News

Sacked CBN workers fault dismissal, seek reinstatement

Former employees of the Central Bank of Nigeria (CBN) are grappling with the shock of their sudden dismissal, accusing the management of maltreatment and injustice.

They claimed that many were not paid their entitlements before their sacking, a move they argued violates the bank’s human resource rules and policy.

In a statement on Sunday in Jos, Plateau State capital, the North Central Coordinator of the Conference of Autochthonous Ethnic Communities Development Association Youth Wing, Paul Dekete, called for the immediate reinstatement of the sacked workers.

The statement read: “The purge wasn’t limited to high-level executives. It extended far beyond directors, impacting Deputy Directors and Assistant Directors who formed the backbone of departmental operations. These were not junior staff; they were seasoned professionals with deep institutional knowledge.

“For example, the Director of Information Technology was overseeing crucial projects on the very day they were terminated, including efforts to secure international information security certifications for the bank.

“In a particularly egregious case, a Director on special assignment, tasked with leading the bank’s efforts to secure an ISO certification for information security, was sacked on the very day the bank successfully achieved this crucial milestone.

“Central banking relies heavily on robust cybersecurity measures, and this certification is a testament to the Director’s competence and the bank’s commitment to financial security. This abrupt dismissal, on the day of a major accomplishment, raises serious questions about the planning and rationale behind the mass layoffs.”

The statement further said, “The mass sack violated the bank’s own HR policy, which mandates board approval for executive terminations.

“This blatant disregard for due process has raised serious questions about transparency. The CBN, a federal institution, must adhere to public service rules. This dismissal exercise, carried out without board approval, lacks a solid legal foundation.

“Making matters worse, the bank offered no clear criteria for the mass sacking. This is a stark departure from their established culture of clear communication with staff during downsizing exercises.”

Dekete, on behalf of the sacked CBN workers further said, “Loyal employees, some with over 30 years of dedicated service, were cast aside with a cold, impersonal letter stating “your services are no longer required.” This callous act extended to a Deputy Director who was let go even though she had already completed all the necessary paperwork and her retirement letter was ready to be issued.

“The human cost of this heartless exercise is staggering. Many staff members had used their salaries as collateral for loans tied to their remaining years of service at the CBN. With their abrupt termination, these loans were immediately deducted from their final paychecks, leaving some with nothing and others still indebted to the bank. The impact on these individuals and their families is devastating, with their dreams and financial security shattered in an instant.

“The CBN’s purge extended beyond individual hardship, raising serious concerns about ethnic bias. Reports indicate that some states saw over 80% of their executive staff removed, with North Central and South Eastern regions disproportionately affected. This blatant disregard for the principle of federal character raises troubling questions about the bank’s commitment to national unity.

“Staff morale has plummeted, with a pervasive sense of fear and uncertainty gripping the institution. Every Friday is met with dread, as rumours swirl of another list of targeted employees. The reported use of an external consultant, seemingly unfamiliar with the bank’s HR policies and civil service regulations, only exacerbates the lack of trust and transparency.”

The CBN’s mass dismissal included the entire Economic Intelligence Unit (EIU), a Unit in the bank tasked with the critical function of identifying and monitoring illegal financial activities within Nigeria. Established in 2018, the EIU was meticulously built by cherry-picking the bank’s brightest minds across various departments.

According to Dekete, the loss of these highly trained professionals represents a significant blow to the bank’s institutional knowledge and capacity to combat money laundering and other illicit financial activities.

He noted that the nature of the sack shows an attempt to cripple the Middle-belt region of the state as Gombe, Plateau and Benue are affected most.

News

NDLEA nabs bandits supplier with drugs concealed in private part(Photos)

… intercepts cocaine in Saudi-bound religious books,

. ..recovers 563kg skunk, meth, heroin in Bayelsa warehouse, arrests 4; destroys cannabis farms in Edo forest

Operatives of the National Drug Law Enforcement Agency (NDLEA) have intercepted a shipment of cocaine concealed in 20 sets of religious books going to Saudi Arabia.

The cocaine consignment consisting of 20 parcels with a total weight of 500grams and buried in the pages of the religious books was uncovered at a courier company in Lagos on Tuesday 15th April 2025 when NDLEA officers of the Directorate of Operations and General Investigation (DOGI) were searching through export cargos going to Saudi Arabia at the logistics firm.

At another courier company same day, NDLEA officers intercepted five parcels of Loud, a strong strain of cannabis weighing 2.8 kilograms hidden in a carton coming from the United States of America.

In Kano, a 22-year-old supplier of illicit substances to bandits, Muhammad Mohammed, has been arrested by NDLEA operatives on patrol along Bichi – Kano road while heading to Katsina with 277 ampoules of pentazocine injection tied to his thigh and private part with Sellotape. He was intercepted on Sunday 13th April, while another suspect, Mohammed Abdulrahman Abdulaziz, 43, was nabbed same day at Research Rimin Kebe area of Nasarawa, Kano with 68 blocks of skunk, a strain of cannabis, weighing 30kg.

