News

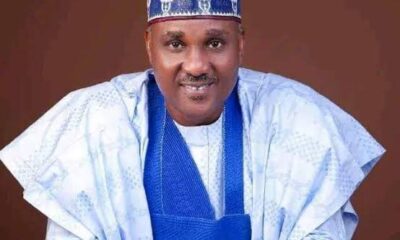

Tinubu Appoints Two New Directors For Bank Of Industry

President Bola Tinubu has approved the appointments of Rotimi Akinde and Ifeoma Uz’Okpala to the positions of Executive Director for Corporate Finance and Risk Management and Executive Director for the Large Enterprises Directorate, respectively, at the Bank of Industry (BOI).

The bank spokesperson, Theodora Amechi, announced in a statement made available to newsmen that these appointments are effective immediately.

Akinde brings over 20 years of experience in Investment and Corporate Banking, with a strong background in capital raising, including Debt, Equities, and Hybrids, as well as expertise in Corporate Finance, encompassing Mergers & Acquisitions, Privatization Advisory, and Project Finance.

Prior to his role at the Bank of Industry, he served as an Associate Partner in Project and Corporate Finance at Infrastructure Delivery International (IDI), where he contributed to the UKNIAF programme and advanced green finance initiatives and structured debt solutions for subnational entities.

His previous experience includes serving as the Corporate Finance Advisor at the Nigeria Infrastructure Advisory Facility (NIAF), where he focused on financing initiatives, modeling, and funding structures for infrastructure projects.

Additionally, he held the position of Group Head and Assistant General Manager for multinationals within Corporate Banking at UBA Plc and was formerly the Vice President of Corporate Finance and advisory at UBA Global Markets, now known as United Capital.

Akinde began his career as an Assistant Manager at Leadbank Plc, working in the Investment and Corporate Banking divisions.

Uz’Okpala has been with BOI since September 2014, initially serving as the Group Head of Large Enterprises Credit and later as the Bank’s Chief Risk Officer before her recent appointment.

In her capacity as the bank’s Chief Risk Officer, Uz’Okpala was instrumental in overseeing and alleviating risks linked to the bank’s operations while also offering support in Environmental, Social, and Governance (ESG) risk matters.

She provided essential ESG guidance during transactions and developed a strategic framework for attracting impact investments.

Uz’Okpala is an experienced professional in Credit and Risk Management, boasting a career that spans more than 30 years within the financial industry.

She began her professional journey at the International Merchant Bank and advanced through significant positions at MBC International, First Bank, Stanbic Bank, and UBA.

Her diverse skill set encompasses Internal Audit, Corporate Finance, Credit Evaluation and Origination, Foreign Operations, and Risk Management.

News

NUJ-FCT Chairman Urges Journalists to Embrace Spirit Easter

News

SAD! SEC DG says “we can’t recover N1.3trn Nigerians lost to CBEX ponzi scheme”

Dr Emomotimi Agama, the Director General of the Security and Exchange Commission (SEC), has explained that there is nothing the Commission can do to help victims of the CBEX scam recover their lost investments.

CBEX or Crypto Bridge Exchange, an unregistered online trading platform vanished last Monday with about N1.3 trillion invested by about 600,000 investors.

CBEX which had operated under ST Technologies International Ltd lured its victims with a 100 percent returns on investment after 30 days.

Asked by Sunday Vanguard if there is anything the Commission can do to help victims recover their money in part or in full, Dr Agama said: “There is nothing the Commission can do”.

He however expressed concern that Nigerians continued to invest in an unregistered digital entity without drawing the attention of the Commission.

“We are worried that this went on for long without anyone drawing our attention to it. That is why we are doing more enlightenment and asking people to come forward to report this for early detection.

How Nigerians can identify a Ponzi Scheme

He warned Nigerians against investing their money in Ponzi Schemes, saying such schemes make promises that are not real.

“You can identify a Ponzi Scheme when an entity makes offers that appear certainly untrue and are bogus. The definition we have in the ISA (Investments and Securities Act, 2025) clearly tells you that when an investment firm makes any promise that is almost totally unattainable, you will know that that is clearly a Ponzi scheme”.

