News

Like CDMA to GSM, ISPs May bow to Starlink

By Sonny Aragba-Akpore

Apart from telecommunications companies (telcos) who provide ubiquitous internet services today,only few conventional internet service providers (ISPs) offer pockets of a semblance of service.

The situation now is akin to the advent of Global System of Mobile Communications (GSM) in 2001 when everyone migrated seamlessly to Digital Mobile Service.

Before GSM ,there were Time Division Multiple Access (TDMA),Code Division Multiple Access (CDMA) among others.But all that has now been confined to the dustbin of history.

No one,not even telecommunications regulators,the Nigerian Communications Commission (NCC) can volunteer reasons for the extinction of these once vibrant operators that provided services despite the threat of comatose Nigerian Telecommunications Limited (NITEL).

Industry players are also strangely silent about the fate of TDMA , CDMA and others.

If we saw the threat of GsM to TDMA and CDMA,are we seeing in clear terms the likely fate that will befall Internet Service Providers (ISPs) following the entry of Elon Musk’s Starlink in the Nigerian telecom environment?

Starlink came with disruptive technologies that are already making a world of difference for consumers and we look on as if nothing is happening.

The company came prepared.

It obtained licences from the NCC and got various permits and approvals to flag off the business of internet services via satellite and equally signed Memorandum of Understanding (MoU) and distribution agreements with Nigerian companies including,Technology Distribution Africa (TD),a big distributor of major technology brands and promoted by a restless technology czar ,Leo Stan Ekeh.

Starlink didn’t stop there ,it has decided to take services to even the unserved and under served communities in Nigeria and parts of Africa for which TD boasts it’s ready for the long haul partnership.

Although,the Internet connectivity provider, Starlink has prohibitive entry level and subscription prices, it’s still going on with what it sees as an agenda for a potential captive market as a result of not very robust services by other ISPs and when it slashed the price of its hardware to N440,000 recently,the company thought it was doing a big Favour to subscribers.

This follows the recently increasing strengthening of the naira against the dollar.

This accounted for 45 per cent reduction from the N800,000 cost of the hardware router earlier.

According to a new price update released by the company, the monthly subscription for the internet service remains unchanged at N38,000.

“N440,000 new hardware price. Unlimited high-speed internet for N38,000 per month,by every standard is high and prohitive “but it is available everywhere in Nigeria,” the internet company said on its website.

As of February 2024, the Starlink router was sold for N378,000. An increment regime implemented in early March saw a price jump to N800,000. This was evidently in response to the rapidly declining value of the naira to as high as N1900 to a dollar.

But by Starlink,s aggressive marketing being deployed ,can indigenous ISPs cope with this complex competition?

So far ,both wireless and cable ISPs are jolted and returning to the drawing board to rejig their strategies for competition with Musk reputed to be one of the richest men in the world.

And with satellite infrastructure dotted around the globe,Starlink is ready to give local ISPs a run for their money?

Will Starlink push local ISPs into extinction and out of relevance like GSM did to CDMA?

Space Exploration Technology Corporation (Space X ) owners of Starlink got six licenses in a roll from the NCC and is expected to deploy nearly $30b over time for the Nigerian operations alone.

The government is excited that with the entry of Starlink,it may achieve 70% broadband connectivity by 2025 as enshrined in the National Broadband Plan (NBP) 2020–2025.

But is the government just desperate to achieve this at the expense of low purchasing powers of subscribers?Time will tell.

Starlink,s six licenses include that for ISP, Gateway Service Provider,international Data Access (IDA),Sales and Installation Major,Gateway Earth Station and Very Small Aperture Terminal (VSAT) thus making it a mega player and a big threat to other players in the industry.

Starlink officially announced its presence in Nigeria in January 2023. The company, which initially quoted its prices in dollars at $600 for the hardware and $43 for the subscription, changed to naira upon its official announcement.

According to Internet Service Providers (ISPs) data released by the Nigerian Communications Commission (NCC), Starlink is now one of the leading ISPs in Nigeria in terms of customer numbers. As of Q3 2023, Starlink Nigeria’s customer base stood at 11,207.

While cable cuts remain a nightmare,Starlink’s boasts of bridging the gap, with its potential impact extending far beyond addressing temporary outages. These include reaching Underserved Areas where Traditional ISPs often struggle to reach remote regions due to the high cost of infrastructure deployment.

