News

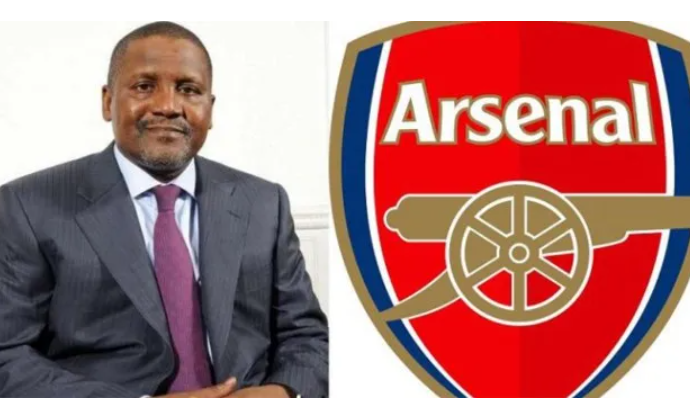

Aliko Dangote regrets not buying his favourite club, Arsenal

By Kayode Sanni-Arewa

The President and Chief Executive of Dangote Group, Alhaji Aliko Dangote, has expressed his regrets for not buying Arsenal when his interest lies with owning a football club.

He said he wished he had bought the English side club when the team was valued at around $2 billion.

Speaking in an interview with Bloomberg’s Francine Lacqua in New York, the billionaire business mogul explained that he missed out on buying Arsenal by committing his resources to the refinery project.

He said, “I think that time has passed. The last time when we had this interview, I told you as soon as I finished with the refinery, I was going to try and buy Arsenal.

“But you know everything has gone up, and the club too is doing very well, Arsenal is doing extremely well right now. That time, Arsenal wasn’t doing well.

“I think I don’t have that kind of excess liquidity to go and buy a club for $4 billion, so to speak and use it as a promotional something.

“But what I will do is to continually be the biggest fan of Arsenal. I watch their games anytime they are playing. So, I will remain a major supporter of Arsenal, but I don’t think it makes sense today to buy Arsenal.’

When asked if he regretted not buying when Arsenal’s value was lower, he said, “Actually, I regret not buying it before but you know my money was more needed in completing my project (Dangote refinery) than buying Arsenal. I would have bought the club for $2 billion, but you know I wouldn’t have been able to finish my project. So, It was either I finish my project or go and buy Arsenal.”

Dangote had, in 2020, made known his intention to go for the North London club after his refinery project.

The richest man in Africa, who has now rested his ambition to take over at Emirates Stadium, founded the Dangote Group — the largest conglomerate in West Africa — in 1981

[With report by The Punch]

News

SAD! Army Captain, Soldier Killed In Recent Borno Attack

An army Captain and a soldier have been killed by Boko Haram terrorists in a midnight attack on Izge community in Gwoza Local Government Area of Borno State

According to the Emir of Gwoza, Mohammed Shehu Timta, the attack happened around 1 am on Wednesday when the terrorists infiltrated the farming community, shooting sporadically before the personnel of the Nigerian Armed Forces with the assistance of local hunters, vigilantes and members of the civilian Joint Task Force repelled the terrorists, killing three of them while recovering items from the fleeing terrorists

Several motorcycles, bicycles, an operational vehicle and a sophisticated rifle, all belonging to the terrorists were recovered.

Speaking to Channels Television Wednesday morning, the traditional ruler commended the military, men of the Civilian Joint Task Force, Local hunters, vigilantes and the resilient community of Izge for their collaborative efforts in repelling the attack while praying for the repose of the souls of the departed military personnel and their family during this irreparable loss.

He also called on urgent step by the Federal Government to address the renewed attacks, as people prepare for this year’s farming season.

“My people in Izge community came under Boko Haram invasion today at about 1am. Unfortunately, a Captain and a Soldier paid the supreme price. But in a brave and swift reaction from the military, men of the Civilian Joint Task Force, Local hunters, vigilantes and the resilient community the attack was repelled with killing of three terrorists.

“As the community is still trailing the terrorists, over 10 bicycles, motorcycles, one sized military vehicle and one sophisticated rifle with ammunition were recovered from the terrorists.

“Let me commend our military forces, other security agencies, men of CJTF, local hunters and vigilantes and our resilient people for their bravery, because as I speak, many people are still in the bush combing the whereabouts of the fleeing terrorists.

“Let me equally commend our passionate governor, Professor Babagana Zulum for his relentless efforts in providing enabling resources to the security agencies and our CJTF members in the fight against Boko Haram/ISWAP terrorists which has brought about relative peace and resettlement of many displaced people back to their ancestral homes.

“I want to equally call on the federal government to equip our security forces with technological warfare/weapons to defeat the remnants of Boko Haram members terrorising our communities almost on daily basis”.

