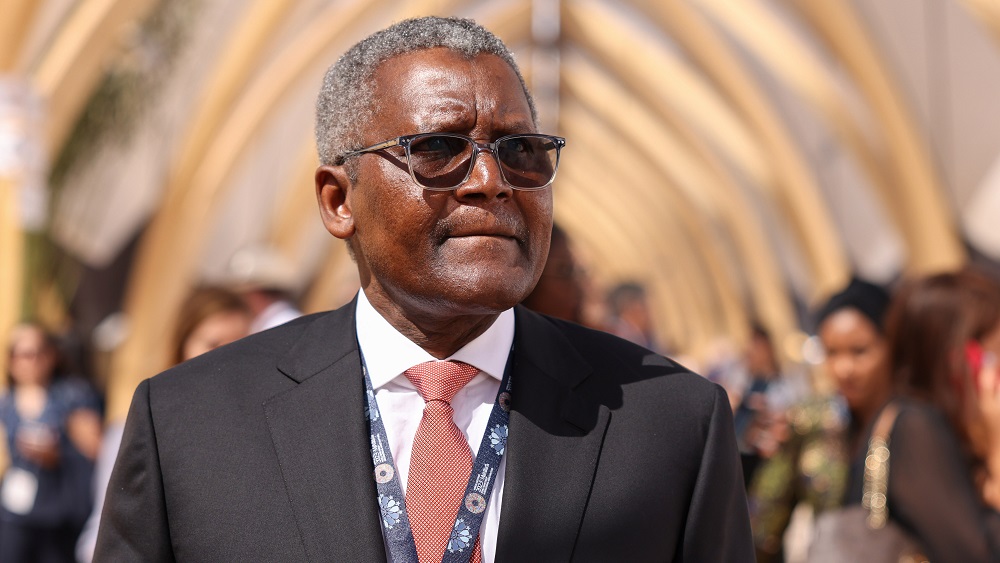

‘Cabals’ still fighting against our refinery — Dangote

The President of Dangote Group, Alhaji Aliko Dangote, says he is still fighting for the survival of his $20bn refinery, stressing that the fight is not yet finished.

Dangote expressed optimism that he would win the fight for the refinery, stating his determination to fight on.

According to Semafor, an international news medium, Africa’s richest man spoke at an investor forum in Lagos on Friday.

The report stated that Dangote pointed out that some individuals who “for a very, very long time” have “made a lot of money from” government-subsidised oil imports into Nigeria, were the ones trying to sabotage the 650,000 barrels per day oil refinery situated in Lekki, Lagos.

Dangote was quoted as saying that “those groups have funded resistance to the Bola Tinubu government’s removal of petrol subsidies and are opposed to the refinery operating easily in the country.”

However, Dangote was confident that the battle between him and the groups would be won, priding himself as a long-time fighter.

“We’re fighting, and the fight is not yet finished. But I have been fighting all my life, and I am ready and 100 per cent sure I will win at the end of the day,” he was quoted.

Dangote’s latest comments came as Nigeria plans to increase its capacity to stockpile petroleum products, to prepare against shocks to the global oil market following US President Donald Trump’s shake-up of international trade with the threat of tariffs.

Recall that Dangote has since last year raised the alarm that some mafias were sabotaging his refinery.

He specifically mentioned that some international oil companies were sabotaging his investment by denying the facility adequate crude supply despite the domestic crude supply obligation.

Dangote had alleged that the Nigerian Midstream and Downstream Petroleum Regulatory Authority was issuing licences to marketers to import substandard petroleum products into the country.

He vowed to push his $20bn refinery to full operational capacity despite what he said were challenges from oil importers seeking to undermine his venture to retain their dominance in the country’s energy sector.

At a point last year, Dangote said he regretted building the refinery, saying the mafias in the oil and gas sector were stronger than those of drugs.

However, he refused to give up on the project as the facility targets its full capacity soon.

The PUNCH recalls that the Dangote Group boss once accused some powerful individuals of frustrating his refinery.

