Economy

Zenith Bank Records Triple-Digit Growth In Q3 2024

Zenith Bank Plc has announced its unaudited results for the third quarter ended 30 September 2024, recording a remarkable triple-digit growth of 118% from N1.33 trillion reported in Q3 2023 to N2.9 trillion in Q3 2024. This performance underscores the Group’s resilience and market leadership in spite of the challenging macroeconomic environment.

According to the Bank’s unaudited third quarter financial results presented to the Nigerian Exchange (NGX), the triple-digit growth in the topline also led to an increase in the bottom line, as the Group recorded a 99% Year on Year (YoY) increase in profit before tax, growing from N505 billion in Q3 2023 to N1.0 trillion in Q3 2024. Profit after tax equally grew by 91% from N434.2 billion to N827 billion in the same period.

The growth in the topline was driven by the expansion of both interest income and non-interest income. Interest income saw a notable 190% rise to N1.95 trillion, attributed to the high-yield environment. Non-interest income rose by 41% to N856 billion, bolstered by substantial growth in fees and commissions, which highlights the strength of Zenith Bank’s retail growth and the robust performance of its digital channels during the reporting period. The robust increase in profitability reflects the Bank’s focus on operational efficiency and strong risk management practices. Earnings per share (EPS) nearly doubled, rising to N26.34 from N13.82 in Q3 2023, underscoring Zenith Bank’s strong value creation for shareholders.

The Bank’s balance sheet grew significantly, with total assets growing by 49% to N30.4 trillion, largely supported by customer deposits, which rose by 42% to N21.6 trillion. This growth in deposits was broad-based across corporate and retail segments, highlighting the Bank’s deepening reach and customer loyalty. Gross loans increased by 46% to N10.3 trillion, underscoring the commitment to supporting strategic sectors in the economy.

Capital adequacy ratio remained strong, improving to 21.9%, well above regulatory requirements. The return on average equity (ROAE) stood at 37.8%, up from 35.1%, while return on average assets (ROAA) also improved to 4.3% as Zenith Bank maximized its asset base. Cost of funds increased to 4.3%, reflecting the broader market trend of rising interest rates, while the cost of risk was maintained at 7.3%, underscoring the Bank’s proactive approach in provisioning for credit risk. The Bank’s cost-to-income ratio rose to 39.5%, reflecting the impact of strategic investments in technology and capacity building aimed at supporting long-term growth, even as it continues to strive for greater operational efficiency.

Zenith Bank’s asset quality remains a cornerstone of its strength, with a non-performing loan (NPL) ratio of 4.5%, within regulatory limits. A high coverage ratio of 198.4% underscores the Bank’s disciplined approach to risk management, positioning it for resilience in the face of market volatility while supporting stable loan growth.

Zenith Bank remains steadfast in its commitment to sustainable growth and value creation. The Bank launched a capital raise program on August 1, 2024, consisting of a combined Rights Issue and Public Offer. This capital raise was driven by the Central Bank of Nigeria (CBN)’s recapitalization directive for commercial banks issued in March 2024. While the Bank awaits final capital verification approvals from authorities, the fundraising exercise was successful, reflecting strong confidence in Zenith Bank’s brand.

The additional capital will enhance the Bank’s ability to expand its product offerings, deepen its penetration in strategic sectors, boost lending to the real sector and pursue its African and global expansion plan. In furtherance of this, the Bank in September 2024 received regulatory approval for the establishment of a Zenith Bank branch in Paris, France, which is fully operational and will enhance the Bank’s product offerings in international markets.

With a strengthened capital base, Zenith Bank is well-positioned to navigate the evolving economic landscape, while putting best-practice sustainability standards at the heart of its business. The Bank will also continue to prioritize opportunities that enhance stakeholder value and a strong compliance and corporate governance culture, which will reinforce the its leadership position within Nigeria’s financial sector and drive long-term growth.

Economy

Volvo announces termination of 800 U.S. workers, cites tariff, market decline

Volvo Group has announced plans to lay off up to 800 workers at three of its U.S. facilities over the next three months, citing ongoing market uncertainty and declining demand exacerbated by tariffs introduced under the administration of President Donald Trump.

The affected locations include the Mack Trucks plant in Macungie, Pennsylvania, as well as Volvo Group sites in Dublin, Virginia, and Hagerstown, Maryland.

