News

Se3ual harassment: Natasha’s husband, Uduaghan confirms Akpabio made advances to his wife

By Kayode Sanni-Arewa

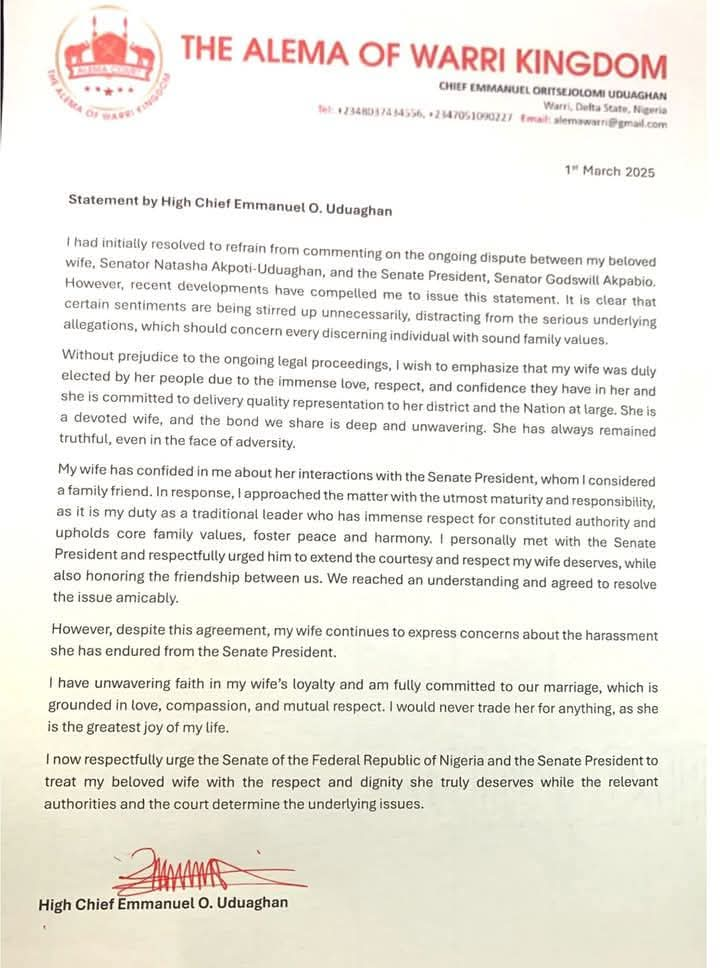

Double Chief Emma Uduaghan, husband of Senator Natasha Akpoti-Uduaghan, has publicly confirmed his awareness of repeated sexual harassment by Senate President Godswill Akpabio towards his wife.

In a statement, Uduaghan revealed that he had confronted Akpabio directly, urging him to respect his wife and cease his inappropriate behavior.

However, according to Uduaghan, Akpabio’s refusal to heed his request has caused significant distress to Senator Akpoti-Uduaghan, ultimately leading to her public outcry.

News

Banditry:” I was chained for 32days while in their den, killed my wife as I watch-Nat’l Assembly DD narrates experience

A Deputy Director at the National Assembly Commission, Michael Adesiyan, has narrated his near-death experience in the hideout of bandits.

Adesiyan was abducted from his Chikakore residence in Kubwa, a suburb in the nation’s capital, alongside his wife on January 26th, 2025 before he was rescued on April 7.

The civil servant narrated his ordeal to journalists at National Counter-Terrorism Centre, Abuja, when fresh 60 kidnapped victims, who were rescued by the security forces were presented to the National Security Adviser, Nuhu Ribadu.

Adesiyan called on the federal government to immediately look for a way to disarm the criminals and educate them, and possibly reintegrate them back to the society, adding that “the bandits don’t know what they are doing.”

According to him, his abductors were between the ages of 17 and 20, and they were stark illiterate people who were not aware of what they were doing, and could not even count N1 million let alone hundreds of millions they were asking as ransom.

He specifically said they were chained for 32 days he spent in the abductors’ den, adding that they killed his wife in his presence.

“I want to thank the government for rescuing us. I was chained for 32 days. I want to advise that the government should find away to disarm or arrest them (bandits), instead of confronting them.

“They can send them to school. Some cannot even count one million. They are stark illiterates. They are young people of ages 17 and 21. They don’t know what they are doing.

“So if they can bring them out, if they want to learn work (apprenticeship), they can let them do, retrain them, reorientate them, that they can be useful to themselves.

“My advice is to, instead of killing them, arrest them, reorientate them. If you want to educate them, they can then work. That’s my advice,” he said.

