News

Just in: Court order EFCC to confiscate Abuja estate with 753 duplexes

The EFCC said in a release that this was the single largest asset recovery by the Commission since its inception in 2003.

Justice Jude Onwuegbuzie, on Monday, ordered the final forfeiture of an estate in the Federal Capital Territory, Abuja, measuring 150,500 square metres and containing 753 Units of duplexes and other apartments.

The EFCC said in a release that this was the single largest asset recovery by the Commission since its inception in 2003.

The estate rests on on Plot 109 Cadastral Zone C09, Lokogoma District, Abuja.

“The forfeiture of the property to the federal government by a former top brass of the government was pursuant to EFCC’s mandate and policy directive of ensuring that the corrupt and fraudulent do not enjoy the proceeds of their unlawful activities.

“In this instance, the Commission relied on Section 17 of the Advance Fee Fraud And Other Fraud Related Offences Act No 14, 2006 and Section 44 (2) B of the Constitution of the 199 Constitution of the Federal Republic of Nigeria to push its case,” the EFCC said.

Ruling on the Commission’s application for the final forfeiture of the property, Justice Onwuegbuzie held that the respondent have not shown cause as to why he should not lose the property, “which has been reasonably suspected to have been acquired with proceeds of unlawful activities, the property is hereby finally forfeited to the federal government.”

The road to the final forfeiture of the property was paved by an interim forfeiture order, secured before the same Judge on November 1, 2024.

The government official which fraudulently built the estate is being investigated by the EFCC.

The forfeiture of the asset is an important modality of depriving the suspect of the proceeds of the crime.

The justification for the forfeiture is derived from Part 2, Section 7 of the EFCC Establishment Act, which stipulates that the EFCC “has power to cause investigations to be conducted as to whether any person, corporate body or organisation has committed any offence under this Act or other law relating to economic and financial crimes and cause investigations to be conducted into the properties of any person if it appears to the Commission that the person’s lifestyle and extent of the properties are not justified by his source of income.”

The Commission’s Executive Chairman, Mr. Ola Olukoyede, has repeatedly described asset recovery as pivotal in the fight against corruption, economic and financial crimes and a major disincentive against the corrupt and the fraudulent.

In the release by the EFCC Head of Media and Publicity, Dele Oyewale, addressing members of the House of Representatives Committee on Anti-corruption recently, he said, “If you understand the intricacies involved in financial crimes investigation and prosecution you will discover that to recover one billion naira is war. So, I told my people that the moment we start investigation we must also start asset tracing because asset recovery is pivotal in the anti-corruption fight; and one of the potent instruments that you can deploy as an anti-corruption agency for an effective fight is asset tracing and recovery.

“If you allow the corrupt or those that you are investigating to have access to the proceeds of their crime, they will fight you with it. So one of the ways to weaken them is to deprive them of the proceeds of their crime. So, our modus operandi has changed simultaneously. The moment we begin investigation, we begin asset tracing. That was what helped us to make our recoveries.”

The Establishment Act of the Commission places huge emphasis on asset recovery. Subject to the provisions of Section 24 of the Act, “whenever the assets and properties of any person arrested under the Act are attached, the Commission shall apply to the court for an interim forfeiture and where a person is arrested for an offence under the Act, the Commission shall immediately trace and attach all the assets and properties of the person acquired as a result of such economic and financial crime and shall thereafter cause to be obtained an interim attachment order from the Court.

“And where the assets or properties of any person arrested for an offence under the Act has been seized or any assets or property has been seized by the Commission under the Act, the Commission shall cause an application to be made to the Court for an interim order forfeiting the property concerned to the Federal Government and the court shall, if satisfied that there is prima facie evidence that the property concerned is liable to forfeiture, make an interim order forfeiting the property to the Federal Government, which the Commission would usually escalate to earn a final forfeiture”.

This procedure was duly followed in this respect. The recovery of the asset represents a milestone in the annals of operations of the EFCC and infallible proof of the commitment of President Bola Ahmed Tinubu to the anti-corruption war.”