Not less than 557.2kg of skunk, 5.6kg of methamphetamine and 29.8grams of heroin were recovered from a house along Major General Isaiah Alllison Street, Opolo, Yenagoa, Bayelsa state where four suspects were arrested when NDLEA operatives raided the premises on Wednesday 16th April. The four suspects arrested during the raid include: Sarimiye Suwa Kurtis, 46; Roland Prosper, 34; Sarimiye Tare Paul, 45; and Fidelis Ugbesla, 46.

While a total of 1,100 kilograms of skunk were recovered from a delivery van with the driver, Ismail Abdullahi arrested in Surulere area of Lagos on Thursday 17th April, NDLEA operatives in Kaduna on Friday 18th April raided the hideout of a suspect, Ike Ani, 30, in Zaria, where no fewer than 31,950 pills of tramadol 225mg and diazepam were recovered.

In Kebbi, NDLEA operatives on patrol along Bagudo road on Friday 18th April intercepted a vehicle loaded with bags of charcoal coming from Malabil, Benin Republic. A search of the vehicle led to the recovery of 97kg skunk concealed in the sacks of charcoal. Three suspects: Abubakar Ibrahim, 50; Mustapha Aliyu, 32; and Bashar Lawali, 28, were arrested in connection with the seizure.

A 48-year-old Okafor Marcel was nabbed with 11.5kg skunk at Abatete, Anambra state while NDLEA operatives in Osogbo, Osun state on Tuesday 15th April arrested Ajala Mercy, 27, with 43 litres of skushi, a mixture of black currant, cannabis and opioids recovered from her room at Dada estate, Halleluyah area of the state capital.

Two cannabis farms in Egbeta forest, Ovia North East LGA, Edo state were raided by NDLEA operatives who destroyed 3,717.8625kg of the psychoactive plant on 1.487145 hectares and recovered 136.5kg of processed cannabis.

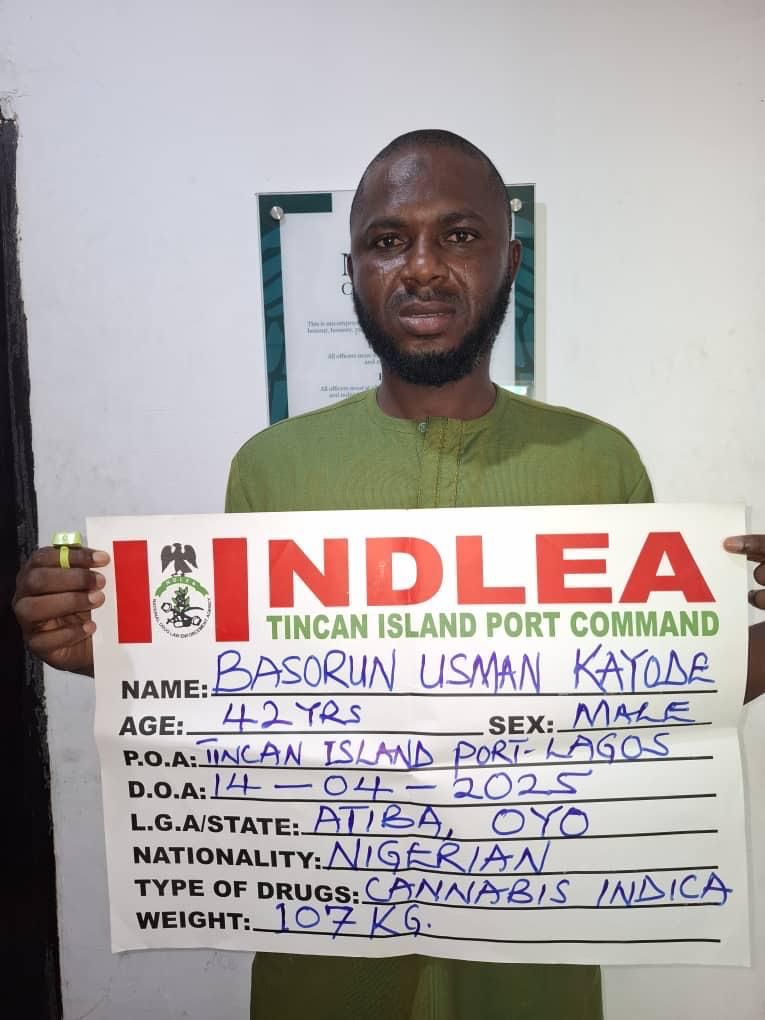

At the Tincan seaport in Lagos, a suspect Basorun Usman Kayode, 40, who has been at large for two years was arrested by NDLEA officers in connection with the seizure of 107kg Loud imported from Cannada in 2023, while another suspect, Dauda Yakubu who distributes illicit drugs within the seaport community was arrested by a team of operatives on Monday 14th April.

The War Against Drug Abuse, WADA, social advocacy activities by NDLEA Commands equally continued across the country in the past week. Some of them include: WADA sensitization lecture delivered to students and staff of St. Michael Anglican Primary School, Epe, Lagos; Community Grammar School, Ipoti Ekiti, Ekiti state; College of Education, Minna, Niger state; traders at Igbona market, Osogbo, Osun state; traders at Marian Market, Calabar, Cross River; drivers and others at Peace Mass Transit park, Upper Iweka, Onitsha, Anambra state, among others.

