News

Govt makes tax clearance compulsory for varsity students’ registration

The Kogi State Government has mandated students at the state-owned tertiary institutions to present their parents’ Tax Clearance Certificate (TCC) for registration.

The order is contained in a circular from Kogi State Internal Revenue Service (KGIRS), dated November 26, 2024 and addressed to all the heads of the state owned tertiary institutions, effective from January 2025.

The circular, signed by KGIRS Chairman, Sule Salihu Enehe, and copied to the Vice Chancellor, Confluence University of Science and Technology, Osara, marked KGIRS/PIT/ Vol.5/11647.

It read, “Enforcement of Tax Clearance as condition for students registration.

“This is to further remind you on the need to ensure compliance for the students of your institution to present the Tax Clearance Certificate (TCC) of their Parents or verifiable Guardian during the process of registration, either as fresh or returning students.

“In line with the provisions of the law , we shall carry out compliance beginning from January 2025.”

However, the move has drawn the ire of stakeholders: parents, concerned citizens and right activists in the state, who described the decision as harsh and absurd.

Several people sought more clarification, noting that the new directive was not in the students’ admission and registration requirements.

Many stakeholders raised onservation that some students sponsored themseveles and are children of peasant farmers or private individuals outside the state.

“We have been on it since last year. It’s unfortunate and condemnable, for a student that have registered and have met all conditions stipulated in the admissions process and yet cannot enjoy his or her rights. It is ridiculous.

“We urged the NBA in Kogi State as a matter of urgency to intervene quickly. There are students that are training themselves; where would they get the clearance from,” said Idris Miliki Abdul, Executive Director, Conscience for Human Rights and Conflicts Resolution (CHRCR).

Also, the National Commissioner in Charge of the Right to Education at the National Human Rights Commission of Nigeria, NHRC, Sir Agabaidu Jideani appreciated the efforts of the Kogi State Government to ensure tax compliance among its citizens, particularly parents.

“However, I strongly believe that the recent memo issued by the Chairman of the Kogi State Board of Internal Revenue Service, which mandates institutions of learning to refuse registration to students without a verifiable tax clearance certificate from their parents, may inadvertently deny children their right to education.

“Our quest to satisfy the financial urge of the government should not deprive the citizens of their fundamental rights especially that of education which is not freely given,” he said.

Meanwhile, a legal practitioner and Rights activist, Arome Odoma, has challenged the legality of the policy, in a pre-action notice addressed to the Governor of the State, Ahmed Usman Ododo, and the Chairman of the Board of Internal Revenue Service.

“This policy is not only repugnant to Natural Justice, Equity and good conscience but also an attempt to deprive the future leaders their right to education.

“The Chairman of the board should take note that education is not a privilege but a right, it then goes to say that education is legally guaranteed for all without discrimination,” said Odoma in his pre- action notice on Parental Tax Clearance for Student Registration.

The state Commissioner for Information and Communication, Kinsley Fanwo, did not respond to messages and calls when contacted.

However, the Public Relations Manager of the KGIRS, Muktar said, “I will speak with you after getting a clearance from my EC.”

He was yet to do so as of the time of filing this report.

News

A’Court reserves judgment on Kano LG poll dispute

A special panel of the Court of Appeal sitting in Abuja has reserved judgment in five separate appeals arising from the legal disputes surrounding the conduct of the 2024 local government elections in Kano State.

The appeals stem from two rulings delivered by the Federal High Court in Kano, which, among other declarations, nullified the composition of the Kano State Independent Electoral Commission.

The cases include Appeal No. CA/KN/20/2025, filed by KANSIEC with the Independent National Electoral Commission and four others listed as respondents.

Another, CA/KN/233/2024, was filed by the Kano State House of Assembly and another party, with Aminu Aliyu Tiga and 14 others as respondents.

Appeal CA/KN/290/2024 was brought by the Attorney General of Kano State and six others against the All Progressives Congress and three others.

Additionally, Appeal CA/KN/291/2024 was filed by KANSIEC and eight others, with the Kano State House of Assembly and six others listed as respondents.

In the appeal marked CA/KN/233/2024, the Kano State House of Assembly and another appellant, represented by Chief Adegboyega Awomolo (SAN), urged the appellate court to overturn the judgment of the Federal High Court, which had barred KANSIEC from conducting local government elections.

Awomolo argued that the Federal High Court lacked jurisdiction to entertain the case, noting that the suit filed by Aminu Tiga and the APC was statute-barred at the time of filing.

He also contended that the plaintiffs lacked the legal standing to initiate the case.

Justice Simon Amobeda of the Federal High Court had, on October 22, 2024, restrained KANSIEC from conducting elections in the 44 local government areas of Kano State.

The judge ruled that the electoral commission’s members were card-carrying members of the ruling New Nigeria People’s Party, in breach of Sections 197 and 200 of the 1999 Constitution.

Justice Amobeda further directed INEC not to release the national voters’ register for the purpose of the local government elections in the state.

Additionally, he barred the police, the Department of State Services, and other security agencies from providing support or protection for the polls.

Unhappy with the verdict, the Kano State House of Assembly and other affected parties approached the Court of Appeal, arguing that local government election matters are under the exclusive purview of the state and can only be adjudicated by a Kano State High Court—not the Federal High Court.

