Economy

Naira Appreciates to N1,474/$ At Official Rate Despite Parallel Market Drop

The Nigerian currency, the Naira, strengthened its position against the US dollar and other major currencies in the foreign exchange market on Friday, according to data from FMDQ Securities Exchange.

The Naira closed at N1,474.62 per US dollar on Friday, up from N1,479.47 on Wednesday, marking a 0.6 percent or N9.5 increase. This was also higher than the N1,433.89 recorded on Tuesday.

However, the Naira lost some ground compared to Monday, when it opened the trading week at N1,419.86 per US dollar.

The Naira also weakened in the parallel market, where it fell to N1,490 per US dollar on Friday, down from N1,440 on Thursday.

The Central Bank of Nigeria (CBN) Governor, Olayemi Cardoso, assured the public of the stability of the exchange rate when he met with the Senate Joint Committee on Banking, Insurance and Financial Institutions in Abuja on Friday.

He said the CBN was committed to implementing the ‘Financial Markets Price Transparency and Market Notice of a revision to the FMDQ FX Market Rate Pricing Methodology’ and other reforms that were introduced two weeks ago, which boosted the Naira to N1,500 per US dollar from N891.

Economy

Windfall tax: FG insists on sanctions for defaulting bank chiefs

The Federal Government has reiterated that the principal officers of banks who refuse to comply with the law on the windfall tax on banks’ foreign exchange profits will be sanctioned.

The government’s position was reiterated on Monday at the National Assembly when the Minister of Finance, Wale Edun, and the Chairman of the Federal Inland Revenue Service, Zack Adediji, met with the finance committees of both chambers on the Amendment of the Finance Bill, 2024.

Last week Wednesday, the Senate gave expeditious passage to President Bola Tinubu’s request to amend the Finance Act to impose a one-time windfall tax on banks’ foreign exchange profits in 2023.

A windfall tax is a higher tax levied by the government on sectors or businesses that have disproportionately benefited from favourable market conditions.

The President said the money would be part of the revenue used to fund the additional N6.2tn added to the 2024 budget.

The bill which has passed the second reading states, “The Federal Inland Revenue shall assess the realised profits, collect, account, and enforce payment of levy payable under section 30 in accordance with the powers of the Service under the Federal Inland Revenue Service (Establishment) Act 2007; and in the exercise of its functions in 32(a) above, may enter into a deferred payment agreement with the assessed banks, provided that such deferred payment agreement is executed on or before December 31, 2024.

“Any bank that fails to pay the windfall profit levy to the service and has not executed a deferred payment agreement before December 31, 2024, commits an offence and shall, upon conviction, be liable to pay the windfall profit levy withheld or not remitted in addition to a penalty of 10 per cent of the levy withheld or not remitted per annum and interest at the prevailing Central Bank of Nigeria minimum rediscount rate and imprisonment of its principal officers for a period of not more than three years.

“Financial year means either the year commencing from January 1, 2023 to December 31, 2023, or any period within the financial year not aligned with the calendar year comprising twelve calendar months of the bank’s financial activity,” it added.

Speaking at the meeting, Edun said, the “bank windfall” profit levy, though small still constituted an important contribution to government finances at a time when revenues had substantially increased despite minimising taxes.

In his explanation, the FIRS chairman explained that the windfall tax was not a new tax imposed on banks.

Adedeji said, “These are the gains that you have without any contribution from you, without any value addition. They result from the effect of an adverse activity on others. And who are these others? If you look at the report of all manufacturing entities in the last one and a half years, you will discover that a lot of registered companies recorded huge losses from exchange transactions.

“Anywhere in the world, your duty as the government is to redistribute the wealth to sustain the progress and prosperity of the nation.

“So the loss suffered by manufacturing, as a result of these foreign gains, which is being recorded in the bank is what the government seeks to redistribute. And that is why we have this levy.

“So we seek your permission and your understanding in balancing this economic inequality that has occasioned due to the circumstances that we find ourselves.”

Speaking on the sharing formula, the FIRS chairman proposed that it be distributed 50/50 between banks and the government.

He said, “These gains that are realised, the levy proposal today is 50 (per cent) for the bank and 50 (per cent) for the government.”

Raising the issue of penalty as stated in the bill, Senator Isah Jibrin ( APC, Kogi East), asked that the bill be more explicit.

