News

NIN headache: Banks may scrap 70m bank accounts

Over 70 million bank customers are at risk of losing access to their accounts when the Central Bank of Nigeria’s directive on restricting accounts without Bank Verification Numbers and National Identification Numbers goes into effect.

The CBN had on December 1, 2023, in a circular directed that a ‘Post no Debit’ restriction be placed on all bank accounts without the BVN and NIN from Friday, March 1, 2024.

‘Post No Debit’ is a term used to describe a restriction imposed by banks on specific accounts, preventing customers from making withdrawals, transfers, or any other debits from such accounts. This measure effectively freezes the funds in the account, rendering them inaccessible for the duration of the restriction.

The circular, jointly signed by the Director, Payments System Management Department, Chibuzo Efobi; and Director, Financial Policy and Regulation Department, Haruna Mustapha, read, “It is mandatory for all Tier-1 bank accounts and wallets for individuals to have BVN and/or NIN. It remains mandatory for Tiers 2 & 3 accounts and wallets for individual accounts to have BVN and NIN.

“For all existing Tier-1 accounts/wallets without BVN or NIN: Effective immediately, any unfunded account/wallet shall be placed on ‘Post No Debit or Credit’ until the new process is satisfied. Effective March 1, 2024, all funded accounts or wallets shall be placed on ‘Post No Debit or Credit’ and no further transactions permitted. The BVN or NIN attached to and/or associated with all accounts/wallets must be electronically revalidated by January 31, 2024.”

The circular went on to warn banks in the country that a “comprehensive BVN and NIN audit shall be conducted shortly and where breaches are identified, appropriate sanctions shall be applied.”

As the deadline approached, some banks sent out messages to their customers to regularise their accounts in line with the new CBN directive. While some asked customers to visit their physical branches, others made provisions for customers to update their accounts online.

FirstBank Nigeria in an email to customers said, “Please ensure that your Bank Verification Number and National Identification Number are linked to your account number on or before February 29, 2024.

“You can seamlessly update your account information with your BVN and NIN by visiting any FirstBank branch close to you. Please note that the Central Bank of Nigeria through its circular: PSM/DIR/PUB/CIR/001/053 dated December 1, 2023, has directed that effective March 1, 2024, all funded accounts without BVN shall be placed on ‘Post No Debit or Credit’ and no further transactions permitted.”

Ecobank Nigeria wrote, “Please be informed that the Central Bank of Nigeria through its circular dated December 1, 2023, has announced that all accounts without Bank Verification Number and/or the National Identity Number would not be able to carry out transactions from March 1, 2024.

“Consequently, you will be required to update your account information with your National Identification Number and Bank Verification Number if you have not done so already.” It, however, offered an online solution.

Fintech firm, OPay, also called on its customers to complete the regularisation of their accounts by linking their BVN or their NIN as mandated by the apex bank, offering them both online and offline options.

A Tier-1 account refers to a bank account that can be opened with minimal or no form of documentation. Such an account can be opened with a passport photograph and has a limit of N50,000 deposit and an operating balance of N200,000 and is mostly not linked to the BVN and is targeted at the unbanked population.

This space is dominated by fintech firms and there are concerns that the lax Know Your Customer requirements are loopholes that are being used to perpetuate fraud.

The National President of the Association of Mobile Money and Bank Agents in Nigeria, Sarafadeen Fasasi, who called for an extension of the deadline, said while the policy was a good move to improve banks’ KYC requirements, its implementation was worrisome.

He said, “We are all aware that it is a good policy for the system for us to have good KYC, but unfortunately, what we have a challenge with is the implementation. This is another wrong implementation. Before you give a deadline, you must have provided the access points. As of today, we have about 104 million NINs out of 200 million people expected to have NINs. So, there is a gap of about 100 million.

“It is the same thing with the BVN, which as of the last report was about 59.9 million out of 134 million expected bank accounts. That means we have over 70 million accounts, which will be affected.”

According to data from Statista, as of 2021, the number of active bank accounts in the country was around 133.5 million, with savings accounts making up about 120 million.

Fasasi claimed that the National Identity Management Commission lacked the capacity to deliver 100 million NINs within the required timeframe.

He said, “The question is, can the NIMC deliver the gap of about 100 million NINs within the deadline? The answer is no, so why should this drive Nigerians into another problem? For BVNs, we have a huge gap to deliver and only bank branches can enrol BVN as of today.