Starlink’s satellite-based approach can effectively bridge this gap, offering high-speed internet access to previously underserved communities by unlocking educational and economic opportunities for millions of Nigerians currently excluded from the digital world.

Starlink boosts Business Continuity by avoiding Frequent internet disruptions that can be detrimental to businesses, especially those reliant on online operations.

Starlink claims to be reliable with independent internet access that can provide much-needed resilience, ensuring business continuity even during cable outages.

The recent cable cuts hampered online learning and remote work arrangements. Starlink’s stable internet connection may have facilitated smoother online learning experiences for students and enable seamless remote work for professionals across the country.

But that is where the beauty ends.

TD Africa, the major distributor for Starlink said , it planned to leverage Starlink’s unique selling points such as high speed, low latency, broad coverage and scalability to bridge the digital divide.

In 2023, Starlink’s global customer base rose to 2.3 million with a presence in over 70 countries

According to the agreement, TD Africa’s extensive distribution network and experience coupled with Starlink’s high-speed Internet aimed to deliver innovative solutions and services that offer broadband connectivity, promoting economic development across Africa.

TD Africa, founded some 24 years ago, will distribute Starlink Internet Kits across Nigeria. It has over 27 global companies including Microsoft, IBM, Apple, Cisco, Hewlett Packard, Dell Technologies, Samsung, Huawei, Nokia, Lenovo, Asus, and many more on its distribution network.

TD Africa’s Coordinating Managing Director, Mrs. Chioma Chimere, highlighted the synergy between TD Africa’s experience as a leading distributor of technology and business solutions and Starlink’s commitment to transforming how the world accesses the internet.

She expressed excitement about the growth opportunities this agreement presents across the continent while emphasising TD Africa’s mission to provide accessible, affordable, and usable Internet solutions to individuals and businesses.

TD Africa boasts that” this transformative agreement signals a new era for Internet access in Africa, with Starlink and TD Africa leading the charge in providing innovative and reliable solutions to meet the evolving needs of the digital economy.”

As at March 2024,internet subscribers base stood at 164,368,292 .Of this figure,GSM accounts for 163,895,185.

ISPs accounted for 213,876 while Voice Over Internet Protocol (VoIP) accounted for 238,139 and fixed/ cable connections stood at 21,092.

By March 2024 too,the number of ISPs stood at 255 and these include the followings:

Spectranet Ltd,Astramix Ltd,VDT Comms Ltd,Cobranet Ltd,Ngcom Ltd,MainOne, an Equinix Company,Hyperia Ltd,I-World Networks Ltd.

There are Inq. Digital Nigeria Ltd (formerly Vodacom),Galaxy Backbone Limited,

Dotmac Technologies Ltd,Radical Tech Network Ltd,Cyberspace Network Ltd,

Suburban Broadband Ltd ,IPNX,Tizeti Network Ltd among others.

Currently, Starlink does not offer truly unlimited data plans in Nigeria though there are reports of data prioritization being implemented in some regions during peak usage times. However, data caps are reportedly quite generous, exceeding the average data consumption of most Nigerian internet users.

Nonetheless,Fiber optic internet offers the fastest and most reliable internet connection currently available. Speeds can reach up to 1 Gigabytes per second (Gbps) and are less susceptible to latency issues compared to satellite internet. In all ,fiber optic infrastructure is expensive to deploy and maintain, limiting its availability in remote areas but more reliable.Starlink offers a faster and more consistent option than traditional satellite internet but may not match the raw speed of fiber.

Starlink offers a significant advantage over mobile data technologies like Long Term Evolution (LTE).

While LTE offers average download speeds between 30-100 Mbps, Starlink’s current minimum download speed of 25 Mbps already surpasses baseline LTE speeds. With potential future upgrades, Starlink could significantly outpace even the fastest LTE connections available in Nigeria.

Nigeria is currently one of Africa’s largest consumer markets, and the way people shop has evolved significantly. The internet has influenced a shift in consumer spending behaviour. As more people gain internet access, they explore online options like subscriptions, selling used items, or venturing into rental services. It’s a situation of where convenience and adaptability reign supreme. For example, when Nigerians experienced a cash crunch earlier in the year, they quickly adapted to cashless systems. However, changing landscape has resulted in substantial e-commerce spending in Nigeria, according to the international trade administration, the market generates approximately $13 billion yearly and is expected to hit $75 billion in revenue yearly by 2025.