News

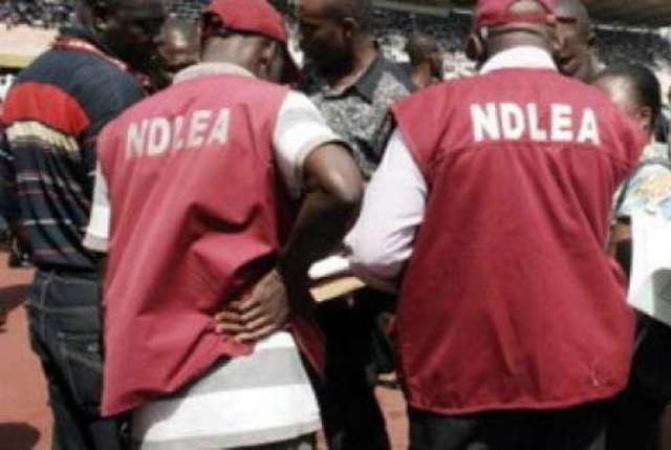

Abuja raid attack: Three NDLEA officers sustain gunshot injuries, hospitalized

Three officers of the National Drug Law Enforcement Agency, NDLEA, have been hospitalized for gunshot injuries sustained after they came under attack from some armed men during a raid operation in Jahi area of the Federal Capital Territory, Abuja on Thursday night.

The incident occurred when a team of NDLEA operatives acting on intelligence and surveillance report raided an uncompleted building at NNPC area of Jahi where 74 bottles of codeine, 10 litres of codeine syrup, 48grams of tramadol 225mg and 4.9kilograms of skunk, a strain of cannabis, as well as five android phones were recovered.

As the NDLEA team made their way out of the location, they came under gun attack.

Three of the NDLEA personnel involved in the raid sustained gunshot injuries: one in the rib and two others on their back and leg.

The wounded officers were initially stabilized at the Police Clinic in Garki Area 1 before they were transferred to the National Hospital Abuja for further medical attention.

Chairman/Chief Executive Officer of NDLEA, Brig Gen Mohamed Buba Marwa (Rtd) expressed appreciation to the staff of the Police Clinic for their prompt support. He also thanked the Chief Medical Director of the National Hospital who was personally reached by him for overseeing the treatment of the wounded officers.

The NDLEA boss who is in Kano on official engagements also spoke on phone with the injured officers to wish them quick recovery. He assured them that the Agency will deploy every means at its disposal and work in collaboration with other security agencies to fish out those responsible for the attack on them.

News

Tinubu preaches hope at Easter gives directive to military to end insecurity

President Bola Ahmed Tinubu on Friday asked Christians in the country to use the Holy Week and Easter to reflect on the enduring values of sacrifice, redemption, love, and hope.

The President made the call in a message he signed on Good Friday, two days to the Easter celebrations.

According to Tinubu, he was saddened by the recent insecurity in the country. He also directed security operatives to decisively end the insecurity without delay.

“The recent tragic incidents and the loss of lives in some parts of our country deeply saddened me. I understand the pain and fear these incidents have caused. Let me assure you that my administration’s resolve to restore peace and security remains unshakable. Forces of evil will never prevail over our country,” Tinubu said.

I have given clear directives to the Armed Forces and all relevant security agencies to end insecurity decisively and without delay. With the unwavering courage and commitment of our gallant men and women in uniform, we are turning the tide and making steady progress in reclaiming peace and stability.

“As President of our blessed nation, I draw inspiration from this timeless message of hope and renewal. I remain steadfast in my commitment to delivering the promise of a Renewed Hope, a better, more just, and prosperous Nigeria for all.

“The Holy Week, which spans Palm Sunday through Holy Thursday and Good Friday and culminates in Easter Sunday, calls us to reflect deeply on the enduring values of sacrifice, redemption, love, and hope.”

“I have given clear directives to the Armed Forces and all relevant security agencies to end insecurity decisively and without delay. With the unwavering courage and commitment of our gallant men and women in uniform, we are turning the tide and making steady progress in reclaiming peace and stability.

“As President of our blessed nation, I draw inspiration from this timeless message of hope and renewal. I remain steadfast in my commitment to delivering the promise of a Renewed Hope, a better, more just, and prosperous Nigeria for all.

