News

Reps Advance Tax Reform Bills Amid Unanimous Support

…as legislators overcome initial opposition to move key revenue laws forward

…weigh concerns over VAT, multiple taxation, Economic Impact

The House of Representatives on Wednesday passed through second reading the four tax reform bills submitted by the President, with no opposition from lawmakers.

The proposed laws include the Nigeria Revenue Service (Establishment) Bill, the Nigeria Tax Bill, the Nigeria Tax Administration Bill, and the Joint Revenue Board (Establishment) Bill.

Originally introduced on October 8, 2024, deliberations on the bills were delayed due to concerns raised by northern leaders and the Nigerian Governors Forum, particularly over the Nigeria Tax Administration Bill, but Speaker Tajudeen Abbas had urged members to consult widely with their constituents before debating the proposals.

Naijablitznews.com reports that ahead of plenary on Wednesday, the four bills were merged into a single document for debate. Despite highlighting potential conflicts with certain constitutional provisions and a few contentious clauses, lawmakers overwhelmingly supported moving the bills forward.

House Minority Leader, Rep. Kingsley Chinda (PDP Rivers, representing minority voices, acknowledged broad support for the reforms but pointed out concerns regarding specific provisions. He emphasized that while the bills aim to restructure the tax system for better revenue generation, the interpretation of certain provisions requires careful review.

The House of Representatives, on Wednesday, continued deliberations on the tax reform bills, with lawmakers expressing mixed reactions to various provisions, including proposed changes to Value Added Tax (VAT) and streamlining of multiple taxes.

Leade of the House, Rep. Julius Ihonvbere commended the President for initiating the reforms, and stated that the bills aim to modernize Nigeria’s tax system, eliminate multiple taxation, enhance revenue collection, and boost economic diversification. He acknowledged opposition to the bills but noted that differing perspectives had strengthened the final proposals.

Ihonvbere highlighted key benefits, including incentives for small businesses, improved revenue generation, and the reduction of tax burdens on low-income earners. He revealed that the reform would consolidate over 60 different taxes into just nine, ensuring quicker resolution of tax disputes within 14 days.

Minority Whip, Rep. Ali Isa (PDP, Gombe) raised concerns over Clause 146 of the Nigeria Tax Bill, which proposes a gradual VAT increase from 7.5% to 10% and later 15%, and cautioned that higher VAT could worsen economic hardship and urged the House to address areas requiring adjustments.

Chairman House Committee on Public Accounts, Rep. Bamidele Salam (PDP, Osun), emphasised that while tax reforms can be challenging, they are necessary for national development. He criticized Nigeria’s complex and duplicative tax laws, arguing that they deter investors and hinder economic growth.

Rep. Stanley Olajide (PDP, Oyo) pointed out that the House regularly establishes new agencies that require funding, making tax reform essential for sustaining government institutions.

Deputy Chief Whip, Rep. Isiaka Ibrahim Ayokunle (APC, Ogun) described the bills as a major step toward tax harmonization but stressed the need for penalties not only for taxpayers who default but also for government agencies failing to implement tax laws effectively.

In his submission, Rep. Sada Soli (APC, Katsina) raised constitutional concerns, particularly regarding Section 141 of the Tax Administration Law, which he said conflicts with existing legislation and creates jurisdictional overlaps. He also criticized ambiguities in VAT and fiscal policies that could overburden taxpayers.

Rep. Babajimi Benson (APC, Lagos) praised the bills for promoting fairness and increasing revenue for states. He also backed the decision to retain key agencies like TETFund, NITDA, and NASENI, stating, “I commend the President for having the guts to push these reforms now.”

Rep. Gboyega Nasiru Isiaka (APC, Ogun) reinforced the House’s commitment to reforms, stating, “From day one, we promised Nigerians a tax overhaul. Our system is outdated, and this is the change we need.”

The debate, which lasted over three hours, showcased a broad consensus on the need for tax reform while highlighting critical areas requiring fine-tuning before the final passage.

During deliberations on the tax reform bills, Rep. Marian Onuoha (APC, Imo) emphasized that the proposed laws aim to create a fairer tax system by placing a heavier burden on high-income earners.

