News

Tax reforms Bills: Reps retain 7.5 percent VAT, snub proposal to increase it by 2030

The House of Representatives has retained Value Added Tax (VAT) at 7.5%, rejecting a proposed gradual increase to 15% by 2030. The House also dismissed a proposal to reintroduce inheritance tax under the guise of taxing family income.

Submitting the report during plenary in Abuja, the Chairman of the House Committee on Finance, Rep. James Faleke, stated that the report represents a comprehensive review of the bills, incorporating extensive public input.

The report covers four key bills aimed at overhauling Nigeria’s tax framework:

Nigeria Tax Bill

Nigeria Tax Administration Bill

Nigeria Revenue Service (Establishment) Bill

Joint Revenue Board (Establishment) Bill

Key Amendments in the Tax Reform Bills

Nigeria Revenue Service (NRS) Bill

Redefined Scope: The NRS will now focus on federal-level revenue collection, excluding individual taxpayers in states and the Federal Capital Territory (FCT).

Board Composition: Section 7 now requires six executive directors, each appointed by the president from the six geopolitical zones on a rotational basis. Each state and the FCT will also have a representative on the board.

Secretary Qualifications: Section 13 mandates that the Secretary to the Board must be a lawyer, chartered accountant, or chartered secretary at the level of Assistant Director or higher.

Fixed Funding Rate: The NRS will now receive a 4% cost-of-collection rate (excluding royalties), subject to National Assembly approval.

Borrowing Powers Restricted: Section 28 now requires Federal Executive Council (FEC) and National Assembly approval before the NRS can secure any loans.

Joint Revenue Board (JRB) Bill

Tax Appeal Commissioners’ Criteria Revised: Section 25 removes the requirement that commissioners must have business management experience, as the Committee deemed it irrelevant.

Strengthened Tax Ombud’s Independence: Section 43 mandates that the Tax Ombud’s Office be funded directly from the Consolidated Revenue Fund, eliminating reliance on external donations.

Independent Funding for Tax Appeal Tribunal (TAT): The tribunal will now operate independently of the Federal Inland Revenue Service (FIRS) to prevent conflicts of interest.

Stricter Adherence to the Evidence Act: New rules ensure that tax appeal proceedings strictly follow the Evidence Act.

Taxpayer Identification Number (TIN) Processing: The timeline for issuing TINs has been extended from two working days to five to accommodate administrative delays.

Faster Tax Returns for Ceased Operations: Companies ceasing operations must now file income tax returns within three months, down from six months, to prevent revenue loss.

VAT System Adjustments: Section 22 ensures that taxable supplies are attributed to their place of consumption, addressing regional imbalances.

VAT Fiscalisation System: Section 23 introduces a new regulatory framework to improve VAT collection.

Increased Reporting Thresholds for Banking Transactions:

Individuals: ₦25 million → ₦50 million

Corporate Entities: ₦100 million → ₦250 million

Judicial Oversight on Asset Seizure: Section 60 mandates that tax authorities must obtain a court order before seizing movable assets.

Mandatory Electronic Taxpayer Records Access: Section 61 formalizes the government’s right to access electronically stored tax records in line with modern practices.

New VAT Revenue Distribution Formula:

70% distributed equally among local governments

30% based on population

General Amendments Across Tax Bills

VAT Rate Maintained at 7.5% – The Committee rejected the proposal to gradually increase VAT to 15% by 2030.

Petroleum Gains Tax Reduced to 30% – Section 78 revises the tax rate on petroleum gains from 85% to 30%.

Excise Duty Provisions Removed – Excise duty-related provisions were deleted due to concerns about their negative economic impact.

Higher Turnover Threshold for Small Companies: A business will now be classified as a small company if its annual turnover is ₦100 million or less (asset cap remains at ₦250 million).

New Penalties for Virtual Assets Service Providers (VASPs): Stricter fines and potential license suspensions for non-compliant crypto and digital asset businesses.

While submitting the report, Rep. Faleke highlighted the importance of the tax reform bills in modernizing Nigeria’s tax system, boosting revenue collection, and fostering economic growth.

“These Bills are critical to implementing a modern, transparent, and efficient tax system that will support economic growth and improve revenue collection,” he said.

He added that the review process was extensive, incorporating input from the public and key government agencies, including:

Nigeria Export Processing Zones Authority (NEPZA)

National Agency for Science and Engineering Infrastructure (NASENI)

National Information Technology Development Agency (NITDA)

Tertiary Education Trust Fund (TETFund)

“We carefully examined every submission to ensure that public opinion was reflected in our recommendations. This process involved a thorough review of existing laws proposed for repeal or amendment,” Faleke noted.