News

Gov Zulum accuses security personnel of promoting criminality, bans dale of alcohol

Borno State Governor, Professor Babagana Zulum, has banned the sale of alcoholic beverages while accusing military and other security personnel of promoting criminality and antisocial vices in Maiduguri and its environs.

The Governor said that ex and current serving personnel of the Nigerian security forces have played a significant role in influencing the civilian populace into criminality, radicalism, prostitution and other vices, heightening terrorism threats in the state.

The governor said this on Tuesday at the inauguration of a reconstituted committee on “revocation of illegal hotels, brothels, shanties, and criminal hideouts and curbing the menace of antisocial vices” at the council chambers of the government house in Maiduguri.

“I am happy to know that army officers are here, especially the military, police, and others are here because most of these activities were committed by whom? Some of them are dismissed army officers, dismissed security officers, current army officers, men and officers, including civilians.

“So, there should be no sacred cow in this matter if we want the Maiduguri metropolis and indeed the state to get rid of insurgency, terrorism and other sorts of criminalities,” Zulum said.

In the brief event, the Zulum reconstituted and re-empowered the committee to purge the state of all forms of criminality and antisocial vices in the Maiduguri metropolis and surrounding environments.

The ban on sales and consumption of liquor and alcoholic contents, according to the governor, stems from the rising cases of clashes among rival groups, cultism, prostitution, drug abuse, thuggery and theft, which have led to loss of lives and valuables.

The governor co-opted the military, police, civil defence, and several other security agencies, including the civilian JTF, to join the committee for a holistic approach.

Acknowledging the task before the reconstituted committee, the co-chair decried the deteriorating internal security in Maiduguri and outlined the committee’s immediate line of action.

With the liquor embargo and the demolition of hotels and infrastructures identified as harbouring criminal activities, it is yet to be seen if this decision will affect internal revenue in the state amidst the controversies surrounding the tax reform bill before the national assembly, which the Borno State Governor and notable leaders from the state have championed.

News

FG starts massive overhaul of NYSC scheme, plans teachers’, medical corps

The Federal Government has set up a committee to carry out major changes to the National Youth Service Corps.

This decision followed rising concerns about the safety of corps members, poor facilities, and whether the NYSC still fits into today’s social and economic realities.

The inauguration of the committee happened in Abuja on Tuesday, with key people from government, civil society, and private businesses in attendance.

Speaking at the event, the Minister of Youth Development, Ayodele Olawande, said the NYSC has played an important role in building national unity and helping young people since 1973.

He said, “The issues of corps members’ safety, infrastructural challenges, and the broader question of the scheme’s relevance in an increasingly dynamic socio-economic environment are among the key concerns. However, these challenges also present opportunities that require urgent, visionary, and determined action.”

Olawande said the committee will look into how NYSC works and suggest ways to make it safer, more creative, and more impactful.

“The outcome of this review must align with broader national development objectives, positioning the NYSC as a strategic tool for youth empowerment and nation-building,” he added.

The committee will review current NYSC policies, talk to people across the country and suggest changes to laws, policies, and how the scheme is run.

It will also come up with better ways to fund, track and improve the NYSC.

The final report will be submitted to the minister within a set time.

Also at the event, the Minister of Education, Maruf Tunji Alausa, said the government planned to start a Teachers’ Corps and a Medical Corps.

These will be for NCE graduates and healthcare workers ready to serve in rural areas.

Alausa explained, “The Teachers’ Corps would help bridge educational gaps and create a pathway to government employment, while the Medical Corps would strengthen healthcare delivery in underserved areas, addressing critical issues such as maternal and child health.”

The Special Adviser to the President on Policy and Coordination, Hadiza Usman, stressed the need to improve technical and vocational skills training.

“Such alignment would empower young people to make meaningful, long-term contributions to their communities and to the nation as a whole,” Usman said.

-

Opinion23 hours ago

Opinion23 hours agoRIVERS, WIKE, FUBARA, AND THE WAY FORWARD

-

Politics21 hours ago

Politics21 hours agoJust in: Delta PDP Reps members defect to APC

-

News20 hours ago

News20 hours agoTension As Lawmakers Warns of Public Revolt Over Insecurity

-

News24 hours ago

News24 hours agoCourt bans Nnamdi Kanu’s in-law from 3 proceedings over live streaming

-

News2 hours ago

News2 hours agoReal cause of Herbert Wigwe’s helicopter crash revealed

-

News19 hours ago

News19 hours agoEdo Speaker, Two Other Lawmakers, Formally Join APC

-

News20 hours ago

News20 hours agoRep Raises Alarm After Deadly Attacks In Borno, Says Boko Haram Is Returning Stronger

-

News8 hours ago

News8 hours agoTinubu presents N1.78 trillion FCT budget to NASS