He said, “My area of worry is concerning the penalty, we need to be very explicit on it.

“On the issue of penalty, here it is stated, 10 per cent of the tax withheld or not remitted per annum and interest at the prevailing Central Bank of Nigeria MRR. So what are we going to do? 10 per cent is like coming from nowhere, so I would suggest that we align the MRR.”

“Then at what point does the issue of imprisonment of the officials come in? At what point do we now say, okay, enough is enough and the officials should be arrested after default, is it after a month, a year, two years, or three years.”

Responding to this, Edun said it was unlikely that banks would defy the government, but noted there were penalties for those who defaulted.

The finance minister said, “To be fair to the banks there is no reason to assume that’s what they trying to do. Let us give the benefit of the doubt to one another.

“Well there has to be, there has to be something that will serve as a deterrent. The penalties have to be there. And at the end of the day, tax evasion is a criminal offence.

“For underreporting of profits by the bank, we have enough technical ability to look at what the bank’s audited accounts say and track the level of foreign exchange and the profits therefrom.”

Adedeji also allayed fears regarding possible cases of underreporting.

He noted that the CBN in a memo in September 2023 and March this year had directed commercial banks in the country not to touch or spend the profits they made from foreign exchange transactions.

Economy

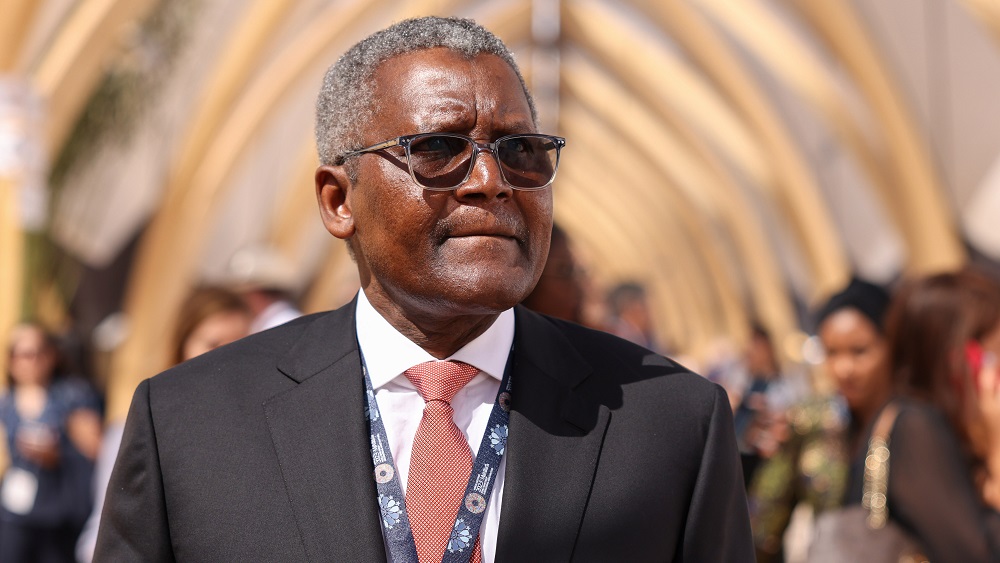

Dangote to scrap steel investment plan in Nigeria over allegations of monopoly

The President and Chief Executive Officer (CEO) of Dangote Group, Aliko Dangote, has announced that the company will abandon its plans to enter Nigeria’s steel industry to avoid being branded a monopoly.

Dangote made this disclosure in a statement on Saturday while addressing journalists at his refinery in Lagos.

The business tycoon explained that the company’s board decided to avoid the steel industry to prevent accusations of attempting to monopolize it.

Furthermore, he noted that pursuing this venture would involve encouraging the importation of raw materials from overseas, which contradicts the firm’s core mandate.

“You know, about doing a new business which we announced, that is, the steel.

“Actually, our own board has decided that we shouldn’t do the steel because if we do the steel business, we will be called all sorts of names like monopoly. And then also, imports will be encouraged. So we don’t want to go into that,” he said.

Dangote, however, urged other Nigerians to invest in the industry to help boost the country’s economy.

“Let other Nigerians go and do it. We are not the only Nigerians here. There are some Nigerians with more cash than us. They should bring that money from Dubai and other parts of the world and invest in our own fatherland,” the CEO added.

In June, Nairametrics reported that Aliko Dangote said his company plans to delve into steel production in the near future stating that he wants to ensure that every steel used in West Africa comes from Nigeria.