“Based on our research, about 300 local government areas out of the 774 LGAs in Nigeria have no bank branches; so, who are those who are going to provide BVN enrolment at those LGAs? It means that people are going to run into trouble.

“Also, the highest that the banks have done is 500,000 enrolment per month. We are not ready for this. Why the rush? Why not plan that every month, this is what we want to achieve based on our capacity and access points?”

He lamented that this was coming at the same time as the National Communications Commission had directed telecom companies to bar mobile lines without the NIN.

“Who is pursuing us in Nigeria in this critical period where everyone is groaning under adverse economic conditions? They want to add extra trauma; I think we need to reconsider this,” he concluded.

The Chairman, Consumer Rights Awareness, Advancement and Advocacy Initiative, Moses Igbrude, said the apex bank ought to assess the level of compliance before wielding the big stick.

He said, “You must check the challenges and the parties who are responsible for the NIN and BVN. What of Nigerians in the Diaspora? They should give more time for this linkage so that they will not disrupt the banking system.

“It is a multifaceted issue involving many players. What is the infrastructure required for them to work? Otherwise, they will use a legal way to disenfranchise a lot of people.”

The President, Bank Customers Association of Nigeria, Dr Uju Ogubunka, called for an extension of the deadline to enable more bank customers regularise their accounts in line with the CBN directive.

Ogubunka told the pres “We know that some of our members have linked their accounts with the BVN/NIN as directed by the CBN. At this point, I think it will be wise to give an extension, because the telecom network has been a bit inclement and, then of course, you talk about power; some of us were unable to charge our phones for some time because there was no power. And these things are happening almost everywhere.

“People are willing to do what they’re supposed to do, but conditions within the environment are a bit difficult. So, I will personally suggest that we consider what is happening and give some extension.”

He went on to suggest that a test run where restrictions would be placed on some affected accounts might be of help in sensitising people to the importance of the directive.

“Another thing that they can do is maybe do a test run so that people will know that it is something that can be done. Some people may not even believe that it is possible to restrict transactions. So, if you do a test run for one day or even a few hours, you announce that those who have not linked up will be unable to access their accounts temporarily, maybe for 24 hours or 12 hours, then give an extension. That should help,” Ogubunka added.

He stated that there had been no reports that banks had started to restrict bank accounts without the BVN and NIN.

“No one has reported that to us yet. But then, they may not know until they want to make use of the accounts. It is not as if they are using the bank accounts every minute of the day. It is only when they want to make use of it and then see that they can’t get through, that is when they have an issue. So far, we don’t have any report on that,” he said.

Multiple bankers, who spoke with journalists on condition of anonymity, said the banks had not yet started to restrict accounts without the BVN and NIN.

They said directives had been issued from their headquarters to create a seamless linking process to avoid account deactivation.

A bank official said, “No one is deactivating accounts yet. They have been sending emails to customers to calm down so that a more seamless linking process will be communicated to customers. They will be reached via text and email. Some people used the NIN to open or update their accounts already so they won’t need to do it again.”

On the number of possible affected customers, the official stated, “We haven’t got the affected number yet. It has to be spooled by our IT team from the backend.”

Another official confirmed the directive to assist more customers via email.

“The deadline still stands; however, not all accounts are blocked because some opened theirs with the national ID from the inception. But we will be reaching out via email and text,” the official wrote to one of our correspondents.

A News Agency of Nigeria report on Friday revealed that customers continued to besiege various bank branches in Lagos to meet the CBN deadline for linking BVN and NIN to their accounts.

The customers also asked the CBN to extend the deadline for them to link their BVNs and NIN with their accounts.

With the implementation of the directive, there was a significant gathering of customers at various banks as early as 8am on Friday to link their NINs with their bank accounts.

A security officer at a Guaranty Trust Bank branch in the Abule Egba area, while addressing customers who were eager to gain entry into the banking hall, said the message sent out by the bank to its customers concerning the directive was a random one.

He said not all customers that got the message were affected by the directive. This got the customers infuriated, as they said the bank should have sent out messages to only those affected. At another GTB branch in Egbeda, the bank advised customers to register online using specified codes displayed on the walls outside the banking hall.

However, at Polaris Bank, the crowd was not allowed to converge, and those who went into the banking hall were told by the customer service desk to produce their NIN slips.

Those without the slips were turned back. Customers who explained their mission to the bank’s security officers before entering the banking hall were told to get the slips.