“In a system where, for 35 years, people are used to counting good money, and all of a sudden, they see that the days of counting that money have come to an end, you don’t expect them to pray for you. Of course, you expect them to fight back.

“And I think that is the process that we’re now really going through. But the truth is that, yes, the country, the sub-region, and also the continent of sub-Saharan Africa, need this refinery. So, you expect them to fight through non-supply of crude, non-purchase of the product, but I think it’s all temporary. We’ll get there,” Dangote added.

He had recalled that he was once persuaded by a former Minister of Energy in Saudi Arabia, Khalid Al-Falih, to shelve the idea of building a refinery. However, he said he told the former minister that he did not need his advice.

In June 2024, the Vice President of Oil and Gas at Dangote Industries Limited, Devakumar Edwin, accused IOCs in Nigeria of plans to frustrate the survival of the new Dangote refinery.

Edwin said the IOCs were “deliberately and willfully frustrating” the refinery’s efforts to buy local crude by hiking the cost above the market price, thereby forcing the refinery to import crude from countries as far as the United States, with its attendant high costs.

Edwin also accused the NMDPRA of granting licences indiscriminately to marketers to import dirty refined products into the country.

“It appears that the objective of the IOCs is to ensure that Nigeria remains a country that exports crude oil and imports refined petroleum products. They (IOCs) are keen on exporting the raw materials to their home countries, creating employment and wealth for their countries, adding to their Gross Domestic Product, and dumping the expensive refined products into Nigeria – thus making us dependent on imported products,” Edwin had stated.

The refinery, which started petrol production last September, is seen as a way for Africa’s biggest crude oil producer to end its reliance on the costly importation of refined fuel.

It was reported that the refinery’s entry has helped push down the pump prices of refined products even as retailers count their losses.

With the naira-for-crude deal, the Dangote refinery promised to ensure enough fuel supply to Nigeria, Africa, and the world.

IPMAN supports Dangote

The Independent Petroleum Marketers Association of Nigeria said they are with Dangote as he pushes ahead to fight the cabal.

IPMAN Publicity Secretary, Chinedu Udadike, said Dangote had promised before that he would fight the so-called cabal for the good of the masses, stressing that the association is behind him.

He said the fight is just the usual competition in any business, especially when a product is doing better than others in the market.

“Well, this is business. Competition abounds. There is no businessman whom people will not fight if he is doing well, especially when it is only your goods that are being produced, and the others are not being patronised because of the price. So, it is evident that every businessman wants to survive. It’s not an issue. What we can do is encourage him.

“We independent marketers are happy with him for his price slashes, although sometimes it’s against our own business strategy and projections. But that is part of the business, it is profit and loss.

“You know the factor of demand and supply matter determines the market. So, if he’s talking about how people want to sabotage him, he has told us that he’s ready to fight the oil cabals, and he is in this business to ensure that Nigerians don’t suffer. So, we encourage him not to lose hope, and we independent marketers support him in all ramifications,” Ukadike said.

No need to fight, says PETROAN

The National President of the Petroleum Products Retail Outlet Owners Association of Nigeria, Billy Gillis-Harry, said there should be no form of discord in the downstream.

According to him, Dangote should be allowed to refine its products with the naira-for-crude deal while importers and other traders should be given a level playing field to operate.

Gillis-Harry noted that there should be facts to back up all claims, saying there will be competition in any business, pleading, however, that it should be healthy.

He appealed to the Federal Government to supply enough crude to Dangote and other refineries.

Asked whether he felt the temporary stoppage of the naira-for-crude deal by the Nigerian National Petroleum Company Limited could have prompted Dangote’s comment, he replied that there was a need to review the pilot phase of the deal, emphasising that PETROAN was always in support of the naira petrol sales deal, which he said would make petroleum products available for all Nigerians.

He stressed that other refineries are coming onstream and there will be more competitors in the market.

“I just want all players to do their business without any fight,” the PETROAN boss said.

The naira-for-crude deal ordered by President Bola Tinubu allowed the sale of crude in naira to the Dangote refinery, prompting a crash in fuel prices.

