News

CBEX: Ponzi scheme promoters face 10 years jail term, N20m fine

The sudden crash of CBEX, a digital investment platform accused of running a Ponzi scheme that allegedly bolted away with over ₦1.3 trillion (about $850) of depositors’ funds, has thrown many Nigerians into a quandary.

CBEX had promised the gullible Nigerians to double their invested funds within a month, but failed to honour its obligations, sending shock waves running through the spine of thousands of Nigerians, who now face financial ruin after the collapse.

The development sparked widespread reactions, with users expressing frustration, criticism, and concern. Many were reported to have stormed the CBEX office in Oyo State to destroy its belongings.

When it started, CBEX claimed to be a global platform linked to a government-owned business in China. However, Beijing Equity Exchange, in a statement released in 2024, denied any affiliation with the Ponzi scheme. It also claimed to operate offices in Canada and has ties with China. These were never substantiated; rather, CBEX displayed certificates online, such as a US FinCEN registration, while no real branches existed outside Nigeria. Business Insider Africa estimates that about 250,000 to 300,000 Nigerians invested their money in CBEX.

This would have raised a red flag for discerning investors to withdraw their patronage, but that did not happen due to greed and get-rich-quick syndrome.

Following its collapse, the Economic and Financial Crimes Commission (EFCC) announced it would collaborate with Interpol to track down the masterminds, including those possibly hiding overseas.

In the aftermath of the sad development, Chief Economist at SPM Professionals, Paul Alaje, has advocated investment education, highlighting that Nigerians have lost an estimated ₦4.8 trillion to pyramid scams since the collapse of MMM in 2016. “Since MMM in 2016, Nigerians have lost approximately 4.8 trillion to pyramid scams. The pyramid scam is a scheme designed to rip you off of funds. It is only a pyramid scam that promises more interest than the IMF and World Bank put together in a month and sometimes in a week,” Alaje said.

Meanwhile, the Securities and Exchange Commission (SEC) clarified that neither CBEX nor its affiliates were granted registration by the Commission at any time to operate as a Digital Assets Exchange, solicit investments from the public, or perform any other function within the Nigerian capital market.

“Preliminary investigations carried out by the Commission have revealed that CBEX engaged in promotional activities to create a false perception of legitimacy, to entice unsuspecting members of the public into investing monies, with the promise of implausibly high guaranteed returns within a short timeframe.

“CBEX has failed to honour withdrawal requests from their subscribers and abruptly closed their physical offices, amid mounting complaints,” the SEC stated.

The SEC emphasised that under the provisions of Section 196 of the Investments and Securities Act 2025, the Commission would collaborate with relevant law enforcement agencies to take appropriate enforcement action against the CBEX, its affiliates, and promoters.

“The Commission uses this medium to remind the public to REFRAIN from investing in or dealing with any entity offering unrealistic returns or employing similar recruitment-based investment models.

“Prospective investors are advised to VERIFY the registration status of investment platforms via the Commission’s dedicated portal: www.sec.gov.ng/cmos before transacting with them”, the SEC added.

SEC Director General, Dr. Emomotimi Agama, had recently said the Commission is launching a more forceful and coordinated enforcement regime against unregistered and illegal “phony” investment schemes, otherwise known as Ponzi schemes. He said that with the newly enacted Investments and Securities Act, 2025 (ISA 2025), the Commission now has enhanced powers to prosecute Ponzi schemes and their promoters.

According to the SEC, investigations were ongoing on CBEX, adding that promoters of the failed scheme will not go scot-free. Agama said the new law has given the Commission more powers and blocked loopholes in emerging areas of virtual and digital assets.

“The ISA 2025 has given the Commission the legal backing to provide clarity, ensure investor protection, and enhance market confidence, especially in new and previously unregulated segments such as digital asset exchanges and online foreign exchange platforms,” Agama said. He said that while the apex capital market regulator would continue to support innovations in finance and investments, the Commission would maintain strict oversight in line with its enhanced investor protection mandate. “We welcome innovation, but it must occur within a regulated environment that protects investors and maintains the integrity of our market,” Agama said.