After hearing all arguments on Tuesday, the three-member appellate panel led by Justice Georgewill Ekanem announced that judgment had been reserved and would be delivered on a date to be communicated to the parties involved.

News

Ondo poly workers commence strike action over unpaid wages

Workers at the Rufus Giwa Polytechnic, Owo, in Ondo State on Tuesday embarked on an indefinite strike over the non-payment of salaries by the Ondo State Government.

The striking workers, who are members of the Non-Academic Staff Union and the Senior Staff Association of Nigeria Polytechnics, staged a peaceful protest on the institution’s campus to express their grievances.

The aggrieved staff revealed they are being owed six months’ salaries and accused the government of failing to implement the national minimum wage.

They carried placards with messages including, “We are hungry, pay our six months’ salaries,” “Mr Governor, please implement our 2025 budget,” and “Acting Rector, please clear our 2022, 2023, and 2024 promotion arrears.”

During the protest, the Chairman of NASU, RUGIPO chapter, Mr. Julius Olugbenga-Aro, and his SSANIP counterpart, Mr. Saka Olokungboye, called on Governor Lucky Aiyedatiwa to urgently address the workers’ demands.

They lamented the hardship faced by their members, saying many are unable to meet basic needs due to the unpaid wages.

Olugbenga-Aro stated, “This protest is to express our frustration over the non-payment of six months’ salary arrears and the failure of the Ondo State Government to implement the national minimum wage for polytechnic staff.”

While acknowledging some of the governor’s developmental efforts at the institution, including the recent approval for the polytechnic’s conversion to a university, the union leaders appealed for more urgent actions.

They urged the state government to approve immediate payment of the outstanding salaries, ensure full implementation of the 2025 institutional budget, and begin payment of the new national minimum wage.

They also warned that failure to act swiftly could result in prolonged disruptions to the academic calendar, further affecting students and the institution at large.

News

Court imposes N100m damages penalty on Abuja school over student’s death

A Federal Capital Territory High Court in Abuja on Tuesday awarded the sum of N100m in general damages against Louisville Girls Secondary School, Gwagwalada, for negligence of duty of care which led to the death of a student.

Mr Ifeanyi Ikpeatusim had sued the school for negligence that resulted in the death of his 9-year-old daughter, Kamzie,

In the suit marked CV/1738/18, Ikpeatusim alleged that the school’s failure to provide adequate medical attention after Kamzie who fell ill shortly after her admission and resumption in the school led to her untimely death.

Kamzie, who was admitted as a boarding student in September 2017 became severely ill by October 2 and died a few days later.

Justice Sylvanus Oriji, while delivering judgment in the suit brought before the court after awarding the N100m cost, ordered a 10 per cent interest on the judgment sum from April 8 until full payment.

He also awarded an additional N300,000 as the cost of the suit.

Justice Oriji while pronouncing the decision of the court, held that the evidence presented showed the school and its agents acted negligently by failing to attend promptly and adequately to Kamzie’s medical needs.

“The claimant established his allegations of negligence against the school.

“There is no amount of money that can bring back the child to life,” he stated.

Justice Oriji however acknowledged the fact that one significant outcome of the case was the improvement of the school’s sickbay following the incident.

He noted that the presence of doctors attending to students twice daily was a commendable development.

While the claimant had asked the court to order the school to name one of its structures in Kamzie’s name in her honour, Justice Oriji noted that the improvement in the school’s sickbay was sufficient enough to know the school is making amends from its mistake.

“The court thinks that the improvement in the sickbay, ensuring doctors are available twice daily, is in honour of Kamzie, as part of reforms recommended by her family.

“The claimant should take solace in the fact that Kamzie has been honoured by the school through these improvements.”

-

News9 hours ago

News9 hours agoOERAF held memorial lecture on conflict resolution, security/safety of community in Nigeria

-

News19 hours ago

News19 hours agoJust in: Founder of Diamond Bank and ex-chairman of MTN, Paschal Dozie is dead

-

News14 hours ago

News14 hours agoTRADE WAR! U.S. angry over Nigeria’s import ban on 25 products

-

News19 hours ago

News19 hours agoNaira Nosedives Against Dollar

-

Sports18 hours ago

Sports18 hours agoReal Madrid keeping tabs on Victor Osimhen

-

News20 hours ago

News20 hours ago2Baba’s Lover Natasha Osawaru Fired As Edo Assembly Minority Leader

-

News14 hours ago

News14 hours agoINTERVIEW: Introduction of Child Rights Curriculum In Nigerian Universities Will Take CRA to Families – Dr Obiorah Edogor

-

News18 hours ago

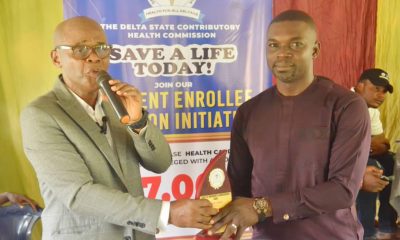

News18 hours agoOERAF Executive Director Dr Akpodiete, Held Memorial lecture on Essence and benefits of health insurance+Photos