In a statement on Friday, Volvo Group North America confirmed that between 550 and 800 employees would be impacted.

The company, a subsidiary of Sweden’s AB Volvo, employs nearly 20,000 people across North America.

The layoffs come amid wider turmoil in the automotive and manufacturing sectors, as shifting U.S. trade policy and a series of tariffs continue to drive up production costs. Economists have pointed to the uncertainty surrounding Trump’s trade strategy as a factor undermining both business and consumer confidence, with concerns mounting over a potential economic slowdown or recession.

According to Volvo, the company is grappling with a decline in heavy-duty truck orders, driven by instability in freight rates, anticipated regulatory changes, and the growing financial burden of tariffs. “We regret having to take this action, but we need to align production with reduced demand for our vehicles,” a company spokesperson stated in an email quoted by Reuters.

Volvo’s announcement marks another blow to an industry already navigating a complex web of supply chain challenges and fluctuating market conditions, with other manufacturers also warning of potential cost hikes and disruptions tied to global trade disputes.

Economy

Inflation surged to 24.23% due to escalating cost of living

Inflationary pressure has reappeared as Nigerians grapple with increases in average costs of basic food items and energy.

For the first time after the rebasing of the Consumer Price Index (CPI), headline inflation spiked in March to 24.23 per cent – 105 basis points above the 23.18 per cent recorded in the previous month.

The National Bureau of Statistics (NBS) yesterday indicated that the rate of increase in the average price level was higher in March than the level in February.

In January, the NBS updated the weight and price reference periods in calculation of the CPI to make the inflationary gauge more reflective of changes in consumption patterns and the economy generally.

The rebasing did not only brought the base year closer to the current period from 2009 to 2024, it also introduced some critical methodology changes to improve the computation processes.

After the rebasing, inflation dropped from 34.80 per cent in the pre-rebased period of December 2024 to 24.48 per cent in January 2025. It dropped further to 23.18 per cent in February.

In its latest report, NBS recorded 186 basis points changes between the monthly inflation rate, with the month-on-month rate rising from 2.04 per cent in February to 3.90 per cent in March.

The NBS attributed the spike to the rise in costs of food and alcoholic beverages, fuels and electricity, among other items.

Analysts at CardinalStone said the resurgence was due to renewed foreign exchange (forex) pressures amid heightened global risk-off sentiment.

They pointed at foreign portfolio investments (FPIs) outflows and increased dollar demand, which saw naira dropping by 2.4 per cent in March.

Experts also cited increase in price of Premium Motor Spirit (PMS) or petrol, following the temporary suspension of the naira-for-crude swap arrangement.

Food inflation rate stood at 21.79 per cent in March 2025. The composite food index decreased to 21.79 per cent from 23.51 per cent.

Core inflation, which excludes volatile agricultural produce prices and energy, rose to 24.43 per cent from 23.01 per cent.

Specifically, the month-on-month food inflation rose by 50 basis points from 1.67 per cent in February to 2.18 per cent in March.

The NBS attributed the increase in food inflation to increases in the average prices of basic food items including ginger, garri, broken rice, honey, crabs, potatoes, plantain flour, periwinkle and pepper amongst others.

On a state-by-state basis, food inflation was higher in Oyo with 34.41 per cent; Kaduna (31.14 per cent) and Kebbi (30.85 per cent).

On the other side, the 9.61 per cent recorded by Bayelsa; Adamawa (12.41 per cent) and Akwa Ibom (12.60 per cent), were the lowest inflation rates.

Analysts expressed concerns that the resurgent inflationary pressure might lead to renewed tightening stance by the Central Bank of Nigeria (CBN).

CBN Governor Dr. Olayemi Cardoso, had at the end of the first Monetary Policy Committee (MPC) meeting in 2025, reiterated the apex bank’s commitment to orthodox monetary policies, noting that the apex bank’s stance will be reflective of the inflationary trend.

With inflation rate dropping in February, the MPC had decided to maintain all key monetary policy parameters, including the Monetary Policy Rate (MPR) at 27.50 per cent, the asymmetric corridor around the MPR at +500/-100 basis points, the Cash Reserve Ratio (CRR) at 50.00 per cent for Deposit Money Banks and 16.00 per cent for Merchant Banks, and the Liquidity Ratio at 30.00 per cent.