Two bank employees used mini computers to do the first registration at the entrance before the security guards allowed the customers into the banking hall.

At Providus Bank on Nnamdi Azikiwe Road, customers were given forms and were assisted with registration simultaneously. The situation was similar at Wema Bank on Broad Street and other banks visited on Lagos Island.

Meanwhile, calls and text messages sent to the CBN spokesperson, Hakama Sidi, yielded no response as of the time of filing this report.

News

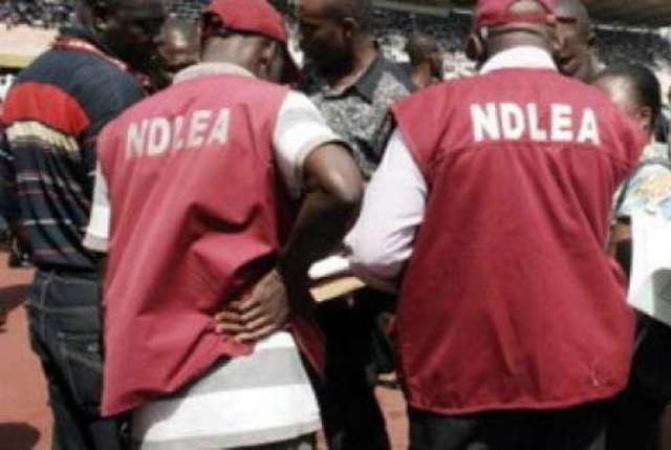

Abuja raid attack: Three NDLEA officers sustain gunshot injuries, hospitalized

Three officers of the National Drug Law Enforcement Agency, NDLEA, have been hospitalized for gunshot injuries sustained after they came under attack from some armed men during a raid operation in Jahi area of the Federal Capital Territory, Abuja on Thursday night.

The incident occurred when a team of NDLEA operatives acting on intelligence and surveillance report raided an uncompleted building at NNPC area of Jahi where 74 bottles of codeine, 10 litres of codeine syrup, 48grams of tramadol 225mg and 4.9kilograms of skunk, a strain of cannabis, as well as five android phones were recovered.

As the NDLEA team made their way out of the location, they came under gun attack.

Three of the NDLEA personnel involved in the raid sustained gunshot injuries: one in the rib and two others on their back and leg.

The wounded officers were initially stabilized at the Police Clinic in Garki Area 1 before they were transferred to the National Hospital Abuja for further medical attention.

Chairman/Chief Executive Officer of NDLEA, Brig Gen Mohamed Buba Marwa (Rtd) expressed appreciation to the staff of the Police Clinic for their prompt support. He also thanked the Chief Medical Director of the National Hospital who was personally reached by him for overseeing the treatment of the wounded officers.

The NDLEA boss who is in Kano on official engagements also spoke on phone with the injured officers to wish them quick recovery. He assured them that the Agency will deploy every means at its disposal and work in collaboration with other security agencies to fish out those responsible for the attack on them.

News

Tinubu preaches hope at Easter gives directive to military to end insecurity

President Bola Ahmed Tinubu on Friday asked Christians in the country to use the Holy Week and Easter to reflect on the enduring values of sacrifice, redemption, love, and hope.

The President made the call in a message he signed on Good Friday, two days to the Easter celebrations.

According to Tinubu, he was saddened by the recent insecurity in the country. He also directed security operatives to decisively end the insecurity without delay.

“The recent tragic incidents and the loss of lives in some parts of our country deeply saddened me. I understand the pain and fear these incidents have caused. Let me assure you that my administration’s resolve to restore peace and security remains unshakable. Forces of evil will never prevail over our country,” Tinubu said.

I have given clear directives to the Armed Forces and all relevant security agencies to end insecurity decisively and without delay. With the unwavering courage and commitment of our gallant men and women in uniform, we are turning the tide and making steady progress in reclaiming peace and stability.

“As President of our blessed nation, I draw inspiration from this timeless message of hope and renewal. I remain steadfast in my commitment to delivering the promise of a Renewed Hope, a better, more just, and prosperous Nigeria for all.

“The Holy Week, which spans Palm Sunday through Holy Thursday and Good Friday and culminates in Easter Sunday, calls us to reflect deeply on the enduring values of sacrifice, redemption, love, and hope.”

“I have given clear directives to the Armed Forces and all relevant security agencies to end insecurity decisively and without delay. With the unwavering courage and commitment of our gallant men and women in uniform, we are turning the tide and making steady progress in reclaiming peace and stability.

