News

First Bank Shareholders In Dilemma As Ownership Tussle Continues, Hindering Recapitalisation

Shareholders of First Bank of Nigeria (FBN) Holdings, Nigeria’s oldest financial institution, are growing increasingly anxious as recent crises and scandals have caused the company’s share price to plummet by over 50% in five months, POLITICS NIGERIA reports.

FBN Holdings, which traded at ₦43.95 per share on March 19, has seen its share price fall to ₦20.35 as of Wednesday, according to data from the Nigerian Securities Exchange (NGX).

This dramatic decline is largely attributed to a series of controversies that have embroiled the company’s management and operations in recent months.

Asides the controversies surrounding the ownership of its controlling stake, a litany of court cases pending determination and a fraud case that led to the dismissal of over a hundred staff have raised concerns for investors holding the bank’s shares, sources confided in this newspaper.

Recapitalisation Stalled

These developments have cast a cloud of uncertainty on the bank’s recapitalisation plans as many of its competitors have completed a fresh capital raise in line with the standard set by the Central Bank of Nigeria (CBN).

Recall that the Apex bank, under a new threshold released in March, stated that commercial banks with international authorization must have at least 500 billion naira, leaving banks with two years to meet the new standard.

FBN Holdings, although announced plans to raise some N300 billion through issuance of shares via a public offering in April, the Annual General Meeting (AGM) which is meant to approve it, is yet to take place.

A Lagos Federal High Court halted an AGM initially scheduled for August 22. The meeting is now postponed till September 3, according to a notice published on the NGX.

Investors are worried that these ongoing issues could lead to a further decline in the bank’s fortunes.

“These are the kind of issues that led to the fall of Skye Bank. If care is not taken, many local and foreign investors will pull out,” said an investor who has held shares in the company since 1995. He added, “The troubles are piling up day by day and it seems there is no end in sight. It is even difficult to hold an ordinary Annual General Meeting, not to mention raising capital.”

Ownership Dispute

The ongoing dispute over the ownership of FBN Holdings’ controlling stake has been a major cause of concern for investors. In December 2021, billionaire Femi Otedola became the company’s single largest shareholder.

However, he was soon displaced by Barbican Capital Limited, a company owned by Oba Otudeko, which now claims to hold a 15.01% stake in the company.

Barbican Capital has filed a lawsuit against FBN Holdings, challenging the reduction of its shareholding from 13.61% in December 2023 to 8.67%. The company submitted evidence from the Central Securities Clearing System (CSCS) to support its claim, showing that it actually owns 5.39 billion shares, representing 15.01% of the lender’s total shares.

This ownership dispute, along with the legal battles surrounding it, has further destabilised investor confidence.

‘Illegal’ 2023 AGM

Despite a court order prohibiting FBN Holdings in 2023, the bank proceeded with the meeting and this has resulted in multiple lawsuits filed by aggrieved shareholders.

One of the plaintiffs, Kujenya Olayiwola Yusuf, prayed the court to nullify all decisions made during the August 223 AGM, including the registration of the new share capital.

In another case related to the controversial AGM, a minority shareholder Yetunde Olowoyeye, argued that all the resolutions passed during the AGM are null and void, having been forged in the fires of judicial contempt.

The outcome of these cases, some shareholders say, will impact on the future of the company as a reversal of the decisions made at the AGM could set the bank on a path of collapse.

40 billion Fraud

While there is so much going on in the FBN Holding board room, the banking hall is also not spared of scandals. The bank sacked at least 120 employees after discovering a ₦40bn fraud, Tech Cabal reported in August.

Tijani Muiz Adeyinka, a manager on the operations team who reportedly diverted ₦40 billion over two years, has been on the run for weeks after his heist was discovered in May. The employees dismissed were accused of laxity in carrying out their duties and were told they should have spotted the fraud earlier.

The Tech Cabal report added; “Several employees were questioned by the Nigerian Police Force (NPF) and detained at the Lion’s Building for at least six hours, one person with direct knowledge of the incident said. Those employees needed to post bail before they were released. Restrictions have been placed on all their personal accounts except their First Bank accounts. “

Meanwhile, Lagos-based banking and finance consultant, Hakeem Morakinyo, told POLITICS NIGERIA that FBN Holdings is in a precarious position as these crises continue to unfold.