So far this growth has been fueled by the increasing internet penetration. Now with even more people having internet presence connectivity, businesses have access to a vast pool of potential customers, creating economic growth, and attracting investments to the e-commerce sector.

The surge in internet users in Nigeria also means an abundance of valuable data for businesses to leverage. With a larger customer base and increased online activity, companies have access to a wealth of information about consumer behaviour, preferences, and purchase history. By understanding their customers better, companies can personalize their offers and make sure they’re giving people what they want.

We saw this happen during the pandemic when many stores had to change how they did business and offer new services.”

News

Ibas Pledges Commitment to Workers’ Welfare

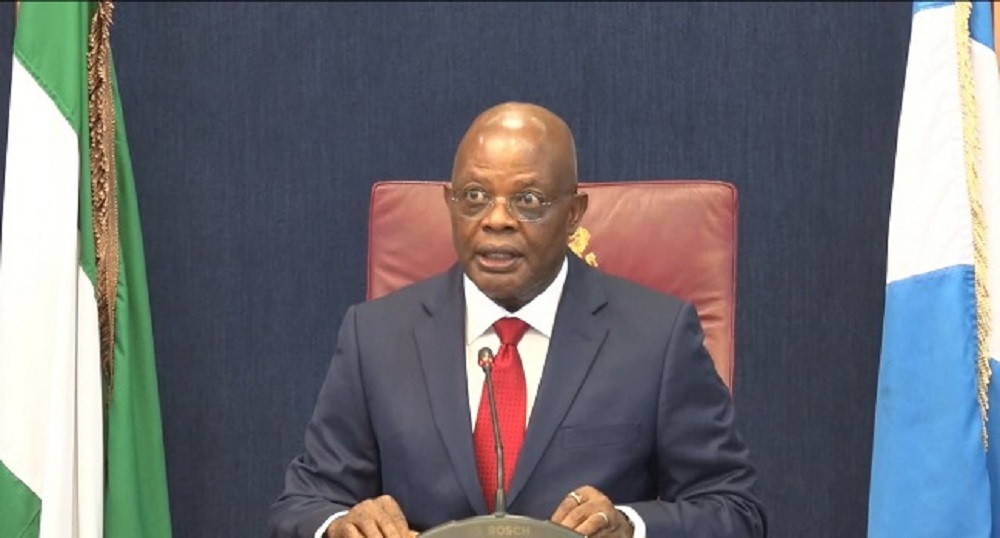

The Administrator of Rivers State, Retired Vice Admiral Ibok-Ete Ibas, has reaffirmed his commitment to improving the welfare of workers across the state.

This assurance was given during a meeting with the leadership of organised labour unions held at the Government House in Port Harcourt.

According to a statement issued by the Senior Special Adviser on Media to the Administrator, Hector Igbikiowubo, the meeting served as a platform for open and constructive dialogue on critical labour matters.

The statement outlined key areas of intervention currently being addressed by the government.

These, he said, included the timely payment of salaries and pensions, as well as the resolution of salary arrears, with approval already granted for the payment of newly employed workers at the Rivers State University Teaching Hospital and the judiciary.

Similarly, he said medical workers in the local government areas would receive their proper wages.

He said the minimum wage was being implemented for all local government employees across the state.

The administrator also noted that his administration was currently reviewing challenges related to the contributory pension scheme, ahead of the July 2025 implementation deadline.

Ibas disclosed that plans were underway to expand the fleet of intervention buses reintroduced to ease the transportation burden of workers.

On capacity building, the administrator announced that specialised leadership training for senior civil servants would begin within the next two weeks.

He also revealed that the government was actively considering the implementation of the N32,000 consequential pension adjustment, along with measures to clear outstanding gratuities owed to retirees.

While commending workers for their dedication to service, he called for continued collaboration with labour unions to ensure lasting industrial harmony in the state.

According to the statement, the State Chairman of the Nigeria Labour Congress (NLC), Alex Agwanwor, expressed appreciation to the administrator for the steps already taken to promote workers’ welfare.

Agwanwor also lauded the government’s openness to dialogue and pledged the sustained support and cooperation of labour unions in achieving shared goals.

