News

Nigeria Struggles With 6% Tax GDP Ratio – Speaker Abbas

News

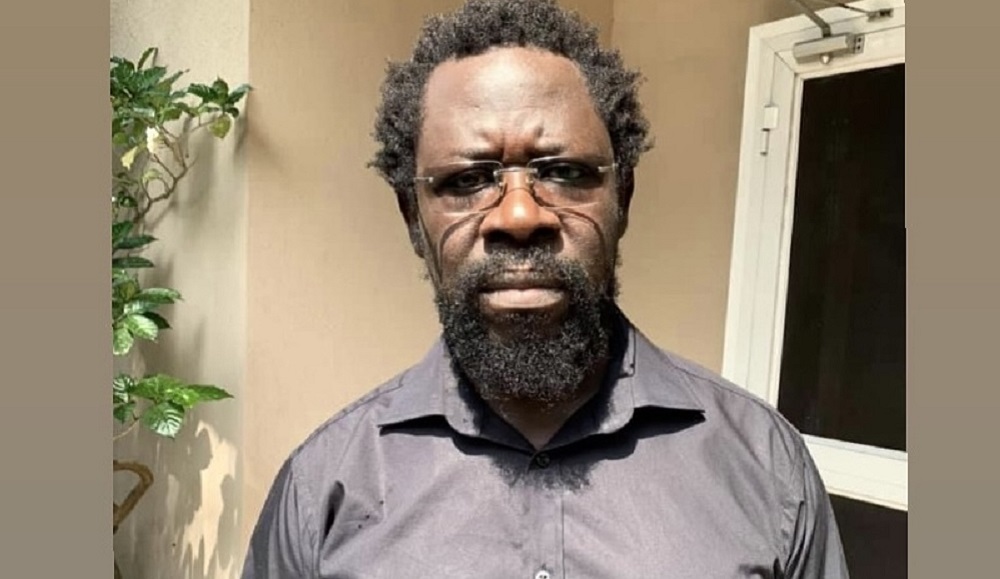

Rashford leaving Man United could bring him to form-Keane

Roy Keane believes leaving Manchester United could do Marcus Rashford the “world of good” as he fears the forward will never regain his hunger at Old Trafford.

Rashford’s future appears to be in the balance after the 27-year-old, a product of United’s youth system, was left out of the Manchester derby.

United won 2-1 at Manchester City on Sunday, with Rashford telling journalist Henry Winter on Tuesday that he was “ready for a new challenge and the next steps”.

“I don’t mind what he said. I think it’s spot on,” former United captain Keane told the Stick to Football podcast.

“Sometimes a deal just works for everybody. It’s been going on for a year or two now, there’s obviously a bit of talent in there, he’s been at the club since he was a kid.

A change would probably do him the world of good, for him and his team and his family. Just go and play, maybe go abroad or whatever it might be.”

Rashford’s current contract at Old Trafford runs until 2028 and although he has been linked to several other clubs, United manager Ruben Amorim is keen for the England forward to stay.

But Keane said: “I always think if you lose that hunger, it is hard to get it back.

“Forget about the few bob (pounds) he’s earned over the years — and listen, good for him — but we know, the great players, it’s nothing to do with that.”

Keane added that leaving United could revive Rashford’s “real hunger” for on-field success.

“I think there’s a good chance he might get it back with a change of a club and scenery, a new country, a new league, whatever, but I don’t think he’ll get it back at United.”

Amorim, talking to reporters ahead of Thursday’s League Cup quarter-final at Tottenham, urged Rashford to “speak with the manager” rather than air his grievances publicly.

Rashford has scored 138 goals in 426 appearances for the club since making his senior debut in 2016.

However, he has lost form over the last 18 months with United and was also axed from England’s Euro 2024 squad.

Rashford has scored just 15 goals in 67 appearances since signing a lucrative new contract 18 months ago, with speculation over his future increasing in recent days.

The forward, who was absent from training on Monday through illness, is set to miss the League Cup quarter-final at Spurs.

Amorim is keen to keep Rashford but he admitted he would have handled the situation differently when he was a player.

“If this was me, probably I will speak with the manager,” he told reporters on Wednesday. “But, guys, let’s focus on Tottenham. Tottenham is the most important thing.”

News

Wike revokes Abuja lands of Buhari, Akume, Abbas, others

The Minister of the Federal Capital Territory (FCT) has revoked lands belonging to former President Muhammed Buhari, the Speaker of the House of Representatives, Tajudeen Abbas; and the Secretary to the Government of the Federation, George Akume.

