News

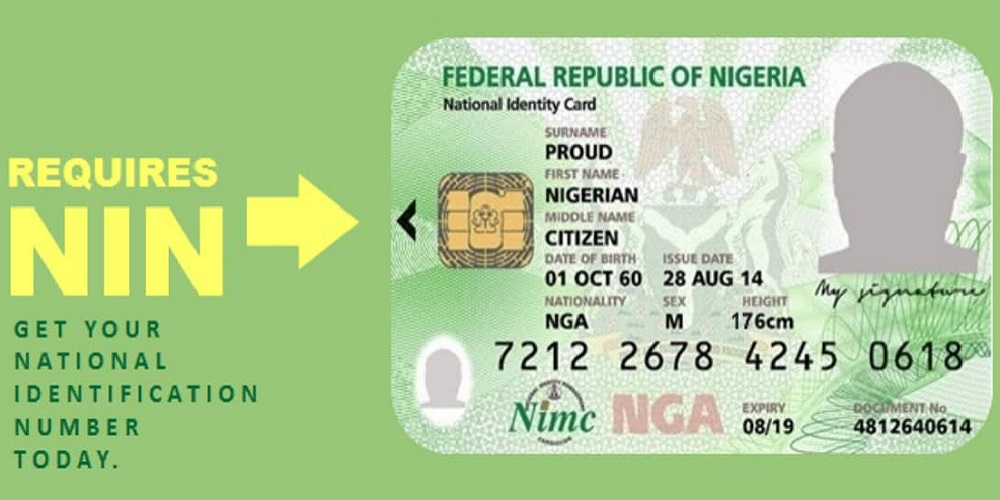

Deadline on NIN/account linkage: Most banks yet to implement directive

As the deadline given to banks to link all bank accounts to NIN elapsed last Thursday, many banks in the country are yet to implement the directive.

Recall that the Central Bank of Nigeria, CBN had issued a directive to all commercial banks in the country last year to restrict tier-1 accounts without proper Biometric Verification Number, BVN and National Identity Number, NIN link by Thursday, March 1st, 2024. And as at that date, approximately 91 million bank accounts faced the risk of being frozen by their respective banks.

Vanguards’ investigation has revealed that against expectations that banks will start blocking accounts not linked to NIN/BVN, few banks were only focused on blocking accounts without BVN but allowed customers that are yet to link their NIN unhindered access to their accounts.

Further investigation also revealed that some customers that have not linked their SIM cards to their NIN were barred by their network providers from using the SIM cards, which consequently affected the mobile transactions of such customers.

Vanguard’s visit to some of the new generation banks around Old Ojo Road at Abulado axis in Lagos State showed partial compliance to the CBN’s directive.

Out of the four banks (Zenith Bank, Ecobank, Access Bank, and Stanbic IBTC Bank) visited by Vanguard only Zenith Bank has started implementation of the directive.

When Vanguard visited Zenith Bank branch around the axis, some customers who visited the bank to rectify blockage were seen trying to fill NIN update form in order to have their accounts unblocked.

An official of the bank told our correspondent that several accounts have been blocked as a result of non-linkage of customers’ account to NIN.

“Several accounts that are not linked to NIN, especially corporate accounts, have been blocked. People who are affected have been coming in to sort it out. Once you fill the NIN update form and submit, the account will be unblocked,” he said.

A customer of Zenith Bank, who simply identified herself as Ngozi, told Vanguard that two separate transfers she made did not go through even though she was debited.

“When I came to the bank to find out what happened, they said that I have to link my NIN to my account,” she said.

However, a customer relations staff at Stanbic IBTC Bank told Vanguard that no account has been blocked in the bank due to non-compliance.

“I am not aware of any customer’s that has been as a result of failure to link their account to NIN. Nobody has complained about it today” she said.

Our findings also revealed that Ecobank has not started implementation of the directive as well. An official of the bank, who spoke with our correspondent, simply said that no account has been blocked and she isn’t aware of when the bank would start implementing the directive.

The story was the same at Access Bank where customers have full access to their accounts without any form of hindrance.

A customer relations officer at the bank told our correspondent that only accounts without BVN are being denied access.

