News

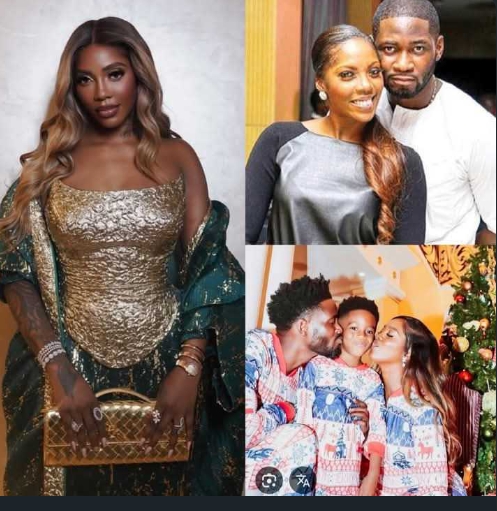

Tiwa Savage, Teebliz officially back together

News

Alleged scam: Coalition wants EFCC to charge ex-Chairman, Bawa to court immediately

…demands full investigation report from DSS

The Economic and Financial Crimes Commission (EFCC) has been called upon, to as a matter of urgent necessity, arraign its former Chairman, Mr. Abdulrasheed Bawa to court, over multiple corruption allegations against him.

The Coalition of Activists Against Corruption in Nigeria (CAACIN), handed this charge, through a statement in Kaduna, Thursday morning.

In the statement signed by the Spokesperson of the Coalition, Comrade Ahmed Aliyu, the Department of State Services (DSS) was also challenged to make public, the report of their investigation, in the over four months detention and interrogation of the erstwhile EFCC Boss in their custody in 2023.

“It is not possible to detian a man of his caliber for 5 months, for nothing. We invite the DSS to make open, the report of their findings. There were multiple corruption allegations against Bawa which the EFCC and DSS were also aware. Nigerians can’t afford to let these be swept under the carpet”, the statement read in part.

The Coalition’s call is coming barely three days after a group, Citizens Forum for Transparency and Integrity (CFTI), in a statement by its President, Alhaji Aminu Mustapha Gidado, in Lagos; accused Bawa of working secretly with the opposition figures to discredit President Bola Tinubu’s administration.

In what the group described as “coordinated and sinister,” the CFTI alleged that Bawa recently met with key opposition figures in London, where discussions were held on using his former contacts within the EFCC to target four serving Ministers in Tinubu’s cabinet.

While reacting on Thursday, the Coalition of Activists Against Corruption in Nigeria also frowned at the rationale behind keeping those appointees and close allies of the ex-Chairman in the Commission, two years after he was sacked.

The Coalition said, “it does not make any sense to still keep the appointees and close allies of a man who was severally accused of embezzlement, fraud, bribery and other corrupt practices in the system. It is as good as still having the corrupt man in the system. Aside the fact that the system will remain corrupted by them, it’s also a simple logic that the ex-Chairman could use them to sabotage the Commission and the government.

“Keeping those Bawa appointed or employed in his two years sway in the Commission is just to say that the EFCC is sitting on a time bomb, as it would only take time for his loyalists to begin sabotage the fight against corruption and rubbish the integrity of the Tinubu’s anti-corruption stance.

“It is on this note that we demand that the DSS should avail the public the report of their investigation. The EFCC should as a a matter of urgent necessity, charge Abdulrasheed Bawa to court. The Commission should also purge itself by showing those Bawa brought in, the way out”.

It would be recalled that, President Tinubu suspended Abdulrasheed Bawa as Acting Chairman of the EFCC in June 2023, exactly two weeks after he took over power. The DSS subsequently picked him same day and detained him in Yellow House for 134 days, without giving reason for his arrest or disclose what the result of their investigation was.

Several credible media houses within and outside the country have reported stories about an alleged embezzlement of public funds by the former EFCC boss. Many organizations, including the North Central Citizens Council (NCCC), have also called for full investigation into the allegations levelled against Bawa, even when he was still in the office.

One of the allegations was that the former Chairman expended a large amount of money to the tune of $300,000 for hotels and other activities, which is far and beyond his income as civil servant, during a visit to Mecca with his family on a lesser Hajj, while still in the office.

There were also reports of how Bawa was probed by the current EFCC Chief, Ola Olukoyede, in 2019, over alleged sales of seized assets worth over N4.8 billion, while Bawa was overseeing the Lagos Zonal Office of the Commission; though the EFCC refuted this claim in 2021.

In his last days as Governor of Zamfara State, Mallam Bello Matawalle, had also, during an interview with the BBC Hausa in May 2023, accused Bawa of demanding a bribe of two million dollars from him.

“If he exits office, people will surely know he is not an honest person. I have evidence against him. Let him vacate the office, I am telling you within 10 seconds probably more than 200 people will bring evidence of bribes he collected from them. He knows what he requested from me but I declined.

