News

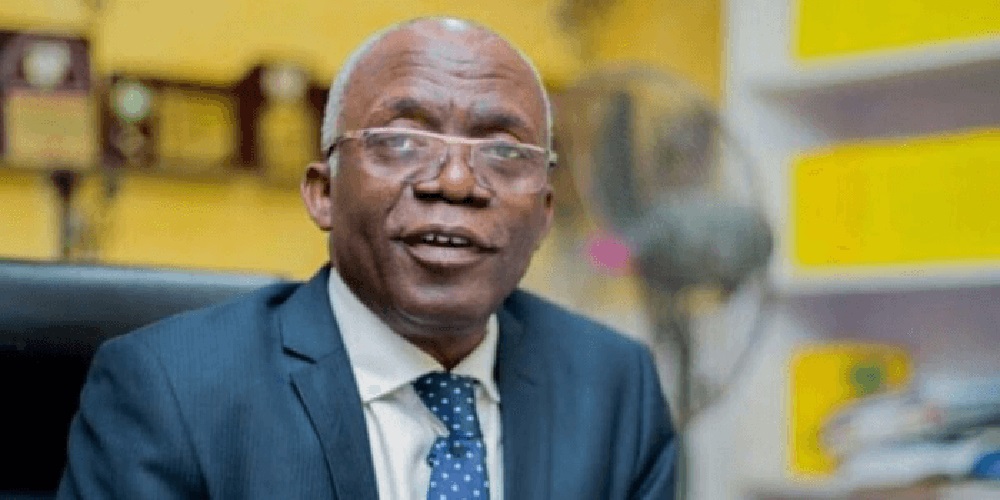

Stampedes: Police, not poverty, caused loss of lives – Falana knocks security agents

Human rights activist and Lawyer, Mr Femi Falana SAN, has blamed the Nigerian Police for the recent stampedes in parts of the country.

Falana stated this on Friday in Akure during a programme organised by the Ondo State Government tagged Akeredolu Leadership Lecture Series to honour the late governor.

The News Agency of Nigeria reports that topic of the of the lecture was; Security Sector Reform in Promoting Peace Stability and Development; The Ondo State Example.

Falana blamed the Nigerian Police for the recent stampedes in Ibadan, Anambra and Abuja where over 65 persons died in the process of collecting palliatives.

According to him, the police failed to adequately protect people during the gatherings.

“It was failure of security, it’s not poverty that caused all the loss of lives.

“If there is any process, or gathering, they (Police) shall provide security,” the lawyer said.

Falana said that Ondo State has become a reference point for states in the country by ensuring peace in the state through the creation of Ondo State Security Network, codenamed Amotekun by Akeredolu.

He said Akeredolu dared the Federal Government to create the state Amotekun which could be likened to a state police.

Falana also said that the greatest tribute of the legacy of Akeredolu was the recent meeting by all the 36 State governors in Abuja with the the Federal Government for the creation of state police.

Falana commended Gov. Lucky Aiyedatiwa for sustaining the legacies of late Gov. Rotimi Akeredolu of of Ondo State.

“The greatest tribute that can be paid to Akeredolu since he passed on, has come from unexpected quarters.

“The President and governors recently met and approved the creation of state police in Nigeria.

“That is the greatest tribute. Ondo State has exported the Amotekun phenomenal to Nigeria.

Later, Gov. Lucky Aiyedatiwa of Ondo State said that he remained the number one legacy of Akeredolu, who made no mistake about who to succeed him.

Aiyedatiwa said that his predecessor must be celebrated for his selfless service and fight for the advancement of democracy and rule of law in the country.

He said the state government rather than celebrate one year in office which coincided with the death of Akeredolu, chose to accord premium to his remembrance.

“Akeredolu was that courageous leader who spoke truth to power and fought for the advancement of democracy and the Rule of Law in our country.

“His leadership was not only marked by integrity, transparency and a deep understanding of the needs of our people, Akeredolu also implemented various initiatives geared towards transforming Ondo State,” he said.

Earlier, the Chairman of the occasion, Chief Sehinde Arogbofa, commended Falana for always speaking for the masses and acknowledged the legacies of Akeredolu.

Also, Hon. Victor Olabimtan, a former Speaker of the House of Assembly and Chairman, SUBEB, lauded Aiyedatiwa for continuing the legacies and projects initiated by Akeredolu.

News

Senate mulls terrorism charges for oil theft offenders

The Senate, yesterday, issued a stern warning that perpetrators of oil theft in the Niger Delta region may soon face terrorism charges and other stiffer penalties.

Senate President, Godswill Akpabio, disclosed this while declaring open a two-day public hearing on the “Incessant and nefarious acts of crude oil thefts in the Niger Delta and the actors held.”