Clarifying the impact of the rebased CPI, Cardoso had explained that the lower inflation figure should not be misinterpreted.

He underlined the need to analyse more data before drawing comparisons, noting that the CBN is currently assessing the figures and will provide further guidance in due course.

The CBN boss stressed the critical importance of collaboration between monetary and fiscal authorities in sustaining recent economic improvements.

Addressing concerns about the impact of elevated borrowing costs on economic growth, the CBN governor assured that the apex bank’s primary objective is to stabilize the foreign exchange and financial markets.

He expressed confidence that such stability would attract increased foreign investments, stimulating the much-needed economic growth.

Cardoso also highlighted the competitiveness of the Nigerian currency, which has spurred growing interest from international investors.

Economy

SEE Current Black Market Dollar (USD) To Naira (NGN) Exchange Rate

The exchange rate between the US dollar and the Nigerian naira continues to draw significant attention from individuals and businesses alike, especially those involved in international trade and remittances.

On Saturday, April 12, 2025, activity in the Lagos parallel market, commonly known as the black market shows that the buying rate for one US dollar stands at ₦1570, while the selling rate is ₦1575.

These figures are sourced from traders and Bureau De Change (BDC) operators who are active in key currency exchange hubs across Lagos.

Why the Black Market Rate Matters

Although the Central Bank of Nigeria (CBN) does not officially recognize or support the use of the black market for foreign exchange transactions, many Nigerians still rely on it due to difficulties in accessing forex through official banking channels. Issues such as limited availability, long processing times, and strict documentation requirements have made the black market a more accessible, albeit riskier, alternative.

CBN’s Official Position

The CBN continues to warn against participating in parallel market trading, stating that such activities undermine the stability of the national currency. The apex bank urges those in need of foreign currency to apply through authorized financial institutions, which are mandated to follow official exchange rates.

Nonetheless, the disparity between the official and unofficial markets persists, often influenced by market forces such as demand, inflation, and fluctuations in Nigeria’s foreign reserves.

Latest Exchange Rates Overview

Black Market (Parallel Market) Rate

Currency Pair Buying Rate Selling Rate

USD/NGN ₦1570 ₦1575

CBN Official Rate

Currency Pair Highest Rate Lowest Rate

USD/NGN ₦1630 ₦1570

Key Notes for Forex Users

The exchange rates in the black market often differ slightly from one location or dealer to another due to market volatility and negotiation margins.

Rates can also fluctuate within hours based on economic news, government policies, and global financial trends.

It is advisable to compare rates from multiple sources before conducting any large transactions, especially in volatile markets.

What This Means for Nigerians

The current forex rates reflect continued pressure on the naira, and many analysts believe that inflation, reduced oil revenue, and inconsistent monetary policies are key factors driving the demand for the dollar. For everyday Nigerians, this means the cost of imported goods remains high, and businesses dependent on international suppliers face growing challenges.

Until forex supply stabilizes through official channels, the black market will likely remain a major player in Nigeria’s currency landscape.

-

News14 hours ago

News14 hours agoBLACK EASTER: Over 150 massacred in Plateau, Benue

-

News23 hours ago

News23 hours agoSAD! Popular Gospel singer, Big Bolaji is dead

-

News10 hours ago

News10 hours agoDouble tragedy: Father, three children, maid killed in Osun road crash

-

News9 hours ago

News9 hours agoSAD! SEC DG says “we can’t recover N1.3trn Nigerians lost to CBEX ponzi scheme”

-

News8 hours ago

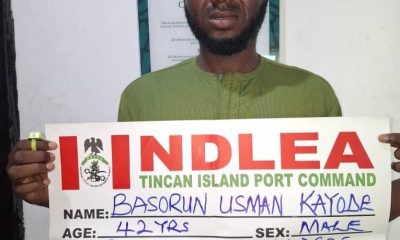

News8 hours agoNDLEA nabs bandits supplier with drugs concealed in private part(Photos)

-

Metro13 hours ago

Metro13 hours agoShock as 2 naked lovers found dead in Kogi

-

News13 hours ago

News13 hours agoIMF expresses concern over high poverty rate, food insecurity in Nigeria

-

News9 hours ago

News9 hours agoNUJ-FCT Chairman Urges Journalists to Embrace Spirit of Easter