“He requested a bribe of two million dollars from me and I have evidence of this. He knows the house we met, he invited me and told me the conditions. He told me governors were going to his office but I did not. If I don’t have evidence, I won’t say this,” the governor said in the interview”, Matawalle had told BBCHausa.

News

PDP Summons Emergency Meeting As South-East Threatens Exodus

By Kayode Sanni-Arewa

The National Working Committee (NWC) of the Peoples Democratic Party (PDP) is preparing for a pivotal meeting today to finalize arrangements for the upcoming National Executive Committee (NEC) gathers momentum.

This meeting takes place amid escalating tensions over the party’s national secretaryship, a dispute that has deepened divisions within the PDP.

The crisis has intensified as the South-East zonal caucus has threatened to withdraw from the party unless their nominee, Sunday Ude-Okoye, is officially confirmed for the national secretary role.

At the heart of the conflict is the leadership tussle between Samuel Anyanwu and Ude-Okoye. Despite a general agreement among PDP governors to replace Anyanwu, who lost the 2023 Imo State governorship election, the matter remains unresolved.

However, a key PDP figure, the Minister of the Federal Capital Territory (FCT), Nyesom Wike, insists that Anyanwu should be allowed to complete his tenure. Wike has even threatened legal action, warning that any communication with the Independent National Electoral Commission (INEC)—including the notice for the NEC meeting scheduled for May 27—must bear Anyanwu’s signature.

The forthcoming NEC meeting, set for May 27, is viewed as a crucial opportunity to address the party’s internal challenges and lay the groundwork for the national convention slated for August.

To help mediate the crisis, PDP governors and stakeholders have formed a seven-member committee, led by former Senate President Bukola Saraki, tasked with finding a resolution.

Besides tackling the leadership dispute, today’s NWC meeting will also address ongoing security issues at the PDP national secretariat, Wadata Plaza in Abuja. The secretariat has been repeatedly targeted by thugs amid the secretaryship conflict, raising safety concerns among staff, some of whom have requested that meetings be held offsite in the past.

The NWC is expected to consider restructuring the security arrangements to enhance protection. The recent endorsement of acting national secretary Setonji Koshoedo by 83 PDP administrative staff underscores the urgency of resolving these matters.

Sources within the party, speaking to Daily Trust, say the NWC is committed to ensuring the NEC meeting proceeds as planned despite attempts by some factions to obstruct it.

“One faction is still working to block the NEC meeting, but the NWC is focused on getting the process started and making sure the meeting happens,” one source said.

The source added, “Security concerns are also high on the agenda. The secretariat has been invaded multiple times during the secretaryship dispute. Staff safety remains a serious issue — at one point, even the Board of Trustees had to hold meetings outside the secretariat. The NWC aims to implement a comprehensive security overhaul.”

News

SEE Current Black Market Dollar (USD) To Naira (NGN) Exchange Rate

By Kayode Sanni-Arewa

As of Wednesday, May 14, 2025, the exchange rate for the US Dollar to the Nigerian Naira on the Lagos Parallel Market (commonly referred to as the black market) stands at ₦1,625 for buying and ₦1,630 for selling.

This information is based on data obtained from reliable sources within the Bureau De Change (BDC) community.

It is important to emphasize that the Central Bank of Nigeria (CBN) does not endorse or recognize the black market. The apex bank has consistently advised individuals and businesses seeking foreign exchange to make use of official channels by contacting their respective commercial banks.

USD to NGN (Black Market) Exchange Rate

Buying Rate ₦1,625

Selling Rate ₦1,630

Official CBN Dollar to Naira Rate – May 14, 2025

USD to NGN (CBN Rate) Rate

Highest Rate ₦1,600

Lowest Rate ₦1,595

Please keep in mind that the rates listed here are subject to market fluctuations and may vary depending on the location, time of transaction, and volume of currency exchanged.

Exchange rates are constantly changing due to market dynamics. This article provides indicative rates and should not be considered as financial advice. For the most accurate and up-to-date rates, consult with your bank or a licensed Bureau De Change operator.

-

News10 hours ago

News10 hours agoTinubu Endorses Establishment of Forest Guards to Counter Terrorism, Banditry

-

News10 hours ago

News10 hours agoFG launches smart police station in Abuja

-

News10 hours ago

News10 hours agoNNPCL failed to remit N500bn revenue in 2024 – World Bank

-

Education21 hours ago

Education21 hours agoJust in: JAMB orders UTME resit for 387,000 candidates

-

News3 hours ago

News3 hours agoNnamdi Kanu’s family wants court to ban NAN coverage of son’s trial or allow live streaming

-

Sports9 hours ago

Sports9 hours agoOsimhen’s brace fires Galatasaray to Turkish cup glory

-

News3 hours ago

News3 hours agoSEE Current Black Market Dollar (USD) To Naira (NGN) Exchange Rate

-

News10 hours ago

News10 hours agoEFCC invites Tompolo over viral naira abuse video