While commending the officers and men of DOGI, Kano, Lagos, Kaduna, Kebbi, Osun, Zone 13, Edo and Tincan Commands of the Agency for the arrests and seizures of the past week, Chairman/Chief Executive Officer of NDLEA, Brig. Gen. Mohamed Buba Marwa (Rtd) equally praised their counterparts in all the commands across the country for ensuring a fair balance between their drug supply reduction and drug demand reduction efforts.

News

NUJ-FCT Chairman Urges Journalists to Embrace Spirit Easter

News

SAD! SEC DG says “we can’t recover N1.3trn Nigerians lost to CBEX ponzi scheme”

Dr Emomotimi Agama, the Director General of the Security and Exchange Commission (SEC), has explained that there is nothing the Commission can do to help victims of the CBEX scam recover their lost investments.

CBEX or Crypto Bridge Exchange, an unregistered online trading platform vanished last Monday with about N1.3 trillion invested by about 600,000 investors.

CBEX which had operated under ST Technologies International Ltd lured its victims with a 100 percent returns on investment after 30 days.

Asked by Sunday Vanguard if there is anything the Commission can do to help victims recover their money in part or in full, Dr Agama said: “There is nothing the Commission can do”.

He however expressed concern that Nigerians continued to invest in an unregistered digital entity without drawing the attention of the Commission.

“We are worried that this went on for long without anyone drawing our attention to it. That is why we are doing more enlightenment and asking people to come forward to report this for early detection.

How Nigerians can identify a Ponzi Scheme

He warned Nigerians against investing their money in Ponzi Schemes, saying such schemes make promises that are not real.

“You can identify a Ponzi Scheme when an entity makes offers that appear certainly untrue and are bogus. The definition we have in the ISA (Investments and Securities Act, 2025) clearly tells you that when an investment firm makes any promise that is almost totally unattainable, you will know that that is clearly a Ponzi scheme”.

SEC disclosed that preliminary investigations have revealed that CBEX engaged in promotional activities to create a false perception of legitimacy, in order to entice unsuspecting members of the public into investing monies, with the promise of implausibly high guaranteed returns within a short timeframe.

The Commission stated that CBEX, which also operates under the corporate identity of ST Technologies International Ltd, Smart Treasure/Super Technology, had held itself out as a digital asset-trading platform, offering high returns to investors in Nigeria.

According to the SEC, “The Commission hereby clarifies that neither CBEX nor its affiliates were granted registration by the Commission at any time to operate as a Digital Assets Exchange, solicit investments from the public or perform any other function within the Nigerian capital market.

The SEC emphasised that pursuant to the provisions of Section 196 of the Investments and Securities Act 2025, the Commission would collaborate with relevant law enforcement agencies to take appropriate enforcement action against the CBEX, its affiliates and promoters.

“The Commission uses this medium to remind the public to refrain from investing in or dealing with any entity offering unrealistic returns or employing similar recruitment-based investment models. Prospective investors are advised to verify the registration status of investment platforms via the Commission’s dedicated portal: www.sec.gov.ng/cmos before transacting with them”, the SEC added.

How I lost N500,000 in 7 days – Victim

Narrating how he got involved in the doomed platform, an Abuja based journalist told Sunday Vanguard that he invested N500,000 on April 4, 2025 with the hope of receiving N1 million after 30 days.

The journalist who requested not be named said: “I was involved for just seven days and lost N500,000 to the scam. I have a friend who has been pressuring me to invest on CBEX since December last year and I actually have been resisting because of my past experience with MMM.

“But he kept telling me and showing me how much he was making. So, I decided to give it a try and I got involved and finally transferred N500,000 on April 4. I was admitted into a Telegram group chat. Then the story began. The only luck I have is that my wife refused to be involved after I asked her to. I would have been in serious trouble by now.

“Immediately I got wind of troubles especially when people were locked out of the Telegram group, I tried to withdraw my money which had risen to N616,000 but I couldn’t”, he narrated.

-

News17 hours ago

News17 hours agoSAD! Popular Gospel singer, Big Bolaji is dead

-

News8 hours ago

News8 hours agoBLACK EASTER: Over 150 massacred in Plateau, Benue

-

News20 hours ago

News20 hours agoEASTER:Let’s use this period to pray for compassionate leaders -Obi

-

News19 hours ago

News19 hours agoPresidency speaks on report that Shettima was denied access to presidential villa

-

News19 hours ago

News19 hours agoSpeaker Abbas Salutes Christians at Easter, Urges All To Emulate Selflessness of Jesus

-

News19 hours ago

News19 hours ago2027 : “If You’re Truly Smart, Don’t Bother To Contest -Datti tells Tinubu

-

News4 hours ago

News4 hours agoDouble tragedy: Father, three children, maid killed in Osun road crash

-

News20 hours ago

News20 hours agoRemain resolute in fight against drug scourge, Marwa charges NDLEA officers(Photos)