“The Holy Week, which spans Palm Sunday through Holy Thursday and Good Friday and culminates in Easter Sunday, calls us to reflect deeply on the enduring values of sacrifice, redemption, love, and hope.”

The President also expressed gratitude to Nigerians for their “patience and resilience as our economy begins to show encouraging signs of recovery.”

“We understand the economic challenges many of you are facing, and we are working tirelessly to restore investor confidence, stabilise key sectors, and build an inclusive economy that serves the interests of all Nigerians.

“During this Easter, we join the global Christian community in thanking God for Pope Francis’s recovery. We pray that his renewed strength continues to inspire his leadership and service to humanity.

“I earnestly pray that Easter’s spirit fills every heart and home with renewed faith in the immense possibilities ahead of us as a nation. Just as Christ triumphed over death, so too shall our country triumph over every challenge we face. The present moment may be cloudy, but it will usher in a glorious day,” he added.

News

Easter: HoR Minority Caucus celebrates with Christians, urges love, peace, national cohesion, calls for end to killings nationwide

The Minority Caucus in the House of Representatives congratulates the entire Christian community in Nigeria, as they join others around the world on the occasion of this year’s Easter celebrations; marking the end of the Lenten period.

This was contained in a statement jointly signed by leaders of the caucus, Rep Kingsley Chinda, Leader, Rt. Hon. Dr. Ali Isa J.C

(Minority Whip) Rt. Hon. Aliyu Madaki , (Deputy Minority Leader)

Rt. Hon. George Ozodinobi

(Deputy Minority Whip) stating that:

” Indeed, Easter is a very unique, and sacred time for every Christian faithful, as it is of significance following the successful completion of the 40-day fasting; which is one of the cardinal tenets of Christianity.

“As our Christian brethren across the country join others around the world to mark this auspicious day; and confident that God Almighty has accepted all prayers and supplications during this time, the Caucus admonish all to sustain the teachings, practice, and lessons of the Lenten period which embodies spiritual, personal, and leadership growth. More importantly, it is necessary to deepen the pivotal messages of the Easter celebrations which are anchored on renewal of faith, resilience and re-invigoration of good deeds, forgiveness of wrong doings, expression of love, joy, and peace to one another, and fostering of compassion, and empathy to all mankind.

“Given our commitment to the preservation and protection of the lives of all Nigerians, and the need to ensure good governance, the Caucus calls on the Federal Government to tackle, headlong the disturbing trend of wanton killings in the country.

“The resumed cases of violence, maiming, kidnapping, and bloodletting in Plateau, Benue, and other parts of the country, portends serious dangers to meaningful growth and development.

“It is appropriate to call on all security agencies to ensure that the negative actions and vicious activities of this group of marauders are comprehensively curtailed, if not entirely wiped out.

“The Caucus urges Christians (and all other Nigerians) to continually pray for our Leaders; at all levels for the right wisdom, knowledge, and understanding towards navigating the country through multi-sectoral, and multi-layered challenges that are not only limiting the realization of Nigeria’s potentials but throwing our people into immeasurable hardship, debilitating hunger, and corrosive poverty.

“Finally, Easter is not just a period for feasting, but also for reflections, new beginnings, and connection with other people, the Caucus admonishes all Nigerians to constantly emphasize virtues that promote unity, and development above negative tendencies that cause divisiveness.

-

News4 hours ago

News4 hours agoJust in: Many Feared Killed In Abuja

-

News17 hours ago

News17 hours agoTinubu Remains Engaged In Governance From Europe, Will Return After Easter – Presidency

-

News17 hours ago

News17 hours agoFirst Lady Convoy Kills Seven-Year-Old Girl In Ondo State

-

News8 hours ago

News8 hours agoSenator Natasha on FB listed 3 politicians that should be arrested if anything happens to her

-

News8 hours ago

News8 hours agoEmergency Rule: We should be thankful to President Tinubu -Wike

-

Foreign17 hours ago

Foreign17 hours agoTrump To Close US Embassies In South Sudan, France, Others

-

News16 hours ago

News16 hours agoNJC investigates 18 Imo judges over suspected age falsification

-

News16 hours ago

News16 hours agoNANS threatens protest over alleged student loan diversion