“The coming weeks will be critical in determining whether the bank can resolve its internal conflicts and restore investor confidence or if it will follow the same path as other failed institutions,” he said.

Credit: POLITICS NIGERIA

News

NAFDAC unveils tools to check fake drugs in N’East

By Francesca Hangeior

The National Agency for Food and Drug Administration and Control has launched innovative mobile technologies aimed at combating counterfeit drugs in Nigeria’s North-East region.

The a two-day sensitisation workshop in Gombe, stakeholders from various healthcare sectors were introduced to the “Scan 2 Verify” and “Green Book App” tools designed to authenticate medicines and ensure public safety.

Speaking on Wednesday, NAFDAC’s Director-General, Professor Mojisola Adeyeye, who was represented by the Director of Post-Marketing Surveillance, Bitrus Fraden, reassured participants that all drugs registered by NAFDAC are safe and available only through legitimate outlets.

Adeyeye further explained that the Green Book App serves as a digital registry listing certified medicines approved by the agency.

“Users can quickly verify a drug’s authenticity, with any product not listed being deemed counterfeit,” Adeyeye said.

The workshop, which targeted key stakeholders, including pharmaceutical vendors, medical doctors, and healthcare professionals, harped on the need to adopt the technologies to ensure only genuine medicines reach consumers.

Participants such as patent medicine dealers and shop owners praised NAFDAC for the timely initiative.

Yakubu Yusuf and Hauwa Musa, participants at the workshop, described the training as a significant step toward resolving the challenges of counterfeit drugs.

NAFDAC also emphasised its ongoing efforts to shut down counterfeit drug markets in Lagos, Onitsha, and other parts of the country, reaffirming its commitment to public health and safety.

The agency highlighted the importance of public awareness in the fight against fake drugs, urging individuals to verify medicines before use and make informed health choices.

News

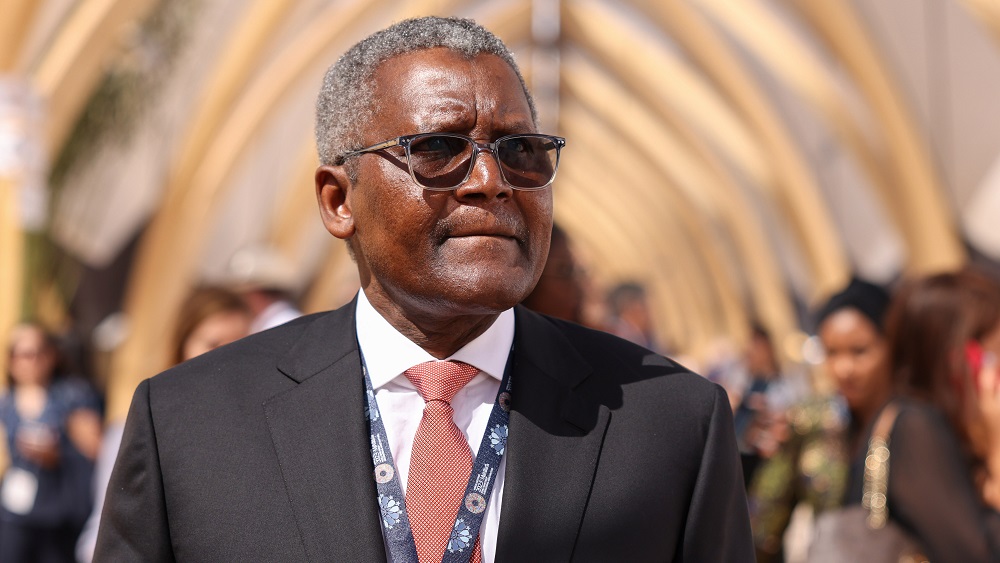

Tinubu hails Dangote’s World Bank appointment

By Francesca Hangeior

President Bola Ahmed Tinubu has congratulated industrialist, Aliko Dangote, on his appointment to the World Bank’s prestigious Private Sector Investment Lab, describing it as a fitting recognition of his transformative contributions to Africa’s private sector.