With the supply of crude in naira, the Dangote refinery continued to crash petrol prices across the country. From about N1,100 per litre, the company slashed the price of premium motor spirit to N860.

But importers of petroleum products lamented the repeated reduction of petrol prices by the refinery. Some of the importers lamented that they were compelled to sell below their costs, as consumers only buy from where the product is cheaper.

While Nigerians were rejoicing over the price slashes, fuel importers and retailers said they were counting losses.

Credit: PUNCH

News

Legislative crisis: Zamfara, Benue govs challenge NASS summons

Governors of Zamfara and Benue states, Dauda Lawal and Hyacinth Alia, respectively, have raised concerns over the legality of the invitation issued to them by the House of Representatives Committee on Public Petitions.

The governors, alongside their respective state houses of assembly, were summoned to appear before the committee over what the lawmakers described as alleged constitutional violations and governance breakdowns in both states.

The summons was contained in a statement issued by the Head of Media, House Committee on Public Petitions, Chooks Oko, on Friday.

The lawmakers, in a meeting scheduled for March 8, seek explanations from the governors and the houses on issues ranging from legislative suspensions to deteriorating security, and why the National Assembly should not take over the functions of the affected houses as permitted under Section 11(4) of the 1999 Constitution.

In Benue State, there was the controversial suspension of 13 members of the state assembly who were not loyal to the governor.

The lawmakers were suspended for kicking against the suspension of the state Chief Judge, Justice Maurice Ikpambese, by the governor.

In Zamfara, the situation is complicated by the emergence of a parallel assembly, with nine lawmakers claiming continued legitimacy despite being suspended.

These lawmakers, operating under a factional leadership, recently asked the governor to present the 2025 budget, as they insisted on performing their legislative duties.

Zamfara and Benue states have also been epicentres of persistent insecurity, with each state facing deeply-rooted security crises that have escalated in recent years.

Zamfara is battling unrelenting attacks by bandits operating across forests and rural communities, engaging in mass abductions, cattle rustling, and extortion.

Benue, often referred to as the “Food Basket of the Nation,” has been a hotspot for violent clashes between farming communities and armed herders with attendant killings.

Speaking on the invitation, a top government official in Benue State who preferred not to be named because he was not authorised to speak on the matter told The PUNCH that the government was already studying it and considering if the National Assembly had the constitutional right to invite a governor and members of the House of Assembly.

“This is a constitutional matter, and the government needs to find out if the National Assembly has oversight functions on the state government and its state assembly.

“I think the law will answer that, so the attorney general would soon respond to that,” the source told our correspondent on the phone.

Efforts to get the Attorney General and Commissioner for Justice and Public Orders, Fidelis Mnyimn, were not successful as calls made to his telephone were not responded to.

He also did not respond to text messages sent to his cellphone as of the time of filing this report.

When contacted, the Speaker of the House of Assembly, Hyacinth Dajoh, said he was yet to receive the formal invitation.

The speaker said, “It’s all a social media issue. I am yet to receive the invitation letter, maybe the letter may reach my office tomorrow (Monday), I cannot say.

“But as I am talking to you now, it’s a mere media issue and I cannot respond to it.”

The opposition Peoples Democratic Party in the state and the Austin Agada-led State Working Committee of the APC loyal to the Secretary to the Government of the Federation, welcomed the invitation.

Speaking in a separate telephone interview with our correspondent on Sunday, the state PDP Publicity Secretary, Tim Nyior, described the suspension of the 13 lawmakers as “legislative rascality.”

Nyior said the suspension had deprived nearly two million people in the state of their legitimate representation.

The Publicity Secretary of the Agada-led APC, Daniel Ihomun, said the suspension of the 13 lawmakers had driven the state gradually to anarchy.

“What is happening in the state is a rape of democracy. You cannot just sack 13 members of the state assembly because the affected members did the right thing in rejecting the recommendation for the sack of the state Chief Judge, Justice Maurice Ikpambese.

“What the House of Representatives has done is to stop anarchy in the state, because the state is already drifting into anarchy,” Ihomun said.

