News

Cash outside banks hits N4.3tn, CBN warns on scarcity

Nigeria continues to face cash scarcity despite a significant year-on-year increase of N1.59 trillion in the amount of currency held outside banks.

Data from the Central Bank of Nigeria’s money and credit statistics shows that a substantial proportion of currency in circulation remains outside the banking system, with more than 90 per cent consistently held outside formal financial institutions in 2024.

The data revealed that currency outside banks surged to N4.29tn in October 2024, accounting for 94.3 per cent of the total currency in circulation of N4.55tn.

This represents a significant year-on-year growth of 59 per cent or N1.59tn from N2.70tn in October 2023, when 89.6 per cent of the total currency was outside banks.

On a month-on-month basis, the amount held outside banks increased by 6.8 per cent or N270bn, compared to the N4.02tn recorded in September 2024.

In September 2024, currency outside banks stood at N4.02tn, representing 93.1 per cent of the total currency in circulation of N4.31tn.

This marked a year-on-year increase of 66.3 per cent compared to N2.42tn in September 2023, when 87.5 per cent of the total was outside banks. The month-on-month increase was 3.8 per cent.

In August 2024, currency outside banks rose to N3.87tn, which accounted for 93.3 per cent of the total currency in circulation of N4.14tn.

This represented a year-on-year increase of 73.9 per cent compared to N2.22tn in August 2023, when 83.6 per cent of the total currency was outside banks.

The trend continued in July 2024 with N3.67tn held outside banks, representing 90.5 per cent of the total currency in circulation of N4.05tn.

Despite efforts to promote cashless transactions, the data shows that Nigerians remain deeply reliant on cash, which could hinder the country’s push for modernised financial systems.

The President, Association of Senior Staff of Banks, Insurance, and Financial Institutions, Olusoji Oluwole, attributed the worsening cash shortage across the country to the CBN’s inability to meet the cash demands of commercial banks.’

CBN to fine banks

Meanwhile, the CBN on Friday announced a fine of N150m per branch on Deposit Money Banks found guilty of facilitating the illegal flow of mint naira notes to currency hawkers and unscrupulous agents.

Saturday PUNCH had reported the surge in the hawking of naira notes at exorbitant charges in different parts of the country, as Nigerians continue to struggle with limited access to cash in banking halls despite threats by the CBN.

The apex bank disclosed this in a circular issued on Friday, December 13, 2024 and signed by the acting Director of the Currency Operations Department, Mohammed Olayemi.

The circular revealed that the CBN was concerned about the increasing prevalence of mint naira notes being traded by hawkers, a practice the bank described as impeding efficient and effective cash distribution to customers and the general public.

The circular, which referred to an earlier directive dated November 13, 2024, highlighted the apex bank’s determination to address the commodification of the naira.

Under the directive, any branch of a financial institution found culpable will face a penalty of N150m for the first violation.

Subsequent infractions, the CBN warned, would attract stricter sanctions under the provisions of the Banks and Other Financial Institutions Act 2020.

To ensure compliance, the apex bank stated that it would increase periodic spot checks in banking halls and ATMs while deploying mystery shoppers to uncover illicit cash hawking spots across the country.

The circular read, “CBN will continue to intensify the periodic spot checks to the banking halls/ATMs to review cash payouts to banks’ customers, as well as mystery shopping to all identified cash hawking spots across the country.

“In this regard, erring deposit money banks or financial institutions that are culpable of facilitating, aiding, or abetting, by direct actions or inactions, the illicit flow of mint banknotes to currency hawkers and unscrupulous economic agents that commodify naira banknotes shall be penalised at first instance N150,000,000.00 (one hundred and fifty million naira) only, per erring branch, and at later instances, apply the full weight of relevant provisions of BOFIA 2020.”

News

Watch current episode of Your family Lawyer as Chinye breaks down intricacies of bloodlines, DNA tests

Again, Chuma Chinye a seasoned lawyer in last Saturday’s podcast of Your family Lawyer adequately thrashed out intricacies associated with DNA tests and bloodlines in family matters.

WATCH:

News

Protests erupt in Plateau over incessant k!llings

Protests erupted in Jos, the Plateau State capital, on Monday morning over the continued killings of indigenous residents by gunmen suspected to be Fulani militants.