He recalled that the SEC had even with the limited scope of the repealed Act, maintained extensive surveillance and was able to shut down a number of Ponzi schemes, with some of the promoters, like Fahmzi Interbiz, jailed for defrauding Nigerians. The ISA 2025 gives the Commission more powers to deal with issues, stressing that the Commission will ensure that promoters of such schemes are not allowed to operate.

Indeed, the performance of the Nigerian capital market has been reinvigorated for sustainable growth in line with global best practices. The market has been modernised with a stronger regulatory framework for financial market infrastructures (FMIs), ensuring stability and reducing systemic risks, notwithstanding the global headwinds occasioned by the Donald Trump tariff war.

Indeed, the Nigerian capital market has been enhanced by the Investments and Securities Bill (ISB) 2025, recently assented to by President Ahmed Bola Tinubu. The landmark legislation, which repeals the Investments and Securities Act No. 29 of 2007, has been described as a major boost to capital market regulation in Nigeria. It strengthens the legal framework of the Nigerian capital market, enhances investor protection, and introduces critical reforms to promote market integrity, transparency, and sustainable growth.

The enactment of the ISA 2025 reaffirms the authority of the Securities and Exchange Commission (SEC) as the apex regulatory authority of the Nigerian Capital Market to regulate the market to ensure capital formation, the protection of investors, and the maintenance of a fair, efficient, and transparent market and reduction of systemic risks. It introduces transformative provisions to further align Nigeria’s market operations with international best practice.

Speaking on key highlights of the Act, Director General of the SEC, Dr. Emomoitimi Agama said, “The Act enhances the regulatory powers of the SEC in a manner comparable with benchmark global securities regulators. These enhanced powers and functions ensure full conformity with the requirements of the International Organization of Securities Commissions (IOSCO) Enhanced Multilateral Memorandum of Understanding (EMMoU), enabling the SEC to retain its “Signatory A” status and enhancing the overall attractiveness of the Nigerian capital market.”

One notable aspect of the ISA 2025 is the recognition of digital assets as securities, providing a legal framework for Virtual Asset Service Providers (VASPs) and Digital Asset Exchanges. For the first time, virtual assets and investment contracts are formally classified as securities under Nigerian law. This brings VASPs, Digital Asset Operators (DAOPs), and Digital Asset Exchanges under the SEC’s regulatory purview, providing a clear legal framework for digital assets.

The new Act provides for “Enforcement Against Illegal Investment Schemes”. It expressly prohibits Ponzi Schemes and other unlawful investment schemes, while prescribing stringent jail terms and other sanctions for the promoters of such schemes. To ensure that illegal fund managers are not allowed to fleece unsuspecting Nigerians of their hard-earned funds, the Act stipulates an express prohibition of Ponzi/Pyramid Schemes and other illegal investment schemes. The Act stipulates that promoters and operators of any entity engaged in a prohibited scheme commit an offence and are liable on conviction to a penalty of not less than N20,000,000 or imprisonment for a term of 10 years or both. This is a transformative step for the capital market, reflecting a commitment to building a dynamic, inclusive, and resilient capital market.

Similarly, salient provisions of the Act address existing restrictions in respect of funds raising from the capital market by Sub-Nationals and their agencies to allow for greater flexibility. State and local governments can now raise funds through the capital markets for public projects like infrastructure or healthcare.

This reduces their reliance on federal allocations or debt, fostering economic development at sub-national levels while increasing transparency in fund utilisation.

Furthermore, transparency in securities transactions has gained traction in the market as the Act introduces the mandatory use of Legal Entity Identifiers (LEIs) by participants in capital market transactions. This stipulation is designed to improve transparency in the conduct of securities transactions.

In the same vein, ISA 2025 introduces a stronger regulatory framework for financial market infrastructures (FMIs), such as clearing houses and central depositories, ensuring stability and reducing systemic risks in Nigeria’s capital markets. It creates a legal framework for commodity exchanges and warehouse receipts, allowing for more structured commodity trading and agricultural financing. This is particularly important for Nigeria’s agricultural and mining sectors, which were not well-integrated into the capital market under the ISA 2007. Under the new law, public companies must obtain SEC consent before engaging in mergers, acquisitions, or issuing securities.