He noted that the next venture after the refinery project would be in steel manufacturing and ensure that all steel products used in West Africa come from Nigeria.

“I don’t like people coming to take our solid minerals to process and bring the finished product. We should try and industrialise our continent and take it to the next level.

“I told somebody we are not going to take any break. What we are trying to do is to make sure at least in West Africa, we want to make sure that every single steel that we use will come from Nigeria”, Dangote said at that time.

Nigeria has tried unsuccessfully to become a leader in the steel manufacturing industry with a handful of failed projects like the Ajaokuta steel plant, Delta Steel Company, Osogbo and Jos rolling mills even under government and private ownership.

Like the oil refineries, the federal government under different administrations has spent billions trying to put the local steel plants to work but has been unsuccessful.

The administration of President Bola Tinubu had promised during the campaigns to ensure steel production starts in the multi-billion-dollar Ajaokuta steel complex.

Dangote investment in the industry might have been a game changer, attracting more capital and economic opportunity to the sector.

However, with the recent revelation and decision from the African richest man, the steel industry may still linger in the shadow of under investment for years to come.

Economy

SEE Dollar to Naira Exchange Rate at the Black Market Today, July 20, 2024

Many Nigerians, especially those engaged in foreign trade, travel, and investment, always tend to be very sensitive and inquisitive about the US dollar-to-naira exchange rate. Parallel market rates, otherwise referred to as black market or Aboki FX rates, would often show different prices from the official Central Bank of Nigeria current rates. For many, this is a critical source of foreign exchange. How much is a dollar to naira now in black market? Dollar to naira exchange rate at black market yesterday (Aboki dollar rate): The exchange rate for a dollar to naira selling at Lagos Parallel Market (Black Market), yesterday, July 19, 2024, players bought dollars for N 1555 and sold at N 1565 according to sources at Bureau De Change, BDC.

Please take note that the Central Bank of Nigeria does not recognize the parallel market, popularly known as the black market, for it has directed anybody willing to sell Forex to go to their respective banks. Dollar to Naira Black Market Rate Today, July 20, 2024 Advertisement Buying Rate: N1575 Selling Rate: N1580 Dollar to Naira CBN Exchange Rate Some stability may come with a government-regulated setting of official rates by the Central Bank of Nigeria. View current rates below:

Dollar to Naira (USD to NGN) CBN Rate Today: Buying Rate: N1655 Selling Rate: N1656 These rates reflect government policies aimed at stabilizing the naira and managing foreign exchange reserves. Businesses and individuals who prefer regulated transactions frequently utilise these rates for their transactions. Please note that the rate at which you are selling or buying forex may not be the same during capture in this piece because prices keep varying.

Dollar to Naira Exchange Rate at Black Market (Aboki FX) July 20, 2024: USD to NGN CBN Rate Advertisement Pounds and Euro to Naira Exchange Rates For those dealing with currencies other than the US dollar, here are the latest rates: Pounds to Naira (CBN Rates) Buying Rate: ₦2,107 Selling Rate: ₦2,108 Euro to Naira (Black Market Rates) Buying Rate: ₦1,767 Selling Rate: ₦1,769

These rates are also subject to market conditions and economic policies.

-

News23 hours ago

News23 hours agoIwuanyanwu was a Heavyweight in all ramifications-Abaribe

-

News22 hours ago

News22 hours agoTinubu, Southern Govs Mourn Iwuanyanwu

-

News21 hours ago

News21 hours agoSokoto Governor, Aliyu’s Wife Holds Lavish Birthday As Guests Spray Dollar Notes On Her Amid Hunger, Hardship

-

News21 hours ago

News21 hours agoProtest: President Tinubu In Closed-door Meeting With Traditional Rulers (Video)

-

News23 hours ago

News23 hours agoTinubu’s Presidency Is Failing Nigerians – Afenifere

-

News18 hours ago

News18 hours agoNationwide protest: ‘Airport Is Filled Up, Govs, Senators, Reps, Ministers Traveling Abroad’ — Fayose

-

News23 hours ago

News23 hours agoIGP Orders DPOs, Their Men To Storm Vulcanizer Shops Ahead Of Planned Nationwide Protest

-

Metro22 hours ago

Metro22 hours ago8 School Children Rescued In Lokoja Auto Crash