Meanwhile, a visit to GT Bank located along Lasu-Igando road showed that the bank is yet to commence implementation.

Speaking on the development, Mrs Ibekwe Onyedikachi, a customer of GT Bank said: “The reason I came to the bank for assistance is not because my GTB account was blocked but because my sister’s GTB account in Nigeria was affected. She cannot carry out any bank transactions because her Nigeria phone number has been barred due to her not linking NIN to her SIM.

Also speaking, Mr Babs who banks with First Bank said: “For some time now I have been receiving messages from my network company that I should link my NIN to my SIM, I have linked my NIN and SIM before, but when the messages kept coming often and often, I decided to go and link my SIM and that was successful.

“It was hectic, trying to link or do anything in Nigeria is always stressing, you will go through hassles to achieve what you would have achieved ordinarily. But I have a First Bank account that I am using, but I cannot use the account for any transaction for now because when I wanted to do a transaction they instructed me to go and link because that account has been barred.”

Meanwhile, a visit to Fidelity Bank in Alaba International Market shows that the bank is yet to implement the directive to block bank accounts that are not linked to NIN.

However, a staff of the bank told Vanguard that the Bank could commence implementation of the directive by the middle of March.

Speaking on the condition of anonymity she said: “For now, our customers are still carrying out their banking transactions without hassles as we are yet to implement the directive. However, information reaching us is that our bank can commence in the middle of the month.”

Also the Alaba International branch of Union Bank is also yet to implement the directive as the bank customers were seen going about their banking transactions unhindered.

Although, the customer care section was crowded with customers wanting to link their NIN to their bank accounts.

Meanwhile in Abuja, some commercial banks have begun implementation of the policy of freezing defaulting accounts.

Checks by Vanguard revealed that some of the banks have already commenced the implementation of the policy, restricting noncompliant customers from accessing their accounts.

When our reporter visited Fidelity bank branch at Federal Housing Estate, FHA, Lugbe, Abuja, staff of the bank confirmed that the policy had commenced and that affected customers were being directed to provide all the necessary information before their accounts could be defrozen.

The banker who pleaded for anonymity said, “Yes we have started implementing the policy, we freeze any account not linked to BVN and NIN, and for us to defreeze such account, the affected customers have to present their NIN, evidence of birth certificate, and make sure that the same names in BVN is what is on the NIN.”

When our reporter visited Wema Bank also in FHA, Lugbe, the story was the same. The bank officials who spoke to our reporter said, “We have started since last week to freeze accounts that were not linked to BVN and NIN. We are a responsible bank and we try as much as possible to follow the CBN directives.”

When asked on the remedy for the affected customers, the banker said, “We have two options for them, either they come to us with their valid identity cards, that is NIN to link their account to BVN or they download the available app and link their NIN to their BVN on their own, they do not necessarily need to come to the bank.”

Some of the bank customers, who spoke to our reporter, confirmed the implementation of the policy by the bank. One of them, Janet Agbo said, “Yes, they have started blocking accounts, they have frozen my own account, I tried to access it few minutes ago and I could not.”

Another bank customer, Uchenna Ekele, who also spoke to our reporter said his account had been frozen but he was going to provide them with all the needed documents to unfreeze it.

Another visit to UBA in the same vicinity showed that the bank is yet to commence the implementation. The head of Customer Care Unit, who spoke to our reporter said, we have not started blocking any account because we have not been given such directive. I am aware that the deadline was last Thursday but we have to be instructed before we can take action on that policy.”

When we paid a similar visit to Polaris bank, the bank officials said, “We have not been given directive to start freezing customers’ accounts that have not been linked to BVN and NIN. We are still receiving customers willing to link their accounts to their BVN and NIN. Until we receive an instruction from the authorities we cannot do otherwise.”

Meanwhile, the World United Consumer Organisation, WUCO, has urged the Central Bank of Nigeria, CBN, to create remote access methods and alternative procedures for Nigerians in diaspora to be able to link their National Identity Number, NIN, and Bank Verification Number, BVN.