When asked why they were in a rush to tell their family members to pay ransom, he said, “When they kill someone in your presence, you would give them anything they want.

“For instance, they killed my wife in my presence. If they request your head in that situation, you will give it to them.”

Earlier, while giving a breakdown, the Coordinator, National Counter-Terrorism Centre, Maj. Gen Adamu Laka said the victims comprising 35 males and 25 females, were rescued on Monday April 7, by troops of 1 Division of the Nigerian Army, in a coordinated operation supported by other security and intelligence agencies.

News

US revokes more than 500 foreign student visas

No fewer than 500 foreign students have had their US visas revoked in recent weeks, as Donald Trump’s administration doubles down on its crackdown on universities.

Nafsa, a network of universities and individuals engaged in international education and exchanges, told the Financial Times on Tuesday it had identified 500 visa revocations by compiling reports from higher education institutions across the US.

“This is uncharted territory on so many levels,” Fanta Aw, chief executive of Nafsa said. “It’s at an unprecedented level and it’s quite concerning because there is a lack of clarity which is creating anxiety.”

The Department of Homeland Security and the Department of State are implementing a wave of actions against university students across the country. Institutions are often unaware that their students have been targeted so cannot easily track their cases or offer support.

The state department’s visa revocations require students to leave the US and reapply for visas after fresh scrutiny. Separately, the homeland security department has triggered “status termination”, Aw said. In both cases, she added, the processes for appeal were unclear.

“There will be a tsunami of legal cases coming,” she warned.

Multiple reports have arisen of foreign students and university employees being taken to detention centres and subsequently facing deportation.

A number of universities have issued warnings to students and faculty against travelling abroad for fear of arbitrary questioning or detention on returning to the US.

Aw said reports of visa revocations had spiralled from students at elite universities — including Stanford, Harvard and Columbia — to a far wider range of higher education institutions across the country. They targeted many different nationalities for a variety of reasons, including for traffic violations.

Since Trump’s election, a growing number of US-based faculty have sought jobs elsewhere, and increasing numbers of high school and college students are applying to universities abroad.

The Central European University in Vienna on Tuesday said US applicants for its programmes in the upcoming academic year had jumped one-quarter, while the University of Toronto reported a “meaningful” rise compared to past years.

On Monday, 16 associations of US universities called for a briefing from the homeland security and state departments, after uncoordinated orders from the authorities requested students to “self-deport”.

The group said the orders contained “no additional information about how to appeal this decision or verification to ensure that mistakes are not being made in identifying these individuals”.

The association warned of the implications for the country given the 1mn international students attending US colleges and universities, who contributed an estimated $43.8bn to the economy, created 375,000 domestic jobs and contributed “to institutions’ intellectual vibrancy and the global literacy of domestic students”.

The homeland security department did not reply to a request to comment.

News

Japa: Nigeria loses $366m as 16,000 doctors move abroad

The Coordinating Minister of Health and Social Welfare, Prof Muhammad Pate said over 16,000 Nigerian doctors have left the country in the last five to seven years to seek greener pastures in other countries.

Prof Pate also said the doctor-to-population ratio is now 3.9 per 10,000 in the country, while the estimated cost of training one doctor exceeds $21,000.

This was as he lamented that nurses and midwives who left have also thinned the number of healthcare workers in the country.

The minister disclosed this at the seventh annual capacity building workshop of the Association of Medical Councils of Africa in Abuja on Tuesday with the theme, “Integrated healthcare regulation and leadership in building resilient health systems.”

According to him, an increasing number of Nigeria’s talented healthcare professionals aspire to work in other countries, driven by factors such as economic opportunity, better working conditions, more advanced training, and superior research environments abroad.

He said the migration of health professionals from developing countries is not new, but it has accelerated in recent years.

“In Nigeria alone, over 16,000 doctors are estimated to have left the country in the last five to seven years, with thousands more leaving in just the past few years. Nurses and midwives have also thinned in numbers. The doctor-to-population ratio now stands at around 3.9 per 10,000—well below the suggested global minimum.

“But this trend is not just about people leaving. It represents a fiscal loss.

The estimated cost of training one doctor exceeds $21,000—a figure that reflects the magnitude of public financing walking out of our countries. It deeply affects our health systems—leaving many of our rural communities critically underserved.”

He, however, emphasised that the phenomenon offers an opportunity to rethink and reshape the policies, to manage the valuable health workforce in ways that benefit our countries first and foremost.

