News

Tinubu’s tax reform bills not to generate revenue — Taiwo Oyedele

The chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has explained the essence of the tax reform bills proposed by President Bola Tinubu.

Oyedele said the essence of the tax reform bill is not to generate revenue.

Speaking during the Tax Reform Bills Town Hall meeting on Monday, he said the bill was aimed at fixing Nigeria’s economy and ensuring prosperity.

“The essence of the tax reform bills is not to generate revenue but to fix the economy in a way that there will be shared prosperity for Nigerians,” he said.

The four tax reform bills proposed are before the National Assembly and have been on the front burner of national discussion.

The four bills—the Nigeria Tax Bill 2024, the Tax Administration Bill, the Nigeria Revenue Service Establishment Bill, and the Joint Revenue Board Establishment Bill—are currently before both chambers of the National Assembly for passage.

News

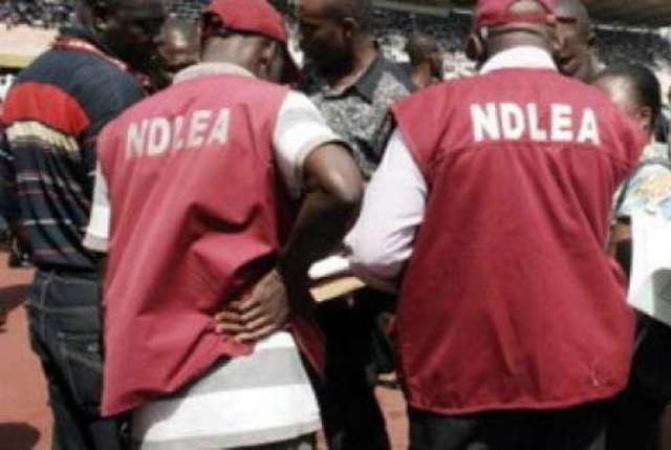

Abuja raid attack: Three NDLEA officers sustain gunshot injuries, hospitalized

Three officers of the National Drug Law Enforcement Agency, NDLEA, have been hospitalized for gunshot injuries sustained after they came under attack from some armed men during a raid operation in Jahi area of the Federal Capital Territory, Abuja on Thursday night.

The incident occurred when a team of NDLEA operatives acting on intelligence and surveillance report raided an uncompleted building at NNPC area of Jahi where 74 bottles of codeine, 10 litres of codeine syrup, 48grams of tramadol 225mg and 4.9kilograms of skunk, a strain of cannabis, as well as five android phones were recovered.

As the NDLEA team made their way out of the location, they came under gun attack.

Three of the NDLEA personnel involved in the raid sustained gunshot injuries: one in the rib and two others on their back and leg.

The wounded officers were initially stabilized at the Police Clinic in Garki Area 1 before they were transferred to the National Hospital Abuja for further medical attention.

Chairman/Chief Executive Officer of NDLEA, Brig Gen Mohamed Buba Marwa (Rtd) expressed appreciation to the staff of the Police Clinic for their prompt support. He also thanked the Chief Medical Director of the National Hospital who was personally reached by him for overseeing the treatment of the wounded officers.

The NDLEA boss who is in Kano on official engagements also spoke on phone with the injured officers to wish them quick recovery. He assured them that the Agency will deploy every means at its disposal and work in collaboration with other security agencies to fish out those responsible for the attack on them.

News

Tinubu preaches hope at Easter gives directive to military to end insecurity

President Bola Ahmed Tinubu on Friday asked Christians in the country to use the Holy Week and Easter to reflect on the enduring values of sacrifice, redemption, love, and hope.

The President made the call in a message he signed on Good Friday, two days to the Easter celebrations.

According to Tinubu, he was saddened by the recent insecurity in the country. He also directed security operatives to decisively end the insecurity without delay.

“The recent tragic incidents and the loss of lives in some parts of our country deeply saddened me. I understand the pain and fear these incidents have caused. Let me assure you that my administration’s resolve to restore peace and security remains unshakable. Forces of evil will never prevail over our country,” Tinubu said.

I have given clear directives to the Armed Forces and all relevant security agencies to end insecurity decisively and without delay. With the unwavering courage and commitment of our gallant men and women in uniform, we are turning the tide and making steady progress in reclaiming peace and stability.

“As President of our blessed nation, I draw inspiration from this timeless message of hope and renewal. I remain steadfast in my commitment to delivering the promise of a Renewed Hope, a better, more just, and prosperous Nigeria for all.

“The Holy Week, which spans Palm Sunday through Holy Thursday and Good Friday and culminates in Easter Sunday, calls us to reflect deeply on the enduring values of sacrifice, redemption, love, and hope.”