The demonstrations, led by Christian leaders including the state chairman of the Christian Association of Nigeria, Rev. Polycarp Lubo, commenced on Monday morning at the Fawvwei Junction community road, causing a heavy gridlock and stranding commuters.

The latest protest comes amid a surge in violent attacks by gunmen in various communities, with over 100 people killed in Bokkos and Bassa LGAS in the past two weeks.

“We are not happy over the continuous attacks and killings by gunmen in our communities. That’s why we have come out again to protest these happenings,” said Gyang Dalyop, one of the protesters.

Another protester, Hannatu Philip, called on the government to intervene before it spirals out of control.

The protesters brandishing placards with different inscriptions were seen marching towards the Rayfield Government House.

News

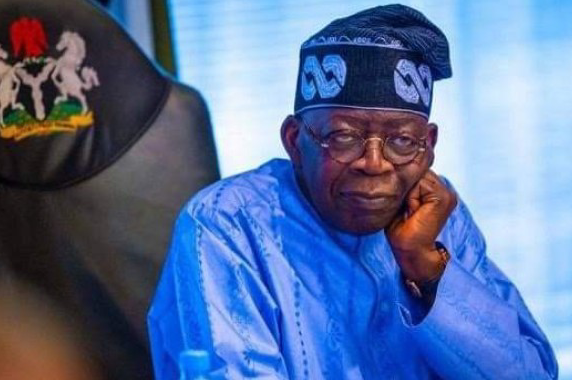

Tinubu not your equal – Presidency replies Peter Obi’s ex-running mate, Datti

The Presidency has said the former Labour Party, LP, presidential running mate, Yusuf Datti Baba-Ahmed is no match for President Bola Tinubu.

Tinubu’s Special Adviser on Media and Public Communication, Sunday Dare was reacting to Datti’s remark that he (Tinubu) would not run for the presidency in 2027.

The former LP running mate insisted that Tinubu’s time is up, adding that everything is there for the president and the ruling All Progressives Party, APC, to see that they lose in 2027.

Dismissing such remark, Dare likened Datti’s comment to the new year predictions of charlatan ‘prophets’ which never come through.

In a statement he signed, Dare said the likes of Peter Obi and Datti would have been president left for the latter’s theories.

According to Dare, Datti has chosen to venture into an unfamiliar terrain.

The statement reads partly: “Yusuf Datti Baba-Ahmed’s “illogical logic” was all over the place in his recent interview with a television channel.

“Listening to Yusuf Datti Baba- Ahmed spurn his postulations about the political future of Nigeria and that of the incumbent President is like listening to the new year predictions of charlatan ‘prophets’ which never come through. Yusuf Baba Ahmed and his co-traveller Peter Obi are indeed a “double whammy“ in the Nigerian political space.

“He chose to base his political calculations on President Bola Tinubu not winning a second term given his antecedents and because Nigerians will decide at the polls among other things. He conveniently avoided the substance of performance and capacity.

“Unfortunately, he chose to walk into a lane he was unfamiliar with and chose to confront a politician he is no match for.”

Similarly, the Presidency had also stressed that Tinubu will reveal his plans for a second term at the right time.

It said the APC 2027 presidential campaign billboards had no links to Tinubu and Vice President Kashim Shettima.

-

News8 hours ago

News8 hours agoBREAKING! Pope Francis is dead

-

News12 hours ago

News12 hours agoRetirees with outstanding loans may lose property – FG

-

News5 hours ago

News5 hours agoUPDATED: How Pope Francis transited, last activity, health challenges, others

-

News22 hours ago

News22 hours agoIsrael’s remote controlled bulldozers breaking ground in Gaza war

-

News12 hours ago

News12 hours agoSad as hotelier slumps, dies at wife’s 60th birthday thanksgiving

-

Sports24 hours ago

Sports24 hours agoEPL Results: Chelsea Boost UCL Hopes, Arsenal Win Big, Man United Lost

-

News22 hours ago

News22 hours ago70-hour Chess Marathon: Onakoya reportedly breaks record set by Norwegians

-

Metro13 hours ago

Metro13 hours ago77-year-old Nigerian Uber driver shot dead in US, passenger in critical condition