Rep. Abubakar Hassan Fulata raised concerns over the absence of an interpretation clause in three of the four bills, warning that without clear definitions, the laws could be misapplied or exploited by those enforcing them.

Rep. Ademorin Kuye (APC, Lagos) stressed that Nigeria must reform its tax laws to remain globally competitive, while Rep. Leke Abejide (ADP, Kogi) praised President Tinubu for taking decisive steps to rescue the economy from collapse.

Addressing the derivation principle, which had been a contentious issue, Rep. Ahmed Jaha (APC, Borno) insisted that the law must clearly define the specific type of derivation it refers to in order to avoid ambiguity.

Rep. Donald Ojogo (APC, Ondo) highlighted the importance of integrating modern technology into tax administration to curb revenue leakages and boost collection efficiency.

Former House Leader, Rep. Alhassan Ado Doguwa commended lawmakers for their patriotism and Speaker Abbas Tajudeen for allowing thorough consultations before proceeding with the bills. He also praised the President for respecting the legislative process, particularly in retaining key government agencies.

Former Deputy Speaker Rep. Ahmed Idris Wase recalled how the tax reform debate initially caused divisions within the House but credited the Speaker’s diplomacy for maintaining unity. He welcomed the retention of TETFund, arguing that removing it would have harmed the education sector.

In a unanimous decision, the House passed the bills for second reading via a resounding voice vote, with no opposition. The bills have now been referred to the House Committee on Finance, which will conduct a public hearing for further scrutiny and stakeholder engagement.

News

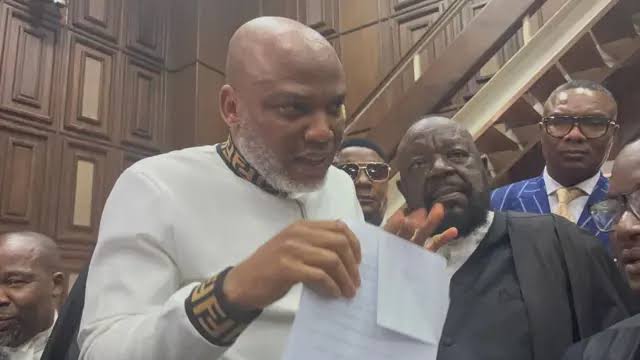

Court bans Nnamdi Kanu’s in-law from 3 proceedings over live streaming

Robert Imoh by Robert Imoh May 6, 2025

Court bans Nnamdi Kanu’s in-law from 3 proceedings over live streaming

The Federal High Court in Abuja, on Tuesday, banished Mrs Favour Kanu, wife of Prince Fineboy Kanu, the younger brother to Nnamdi Kanu for streaming the proceedings of the court life on her Facebook page.

Kanu, the leader of the proscribed Indigenous People of Biafra (IPOB), is being prosecuted by the Federal Government for alleged terrorism charge.

Justice James Omotosho, who gave the order, after Mrs Favour admitted engaging in the act and apologised to the court, held that Mrs Favour would have been charged for contempt of court.

Although Kanu’s lawyer, Chief Kanu Agabi, SAN, also apologised on her behalf, Justice Omotosho insisted that Mrs Favour would be barred from three proceedings.

The judge expressed surprise that despite that Mrs Favour’s phone was confiscated on the last adjourned date when she was caught recording him, she still went ahead to post the video online.

” I want to hear from her. Were you not the one that I took your phone?

“I did not give order to forfeit that phone. I don’t know if she might be a wife to my brother (Nnamdi Kanu,” the judge said, but Prince told the judge that she is his wife.

The judge, who cautioned against any act that could cause delay in the trial, assured all parties in the case that justice would be served.

News

Defence minister confirms over 8,000 terrorists, bandits wasted under Tinubu’s admin

The Minister of State for Defence, Bello Matawalle, has announced that over 8,000 terrorists and bandits were neutralised across Nigeria in 2024 under the leadership of President Bola Ahmed Tinubu.

Matawalle attributed the improved security outcomes to renewed strategic military operations and the focused leadership brought by the Tinubu administration.

In addition to the killings, security forces reportedly arrested more than 11,600 suspected criminals and recovered over 10,000 illegal firearms nationwide.

These figures were contained in a statement released Monday by Patience Ituke, on behalf of the Ministry of Defence’s Director of Information and Public Relations.