SEC disclosed that preliminary investigations have revealed that CBEX engaged in promotional activities to create a false perception of legitimacy, in order to entice unsuspecting members of the public into investing monies, with the promise of implausibly high guaranteed returns within a short timeframe.

The Commission stated that CBEX, which also operates under the corporate identity of ST Technologies International Ltd, Smart Treasure/Super Technology, had held itself out as a digital asset-trading platform, offering high returns to investors in Nigeria.

According to the SEC, “The Commission hereby clarifies that neither CBEX nor its affiliates were granted registration by the Commission at any time to operate as a Digital Assets Exchange, solicit investments from the public or perform any other function within the Nigerian capital market.

The SEC emphasised that pursuant to the provisions of Section 196 of the Investments and Securities Act 2025, the Commission would collaborate with relevant law enforcement agencies to take appropriate enforcement action against the CBEX, its affiliates and promoters.

“The Commission uses this medium to remind the public to refrain from investing in or dealing with any entity offering unrealistic returns or employing similar recruitment-based investment models. Prospective investors are advised to verify the registration status of investment platforms via the Commission’s dedicated portal: www.sec.gov.ng/cmos before transacting with them”, the SEC added.

How I lost N500,000 in 7 days – Victim

Narrating how he got involved in the doomed platform, an Abuja based journalist told Sunday Vanguard that he invested N500,000 on April 4, 2025 with the hope of receiving N1 million after 30 days.

The journalist who requested not be named said: “I was involved for just seven days and lost N500,000 to the scam. I have a friend who has been pressuring me to invest on CBEX since December last year and I actually have been resisting because of my past experience with MMM.

“But he kept telling me and showing me how much he was making. So, I decided to give it a try and I got involved and finally transferred N500,000 on April 4. I was admitted into a Telegram group chat. Then the story began. The only luck I have is that my wife refused to be involved after I asked her to. I would have been in serious trouble by now.

“Immediately I got wind of troubles especially when people were locked out of the Telegram group, I tried to withdraw my money which had risen to N616,000 but I couldn’t”, he narrated.

News

Double tragedy: Father, three children, maid killed in Osun road crash

A truck driver driving on one way has killed a father and his three children along with their maid in a road accident along Ife-Ilesa express road in Osun State.

The incident, which occurred on Saturday morning, involving a Mark trailer and the family’s Toyota Hilux vehicle, left the wife critically injured.

A statement issued by Osun State sector command of the Federal Road Safety Corps, FRSC, Taofeek Tokunbo and made available to newsmen by the spokesperson, Agnes Ogungbemi, indicated that the accident was caused by the truck driver who drove on the wrong lane.

She added that the bodies of the deceased were taken to the Obafemi Awolowo University Teaching Hospital in Ile-Ife, while the injured woman was taken to a private hospital in Ipetumodu for treatment.

The statement added that the truck driver is presently in police custody for prosecution.

The FRSC sector commander, Taofeek Adeyemi, added that the cash of N508,900 and other items recovered from the scene were handed over to relatives of the deceased in the presence of police operatives.

He then warned road users to stop driving on wrong lanes and adhere strictly to road traffic rules to curb unnecessary death on the roads.

-

News15 hours ago

News15 hours agoSAD! Popular Gospel singer, Big Bolaji is dead

-

News22 hours ago

News22 hours agoINSECURITY: Armed herders attack reportedy leaves family of eight dead, nine others

-

News23 hours ago

News23 hours agoCriminals in military uniform kill 12 at cockfight

-

News5 hours ago

News5 hours agoBLACK EASTER: Over 150 massacred in Plateau, Benue

-

News17 hours ago

News17 hours agoEASTER:Let’s use this period to pray for compassionate leaders -Obi

-

News17 hours ago

News17 hours agoPresidency speaks on report that Shettima was denied access to presidential villa

-

News22 hours ago

News22 hours agoCBEX: Ponzi scheme promoters face 10 years jail term, N20m fine

-

News16 hours ago

News16 hours agoSpeaker Abbas Salutes Christians at Easter, Urges All To Emulate Selflessness of Jesus