News

Dollar recovers, appreciates against naira in official market

By Kayode Sanni-Arewa

The value of the Naira depreciated in the official foreign exchange market at the close of trading on Thursday, February 7.

Data from FMDQ securities showed that at the Nigerian Autonomous Foreign Exchange Market the forex market closed at N1500.65/1$ on Thursday.

Thursday’s rate represents a slight depreciation when compared to the exchange rate of N1,499.76/$1 reported on Wednesday’s market.

The latest performance of the naira means that the Nigerian currency has depreciated for two consecutive days against the US Dollar.

Naira against dollar in black market

It was a different scenario for the Naira in the parallel market, popularly known as the black forex market.

BDC operators told Legit.ng that the Dollar depreciated further on Thursday, February 6, selling at N1,552, while the buying rate stood at N1,530.

This represents an improvement from Wednesday’s rates, where the Dollar was sold at N1,582 and bought at N1,565.

Naira/dollar: Official and unofficial market rate gap closes

The latest movement in the naira exchange rate indicated that the gap between the official and black markets is nearing convergence.

With the black market exchange rate now at N1,530/$, and official rate at N1500.65/ the gap between the official and black markets is now N30.

CBN’s latest naira rates against other currencies

Here are the latest exchange rates against other currencies on the Nigerian Foreign Exchange Market (NFEM).

NFEM rate is derived at Volume Weighted Average and stands as the official exchange rate for the day.

1. CFA – N2.38

2. Yuan/Renminbi – N205.75

3. Danish Krona – N208.47

4. Euro – N1555.18

5. Yen – N9.87

6. Riyal – N399.92

7. South African Rand – N80.81

8. Pounds Sterling – N1859.98

CBN permits BDCs to buy dollar from official sources

The CBN recently announced that it had extended the window of allowing Bureau De Change (BDC) operators to buy FX from the official market until the end of May.

This policy allows BDCs to purchase $25,000 worth of forex per week and should not resell to their customers at a profit margin above one per cent.

Also, BDCs can only disburse purchased FX for specific

transactions, with a maximum of $5,000 per transaction, quarterly

News

Just in: Lagos LG chairman slumps during APC meeting

The Chairman of Bariga Local Government Area of Lagos State, Kolade Alabi, on Wednesday, suddenly slumped at the All Progressives Congress stakeholders’ meeting held at the party’s Secretariat in Ikeja, the state capital.

According to The PUNCH, Alabi, who is the state chairman of the Association of Local Government of Nigeria, was addressing party members when the sad incident occured.

Fortunately, he was immediately revived and rushed away to the hospital in an ambulance for further treatment.

Details shortly…

News

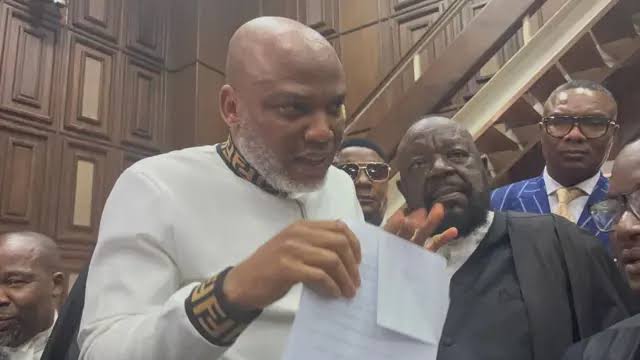

Multiple video evidence against Nnamdi Kanu

The Federal High Court in Abuja on Wednesday, admitted a video recording allegedly showing the leader of the Indigenous People of Biafra (IPOB), Nnamdi Kanu issuing inflammatory directives which the prosecution claims incited acts of terrorism across the South – East region of the country.

The Wednesday proceedings resumed with the continuation of the testimony of the second Prosecution witness, an operative of Department of State Services (DSS) codenamed PWBBB.

In the video played in open court, Kanu was seen addressing his followers in what he called, “the blessed land of Biafra”, wherein he announced the formation of the Eastern Security Network (ESN), urging followers to defend their land against what he referred to as “Fulani domination.”

He warned political leaders in the region against compromises and issued a directive forbidding the presence of fulani herdsmen, saying, “No Fulani parading as herdsman shall be allowed in our land. If you are an agent of the Fulani, turn your way this evening.”

The device was admitted as evidence alongside a certificate of compliance, despite objections from the defence.

They were marked as Exhibits PWA and PW1, respectively.

The court also admitted a letter dated June 17, 2021, authored by the former Attorney General of the Federation, Abubakar Malami, SAN, which accused Kanu of terrorism, murder, and incitement to violence.

The letter, addressed to the DSS, was tendered without objection and marked as Exhibit PWF.

Reading from the document, the witness, who was led in evidence by the prosecuting counsel, Chief Adegboyega Awomolo, SAN alleged that Kanu’s broadcasts were followed by coordinated attacks on police stations and correctional facilities, resulting in loss of lives and property.

He quoted the petition as saying Kanu had instructed that security operatives be “brought down” and their weapons seized.

News

Just in: Security and Exchange Commission declares PWAN as PONZI scheme, cautions Nigerians

Securities and Exchange Commission (SEC) has alerted the public on the activities of Property World Africa Network (PWAN), which holds itself out as a real estate investment company and solicits funds from the public for investment purposes through PWAN MAX.

In a statement on Tuesday, the SEC said PWAN/PWAN MAX are not registered either to solicit investments from the public or operate in any other capacity within the Nigerian capital market.

The SEC said investigations revealed that PWAN’s operations exhibit the typical indicators of a fraudulent Ponzi scheme, including the promise of unusually high returns and failure to honour withdrawal requests from subscribers.

“Accordingly, the public is strongly advised to be wary about investing with PWAN/PWAN MAX, as any person who places such investment with these entities, does so at his/her own risk.

“The commission similarly reminds potential investors of the need to verify the registration status of investment platforms via the commission’s dedicated portal: www.sec.gov.ng/cmos before transacting with them,” the SEC said.

(The Guardian)

-

News6 hours ago

News6 hours agoReal cause of Herbert Wigwe’s helicopter crash revealed

-

Politics7 hours ago

Politics7 hours agoUghelli North PDP Holds Crucial Meeting

-

News13 hours ago

News13 hours agoTinubu presents N1.78 trillion FCT budget to NASS

-

News23 hours ago

News23 hours agoEdo Speaker, Two Other Lawmakers, Formally Join APC

-

News13 hours ago

News13 hours ago2027: Why Obi should reject VP slot — Tinubu’s aide

-

News24 hours ago

News24 hours agoRep Raises Alarm After Deadly Attacks In Borno, Says Boko Haram Is Returning Stronger

-

News13 hours ago

News13 hours agoNnamdi Kanu wanted more states for Biafra – DSS

-

Economy7 hours ago

Economy7 hours agoSEE Black Market Dollar to Naira Exchange Rate Today – 7th May 2025