“As President of our blessed nation, I draw inspiration from this timeless message of hope and renewal. I remain steadfast in my commitment to delivering the promise of a Renewed Hope, a better, more just, and prosperous Nigeria for all.

“The Holy Week, which spans Palm Sunday through Holy Thursday and Good Friday and culminates in Easter Sunday, calls us to reflect deeply on the enduring values of sacrifice, redemption, love, and hope.”

The President also expressed gratitude to Nigerians for their “patience and resilience as our economy begins to show encouraging signs of recovery.”

“We understand the economic challenges many of you are facing, and we are working tirelessly to restore investor confidence, stabilise key sectors, and build an inclusive economy that serves the interests of all Nigerians.

“During this Easter, we join the global Christian community in thanking God for Pope Francis’s recovery. We pray that his renewed strength continues to inspire his leadership and service to humanity.

“I earnestly pray that Easter’s spirit fills every heart and home with renewed faith in the immense possibilities ahead of us as a nation. Just as Christ triumphed over death, so too shall our country triumph over every challenge we face. The present moment may be cloudy, but it will usher in a glorious day,” he added.

News

Easter: HoR Minority Caucus celebrates with Christians, urges love, peace, national cohesion, calls for end to killings nationwide

The Minority Caucus in the House of Representatives congratulates the entire Christian community in Nigeria, as they join others around the world on the occasion of this year’s Easter celebrations; marking the end of the Lenten period.

This was contained in a statement jointly signed by leaders of the caucus, Rep Kingsley Chinda, Leader, Rt. Hon. Dr. Ali Isa J.C

(Minority Whip) Rt. Hon. Aliyu Madaki , (Deputy Minority Leader)

Rt. Hon. George Ozodinobi

(Deputy Minority Whip) stating that:

” Indeed, Easter is a very unique, and sacred time for every Christian faithful, as it is of significance following the successful completion of the 40-day fasting; which is one of the cardinal tenets of Christianity.

“As our Christian brethren across the country join others around the world to mark this auspicious day; and confident that God Almighty has accepted all prayers and supplications during this time, the Caucus admonish all to sustain the teachings, practice, and lessons of the Lenten period which embodies spiritual, personal, and leadership growth. More importantly, it is necessary to deepen the pivotal messages of the Easter celebrations which are anchored on renewal of faith, resilience and re-invigoration of good deeds, forgiveness of wrong doings, expression of love, joy, and peace to one another, and fostering of compassion, and empathy to all mankind.

“Given our commitment to the preservation and protection of the lives of all Nigerians, and the need to ensure good governance, the Caucus calls on the Federal Government to tackle, headlong the disturbing trend of wanton killings in the country.

“The resumed cases of violence, maiming, kidnapping, and bloodletting in Plateau, Benue, and other parts of the country, portends serious dangers to meaningful growth and development.

“It is appropriate to call on all security agencies to ensure that the negative actions and vicious activities of this group of marauders are comprehensively curtailed, if not entirely wiped out.

“The Caucus urges Christians (and all other Nigerians) to continually pray for our Leaders; at all levels for the right wisdom, knowledge, and understanding towards navigating the country through multi-sectoral, and multi-layered challenges that are not only limiting the realization of Nigeria’s potentials but throwing our people into immeasurable hardship, debilitating hunger, and corrosive poverty.

“Finally, Easter is not just a period for feasting, but also for reflections, new beginnings, and connection with other people, the Caucus admonishes all Nigerians to constantly emphasize virtues that promote unity, and development above negative tendencies that cause divisiveness.

-

News15 hours ago

News15 hours agoTinubu Remains Engaged In Governance From Europe, Will Return After Easter – Presidency

-

News15 hours ago

News15 hours agoFirst Lady Convoy Kills Seven-Year-Old Girl In Ondo State

-

News2 hours ago

News2 hours agoJust in: Many Feared Killed In Abuja

-

Foreign15 hours ago

Foreign15 hours agoTrump To Close US Embassies In South Sudan, France, Others

-

News6 hours ago

News6 hours agoEmergency Rule: We should be thankful to President Tinubu -Wike

-

News6 hours ago

News6 hours agoSenator Natasha on FB listed 3 politicians that should be arrested if anything happens to her

-

News14 hours ago

News14 hours agoNJC investigates 18 Imo judges over suspected age falsification

-

News14 hours ago

News14 hours agoNANS threatens protest over alleged student loan diversion