Meanwhile the NLC has directed its members in the state to observe the International Workers’ Day as a peaceful rally, which is expected to be held within the premises of the union, involving all affiliate unions, and would focus on advocating for the restoration of democratic governance in the state.

News

Just In: Explosion rocks Borno military barracks

Panic has gripped residents of Maiduguri, the Borno State capital, as multiple explosions rocked the Giwa Barracks in the early hours of Thursday.

The incident reportedly began at about 12:05 am, with residents in the vicinity forced out of their homes by the sounds of loud blasts and the sight of red flares lighting up the sky around the barracks.

While the cause of the fire is yet to be ascertained, residents living in the area confirmed that the blast came from the armoury area

One of the residents, Rakiya Garba, confirmed the presence of men of the fire service, with sirens sounding all around the area

“We are safe, but we are in fear. The explosion is coming from inside the barracks. It is not an attack because we are not hearing gunshots.

“However, it has been a sporadic explosion,” she confirmed

Meanwhile, the Deputy Governor of Borno state, Dr Umar Kadafur, has called for patience, saying that the explosion is a result of a fire incident that erupted at an Armoury of Giwa Barracks

He dismissed reports speculating that it was a Boko Haram attack.

He encouraged everyone to remain indoors, as security operatives are on top of the situation.

News

CBEX restarts operations despite SEC ban, N1.2tn EFCC investigation

Despite the alleged N1.2tn digital trading fraud that reportedly affected over 600,000 Nigerians, the embattled Crypto Bridge Exchange trading platform, accused of these acts, has resumed operations, announcing fresh withdrawal options in a move to restore investor confidence.

Two traders on the CBEX platform confirmed to The PUNCH on Wednesday that the digital trading firm has quietly resumed operations, allowing new users to register, trade, and withdraw profits, despite ongoing investigations by regulatory agencies.

According to the sources, an insurance verification process and an external audit of the company’s financial records are currently underway to ascertain the actual amount lost in the scheme, which collapsed in April.

They added that existing investors, many of whom have been unable to access their funds for weeks, will be able to take out their funds starting from June 25, 2025, when the audit is expected to be concluded by an insurance firm based in the United Kingdom.

This development comes barely weeks after the Securities and Exchange Commission declared the platform illegal, and the Economic and Financial Crimes Commission confirmed an ongoing investigation into the firm’s operations.

CBEX, a digital investment platform, offered investors 100 per cent profit after 30 days of purported AI trading. The trading platform started operations in 2024 after receiving registration approval from the Corporate Affairs Commission on September 25, 2024, and the EFCC’s Special Control Unit Against Money Laundering on January 16, 2025.

No fewer than 600,000 Nigerians reportedly invested in the scheme and lost N1.2tn after it collapsed on April 14, 2025.

Miffed by the development, the EFCC declared eight persons wanted for promoting the program. They include Johnson Oteno, Israel Mbaluka, Joseph Michiro, Serah Michiro, Adefowora Olanipekun, Adefowora Oluwanisola, Emmanuel Uko, and Seyi Oloyede.

On Monday, Adefowora Abiodun, a prominent leader and trader on the platform, voluntarily surrendered himself to the anti-graft agency for interrogation.

Other regulatory agencies, such as the SEC, also condemned the operations of the suspected Ponzi scheme, warning Nigerians to exercise extreme caution and steer clear of investment platforms that offer unrealistic returns under the guise of digital trading.

However, in defiance of regulatory warnings, fresh findings by The PUNCH on Wednesday revealed that more Nigerians are still being lured by promises of quick profits, with new users flocking to the platform in hopes of cashing in on its resumed operations.

One of the sources told one of our correspondents in confidence due to lack of authorisation to speak on the matter, that withdrawal options on the CBEX platform had been reactivated, noting that while new accounts could process withdrawals, funds from older accounts—allegedly wiped—remained inaccessible for now.

The trader noted that the platform is making efforts to clear its name of any allegations of fraud or any association as a Ponzi scheme.

The source said, “People can now withdraw from the CBEX platform. The withdrawal option has been activated. Let me explain the withdrawal. The old account was wiped; you can’t take out funds from it yet. On the 14th of this month, the Artificial Intelligence on the platform traded 100 per cent, lost its trade, and wiped people’s money out.

