News

Oil, gas companies owe FG $6bn, N66bn in unpaid revenues – NEITI report

The liabilities of oil companies to the Federation have increased to $6.175bn as of June 2024, a new report by the Nigerian Extractive Industries Transparency Initiative has stated.

It noted that in last decade, the Federal Government HAD spent a total sum of N15.8tn on price differentials and under-recovery (subsidy) on the importation of 200.85 billion litres of petrol into the country.

This revelation was contained in the 2022/2023 oil and gas industry report, presented by the agency on Thursday in Abuja. The report’s details were based on an audit of the petroleum industry conducted by the agency during the review period, according to the NEITI Executive Secretary, Dr Orji Ogbonnaya.

“A total of N15.87tn has been claimed as under-recovery/price differentials between 2006 and 2023, with 2022 recording the highest of N4.714tn,” the report read in part.

In his address at the event, Orji said the released report was not just a document but a call to action, marking a significant milestone in the ongoing efforts to promote transparency, accountability, and good governance in Nigeria’s extractive sector.

“This report, produced by the Nigeria Extractive Industries Transparency Initiative, comes at a critical time when the nation is intensifying its reforms in the oil and gas sector. The report provides valuable insights that will help guide policy, encourage robust public debate, and ultimately improve governance in the management of our natural resources,” he said.

Orji further noted the report contains several key findings and recommendations, which include the identification of revenue leakages, the need for improved compliance with regulatory frameworks, and suggestions for increasing transparency in oil and gas operations.

An analysis of the report showed that the government expended a considerable amount of its resources to pay for price differentials, also known as subsidies, between 2014 and 2023, while its petrol imports surged yearly increasing the cost of subsidies.

The report disclosed that the government paid N3.01tn for the petrol subsidy in 2023 compared to N4.71tn paid in 2022.

It stated that a total of 23.54bn litres of PMS (Premium Motor Spirit) were imported into the country in 2022, while 20.28bn litres were imported in 2023. This represents a reduction of 3.25bn litres, or a 14 per cent decline, following the removal of the subsidy.

“A detailed 10-year trend analysis (2014–2023) shows that the highest annual PMS importation into the country, 23.54bn litres, was recorded in 2022, while the lowest, 16.88bn litres, was recorded in 2017. A total of N15.87tn was claimed as under-recovery/price differentials between 2006 and 2023, with the highest amount, N4.714tn, recorded in 2022,” it stated.

A further breakdown showed that N480bn was spent as subsidies for the importation of 18.93bn litres of fuel in 2014. This figure reduced to N320bn despite an increase amount of fuel import of 19.27bn litres in 2015.

In 2016, the NEITI said the government spent N100bn to import 18.76bn liters of fuel while N140bn was disbursed for the for the import of 16.88bn liters of petrol products in 2017.

However, by the following year of 2018, the figure for subsidy increased drastically by N580bn to N720bn, for the import of 20bn liters. The figure dropped sharply to N580bn for an increased import of 20.60bn litres in 2019.

By 2020, the amount spent on subsidy reduced further to N130bn. The government imported a total sum of 22.05bn litres within this period.

In contrast, the government spent N1.16tn as subsidy on the import of 22.54bn liters in 2021, disbursed N4.71tn as a price differential for the import of 23.54bn liters in 2022, and N3.01tn for the import of N20.28bn liters in 2023.

It added that liabilities owed to the federation include $6.071bn and N66.4bn in unpaid royalties and gas flare penalties owed to the Nigerian Upstream Petroleum Regulatory Commission by August 31, 2024.

Additionally, there are outstanding petroleum profit taxes, company income taxes, withholding taxes, and VAT owed to the Federal Inland Revenue Service amounting to $21.926m and N492.8m as of June 2024.

Reacting to this, the Chairman of the Economic and Financial Crimes Commission, Olanipekun Olukayode, pledged to recover the owed debts of $6bn and N66bn to the federation.

The EFCC chairman also announced that he had approved the transfer of over N1bn derived from funds recovered through previous NEITI audits into the Federation Account.

Olukayode said, “Over the years as an anti-corruption agency in the country we are part of the success of the work of NEITI. Where the work stops at the level of presenting this report, then we take off from there to ensure that the recommendations therein and revelations therein particularly as relates to criminal infractions, and violation of our financial laws, it is taken up seriously.

“I am also happy to announce to you that as of yesterday (Wednesday), I still approved that over a billion so remitted to the Federal Government account as a result of the work of the last report of NEITI.”

On his part, the Secretary to the Government of the Federation, George Akume, assured stakeholders that the government would continue to grant NEITI the freedom to do fulfill its mandate to the country and the global Extractive Industries Transparency Initiative.

Akume said, “As the Chairman of the NEITI Board, I stand before you today to underscore the Federal Government’s respect for NEITI’s independence. While my role as Chairperson is a testament to the importance the government places on NEITI, it also signifies the commitment to ensure that NEITI operates independently, without interference, as mandated by the EITI standard.

“We have to safeguard this independence with great care and diligence, ensuring that NEITI can operate free from undue influence.”

News

Celebrity boxing: Speed Darlington wants rematch after losing to Portable

By Kayode Sanni-Arewa

Nigerian singer Speed Darlington is calling for a rematch against Portable after losing to him in a celebrity boxing match.