“In Nigeria, guided by the vision of President Bola Ahmed Tinubu, who was appointed by African Heads of State as the AU’s Continental Champion for Human Resources for Health and Community Health Delivery—we are pursuing a new direction. His vision is that Nigeria becomes a prosperous, people-oriented country, contributing to a peaceful and thriving continent. Not a standalone Nigeria, but a Nigeria that is interlinked with all our neighbours and sister countries. Under the Renewed Hope Agenda, and within the framework of the Nigeria Health Sector Renewal Investment Initiative, we have embraced a new path—combining strategic realism with visionary ambition.

“The National Policy on Health Workforce Migration is a cornerstone of this path. It is designed to address health workforce migration with dignity—dignity for health workers, for the country, and for the profession. It is data-driven, evidence-guided, and signals a clear direction. This is not a restrictive policy, nor is it one born out of resignation. We understand that the global health workforce shortage is at 18 million, and countries in the Global North face their own human resource crises due to demography and other factors. But our response is based on stewardship—balancing the rights of health professionals to seek opportunities abroad with our duty to protect the integrity and viability of our national health system.

“The objectives are clear. To retain and motivate health workers currently serving in Nigeria—thousands of whom work under difficult conditions; to establish ethical norms and explore bilateral frameworks for recruitment, aiming to correct global asymmetries; to expand training capacity—not only for domestic needs, but to contribute to global workforce needs, to enable structured reintegration for the thousands of Nigerian professionals abroad; and to strengthen governance, improve regulatory coordination, and build real-time data systems.”

He urged Africa to lead in forging a new global compact on health workforce mobility—anchored in pan-African training and accreditation standards; shared planning tools, evidence, and data; continental negotiating platforms with destination countries; and sustained investments in the people who care for our people.

The President of AMCOA, Prof Joel Okullo, stressed the importance of collaboration among African countries to tackle healthcare challenges and improve regulation and leadership across the continent.

He expressed the belief that the outcome of the workshop would produce actionable strategies to improve healthcare services across Africa.

“This year’s theme highlights our commitment to tackling the diverse array of challenges within the health regulatory landscape. It seeks to empower AMCOA members and associate members with the wisdom and skills needed for informed strategic and operational decisions in the coming year.

“In this intricate regulatory tapestry, our discussions will illuminate strategies and insights that will bolster regulators’ capabilities. Our focus will revolve around managing health workforce mobility, improving credentialing and information data management systems

“Let us embark on this journey with enthusiasm and a shared sense of purpose. Our collaborative efforts today and over the next few days will lay the groundwork for transformative changes that will resonate across the healthcare landscape of Africa,” he noted.

The Registrar of the Medical and Dental Council of Nigeria, Dr Fatima Kyari, while welcoming participants to the event, noted that it was Nigeria’s first AMCOA workshop while commending the alignment of leadership towards the shared goal of patient safety.

The Board Chairperson of MDCN, Prof Afolabi Lesi highlighted the need for healthcare regulators to uphold global standards while adapting to local contexts.

Lesi, who is also the Chairman of the Local Organizing Committee for the workshop addressed the challenges of fragmented professional relationships that hinder implementation and compromise patient care.

“The reality is that while we have committed and clear directions at the level of governance, implementation of actions is bedeviled by the fractioned and fractious relationship among health workers who ought to be working as a team, with the patient (well-being and safety) as the primary focus of all our actions,” he said.

Photo caption: Members of AMCOA; the Registrar of MDCN, Dr Fatima Kyari; the Board Chairperson of MDCN, Prof Afolabi Lesi; the Coordinating Minister of Health and Social Welfare, Prof Muhammad Pate; the Minister of State of Humanitarian Affairs and Poverty Reduction, Dr Yusuf Sununu; and other AMCOA members.

-

News19 hours ago

News19 hours agoOERAF held memorial lecture on conflict resolution, security/safety of community in Nigeria

-

News5 hours ago

News5 hours agoUS revokes more than 500 foreign student visas

-

News7 hours ago

News7 hours agoIbas picks administrators for 23 Rivers LGs(SEE list)

-

News11 hours ago

News11 hours agoBandits have seized control of 64 communities in Plateau – Gov Muftwang

-

News19 hours ago

News19 hours agoHoR Minority Caucus decries killings in Plateau, Benue states, urges immediate presidential decisive actions

-

Economy11 hours ago

Economy11 hours agoMobile Money transactions hit $1.68trn in one year

-

News11 hours ago

News11 hours agoAir Peace unveils new process for boarding passengers

-

Metro6 hours ago

Metro6 hours agoINSECURITY! Gunmen Attack Abuja-Bound GUO Bus, Passengers Injured