The hearing organised by the Senate Ad-hoc Committee on Incessant Crude Oil Theft chaired by Ned Nwoko is aimed at addressing the persistent theft of crude oil in the Niger Delta and produce actionable solutions to the problem.

Akpabio, who was represented by his deputy, Barau Jibrin, said the 10th National Assembly would not stand idly by as the country loses billions of dollars annually to what he described as “brazen economic sabotage.”

He disclosed that the National Assembly was considering a range of strong legislative responses, including categorising major acts of oil theft as terrorism, mandatory digital metering for all oil production and exports, real-time monitoring, improved transparency in crude lifting and revenue reporting, as well as enhanced coordination among military, law enforcement, and anti-corruption agencies.

“Crude oil theft is not a victimless crime. It is directly responsible for economic instability, a weakened naira, underfunded critical sectors, and widespread poverty in oil-producing communities. It also finances illegal arms, fuels violence, and strengthens criminal networks.”

Akpabio lamented that despite past efforts, crude oil theft continues unabated due to systemic failures and gaps in enforcement and oversight. Recent reports estimate that Nigeria loses between 150,000 and 400,000 barrels of crude oil daily, costing the country billions in lost revenue.

“This public hearing must address critical questions: Who are the perpetrators? Are they militants, corrupt officials, international collaborators—or all three? Why have current security measures failed? And how are stolen shipments leaving the country undetected?” he asked.

The Senate President called on all stakeholders including regulatory agencies, oil companies, security forces and host communities, to work collaboratively to stop the looting of the country’s most valuable resource. He emphasised that oil companies must invest in surveillance technology and secure infrastructure, while host communities should act as first-line defenders rather than victims or accomplices.

“To the criminals stealing our crude oil, your time is up. To the agencies tasked with protecting our resources, the nation is watching. And to this Ad-hoc Committee, the Senate expects a robust, no-holds-barred report that will guide firm legislative and executive action.”

Akpabio commended Nwoko, who chairs the Committee convening the hearing and stressed that the recommendations must lead to actionable, measurable and time-bound solutions.”

“The survival of Nigeria’s economy depends on how we respond to this crisis,” he concluded.

Meanwhile, ahead of its planned two-day national security summit, the Senate, yesterday, set up a 20-member committee to organise the event.

The Senate President, Akpabio, who announced the committee’s formation during plenary, said it would be chaired by the Senate Leader, Opeyemi Bamidele, with Yahaya Abdullahi serving as the vice chairman.

Other members are Ireti Kingibe (FCT), Adebule Idiat (Lagos), Barinada Mpigi (Rivers), Babangida Hussaini (Jigawa), Jimoh Ibrahim (Ondo), Osita Ngwu (Enugu), Tahir Monguno (Borno), Titus Zam (Benue), Ahmed Lawan (Yobe), Abdulaziz Yar’Adua (Katsina), Gbenga Daniel (Ogun), Austin Akobundu (Abia), Shehu Buba (Bauchi), Ahmed Madori (Jigawa), Emmanuel Udende (Benue), Adams Oshiomhole (Edo), Shuaib Salisu (Ogun), Isah Jibrin (Kogi) and the Clerk of the Senate, Andrew Nwoba.

The committee is tasked with developing the summit’s framework, including setting the agenda, identifying core issues for discussion, and recommending actionable strategies to improve national security. Akpabio directed the committee to submit its report within two weeks.

The decision to convene the summit followed a resolution passed on May 6 after a motion sponsored by Jimoh Ibrahim to address escalating security challenges in the country was adopted. It is expected to address pressing issues such as terrorism, insurgency, and the alarming trend of leaking military intelligence to militant groups, an issue widely seen as compromising ongoing security operations.

This is not the first time the National Assembly would attempt to address security concerns through a summit. In May 2021, the ninth Assembly, under the then Senate President, Ahmad Lawan and House Speaker, Femi Gbajabiamila, organised a similar summit. Despite contributions from security experts, civil societies, and government agencies, insecurity has continued to plague the country.

News

Court convicts 10 Thai sailors, vessel for cocaine trafficking

Justice Daniel Osiagor of the Federal High Court in Lagos on Thursday convicted ten Thai nationals for trafficking 32.9 kilograms of cocaine into Nigeria.

The convicted individuals, all sailors, were found guilty alongside their vessel, MV Chayanee Naree, which was used to smuggle the illicit drug into the country.

The convicted Thais’ sailors are: Krilerk Tanakhan; Boonlert Hansoongnern; Jakkarin Booncharoen; Thammarong Put-tlek; Worrapat Paopinta; Marut Kantaprom; Werapat Somboonying; Urkit Amsri; Panudet Jaisuk, and Amrat Thawom.