Also, 759 other prominent figures and organisations in Maitama II, Abuja. were also affected by the revocation which was for non-payment of Certificate of Occupancy.

This was contained in a publication by the FCT Administration and made available to Channels Television by the Special Adviser to the FCT Minister, Lere Olayinka.

In a separate publication, the minister also threatened to revoke lands belonging to the Minority Leader of the House of Representatives, Kingsley Chinda; former presidents of the Senate, Iyorchia Ayu and Ameh Ebute; the Chief Whip of the Senate, Tahir Monguno; and 610 others for outstanding fees owed to the FCTA for certificate of occupancy not paid within two weeks.

This revocation by the minister comes months after he made several pleas to residents of the FCT, particularly those residing in hybrid areas of the nation’s capital, to pay outstanding fees owed to the FCTA or risk revocation of their lands.

News

Afenifere demands for unconditional release of Farotimi

The pan-Yoruba socio-political organisation, Afenifere, has intervened in the ongoing face-off between legal luminary, Chief Afe Babalola and activist, Dele Farotimi, calling for unconditional release of the activist.

The organisation at a World Press Conference held at the residence of its leader, Chief Ayo Adebanjo in Lagos said while it was not talking about the merit or demerit of the case, the procedure and manner of arrest of the activist was condemnable.

Deputy Leader of the Group, Oba Oladipo Olaitan who addressed the press conference expressed concern over the continued incarceration of Farotimi over a bailable offence.

Farotimi, a member of the National Caucus of Afenifere, was arrested on Tuesday December 3, 2024 in his office in Lekki Lagos by plain-clothed police officers from Ekiti State Police Command over a petition by Babalola.

Babalola had claimed he was defamed in the book written by Farotimi titled, “Nigeria and its Criminal Justice System.”

The Chief Magistrate Court in Ekiti has reserved a ruling on his bail application until December 20.

But Afenifere Deputy Leader criticised the chief magistrate, Abayomi Adeosun, for denying bail, describing the charges as bailable.

He stated that what is happening to Farotimi represented a script playing out as the charges are bailable and should have been granted bail on self-recognisance.

“It is Dele Farotimi today, it could be you tomorrow,” the Deputy Leader added.

“Afenifere believes that Chief Afe Babalola, like every citizen, has a right to defend his reputation if injured to the full extent of the law but not outside the strictures of the law. Therefore, Dele Farotimi must have his day in court. He cannot be unjustly incarcerated. His rights must be similarly protected,” he said.

The group called for an end to using the police from other states to arrest citizens, saying, “The increasing practice of arresting people in a state and transporting (rendering) them out of state often without the knowledge of the relatives of those arrested and also charged in a state other than the state of normal residence of the suspect need to be stopped.

“The practice exerts undue mental agony and expense on the accused person and their families who are often left wondering for hours or days about the safety and whereabouts of their loved ones. The Police must stop this practice.

“It is a loophole that can be exploited by criminals who may be tempted to disguise their crimes by acting out their nefarious activities by imitating the rogue police operations.”

Oba Olaitan added that the delay in granting bail to Mr. Farotimi “has confirmed the fears of well-meaning people all over the world that these processes are driven by extraneous considerations outside the facts and laws in respect of the petition on which the Police and the Chief Magistrate in Ekiti are hinging their actions.”

-

News20 hours ago

News20 hours agoReps Call for Revival of NAPAC to Boost Transparency, Accountability

-

News24 hours ago

News24 hours agoFinally, PDP Flushes Out Suspended National Vice Chairman, Ali Odefa

-

News20 hours ago

News20 hours agoReps Recommends Delisting NECO, UI, Labour Ministry, 21 Others From 2025 Budget

-

News14 hours ago

News14 hours agoLawmaker laments over 2023, 2024, 2025 budget running in one circle

-

News13 hours ago

News13 hours agoVideo: Tinubu Arrives Lagos, Meets Old ‘Friend’ Papa Ajasco

-

News21 hours ago

News21 hours agoNigeria Needs Comprehensive Reforms To Expand Its Tax Base – Speaker Abbas

-

Sports13 hours ago

Sports13 hours agoI Failed In Front of the World Four Years Ago — Lookman’s Touching Speech After Winning CAF Award

-

Economy13 hours ago

Economy13 hours agoUK inflation rises further ahead of Bank of England rates decision