The governor’s APC faction, however, said the situation in the state did not warrant the National Assembly takeover.

The state Publicity Secretary of the caretaker committee, James Orgunga, said, “This is the issue of the law, and the law is very clear on this matter.

“It’s when the state assembly cannot carry out its function that the National Assembly takes over.

“In this situation, there is nothing to warrant that because the assembly is carrying out its function.”

The Senior Special Assistant to Governor Dauda Lawal on Media and Communications, Mustafa Kaura, said the National Assembly had no constitutional right to invite a serving governor to appear before it.

He said, “The National Assembly, whether Senate or the House of Representatives, cannot invite the governor on issues relating to his state.

“Only the state assembly has the power to invite a governor to appear before it.”

Kaura also wondered how the lawmakers who were currently on recess could hurriedly return to the National Assembly and invite the governor to appear before them.

“The honourable members are currently on recess, and I wonder if they have terminated their holidays and returned to Abuja just to see the two governors of Zamfara and Benue.

“Governor Lawal did not even receive the invitation letter and will not go to Abuja to waste his time,” he said.

Defending the Zamfara State governor, the state PDP spokesperson, Halliru Andi, said the House of Representatives may invite governors on national issues, but it was not compulsory/binding on the governors to accept the invitation.

Andi said the invitation seemed to be politically motivated rather than a legitimate constitutional step.

“The committee needs to be reminded that governors are accountable to their state legislatures and the electorates, not to the House of Representatives.

“We all know that all the blame directed at Governor Dauda Lawal on the issue of insecurity in the state was politically motivated and sponsored by members of the immediate-past administration,” he said.

Andi blamed the Federal Government and past governors for their inability to end banditry.

He asked, “How does one expect the PDP government in the state to end banditry within two years, something that APC governments at the state and federal levels couldn’t end in 12 years?”

The PDP spokesperson said the call for the declaration of a state of emergency in Zamfara over banditry was sponsored by the APC stakeholders to drag the state backwards.

“It is the responsibility of the Federal Government to provide security to the people of the country.

“As such, the lawmakers should blame nobody but Tinubu’s government for a security breach,” he said.

Countering his position, Zamfara APC spokesperson, Yusuf Idris, said the invitation extended to the Benue and Zamfara governors was the right move in the right direction.

He said, going by the security situation in Zamfara State, the Federal Government and other relevant stakeholders like the National Assembly have a duty to restore peace in the state.

“Going by the deteriorating nature of the security situation in Zamfara State, it is a welcome development for the members of the House of Representatives to invite the governor of Zamfara State and his counterpart in Benue State to find lasting solutions,” he said.

Idris also said the issue of parallel houses of assembly in the state was enough to invite the governor.

“Even the budget he is currently executing is illegal because it did not pass through the legislative process, as there were only 10 members present during the budget presentation,” he said.

Meanwhile, the nine-member parallel assembly members in Zamfara State have vowed to continue sitting, despite alleged intimidation and harassment by the government.

In a statement on Sunday, signed by the member representing Talata-Mafara South Constituency, Aliyu Kagara, on behalf of other members, the factional assembly said its members would continue to work in the spheres of their mandate as lawmakers in the state.

“We in the Zamfara State parallel House of Assembly under the eminent leadership of Hon Bashar Aliyu Gummi wish to categorically state and inform the good people of the state that we shall continue to work in the spheres of our mandate as lawmakers of our dear state and representatives of our respective constituents.

“No amount of intimidation from the state government, including the use of some so-called politically twisted courts or legal officers, can derail our focused leadership.

“We are aware of the malicious actions against us by the state government and have written petitions against the Dauda Lawal-led administration to security agencies, both at the state and national levels,” the statement read.

It added that members were aware of the alleged plan to attack them and their families by using political thugs.

“We are also aware and in possession of a recorded planned attack on us and our families by some thugs close to the governor and have alerted the security on these, in case anything happens to any of us (individually or collectively),” the statement added.