“I have given clear directives to the Armed Forces and all relevant security agencies to end insecurity decisively and without delay. With the unwavering courage and commitment of our gallant men and women in uniform, we are turning the tide and making steady progress in reclaiming peace and stability.

“As President of our blessed nation, I draw inspiration from this timeless message of hope and renewal. I remain steadfast in my commitment to delivering the promise of a Renewed Hope, a better, more just, and prosperous Nigeria for all.

“The Holy Week, which spans Palm Sunday through Holy Thursday and Good Friday and culminates in Easter Sunday, calls us to reflect deeply on the enduring values of sacrifice, redemption, love, and hope.”

The President also expressed gratitude to Nigerians for their “patience and resilience as our economy begins to show encouraging signs of recovery.”

“We understand the economic challenges many of you are facing, and we are working tirelessly to restore investor confidence, stabilise key sectors, and build an inclusive economy that serves the interests of all Nigerians.

“During this Easter, we join the global Christian community in thanking God for Pope Francis’s recovery. We pray that his renewed strength continues to inspire his leadership and service to humanity.

“I earnestly pray that Easter’s spirit fills every heart and home with renewed faith in the immense possibilities ahead of us as a nation. Just as Christ triumphed over death, so too shall our country triumph over every challenge we face. The present moment may be cloudy, but it will usher in a glorious day,” he added.

News

Easter: HoR Minority Caucus celebrates with Christians, urges love, peace, national cohesion, calls for end to killings nationwide

The Minority Caucus in the House of Representatives congratulates the entire Christian community in Nigeria, as they join others around the world on the occasion of this year’s Easter celebrations; marking the end of the Lenten period.

This was contained in a statement jointly signed by leaders of the caucus, Rep Kingsley Chinda, Leader, Rt. Hon. Dr. Ali Isa J.C

(Minority Whip) Rt. Hon. Aliyu Madaki , (Deputy Minority Leader)

Rt. Hon. George Ozodinobi

(Deputy Minority Whip) stating that:

” Indeed, Easter is a very unique, and sacred time for every Christian faithful, as it is of significance following the successful completion of the 40-day fasting; which is one of the cardinal tenets of Christianity.

“As our Christian brethren across the country join others around the world to mark this auspicious day; and confident that God Almighty has accepted all prayers and supplications during this time, the Caucus admonish all to sustain the teachings, practice, and lessons of the Lenten period which embodies spiritual, personal, and leadership growth. More importantly, it is necessary to deepen the pivotal messages of the Easter celebrations which are anchored on renewal of faith, resilience and re-invigoration of good deeds, forgiveness of wrong doings, expression of love, joy, and peace to one another, and fostering of compassion, and empathy to all mankind.

“Given our commitment to the preservation and protection of the lives of all Nigerians, and the need to ensure good governance, the Caucus calls on the Federal Government to tackle, headlong the disturbing trend of wanton killings in the country.

“The resumed cases of violence, maiming, kidnapping, and bloodletting in Plateau, Benue, and other parts of the country, portends serious dangers to meaningful growth and development.

“It is appropriate to call on all security agencies to ensure that the negative actions and vicious activities of this group of marauders are comprehensively curtailed, if not entirely wiped out.

“The Caucus urges Christians (and all other Nigerians) to continually pray for our Leaders; at all levels for the right wisdom, knowledge, and understanding towards navigating the country through multi-sectoral, and multi-layered challenges that are not only limiting the realization of Nigeria’s potentials but throwing our people into immeasurable hardship, debilitating hunger, and corrosive poverty.

“Finally, Easter is not just a period for feasting, but also for reflections, new beginnings, and connection with other people, the Caucus admonishes all Nigerians to constantly emphasize virtues that promote unity, and development above negative tendencies that cause divisiveness.

-

News13 hours ago

News13 hours agoJust in: Many Feared Killed In Abuja

-

News16 hours ago

News16 hours agoSenator Natasha on FB listed 3 politicians that should be arrested if anything happens to her

-

News17 hours ago

News17 hours agoEmergency Rule: We should be thankful to President Tinubu -Wike

-

News15 hours ago

News15 hours agoChina Reaffirms One-China Principle, Commend Support From Nigeria

-

News13 hours ago

News13 hours agoPolice clarify on report alleging First Lady’s convoy killed 7-yr-old baby

-

News19 hours ago

News19 hours agoCourt Orders Fast-Tracked Trial Of 15 Workers Held In Prison For 6 Yrs Over Patience Jonathan’s Missing Jewellery

-

News11 hours ago

News11 hours agoAbuja raid attack: Three NDLEA officers sustain gunshot injuries, hospitalized

-

News19 hours ago

News19 hours agoCatholic Church gives Anambra APC guber candidate rigid conditions for support