News

Access Bank Becomes First to Meet CBN’s Minimum Capital Requirement with N351bn Rights Issue

By Gloria Ikibah

Access Holdings Plc has announced the successful completion of its Rights Issue, raising N351,009,103,017.25 through the issuance of 17,772,612,811 ordinary shares at N19.75 per share.

This achievement follows full regulatory approvals from the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC).

With this milestone, Access Bank Plc, the flagship subsidiary of Access Holdings, is the first bank to meet the CBN’s N500 billion minimum capital requirement for banks with international authorisation, well ahead of the March 2026 deadline. The bank’s share capital now stands at N600 billion, exceeding the regulatory threshold by N100 billion.

This marks a significant achievement as Access Holdings is the first CBN-licensed financial holding company to execute a fully digital Rights Issue. The process utilised the Nigerian Exchange Group’s E-offer platform to provide shareholders with a seamless and efficient subscription experience, enhancing accessibility and participation.

Speaker on the development, the Holding Company’s Chairman, Aigboje Aig-Imoukhuede, highlighted the innovation and leadership demonstrated by the institution. Further details from the statement emphasize the bank’s commitment to leveraging technology to drive growth and improve shareholder value.

News

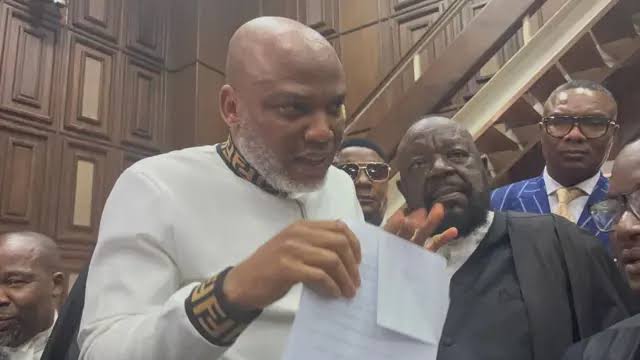

Four SANs join Agabi to defend Nnamdi Kanu

Indigenous People of Biafra (IPOB) leader Mazi Nnamdi Kanu has added four Senior Advocates of Nigeria (SANs) to his defence team.

The additions bring the number of SANs on the team to six.

In addition to Chief Kanu Agabi (SAN) and Uchenna Njoku (SAN), the new SANs are Prof Onyechi Ikpeazu, Emeka Etiaba, Mela Audu Nunghe and Dr. Joseph Akubo.

They will all be in court today as well as on May 2 and 6 as Kanu’s trial continues.

A member of Kanu’s legal team, Aloy Ejimakor, provided the update via his verified X handle @AloyEjimakor.

The Federal Government on March 21 re-arraigned Kanu before Justice James Omotosho on a fresh seven-count charge bordering on terrorism.

Kanu apologised for his February 10 verbal attack on Justice Binta Nyako, who recused herself from the case.

The IPOB leader said Justice Nyako “did not deserve the unjust attack.”

He tendered his apologies through Agabi, a former Attorney General of the Federation and Justice Minister.

The SAN attributed Kanu’s outburst to anger and urged everyone to forgive him.

“He has been angry for a long time and therefore he should not have spoken when he was angry,” Agabi said.

News

Borno govt reintegrates 300,000 former Boko Haram terrorists

Borno State Governor, Babagana Zulum, has disclosed that the state has reintegrated no fewer than 300,000 repentant Boko Haram terrorists over the past three years.

Governor Zulum made the revelation while receiving the Minister of Defence, Badaru Abubakar; the Chief of Defence Staff, Gen. Christopher Musa; and other top military commanders during their visit to Maiduguri.

“Borno State has, within the last three years, received more than 300,000 repentant Boko Haram fighters — and not all of them are fighters. Some of them are farmers,” he said.

While acknowledging the efforts of the Nigerian military, the governor noted that several challenges continue to hamper the effective fight against terrorism and called for urgent interventions.

He stressed the importance of combining kinetic and non-kinetic approaches in the ongoing counterterrorism efforts.

“Manpower is very essential. While I’m aware of the constraints of the Nigerian Army — because right now, you are everywhere in Nigeria: the North-East, North-West, North Central, as well as southern Nigeria — I’m aware of your limitations,” he said.

“But still, considering the northeastern region, the Nigerian Army should look into the possibility of sending more trained manpower. There is a difference between Boko Haram, ISWAP, and bandits.”

Governor Zulum further warned of the growing external support for terrorist groups operating in the region.

“ISWAP and Boko Haram are terrorists getting support internationally, and looking at our porous borders, they remain infiltrated through the Sahel, which is our major problem.”

He emphasised the strategic importance of securing the Sahel to achieve lasting peace across Nigeria.

“If the Sahel is not secured, Nigeria will never be secured. So, there is a need for us to fortify the security situation in the Sahel with a view to ending the crisis in the entire nation.”