The amendments impact key laws, including:

Companies Income Tax Act (CITA)

Value Added Tax Act (VAT Act)

Personal Income Tax Act (PITA)

Federal Inland Revenue Service (Establishment) Act

Petroleum Industry Act

Nigeria Export Processing Zones Act

Oil and Gas Free Trade Zone Act

The House of Representatives is expected to deliberate on the report in the coming weeks as part of its legislative process.

News

Narrow escape: American Airlines plane catches f!re at Denver airport, 12 hospitalised with minor injuries

It was narrow escape for passengers on an American Airlines flight were forced to stand on the wing of the plane at Denver International Airport as they evacuated the aircraft after one of its engines caught f!re Thursday evening, sending thick black smoke billowing into the air.

American Airlines Flight 1006, a Boeing 737-800 en route to Dallas-Fort Worth from Colorado Springs with 172 passengers and six crew aboard, diverted to Denver around 5:15 p.m. local time, after the crew reported “engine vibrations,” the Federal Aviation Administration said in a statement.

“After landing and while taxiing to the gate an engine caught fire,” the statement said. The FAA is investigating.

Shortly before landing, the plane’s pilot notified air traffic controllers in Denver that the flight was experiencing engine issues, but it was not an emergency, according to air traffic control audio from LiveATC.net.

Twelve passengers were taken to the hospital with minor injuries, the Denver Fire Department revealed.

CNN

News

Justice Delivered! Nigerian lady falsely declared dead wins UK court case, retains £350,k home

By Kayode Sanni-Arewa

A 55-year-old Nigerian lady June Ashimola, who was falsely declared dead, has appeared via video link from Nigeria before the UK High Court to prevent a convicted fraudster from seizing her £350,000 home in Woolwich, southeast London.

Ashimola was reportedly declared dead in February 2019, sparking a protracted legal battle over her estate.

However, she presented herself before Deputy Master John Linwood, asserting that she was alive and was a victim of a scam.

According to DailyMail on Wednesday, the court heard that following her wrongfully being declared dead, power of attorney over her estate, which consisted primarily of a house, was granted to Ms. Ruth Samuel, acting on behalf of Bakare Lasisi, who falsely claimed to have married Ashimola in 1993.

However, the judge ruled that the supposed marriage was a fabrication and that Lasisi did not exist.

According to court records, Ashimola left the UK for Nigeria in 2018 and had not returned since.

By October 2022, power of attorney had been awarded to Samuel on behalf of the fictitious Lasisi, who laid claim to Ashimola’s estate.

The judge ultimately found that Tony Ashikodi, a convicted fraudster who served three years in prison in 1996 for obtaining property by deception, had orchestrated the elaborate scheme to seize her home.

“This is an unusual probate claim in that the deceased says she is very much alive,” Deputy Master Linwood remarked, describing the case as a web of fraud, forgery, impersonation, and intimidation.

The root of this claim is a long running battle or campaign waged by a Mr Tony Ashikodi for control and/or ownership of the property.

‘Ms Ashimola left the UK for Nigeria in about October 2018 and has not returned since. This claim involves wide-ranging allegations of fraud, forgery, impersonation and intimidation,” Linwood added.

Despite visa challenges preventing her from appearing in person, Ashimola’s identity was verified through passport photographs, leading the judge to dismiss the claims against her estate.

After reviewing the evidence, Deputy Master Linwood ruled, “’I find Ms Ashimola is alive and that the death certificate was forged and/or fraudulently obtained or produced or concocted.

“Her alleged death was part of Mr Tony Ashikodi’s attempts to wrest control of the property from her.

“The person who appeared before me and identified herself as Ms Ashimola was physically like her photographs in each passport.

“I find that Ms Ashimola was not married to Mr Lasisi and that the marriage certificate is a concocted or fraudulent document for these reasons.

“I do not accept Mr Lasisi exists or if he does is aware of his identity being used. I do not accept that emails supposedly from him were actually from him.”

He further accused Ashikodi of attempting to mislead the court and found that both Ashikodi and Samuel were either directly involved in producing the fraudulent documents or knowingly relied on them.

He added, “I find that the probate power of attorney submitted supposedly by Mr Lasisi and Ms Samuel was a fraudulently produced or concocted document.

“The death certificate was not proven to the necessary standard in that only a copy was produced. The provenance was unknown. There was no evidence before me that it was a genuine document evidencing a real event.

“I find it was forged and/or fraudulently produced or concocted. The persons who relied upon it namely Mr Tony Ashikodi and Ms Samuel were either directly involved in its production or else knew it was false.’”

As a result, the power of attorney was revoked, safeguarding Ashimola’s rightful ownership of her £350,000 property.