“But now, the promoters are saying that the platform and the CBEX application are insured, with verification of funds ongoing by the insurance company. Now, previous investors who have $1,000 as their capital would have to inject $100, and the former account balance would be restored, while persons with over $1,000 would have to put in $200 to bring back the account balance. And we have started seeing people put in these funds to get back their money, and are using it to trade now, as I talk to you.

“According to the latest information shared, previous investors can only trade but not withdraw because the United Kingdom government is carrying out an audit on their financial account, which will be completed between 30 to 60 days. Hence, the reason why previous investors cannot withdraw their funds yet.

“But from June 25th, you can now withdraw up to 50 per cent of your capital from the old account. For example, if you invested $1,000 and you could only withdraw $200 before, from the 25th, you can withdraw $400 from the remaining $800 capital, then from August 25th, you can withdraw the remaining $400 capital. But if you don’t do the verification, it won’t reflect in your account.”

Another source explained that fresh investors are currently able to register new accounts, fund them, and withdraw profits without restrictions, as the newly created accounts are not subject to ongoing audits.

According to the source, only the old accounts remain under financial review.

The promoters also refute allegations of fraud, insisting that funds remain intact and that the ongoing audit was focused on reconciling discrepancies in old accounts.

“Currently, fresh investors can register a new account, fund it, and withdraw their profit. The new accounts are not under audit. It is the old account that is under review.

“What they are auditing is because the Federal Government said they scammed Nigerians of N1.2tn, and they are insisting that the amount is not up to half of the publicised amount. They are claiming only N126bn was lost, and that is the reason for the audit. But new accounts can now start investing and get their money. There is also a bonus for referrals that you can withdraw immediately, and this is ongoing currently.

“They just want to prove to Nigerians that they are not scammers. It was just because AI traded 100 per cent of the funds that the money was lost. There is a new group where people can say whatever they want to say; they also drop signals for trading three times a day, but it is no longer automated; you have to do it by yourself. They would give you a code; you just have to put it in your account and trade. If you notice any abnormality, you can cancel it. That was how it was before AI started doing the trading,” the source stated.

When questioned on why the audit was not conducted by the Nigerian government, a source explained, “The firm is registered in the United Kingdom, not in Nigeria. They merely extended their operations here. In fact, they also have branches in Kenya, South Africa, and Egypt.”

Similarly, messages sent to a new Telegram group created for information sharing showed that a person could withdraw referral bonuses.

Addressing concerns from interested members in a user group, an admin identified simply as Laura stated that the specific cause of the platform’s issues was still under investigation, adding that the findings of the ongoing probe by the UK government would determine what is eventually made public.

The message read, “There are some factors in the incident on April 14th that I cannot tell you in detail. I can only tell you that Al was attacked and the trading strategy was tampered with.

“This is why some users who did not turn on HOSTING were able to survive. And this attack was definitely not from an individual, because Al’s firewall cannot be easily breached. Including the Bybit hacker incident last month, it was definitely not something that an individual could do. This was an organized and premeditated action.

“The specific cause is under investigation, and we need to wait for the official investigation results of the UK government before we make it public. As for this channel, some scammers affected by ST and online rumour mongers who received donations from scammers deliberately stigmatized the compensation.

“Some rumour mongers even claimed that CBEX administrators transferred more than $800m in assets. These are purely slanderous rumours. An exchange’s payment system can’t have only one common account. The payment system will randomly generate deposit addresses. These are all procedures of the exchange Including any wallet we use now will regularly update the deposit address.”

According to her, users must first accept the claims process initiated by the insurance company linked to the ST Fund firm.

She said, “We need to accept the claims processing of the insurance company that the ST fund company is tied to.”

The process involves verifying the authenticity of each account before any compensation can be issued for losses allegedly caused by the AI-related incident on April 14.

She added that many users have already begun receiving compensation.

“Moreover, the impact of this incident on the Internet has seriously exceeded our expectations. The UK government has also been negotiating with the Nigerian government.

“So the EFCC of Nigeria also contacted the CBEX official yesterday and provided absolute evidence through ST, proving that the ST fund company has indeed compensated users for their losses. You know the EFCC of Nigeria… If they are not absolutely sure, how can they have such courage to say to the public, ‘you will get your money back?’”

