Economy

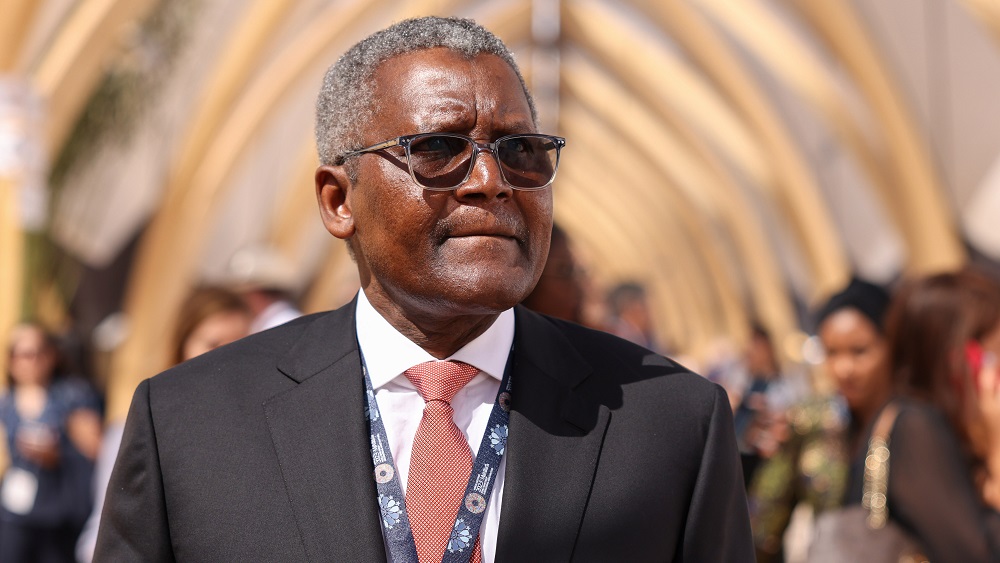

Enforce the PIA act on crude supply, Dangote urges NUPRC

Management of Dangote Petroleum Refinery has urged the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) to enforce the domestic crude supply obligation as specified in the Petroleum Industry Act (PIA), insisting that refineries in Nigeria should be allowed to buy crude directly from the companies that produce it in Nigeria rather than from international middlemen, as enshrined in the PIA act.

Spokesman of Dangote Group, Anthony Chiejina, said: “We are in receipt of NUPRC’s statement that they have facilitated the allocation of 29 million barrels of crude oil to the Dangote Petroleum Refinery and Petrochemicals, we would like to thank them for this allocation but at the same time we wish to let them know that we are yet to receive these cargoes.

“Aside from the term supply we bilaterally negotiated with NNPCL, so far NUPRC has only facilitated the purchase of one crude cargo from a domestic producer. The rest of the cargoes we have processed were purchased from international traders.”

“All we are asking for, is for refineries in Nigeria to buy crude directly from the companies that produce it in Nigeria rather than from international middlemen. This is specified in the PIA.

Unfortunately, the NUPRC has effectively admitted in their statement, that they will be unable to enforce the domestic crude supply obligation as specified in the PIA citing “sanctity of contracts” as an excuse.”

It would be recalled that Dangote Petroleum Refinery management had insisted that it was not yet getting enough crude required for the effective optimization of its refinery from the Nigerian National Petroleum Corporation Limited (NNPCL).

The refinery management, in a release signed by Chiejina, said, “We therefore still insist that we are unable to secure our full crude requirement from domestic production and urge the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), to fully enforce the domestic crude supply obligation as mandated by the PIA.”

Chiejina clarified that his company had never accused NNPC of not supplying “…us with crude. Our concern has always been NUPRC’s reluctance to enforce the domestic crude supply obligation and ensure that we receive our full crude requirement from NNPC and the IOCs.”

He added, “For September, our requirement is 15 cargoes, of which NNPC allocated six. Despite appealing to NUPRC, we’ve been unable to secure the remaining cargoes. When we approached IOCs producing in Nigeria, they redirected us to their international trading arms or responded that their cargoes were committed.

“Consequently, we often purchase the same Nigerian crude from international traders at an additional $3-$4 premium per barrel which translates to $3-$4 million per cargo”

Economy

75.5% of rural Nigerians now live below poverty line — World Bank

The World Bank has disclosed that a staggering 75.5 per cent of rural Nigerians are now living below the poverty line, reflecting deepening hardship in the country’s hinterlands.

This was revealed in the Bank’s April 2025 Poverty and Equity Brief for Nigeria, which paints a grim picture of worsening economic hardship, widening inequality, and persistent underdevelopment across much of the nation.

While poverty is widespread among urban populations, the report emphasised that the situation is significantly worse in rural areas, where economic stagnation, high inflation, and insecurity have exacerbated living conditions.