Speed Darlington was knocked out in the second round, and he’s unhappy about the outcome.

In a video, he claimed Portable didn’t deserve the win and the prize money, saying he had plans to use the money to build a swimming pool for his community in Imo State.

Portable, I want a rematch. E dey pain me say you dey carry all that money dey go. E dey break my heart.

” I want a rematch. It’s so unfair. You have up to two experience before me and you fight. I never enter ring before. I did not come from poverty,” he said.

“You don’t deserve that money. E dey pain me. I want to build swimming pool for my villagers. I need a rematch, Portable”, he said.

According to Speed Darlington, Portable had an unfair advantage due to his experience, accusing him of using supernatural means to win the fight.

He also claimed he suffered a shoulder injury during the match despite not feeling tired.

Speed Darlington, who wants a rematch, said he needs 30 days to prepare better

News

Israel’s remote controlled bulldozers breaking ground in Gaza war

At first glance, there is nothing unusual about the bulky bulldozer turning up soil at a testing site in central Israel, but as it pulled closer it became clear: the driver’s cabin is eerily empty.

This is the Robdozer, a fortified engineering vehicle manned remotely, and in this case operated from a military expo halfway across the globe in Alabama.

Army engineers and military experts say that the Robdozer — the robotic version of Caterpillar’s D9 bulldozer — is the future of automated combat.

The Israeli military has used D9 for years to carry out frontline tasks like trowelling roads for advancing troops, removing rubble and flattening terrain.

But since war in Gaza broke out in October 2023 and later in Lebanon, the Israeli military has increasingly deployed this robotic version in a bid to enhance its field operations and reduce the risks to its troops.

“The idea is to eliminate the person from the cockpit of the dozer,” said Rani, whose team at the state-owned Israel Aerospace Industries developed the Robdozer.

An unmanned D9 bulldozer digs up a field during a demonstration to the press at the Israel Aerospace Industries (IAI) quarters near Tel Aviv on March 26, 2025. Israel’s increasing use of advanced technology on the battlefield, from air defence systems to a broad range of AI-driven intelligence tools, has been well-documented but also criticised for inaccuracies, lack of human oversight and potential violations of international law. (Photo by GIL COHEN-MAGEN / AFP)

During the Gaza war, the military has increasingly opted for the unmanned version, which can carry out a full range of tasks “even better than a human”, said Rani, using his first name only for security reasons.

While such vehicles and other systems are currently operated by humans, future versions could be autonomous, raising ethical and legal concerns over the unchartered future of warfare being shaped by the Israeli military in the Gaza war.

‘Changing the paradigm’

Israel’s increasing use of advanced technology on the battlefield, from air defence systems to a broad range of AI-driven intelligence tools, has been well-documented but also criticised for inaccuracies, lack of human oversight and potential violations of international law.

Analysts say the growing Israeli deployment of the Robdozer reflects broader global trends towards automation in heavy combat vehicles, like remote-controlled personnel carriers that operate much like drones.

An Israeli military official, who requested anonymity to discuss sensitive matters, told AFP that the army has been using “robotic tools for over a decade, but in very small numbers. Now it is being used in large-scale warfare”.

News

70-hour Chess Marathon: Onakoya reportedly breaks record set by Norwegians

Nigerian chess sensation and founder of Chess in Slums Africa, Tunde Onakoya, has broken the chess marathon record of 61 hours, 3 minutes, and 34 seconds, set by two Norwegian players, Hallvard Haug Flatebø and Sjur Ferkingstad, in June 2024.

Onakoya and his chess partner, Shawn Martinez, are currently aiming to complete a 70-hour chess marathon in Times Square, New York.

The marathon, a four-day non-stop gameplay, started on April 17.

In a post shared on X shortly after surpassing the current record, he expressed fulfillment and called for action to educate and create opportunities for street children in Nigeria.

For all the dreamers! We’ve officially BROKEN THE RECORD with my brother,” he wrote.

Although the official confirmation from Guinness World Records is still being awaited, Nigerians and chess lovers from different parts of the world have congratulated the chess master on his latest achievement.

-

News16 hours ago

News16 hours agoBLACK EASTER: Over 150 massacred in Plateau, Benue

-

News12 hours ago

News12 hours agoDouble tragedy: Father, three children, maid killed in Osun road crash

-

News12 hours ago

News12 hours agoSAD! SEC DG says “we can’t recover N1.3trn Nigerians lost to CBEX ponzi scheme”

-

News10 hours ago

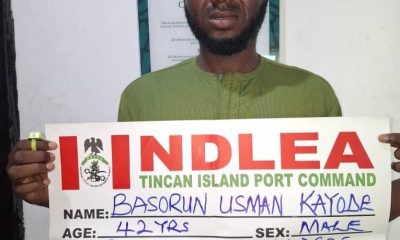

News10 hours agoNDLEA nabs bandits supplier with drugs concealed in private part(Photos)

-

Metro16 hours ago

Metro16 hours agoShock as 2 naked lovers found dead in Kogi

-

News16 hours ago

News16 hours agoIMF expresses concern over high poverty rate, food insecurity in Nigeria

-

News11 hours ago

News11 hours agoNUJ-FCT Chairman Urges Journalists to Embrace Spirit of Easter

-

Economy16 hours ago

Economy16 hours agoVolvo announces termination of 800 U.S. workers, cites tariff, market decline