The Act mandates that no public company shall undertake schemes, transactions, arrangements, or issue securities related to corporate actions and restructurings without prior approval from the SEC. The idea is to ensure that corporate restructuring activities comply with market regulations and enhance transparency.

Some other provisions of the Act include Comprehensive Insolvency Provisions for Financial Market Infrastructures, which introduce provisions that exempt transactions facilitated through or otherwise involving Financial Market Infrastructures from the application of general insolvency laws.

Management of Systemic Risk – introduces provisions for the monitoring, management and mitigation of systemic risk in the Nigerian capital market. Expansion of the Category of Issuers to the Public – The Act expands the categories of issuers, as a key step towards the introduction of a wide range of innovative products and offerings as well as the facilitation of “commercial and investment business activities”, subject to the approval of the Commission and other controls stipulated in the Act. Classification of Exchanges and inclusion of provisions on Financial Market Infrastructures – The Act classifies Securities Exchanges into Composite and Non-composite Exchanges. A Composite Exchange is one in which all categories of securities and products can be listed and traded, while a Non-composite Exchange focuses on a singular type of security or product. There are also new provisions on Financial Market Infrastructures such as Central Counter Parties, Clearing Houses, and Trade Depositories.

Comprehensive Insolvency Provisions for Financial Market Infrastructures – The Act introduces provisions that exempt transactions facilitated through or otherwise involving Financial Market Infrastructures from the application of general insolvency laws. Management of Systemic Risk – The Act introduces provisions for the monitoring, management and mitigation of systemic risk in the Nigerian capital market. Expansion of the Category of Issuers to the Public- The Act expands the categories of issuers, as a key step towards the introduction of a wide range of innovative products and offerings as well as the facilitation of “commercial and investment business activities”, subject to the approval of the Commission and other controls stipulated in the Act. Strengthening the Investments and Securities Tribunal – The Act amends some key provisions in the repealed ISA 2007 on the Composition of the Tribunal, constitution of the Tribunal, qualification and appointment of the Chief Registrar, as well as the jurisdiction of the Tribunal to enhance the ability of the Tribunal to discharge its mandate optimally.

The capital market expert said the enactment of ISA 2024 is a welcome development that promises to modernize Nigeria’s investment and securities laws, improve regulatory oversight, protect investors, and support emerging financial technologies.

According to Prof Uche Uwaleke, Director of the Institute of Capital Market Studies at the Nasarawa State University Keffi and President of the Capital Market Academics of Nigeria, “For achieving this feat, the National Assembly Committees on the Capital Market, the Securities and Exchange Commission, and indeed the entire Capital Market community in Nigeria deserve a pat on the back.

“It bears repeating that the ISA 2025 ensures a more transparent, efficient, and competitive capital market consistent with global standards set by the IOSCO. This should strengthen investor confidence, enhance market integrity, encourage foreign investment, and ensure that Nigeria retains its “Signatory A” status under IOSCO’s Enhanced Multilateral Memorandum of Understanding (EMMoU).

News

Just in: Lagos LG chairman slumps during APC meeting

The Chairman of Bariga Local Government Area of Lagos State, Kolade Alabi, on Wednesday, suddenly slumped at the All Progressives Congress stakeholders’ meeting held at the party’s Secretariat in Ikeja, the state capital.

According to The PUNCH, Alabi, who is the state chairman of the Association of Local Government of Nigeria, was addressing party members when the sad incident occured.

Fortunately, he was immediately revived and rushed away to the hospital in an ambulance for further treatment.