“Based on the most recent official household survey data from Nigeria’s National Bureau of Statistics, 30.9 per cent of Nigerians lived below the international extreme poverty line of $2.15 per person per day in 2018/19 before the COVID-19 pandemic,” the report stated.

The report also highlighted Nigeria’s enduring regional disparities. “Nigeria remains spatially unequal. The poverty rate in northern geopolitical zones was 46.5 per cent in 2018/19, compared with 13.5 per cent for southern ones. Inequality measured by the Gini index was estimated at 35.1 in 2018/19.

“Nigeria’s Prosperity Gap — the average factor by which individuals’ incomes must be multiplied to attain a prosperity standard of $25 per day for all — is estimated at 10.2, higher than most peers.”

Despite successive policy interventions, these figures underscore a persistent economic divide across the country.

The report’s demographic analysis found that children aged 0 to 14 years had a poverty rate of 72.5 per cent, reflecting the scale of deprivation among the youngest segment of the population.

Gender disparities were also observed, with 63.9 per cent of females and 63.1 per cent of males classified as poor under the $3.65 per day lower-middle-income threshold.

Education emerged as a significant determinant of poverty, with Nigerians lacking formal education experiencing a poverty rate of 79.5 per cent. This contrasts with 61.9 per cent for those with primary education and 50.0 per cent for secondary school graduates. Only 25.4 per cent of those with tertiary education were considered poor.

The report also drew attention to multidimensional poverty indicators, which further reflect widespread deprivation.

According to the World Bank, about 30.9 per cent of Nigerians live on less than $2.15 daily, 32.6 per cent lack access to limited-standard drinking water, 45.1 per cent do not have limited-standard sanitation, and 39.4 per cent have no electricity.

Education access remains a challenge, with 17.6 per cent of adults yet to complete primary education, and 9.0 per cent of households reporting at least one school-aged child not enrolled in school.

The report noted that even before the COVID-19 pandemic, efforts to reduce extreme poverty had largely stalled.

“Before COVID-19, extreme poverty reduction had almost stagnated, dropping by only half a percentage point annually since 2010. Living standards of the urban poor are hardly improving, and jobs that would allow households to escape poverty are lacking,” the report read.

Although the World Bank acknowledged recent economic reforms aimed at stabilising Nigeria’s macroeconomic outlook, it warned that persistently high inflation continues to undermine household purchasing power, particularly in urban areas where incomes have not kept pace with rising costs.

In light of the worsening situation, the Bank called for urgent policy action to shield vulnerable groups from inflationary shocks and to drive job creation through more productive economic activities.

Economy

Naira Records Marginal Decline Against Dollar at Official Market

The Nigerian naira experienced a mild drop in value on Friday, closing at ₦1,602.18 per dollar in the official foreign exchange market, based on figures released by the Central Bank of Nigeria (CBN).

This marks a decrease of ₦5.49 from the rate of ₦1,596.69 recorded on April 30, the last trading day before the May 1 Workers’ Day holiday—indicating a depreciation of approximately 0.34%.

Earlier in the week, from Monday to Wednesday, the naira remained relatively stable, exchanging at ₦1,599.95, ₦1,599.71, and ₦1,596.69 respectively.

Although the local currency showed some consistency mid-week, it wrapped up the week with a loss, following a sligh dip of 0.02% at the beginning of the week

Economy

Black Market Dollar hits N1,610 Amid Economic quagmire

What is the Dollar to Naira Exchange Rate in the Black Market (Also Known as the Parallel Market or Aboki FX)?

Below is the black market exchange rate for the U.S. dollar to the Nigerian naira as of Thursday, May 1, 2025. These are the typical rates at which you can exchange dollars for naira:

Dollar to Naira Black Market Exchange Rate (May 1, 2025):

At the Lagos Parallel Market, also referred to as the black market, Bureau De Change (BDC) operators are buying dollars at ₦1,602 and selling at ₦1,610, according to market sources.

Please note: The Central Bank of Nigeria (CBN) does not recognize or endorse transactions conducted on the parallel market. The CBN advises individuals and businesses seeking foreign exchange to use official banking channels.

-

News21 hours ago

News21 hours agoWhy ‘VeryDarkMan was arrested – EFCC

-

Education24 hours ago

Education24 hours agoOver 1.5m candidates score less than 200 in 2025 – UTME

-

Entertainment21 hours ago

Entertainment21 hours agoHow I narrowly escaped death in U.S hotel room – Seun Kuti

-

News23 hours ago

News23 hours ago‘S3x is good, I enjoy it,’ Bishop Adejumo tells wives

-

News18 hours ago

News18 hours agoReps Minority Caucus condemns unlawful detention of VDM, demands his immediate release

-

News8 hours ago

News8 hours agoMinistry denies awarding N13bn contracts without due process

-

News20 hours ago

News20 hours agoWATCH Your family Lawyer’s last episode on how to end marriage

-

News8 hours ago

News8 hours agoFULL STEPS: How to check 2025 JAMB results