The court also heard that legal costs incurred by both parties have exceeded £150,000, an amount that may surpass the property’s equity value.

News

MAN laments 66% rose in manufactured goods exports, insists it’s poor

By Kayode Sanni-Arewa

The Manufacturers Association of Nigeria has said the 65.84 per cent increase in the value of manufactured goods exported in 2024 from 2023, stating it is below expectations.

The PUNCH found that the gross value of manufactured goods exported in 2024 was N2.28tn, an increase from N778.44bn in 2023.

While manufactured goods exports in 2023 were worse than the previous year, export value slumped in the fourth quarter of 2024.

The National Bureau of Statistics’ Foreign Trade in Goods data showed the sector’s export value sustained growth in the first quarter of 2024 with N268.70bn, N480.82bn, and N1.04tn in the second and third quarters, respectively.

However, the export value of manufactured goods dropped by 52.48 per cent in Q4 2024 as the NBS reported a lesser value of 494.22bn.

Secretary of the Manufacturers Association of Nigeria Export Promotion Group, Dr Benedict Obhiosa told The PUNCH in a phone interview that the decline in the manufacturing sector’s Q4 2024 export performance stemmed from a hostile operating environment.

“The operating environment has been very hostile for the manufacturing sector over the past two years, especially in terms of infrastructure,” Obhiosa stated. “The high cost of energy, high cost of borrowing, erratic fluctuations in the exchange rate, among others has culminated in the low performance of the manufacturing sector.”

MAN has called attention to the manufacturing sector’s debilitating state. Earlier in its Q4 2024 Manufacturers Chief Executive Officers Confidence Index, MAN’s Director-General, Segun Ajayi-Kadir noted, “Findings show that production and distribution costs surged further by 18.2 per cent in the quarter under review, from the 20.1 per cent increase witnessed in the preceding quarter.”

Meanwhile, MANEG’s Secretary, Obhiosa disagreed that the improvement in export value from 2023 was not enough to celebrate.

Obhiosa argued that while the NBS data revealed a slight increase, it does not transcend to growth in the sector. He explained that the manufacturing companies were still performing “far below their installed capacity.”

He declared that a more concrete path out of the challenge was an increased government commitment to issuing manufacturers export grants.

“To maximise the potential of the manufacturing export sector, the Federal Government needs to be more deliberate and action-minded about fully implementing the Export Expand Grant aimed at boosting the non-oil export sector in Nigeria,” Obhiosa stressed. “Historically, EEG has been found to have spurred non-oil export growth in Nigeria.”

Obhiosa alleged that the Federal Government was complicit as it had not paid the EEG leading to years of payment backlog.

He explained: “If the Federal Government can be consistent with the payment of EEG, you can rest assured of higher foreign exchange earnings and inflow to Nigeria as export proceeds payments. As a result, many informal sector operators will even be attracted to the formal export channel.”

According to the NBS, the value of manufactured goods traded in Q4 2024 stood at N8.96tn, representing 24.50 per cent of total trade.

The main export commodities were unwrought aluminium alloys exported to Japan and China, dredgers exported to Ivory Coast, and cathodes exported to Japan and China.

The NBS added that manufactured goods were mainly exported to Africa at N215.85bn, followed by exports to Asia valued at N165.97bn and Europe at N62.13bn.

-

Entertainment23 hours ago

Entertainment23 hours agoJust in: Court Orders immediate arrest of VDM

-

News23 hours ago

News23 hours agoSAD! Nigerian Man Slumps, D!es Inside S3x Worker’s Apartment

-

Sports23 hours ago

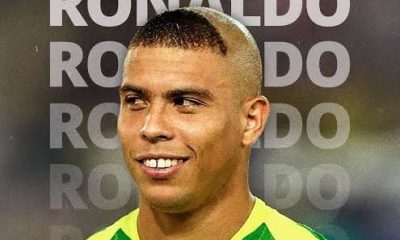

Sports23 hours agoRonaldo pulls out from race to become president

-

News2 hours ago

News2 hours agoPolice confirm report of lady who jumped into lagoon to her d3ath from 3rd Mainland Bridge

-

News14 hours ago

News14 hours agoRivers State Now Cocoa Farm: Ugochiyere Hands over to Adeyanju

-

News19 hours ago

News19 hours agoWike notifies me each time he wants to visit Assembly -Ex-Speaker

-

News20 hours ago

News20 hours agoECS: NSITF partners NUJ to enhance public awareness, targets informal economy

-

News17 hours ago

News17 hours agoNew Tax Laws Will Be Beneficial To Nigerians – Chairman Finance C’ttee