Details shortly…

News

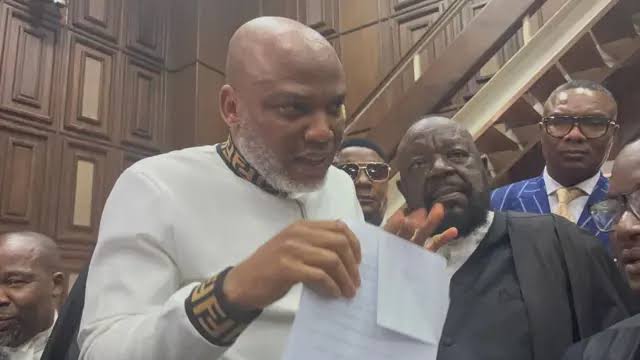

Multiple video evidence against Nnamdi Kanu

The Federal High Court in Abuja on Wednesday, admitted a video recording allegedly showing the leader of the Indigenous People of Biafra (IPOB), Nnamdi Kanu issuing inflammatory directives which the prosecution claims incited acts of terrorism across the South – East region of the country.

The Wednesday proceedings resumed with the continuation of the testimony of the second Prosecution witness, an operative of Department of State Services (DSS) codenamed PWBBB.

In the video played in open court, Kanu was seen addressing his followers in what he called, “the blessed land of Biafra”, wherein he announced the formation of the Eastern Security Network (ESN), urging followers to defend their land against what he referred to as “Fulani domination.”

He warned political leaders in the region against compromises and issued a directive forbidding the presence of fulani herdsmen, saying, “No Fulani parading as herdsman shall be allowed in our land. If you are an agent of the Fulani, turn your way this evening.”

The device was admitted as evidence alongside a certificate of compliance, despite objections from the defence.

They were marked as Exhibits PWA and PW1, respectively.

The court also admitted a letter dated June 17, 2021, authored by the former Attorney General of the Federation, Abubakar Malami, SAN, which accused Kanu of terrorism, murder, and incitement to violence.

The letter, addressed to the DSS, was tendered without objection and marked as Exhibit PWF.

Reading from the document, the witness, who was led in evidence by the prosecuting counsel, Chief Adegboyega Awomolo, SAN alleged that Kanu’s broadcasts were followed by coordinated attacks on police stations and correctional facilities, resulting in loss of lives and property.

He quoted the petition as saying Kanu had instructed that security operatives be “brought down” and their weapons seized.

News

Just in: Security and Exchange Commission declares PWAN as PONZI scheme, cautions Nigerians

Securities and Exchange Commission (SEC) has alerted the public on the activities of Property World Africa Network (PWAN), which holds itself out as a real estate investment company and solicits funds from the public for investment purposes through PWAN MAX.

In a statement on Tuesday, the SEC said PWAN/PWAN MAX are not registered either to solicit investments from the public or operate in any other capacity within the Nigerian capital market.

The SEC said investigations revealed that PWAN’s operations exhibit the typical indicators of a fraudulent Ponzi scheme, including the promise of unusually high returns and failure to honour withdrawal requests from subscribers.

“Accordingly, the public is strongly advised to be wary about investing with PWAN/PWAN MAX, as any person who places such investment with these entities, does so at his/her own risk.

“The commission similarly reminds potential investors of the need to verify the registration status of investment platforms via the commission’s dedicated portal: www.sec.gov.ng/cmos before transacting with them,” the SEC said.

(The Guardian)

-

News7 hours ago

News7 hours agoReal cause of Herbert Wigwe’s helicopter crash revealed

-

Politics8 hours ago

Politics8 hours agoUghelli North PDP Holds Crucial Meeting

-

News13 hours ago

News13 hours agoTinubu presents N1.78 trillion FCT budget to NASS

-

News24 hours ago

News24 hours agoEdo Speaker, Two Other Lawmakers, Formally Join APC

-

News13 hours ago

News13 hours ago2027: Why Obi should reject VP slot — Tinubu’s aide

-

News13 hours ago

News13 hours agoNnamdi Kanu wanted more states for Biafra – DSS

-

Economy7 hours ago

Economy7 hours agoSEE Black Market Dollar to Naira Exchange Rate Today – 7th May 2025

-

News13 hours ago

News13 hours agoUromi Killings: Senate Proposes Oversight of Vigilante, Hunters