News

NELFUND under fire over loans to ex-students

Some graduates from public tertiary institutions have raised concerns over the delayed disbursement of student loans, revealing that funds were sent to their schools months after they had already graduated.

They also continue to receive N20,000 monthly upkeep stipends despite no longer being students.

In separate interviews with The PUNCH, the affected individuals explained that while they had applied for the Nigeria Education Loan Fund before graduating, disbursements were delayed, forcing them to seek alternative means to pay their fees.

To their surprise, the loans were eventually paid to their institutions long after they had settled the fees themselves and left school.

The student loan scheme has recently come under scrutiny after the National Orientation Agency alleged that some institutions were profiting illegally by making fraudulent deductions from the loans disbursed.

In addition, the Independent Corrupt Practices and Other Related Offences Commission has launched a comprehensive investigation into alleged irregularities in the loan process.

According to preliminary findings by the ICPC, while NELFUND released N100bn loan, only N28.8bn actually got to applicants—leaving a staggering N71.2bn unaccounted for.

The development has drawn the ire of the National Association of Nigerian Students, which has vowed to protest what it described as a major discrepancy in the handling of the loan funds.

The NOA also alleged that certain institutions, in collusion with some banks, deliberately delayed payments to qualified students in order to exploit the situation financially.

This followed media reports that some institutions made unauthorised deductions ranging from N3,500 to N30,000 from tuition fees paid through the loan scheme.

In a statement issued last Thursday, ICPC spokesperson, Demola Bakare, confirmed that the commission’s Special Task Force had commenced investigations immediately upon receiving the allegations.

One graduate, speaking to The PUNCH, said, “I registered for NELFUND when I desperately needed funds to pay my second-semester final year fees. But the approval didn’t come in time, so I sourced the money myself and paid the school. I eventually graduated, only to later discover via my student portal that NELFUND had paid my fees in full.”

“I contacted them and was told to request a refund from the school. But how do I request a refund for a fee I’ve already paid and when I’m no longer a student? I also keep receiving upkeep money despite informing them I’ve graduated. When repayment begins, I’ll return the upkeep funds. But I will not repay the institutional fee—they paid it after I had already graduated and settled my dues.”

Another graduate from the University of Benin said, “I applied for the loan in my final days as a 400-level student. I waited for months but had to pay the fees myself before my final exams. Last month, I suddenly got a N20,000 upkeep payment and discovered my loan had just been approved—months after graduation. NELFUND is handling this poorly. Why are you disbursing loans to graduates? This shows serious inefficiency in the system.”

A parent, Mr. Ibrahim, also expressed concern, saying his son, who graduated two months ago, continues to receive upkeep payments.

“He was shocked when he got the alert. We don’t know how to stop it. We need help,” he said.

Meanwhile, the Academic Staff Union of Universities says it is closely monitoring the developments and awaiting the outcome of the investigation.

ASUU’s National President, Prof. Emmanuel Osodeke, said, “We are awaiting the result of the investigation, and we hope all those involved will be brought to book.”

Efforts to reach the Director of Corporate Communications at NELFUND, Oseyemi Oluwatuyi, were unsuccessful as he did not respond to inquiries as of the time this report was filed.

-

News23 hours ago

News23 hours agoFive Asian countries Nigerians can visit without a visa

-

Entertainment23 hours ago

Entertainment23 hours agoOld Prophecy Of Pastor About VeryDarkman Goes Viral After His Arrest

-

News23 hours ago

News23 hours agoInsecurity! Bandits abduct 25 female wedding guests

-

News23 hours ago

News23 hours agoTompolo Launches Door-to-Door Campaign for Tinubu’s 2027 Re-Election!

-

News23 hours ago

News23 hours agoEzekwesili slams political establishment over harassment allegation, defends Natasha

-

News10 hours ago

News10 hours agoFormer Plateau deputy governor is dead

-

News17 hours ago

News17 hours agoINTERPOL uncovers 150 stolen vehicles from Canada in Nigeria, Gambia, other W.A. countries

-

News23 hours ago

News23 hours agoKyari breaks silence: “I’m not in EFCC custody, I served God, country, not corruption”