Efforts to get the EFCC’s spokesman, Dele Oyewale, reaction on the latest development proved abortive. He did not pick up calls to his line and was yet to respond to a message sent to him on the matter.

However in furtherance of its investigation, the anti corruption agency has declared a foreign national, Elie Bitar, wanted for his alleged involvement in a cryptocurrency investment fraud linked to the online trading platform, Crypto Bridge Exchange.

In a bulletin released on Wednesday via the commission’s official social media platforms, the EFCC called on members of the public with useful information about Bitar’s whereabouts to contact any of its offices nationwide or reach out through its hotlines and email.

His last known address, according to the EFCC, is Eng. George Enemoh Crescent, Lekki Phase 1, Lagos.

It read, “The public is hereby notified that ELIE BITAR, whose photograph appears above, is wanted by the EFCC for fraud allegedly perpetrated on an online trading platform called Crypto Bridge Exchange,” the statement read.

Meanwhile, the Nigerian Financial Intelligence Unit has issued a strong advisory warning Nigerians against engaging in unregulated digital asset investment platforms, many of which exhibit traits of Ponzi and pyramid schemes.

In an advisory released on Wednesday, the NFIU flagged multiple online platforms—including eWealth Connect, WWCoin (also known as TOFRO), Delux, and ADK—as posing significant financial risks due to lack of regulatory oversight, unrealistic profit promises, and deceptive marketing tactics.

Among the platforms named, the NFIU described ADK, an investment and betting platform as dangerous to invest in due to its deceptive profit claims, multi-level agent system, and predatory practices in jurisdictions with limited investor protection.

The advisory partly read, “ADK is a high-risk investment and betting platform that profits through a 9 per cent withdrawal fee and investor losses, particularly targeting users in regions without compensation agreements.

“It operates with a multi-level agent system (e.g Junior/Gold Agents) where earnings depend on recruitment and trading losses, while advertising a deceptive 97 per cent win rate that hides low-profit margins. With its reliance on unsustainable recruitment rewards and selection. ADK exhibits strong red flags of a potential Ponzi scheme or scam, making it a dangerous platform for investors.”

The advisory also said EWC was identified as a community-driven trading platform launching on the Solana blockchain, offering daily P2P auctions and tiered investment packages.

NFIU said, “eWealth Connect is a decentralised, community-driven platform built on the Solana blockchain, designed to revolutionise digital asset trading through peer-to-peer (P2P) auctions. Launching in Q4 2024, it offers features like dual daily trading sessions, transparent pricing, and real-time settlements, with a focus on emerging markets like Nigeria.

‘’The platform’s native EWC token provides utility such as reduced fees, governance rights, and exclusive trading benefits. EWC emphasizes community empowerment, allowing users to participate in platform development and governance while offering tiered investment packages with projected returns. Despite its ambitious roadmap, including international expansion and NFT integration, the platform’s sustainability and regulatory compliance remain to be tested, warranting cautious evaluation by potential users.“

Despite its innovative design and roadmap, the NFIU cautioned that its regulatory compliance remains untested.

The NFIU also cautioned the citizens especially students, freelancers and content creators among others about Delux, a platform designed to help users to monetize their activities online.

“Delux is a platform designed to help users monetise their online activities, particularly through social media engagement (like TikTok), content creation, and completing daily tasks. It promotes financial freedom by offering flexible earning opportunities, such as referral rewards, task-based income, and content monetisation, with an emphasis on simplicity and accessibility.

“While it targets students, freelancers, and creators, users should verify its legitimacy, payment proofs, and terms to ensure it’s not a pyramid scheme or scam. Always research before investing time or money, “ the advisory stated.

The NFIU flagged WWCoin (TOFRO) as exhibiting “classic Ponzi characteristics with its unrealistic daily returns of up to 6 per cent, alongside aggressive deposit incentives and high withdrawal fees.

“WWCoin (aka TOFRO) is a newly launched trading platform (as of October 2024) that offers daily trading signals, deposit bonuses, and promises high returns (1 per cent profit per signal, totaling 6 per cent daily). Key features include a minimum deposit of $100, withdrawal fees (20 per cent before doubling funds, 10 per cent after), and extra signals for larger deposits.