The governor also called for enhanced air capabilities to counter the evolving threats posed by terrorist groups.

“We need air support. I know the kind of constraints you face accessing fighter helicopters and others, but attack helicopters are very important in these areas, and drones are also very important.”

Highlighting recent developments, he said: “The last attack that happened in Wulgo, carried out by ISWAP and Boko Haram — a confirmed statement said it was carried out with the support of armed drones. They hit the MNJTF (Multinational Joint Task Force) with drones.

“This is the time for the Nigerian military to rise again and procure sophisticated drones and anti-drone equipment so that we get rid of these problems.”

Governor Zulum described the situation as a serious setback not only for Borno State but for the entire Northeast region.

News

Court orders Aisha Achimugu to appear before EFCC today

Justice Iyang Ekwo of the Federal High Court in Abuja, has ordered Aisha Achimugu to appear before the Economic and Financial Crimes Commission (EFCC) on Tuesday (today) to answer questions regarding an ongoing investigation.

The judge also directed that she must appear before the court on Wednesday, April 30, 2025.

The gave the order in a ruling he delivered on Monday, April 28, 2025, in respect of a suit marked FHC/ABJ/CS/626/2025, filed by Achimugu against several law enforcement agencies, including the Nigeria Police Force, the Independent Corrupt Practices and Other Related Offences Commission (ICPC) the Department of State Services (DSS), the EFCC, the Nigeria Security and Civil Defence Corps (NSCDC) and the Nigeria Immigration Service (NIS).

In its response to Achimugu’s application, lawyer to EFCC, Ekele Iheanacho (SAN), informed the court of a counter-affidavit deposed to by one of its investigators, Chris Odofin, outlining the circumstances leading to her invitation.

In the affidavit, Odofin disclosed that Achimugu is under investigation for alleged conspiracy, obtaining money by false pretence, money laundering, corruption and possession of property reasonably suspected to have been acquired through unlawful means.

Achimugu had initially honoured the Commission’s invitation on February 12, 2024, during which she made a written statement and was subsequently granted administrative bail through her lawyer and surety, Darlington N. Ozurumba.

But she allegedly failed to report back as agreed, choosing instead to file a fundamental rights enforcement suit against the Commission.

The affidavit further revealed that Achimugu, in her statement, explained the inflow of N8.71billion into her corporate bank accounts as an ” investment fund” for the acquisition of an oil block.

She claimed the funds were transferred to the Federal Government’s account through her company, Oceangate Engineering Oil and Gas Limited, referencing documentation from the Nigerian Upstream Petroleum Regulatory Commission, NUPRC.

Further investigation in the affidavit however, indicated that Achimugu’s company actually acquired two oil blocks, Shallow Water PPL 3007 and Deep Offshore PPL 302-DO at the cost of $25.3 million.

Investigations showed that the payments were allegedly made in cash via bureau de change operators and that the ultimate sources of the funds could not be traced to any legitimate business income or partnerships.

The Commission also alleged that the acquisition process was fraught with corruption. Despite the acquisition, neither of the two oil blocks had commenced exploration or production as of the time of investigation.

The EFCC stressed that Achimugu’s current suit is a calculated attempt to frustrate the ongoing investigation, despite a previous court decision in suit No. FHC/ABJ/CS/451/2024 dismissing her claim of fundamental rights violations.

Following the dismissal of the earlier suit, the EFCC continued its investigation by dispatching inquiry letters to various banks and the Corporate Affairs Commission (CAC), the Federal Inland Revenue Services (FIRS), Land Authorities, Special Control Unit against Money Laundering (SCUML), Central Bank of Nigeria (CBN) to gather more evidence. As more responses were received, the team analysed them while further responses are being awaited.

The affidavit also shows that Aisha Achimugu operates a total of 136 bank accounts across 10 different banks both in her personal and corporate names.

The case continues on Wednesday, April 30, 2025 with Achimugu expected to report to the EFCC on Tuesday as directed by the court.

-

News22 hours ago

News22 hours agoInsecurity: BUDA urges govt to quickly rescue Baruten from terrorists

-

News24 hours ago

News24 hours agoUNUSUAL! Without invitation, Police declared me wanted — Daughter of ABC Transport owner

-

News19 hours ago

News19 hours agoBreaking: Late gospel singer Osinachi’s husband sentenced to death by hanging

-

News4 hours ago

News4 hours agoCourt dismisses Emefiele’s bid to reclaim forfeited 753 duplex estate

-

News20 hours ago

News20 hours agoWeeks to 2nd anniversary, Niger deputy gov, plans to resign, move out personal effects

-

Entertainment23 hours ago

Entertainment23 hours agoMy tongue slipped, Annie Macaulay apologizes after referring to Herself as ‘Idibia’ at Headies 2025

-

News18 hours ago

News18 hours agoVatican: Conclave to elect a new pope will start on May 7

-

News18 hours ago

News18 hours agoSultan declares Tuesday first day of Zulki’ida 1446AH