The vessel and convicted sailors were first arraigned before the court alongside nine Nigerians, on the alleged offences in February 2022, by the National Drug Law Enforcement Agency (NDLEA).

The Nigerians are: Samuel Messiah; Ishaya Maisamari; Ilesanmi Ayo Abbey; Osabeye Stephen; Gbenga Ogunfadeke; Kayode Buletiri; Rilwan Omotosho Liasu; Saidi Sule Alani, and Jamiu Adewale Yusuf.

The vessel, the convicted sailors and the nine Nigerians were arrested on October 13, 2021, at Apapa, Lagos, on their arrival from Brazil.

They were charged before the court on charges bordering on conspiracy, unlawful transportation and unlawful importation of 32.9 kilograms of Cocaine.

Their illegal acts, according to the NDLEA, contravened sections 11 (b), 11(a) and 14 (b) of the National Drug Law Enforcement Agency Act Cap N30 Laws of the Federation of Nigeria, 2004. And punishable under the same Act.

The convicted Thais and their Nigerian alleged co-conspirators were accused of committing the acts alongside the trio of Kehinde Enoch, Ayo Joseph and one Tunde, all said to be at large.

The convicted sailors were prosecuted by the NDLEA prosecutors, who include; Mrs Theresa Asuquo, A. Adebayo and Paul Awogbuyi. While they were defended by their team of lawyers, who include Babajide Koku, Femi atoyebi and Tunde Adejuyigbe, who are Senior Advocates of Nigeria (SAN).

Upon conclusion of the NDLEA’s case, the convicted sailors opted for No-Case-Submission instead of opening their defence against the allegations against them. This was, however, contended by the prosecutors, who submitted that they had established a prima facie case against the vessel and its Crew.

In deciding the No-Case-Submission, Justice Osiagor acceded to the submissions of the prosecution and held that the prosecution had established a prima facie case against the vessel and its Crew members.

The judge therefore ordered the convicted Thais and others to open their defence against the charges against them.

Based on the court’s ruling, the convicted sailors entered a plea bargain agreement with the NDLEA.

At the resumed hearing of the matter for judgment today, and based on the plea bargain agreement, Justice Osiagor ordered the vessel to pay a fine of $4 million USD or Naira equivalent.

On the convicted sailors, the judge ordered the three Captains of the vessel, namely; Krilerk Tanakhan; Boonlert Hansoongnern; Jakkarin Booncharoen; to pay the sum of $50, 000, 00 USD. And that the other crew member to pay $30, 000, USD each. And that other convicted sailors are ordered to pay the sum of N100,000. 00, as a fine optio n.

Meanwhile, the trial of the nine Nigerians has been adjourned to June 25.

News

Court of Appeal affirms nullification of Ebonyi council polls

The Court of Appeal Enugu Division has affirmed the judgement of Justice R O Riman of the Federal High Court Abakaliki, nullifying the conduct of Local Government election in Ebonyi State.

Justice Joseph Ekanem, who read the lead judgement of the Appeal court, gave the ruling while dismissing the three appeals filed by Ebonyi State Government, Central Bank and Local Government Chairmen, challenging the ruling of the Federal High Court.

The Appeal Court ruled that the earlier judgement of Justice R O Riman then of Federal High Court Abakaliki remains valid and subsisting.

According to the Appeal court: “The judgment in FHC/AI/CS/224/2022, which the Appellants challenged on appeal, was meant to enforce compliance with the earlier judgment in FHC/AI/CS/151/2022 contrary to the argument of the appellants.”

The court ruled that the appeals were dismissed for proliferation of issues for determination by the appellants which resulted in an incompetent brief of argument.

-

News17 hours ago

News17 hours agoAlleged cyber bullying: IGP re-arraigns VDM

-

Opinion23 hours ago

Opinion23 hours agoHuman Capital Devt: The Rep Paul Nnamchi

-

News19 hours ago

News19 hours agoBREAKING: PDP, NNPP Rep members abandon parties, lace boots with APC

-

News23 hours ago

News23 hours agoNnamdi Kanu’s family wants court to ban NAN coverage of son’s trial or allow live streaming

-

News23 hours ago

News23 hours agoSEE Current Black Market Dollar (USD) To Naira (NGN) Exchange Rate

-

News16 hours ago

News16 hours agoBill To Make Voting Compulsory For Nigerians Passes Second Reading

-

News23 hours ago

News23 hours agoPDP Summons Emergency Meeting As South-East Threatens Exodus

-

News22 hours ago

News22 hours agoAlleged scam: Coalition wants EFCC to charge ex-Chairman, Bawa to court immediately