Commending the President’s reform agenda, Matawalle expressed confidence that Tinubu’s efforts are laying the groundwork for national progress and may position him favorably for re-election in 2027.

“Bello Matawalle lauded President Bola Ahmed Tinubu for his transformative reforms, asserting that these initiatives will pave the way for a brighter future for Nigeria and potentially secure Tinubu’s re-election in 2027,” the statement noted.

The minister outlined several major accomplishments under the current administration, particularly in the defence sector.

The neutralisation of over 8,000 terrorists and bandits, arrest of 11,600 suspected criminals and recovery of more than 10,000 illegal weapons.

He also highlighted the establishment of the Multi-Agency Anti-Kidnap Fusion Cell as a significant step in strengthening coordination among security agencies to combat kidnapping.

Matawalle further cited the creation of the Ministry of Livestock Development as a strategic move to boost agricultural productivity and reduce grain prices, particularly in northern Nigeria.

“The Ministry of Livestock Development is harnessing the agricultural potential of the region, boosting the economy, and improving livelihoods,” he said.

On infrastructure, the minister mentioned ongoing road construction projects and upgrades to the nation’s transportation networks. He believes these efforts will drive economic growth, especially in underserved communities.

While confident in the President’s record so far, Matawalle noted that Tinubu’s chances for a second term would ultimately depend on the sustained momentum of these initiatives.

News

NANS Barricades Lagos-Ibadan Expressway Over Alleged NELFUND Mismanagement

Students under the umbrella of the National Association of Nigerian Students, blocked the Redeemed Christian Church of God (RCCG) Camp section of the Lagos-Ibadan Expressway, to protest the alleged mismanagement of N100billion funds allocated to the Nigeria Education Loan Fund (NELFUND).

The blocking of both sides of the busiest highways in the country by the protesting students, however, caused gridlock as the vehicular movement was halted for more than one hour.

Addressing newsmen from a text jointly signed by the National Vice President, Inter-Campus and Gender Affairs of NANS and the Ogun State Chairman of NANS, Akinbodunse Sileola Felicia and Gabriel Abiola Francis, respectively, Gabriel explained that students were mobilized to block the ever-busy expressway in order to get attention of President Bola Ahmed Tinubu to take decisive action on the graft discovered in the disbursement of student loans.

The Independent Corrupt Practices Commission and Related Offences (ICPC) in a statement by its spokesperson, Demola Bakare, last Thursday, said the anti-graft agency had launched a comprehensive investigation into discrepancies in the Nigeria Education Loan Fund (NELFUND) student loan disbursements.

Bakare added that the probe was as a result of reports implicating 51 tertiary institutions in unauthorised deductions of N3,500 to N30,000 from students’ institutional fees funded by NELFUND.

He noted further that preliminary findings revealed a significant gap in the financial records of the disbursement process.

While the federal government reportedly allocated N100 billion, only N28.8 billion reached students, leaving N71.2 billion unaccounted for.

Bakare further informed that the ICPC’s Chairman’s Special Task Force acted swiftly, inviting stakeholders, including the Director General of the Budget Office, the Accountant General of the Federation, Central Bank of Nigeria officials, and NELFUND’s CEO and Executive Director for documentation and interviews.

The investigation revealed NELFUND received N203.8 billion as of March 19, 2024, comprising N10billion from the Federation Allocation.

-

News22 hours ago

News22 hours agoWhy ‘VeryDarkMan was arrested – EFCC

-

Entertainment22 hours ago

Entertainment22 hours agoHow I narrowly escaped death in U.S hotel room – Seun Kuti

-

News24 hours ago

News24 hours ago‘S3x is good, I enjoy it,’ Bishop Adejumo tells wives

-

News19 hours ago

News19 hours agoReps Minority Caucus condemns unlawful detention of VDM, demands his immediate release

-

News9 hours ago

News9 hours agoMinistry denies awarding N13bn contracts without due process

-

News9 hours ago

News9 hours agoFULL STEPS: How to check 2025 JAMB results

-

News21 hours ago

News21 hours agoWATCH Your family Lawyer’s last episode on how to end marriage

-

News22 hours ago

News22 hours agoNBA explains delay in Patience Jonathan’s domestic staff trial