In a statement by his Special Adviser on Information and Strategy, Mr. Bayo Onanuga, Tinubu commended the billionaire businessman and President of the Dangote Group, stating that his inclusion in the global economic initiative is well-deserved.

“The President describes the appointment as apt, given Dangote’s rich private sector experience, strategic investments, and many employment opportunities created through his Dangote Group,” the statement said.

The World Bank announced Dangote’s appointment on Wednesday as part of a broader effort to expand the reach and impact of its Private Sector Investment Lab.

The Lab, established to harness private capital and scale up investment in developing economies, is entering a new phase that emphasizes job creation as a key development strategy.

Dangote joins other global business leaders on the panel, including Bill Anderson, CEO of Bayer AG; Sunil Bharti Mittal, Chair of Bharti Enterprises; and Mark Hoplamazian, President and CEO of Hyatt Hotels Corporation.

The Bank said the newly expanded membership reflects its strategic focus on leveraging proven private sector leaders to drive employment growth and innovation across emerging markets.

Tinubu urged Dangote to bring his signature blend of vision and innovation to the World Bank role, expressing confidence that he would make a lasting global impact.

“President Tinubu urges Dangote to bring to bear on the World Bank appointment his transformative ideas and initiatives to impact the emerging markets across the world fully,” the statement said.

Dangote, Africa’s richest man, leads one of the continent’s most diversified industrial groups. The Dangote Group spans sectors such as cement, fertilizer, salt, sugar, and oil and gas.

Its $20 billion petroleum refinery and petrochemical complex, recently inaugurated in Nigeria, is considered the continent’s most ambitious private sector investment and a game-changer for regional energy security.

With his new role at the World Bank, Dangote is expected to help guide efforts to channel private investments into sectors critical to sustainable growth and economic resilience in the developing world.

News

Police arrest eight suspects over cult-related killings in Lagos

By Francesca Hangeior

Eight suspected cultists allegedly involved in several cult-related killings within Yaba College of Technology and its environs have been arrested by tactical operatives of the Lagos State Police Command.

One Beretta pistol, four 9mm cartridges, one cartridge, two battle axes, and two cutlasses were recovered, according to the police.

Spokesman for the Lagos State Police Command, CSP Benjamin Hundeyin, described the operation which took place on April 29, 2025, as intelligence-led.

He gave the identities of the arrested suspects as: Adeyemo Abdulsamad, alias Cloud, 24; Afeez Enitan, 28; Ayomide Daniel, aged 30; Olamilekan Adeagbo, alias Skinny, 26; Mayor Samson, aged 38; Basit Ishola, aged 20; Quadri Sikiru, aged 26; and Mariam Salihu, a female, 23 years old.

Hundeyin said, “Investigation is still in progress to unravel the full extent of the suspects’ involvement in cult-related activities. Members of the public are assured that the suspects will be made to face the full wrath of the law.

“The Commissioner of Police, Lagos State Command, CP Olohundare Jimoh, while commending the swift response and excellent work of the Command’s tactical teams and Eko Strike Force, who carried out the operation, urges the public to remain vigilant and report any suspicious activity to the police for appropriate action. He equally assures the public that the Command will continue to work tirelessly to ensure the safety and security of all residents and visitors to Lagos State.”

-

News24 hours ago

News24 hours agoJust in: Popular Nigerian billionaire, E-Money nabbed by EFCC

-

Metro8 hours ago

Metro8 hours agoGunmen storm University of Benin teaching hospital, kill doctor

-

Politics20 hours ago

Politics20 hours agoJust in: Ex- Gov Okowa accepts betraying Southern Nigeria, laments running with Atiku

-

Metro9 hours ago

Metro9 hours agoFCTA destroys 601 motorbikes over violations

-

News20 hours ago

News20 hours agoBoko Haram Kill Mourners, Kidnap Others In Borno

-

News8 hours ago

News8 hours agoJust in: FG declares tomorrow public holiday

-

News20 hours ago

News20 hours agoDeputy Speaker Leads Defection of PDP Stalwart Chris Igwe, 13,000 Followers to APC In Abia

-

News2 hours ago

News2 hours agoJUST IN: Major General Paul Ufuoma Omu Rtd, dies at 84