“However, the platform raises significant red flags, such as unrealistic profit claims, high withdrawal fees, lack of regulatory transparency, and aggressive deposit incentives, all common traits of Ponzi schemes or high-risk scams,” the advisory noted.

The advisory highlighted common red flags Nigerians should watch out for, including guaranteed high returns with zero risk and the absence of regulatory approval or licensing.

“Unrealistic or Guaranteed Returns: Promises of fixed daily, weekly, or monthly ROI, e.g “5 per cent daily for life” or “15 per cent or more monthly return.” Claims like “your money works for you 24/7 with zero risk.” It is suspicious because legitimate investments tied to market performance cannot guarantee consistent high returns, especially with crypto volatility, “the advisory stated.

The advisory warned against schemes whose revenue depends on referrals rather than product or service delivery.

It said, “Overemphasis on Referrals and Affiliates: Income is primarily earned from recruiting new investors, not from actual product or trading activity. Referral bonuses or commissions for every new investor brought in. Classic pyramid and Ponzi structures rely on continuous recruitment to fund payouts. Use of Newly Created or Unknown Tokens: Platform issues its own token (e.g., “XToken” or “Pinkoin”) with no market value or external exchange listing. Promotes speculative token value without utility or governance model. Many Ponzi schemes mint fake tokens to simulate value and lure victims.

“Fake Partnerships and Credentials: False claims of affiliations with International Organisations like the United Nations, World Bank, Binance, Coinbase, etc. Fabricated endorsements by celebrities or government officials.”

The advisory added, “Opaque Business Model: Vague explanations of how profits are generated e.g.g “AI-driven crypto trading” or “quantum blockchain technology” with no evidence). No whitepaper, audited financials, or identifiable fund managers. It is a red flag because transparency is a hallmark of legitimate financial operations.

“Pressure to Act Quickly: Limited-time offers, countdown clocks, or “investment windows” that push urgency. Fear-of-missing-out (FOMO) tactics like “Top 100 users get double ROI!”. This discourages due diligence and encourages impulse investment. “

The NFIU urged investors to conduct due diligence, consult licensed financial advisers, and report suspicious platforms to relevant authorities.

Furthermore, the Director-General of the Securities and Exchange Commission, Dr Emomotimi Agama, has warned Nigerians that registration with the Corporate Affairs Commission and the Special Control Unit Against Money Laundering under the Economic and Financial Crimes Commission does not confer legitimacy on any investment scheme operating in the country.

Speaking during a sensitisation tour against Ponzi schemes at the Garki Market in Abuja, Agama said, “CAC registration and EFCC certificate is not enough to show that a company is registered with SEC. These are red flags Nigerians must look out for.”

He noted that several companies, both Nigerian and foreign, have taken advantage of citizens by luring them into unregistered investment schemes, adding that the government will not sit back and allow billions of naira to be lost to such operations.

“It is disheartening that some Nigerians and foreign companies have specialised in duping people. The government won’t sit and watch Nigerians being defrauded. That is why the SEC is coming out to educate the people. If it’s too good to be true, then it is likely fraudulent,” Agama said.

The SEC boss added that the Investments and Securities Act, recently signed into law, provides a N20m fine and a 10-year jail term for those involved in Ponzi schemes. He said this new legal framework gives the Commission stronger enforcement powers to tackle illegal investment operations.

Agama further advised Nigerians to always verify the registration status of any investment platform with the SEC before committing their money, warning that training programmes used to lure people into such schemes are also illegal.

Credit: PUNCH

-

News18 hours ago

News18 hours agoAlleged money laundering: EFCC produces Aisha Achimugu in court

-

News20 hours ago

News20 hours agoJUST IN: Major General Paul Ufuoma Omu Rtd, dies at 84

-

News20 hours ago

News20 hours agoTinubu hails Dangote’s World Bank appointment

-

News14 hours ago

News14 hours agoHon. Dennis Agbo Resigns From Labour Party

-

News14 hours ago

News14 hours agoJust in: Osun PDP receives defectors from APC, others

-

News22 hours ago

News22 hours agoSAD! Professor’s son takes own life inside varsity staff quarters

-

News18 hours ago

News18 hours agoCBN announces revised documentation requirements for PAPSS transactions

-

News18 hours ago

News18 hours agoReps Set Stage for Nigeria’s First Legislative Conference on Renewable Energy