Economy

CBN threatens sanction over cash scarcity at ATMs

The Central Bank of Nigeria has threatened to impose fines on erring players in the financial sector over cash scarcity at Automated Teller Machines.

This announcement was made by the CBN Governor, Olayemi Cardoso, on Friday at the annual Bankers’ Dinner organised by the Chartered Institute of Bankers of Nigeria in Lagos.

There have been reports of cash scarcity at banks in recent times both at ATMs and over the counter in banks.

Cardoso stated, “We also recognise the ongoing challenges with cash availability at ATMs, which disproportionately affect ordinary Nigerians.

“To address this, we are conducting spot checks across the Deposit Money banks, and we impose penalties on the underperforming institutions. Effective December 1. 2024, customers are encouraged to report any difficulties with joint cash from bank branches or ATMs directly to the CBN through designated phone numbers and email addresses for their respective states.

“Guidelines will be distributed widely to raise public awareness. We will also urge full regulative compliance by all stakeholders, including mobile money operators and POS agents, to promote digital transaction channels and improve service delivery. I repeat, financial institutions found engaging in malpractices or sabotage will face changing penalties.

“The CBN will continue to maintain a robust cash offering to meet the country’s needs, particularly during high demand periods such as the festive season and year-end.”

The CBN governor also stated that so far, nearly N1tn has been recovered from development programmes.

Cardoso had announced the discontinuation of intervention programs at the 2023 Bankers Dinner and revealed that CBN pumped over N10tn into the economy through different initiatives in sectors ranging from agriculture, aviation, power, youth and many others.

He said, “As previously noted, the Central Bank’s return to orthodox monetary policy means that we will refrain from direct intervention in developmental initiatives. That said, I am pleased to report that as of October 2024, nearly N1tn has been recovered or repaid under previous development finance programs, thanks to the enhanced monitoring and enforcement of the guideline.

“Our focus remains on ensuring the effective utilization and recovery of outstanding loans within the framework of established guidelines. While development finance has a role in the economy of Nigerians, it must be approached with proper governance to achieve meaningful impacts.”

“On the outlook, Cardoso projected that with the improved framework for deploying products targeting the Nigerian diaspora and efforts to establish a well-founded FX market, “We anticipate increased diaspora and foreign investment over the next 12 months building on more resilient and liquid FX markets.”

He added that the apex bank has in its sight a monthly inflow of $1m in diaspora remittance.

“I recall when we took the view that it was important to focus on the diaspora remittances, and at that time, we said double. People thought it was an impossible thing to do, and it happened. As a result of that, we are even more happy to look at a target of $1m per month in the not-too-distant future,” he added.

Meanwhile, the CIBN conferred fellowship of the institute on the CBN governor and the governor of Lagos State, Babajide Sanwo-Olu.

Some dignitaries at the event include the Minister of Budget and Economic Planning of Nigeria, Atiku Bagudu, Chairman, the Senate Committee On Banking, Insurance and Other Financial Institutions, Senator Tokunbo Abiru, among others.

Economy

SEE Black Market Dollar To Naira Exchange Rate Today 3rd April 2025

NOTE: The exchange rate changes hourly. It depends on the volume of dollars available and the Demand. This means that…you can buy or sell 1 dollar at a certain rate and the price can change (high or low) within hours.

The official naira black market exchange rate in Nigeria today including the Black Market rates, Bureau De Change (BDC), and CBN rates.

Please note that the exchange rate is subject to hourly fluctuations influenced by the supply and demand of dollars in the market.

As of now, you can purchase 1 dollar at a certain rate now, however, it’s important to remember that the rate can shift (either upwards or downwards) within hours.

What’s the dollar to naira black market today 3rd April 2025?

The local currency (abokiFx) opened at ₦1,560.00 per $1 at the parallel market, otherwise known as the black market, today, Thursday, 3 April 2025, in Lagos, Nigeria, after it closed at ₦1,550.00 per $1 on Wednesday, 2 April 2025.

Dollar to Naira (USD to NGN) Black Market Exchange Rate Today

Buying Rate of $1 ₦1,545

Selling Rate of $1 ₦1,555

Please note that Nigeria’s black market dollar-to-naira exchange rate is typically higher than the official exchange rate because the Federal Government does not regulate it. The rates you buy or sell forex may differ from what is captured in this article because prices vary.

What is the official exchange rate for dollar to naira today? Here is the dollar to naira CBN rate today

Dollar to Naira (USD to NGN) CBN Rate Today

Buying Rate of $1 ₦1,530

Selling Rate of $1 ₦1,531

Please note that the Central Bank of Nigeria (CBN) does not recognize the parallel market (black market), as it has directed individuals who want to engage in Forex to approach their respective banks.

Economy

Naira rebounces against the dollar in parallel market

Naira appreciated against the dollar on Wednesday at the official foreign exchange market after the Eid-el-Fitr holidays.

The Central Bank of Nigeria’s data showed that the naira strengthened to N1,531.25 per dollar on Wednesday from N1,536.82 recorded last Friday.

This means that the naira gained N5.57 per dollar on a day-to-day basis.

Meanwhile, on the black market, the naira depreciated to N1,555 per dollar on Wednesday from N1,550 traded on Friday before the Eid-el-Fitr holidays.

Meanwhile, recall that over the weekend, the Central Bank of Nigeria announced that the Net Foreign Exchange Reserve, NFER, stood at $23.11 billion, the highest level in over three years.

Economy

CBN denies N5,000, N10,000 banknote rumour

The Central Bank of Nigeria (CBN) has dismissed claims that it has introduced new N5,000 and N10,000 notes, labeling the reports as false.

In a statement posted on X on Wednesday, the apex bank debunked the rumors, stating: “This content is NOT from the Central Bank of Nigeria. Kindly note that the official website of the CBN is cbn.gov.ng.”

The clarification comes amid widespread misinformation suggesting that the CBN planned to roll out high-denomination banknotes to reduce cash-handling costs and improve liquidity management.

Some versions of the false reports even attributed comments to a supposed Deputy Governor, Dr. Ibrahim Tahir Jr., claiming the notes would be introduced on May 1, 2025.

-

Business22 hours ago

Business22 hours agoBank stops transfer fees on online transactions

-

News9 hours ago

News9 hours agoRivers APC demands Fubara’s probe over ex-HoS allegations

-

News22 hours ago

News22 hours agoS/African Court Acquits Nigerian Pastor Of Rape, 31 Other Charges

-

Economy2 hours ago

Economy2 hours agoSEE Black Market Dollar To Naira Exchange Rate Today 3rd April 2025

-

Economy10 hours ago

Economy10 hours agoNaira rebounces against the dollar in parallel market

-

News2 hours ago

News2 hours agoNatasha: Kogi PDP hammers Ododo, reiterates unfeigned support for her

-

News9 hours ago

News9 hours agoAir Algerie Inaugural Flight to Abuja Will Strengthen Nigeria-Algeria Ties – FG

-

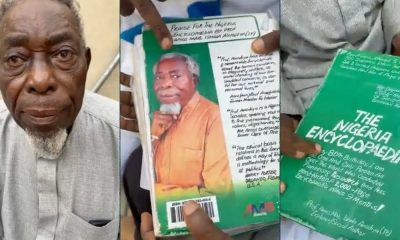

News10 hours ago

News10 hours agoVideo: Professor Returns To Nigeria With Nothing After 48 Years In Canada