The global advocacy group which is dedicated to ensuring equitable access to essential services for consumers worldwide, equally urged the apex bank to reconsider its deadline for NIN/BVN linkage.

In a statement issued on Tuesday, WUCO, through its President and human rights lawyer, Mr. Clement Osuya, stressed that though the CBN’s directive may be well intentioned, “It fails to consider the unique challenges Nigerians living abroad face.”

Credit: Vanguard

News

Total Blackout Looms As Vandals, Again, Attack Transmission Line – TCN

By Kayode Sanni-Arewa

The Transmission Company of Nigeria (TCN) on Thursday said its tower T195 along the Ugwuaji–Makurdi 330 kV transmission line was vandalised on Saturday.

TCN’s General Manager, Public Affairs, Mrs Ndidi Mbah, in a statement in Abuja, said that the vandalism took place at Watuolo village, Utonkon, in Ado Local Government Area of Benue.

Mbah, however, said that the vandalism was thwarted by the vigilance of the community members, who at about 3 a.m. noticed suspicious activity around the tower.

She said that the community members promptly apprehended one of the suspected vandals while the others escaped and handed him over to the police.

”TCN commends the people of Watuolo village for their swift action and vigilance.

”We equally appeal to communities hosting critical infrastructure to emulate this example and take ownership of protecting transmission installations in their vicinity.

As we continue to work with security operatives and host communities against vandalism, we appeal for more vigilance by the residents in the communities, who we believe are very critical in this fight,” she said.

(NAN)

News

Lovers jailed 3 months for adultery in FCT

A Gwagwalada Magistrates’ Court, Abuja on Thursday sentenced two lovers, Mohammed Nazifi, 30, and Bilkisu Ibrahim, 25, to three months imprisonment each for adultery.

The police charged the lovers with a one-count charge of adultery by man and woman, to which they pleaded guilty.

Nazifi pleaded with the court to temper justice with mercy, saying he was a married man with little children to take care of.

Ibrahim also begged the court for mercy, saying she had a 3-year-old child and an aged mother, who depended on her.

The Magistrate, Olatunji Oladunmoye, had previously remanded the convicts in order for them to provide a witness that would vouch for their conduct of good character.

He finally sentenced them when they could not provide any.

Oladunmoye sentenced the lovers to 3 months imprisonment each with an option of N25,000 fine each.

The magistrate said the essence of the punishment was not to ruin or destroy the convicts but to reform them.

He added that it would also serve as a deterrent to anyone who wanted to toe the same path.

Earlier, the prosecutor, Dabo Yakubu, told the court that the complainant, Mr Dayabe Abdullahi of Chibiri village, Kuje, Abuja, reported the matter at the Area Command, Gwagwalada, Abuja on Jan. 16.

Yakubu said that the convicts conspired and had sexual intercourse, and both confessed to the crime in their statements.

He said that the offence contravened the provisions of sections 387 and 388 of the Penal Code.

According to him, sections 387 and 388 refer to a man or a woman subject to customary law where extra-marital sexual intercourse is recognised as a criminal offence.

“If the man or woman has sexual intercourse with anyone other than his spouse, he/she is guilty of adultery and shall be punished with imprisonment for a term. The term may extend to two years or with fine or with both,” he said.

NAN

News

Billionaire kidnapper, Evans Re-Arraigned, Begs For Plea Bargain, clemency

Billionnaire kidnapper Chukwudumeme Onwamadike a.k.a Evans, on Thursday urged the Lagos High Court Ikeja, to consider his application for plea bargain, forgiveness and clemency.

He spoke through his new lawyer, Chief Emefo Otudo, immediately after he was re-arraigned over a five-count charge of alleged murder and kidnapping, by the Lagos State Government.

In the charge filed before Justice Adenike Coker, Evans and one Joseph Nkenna Emeka pleaded not guilty to alleged kidnapping and murder.

According to Evans lawyer, Chief Etudo, the substance of Evans’ application for plea bargain, is with respect to three pending criminal cases on compassionate grounds.

He has earlier been convicted in two other cases with 14 years imprisonment and life jail respectively.

His lawyer told Justice Coker that have been converted to a reasonable human being and being a criminal to a teacher charged entirely Evans name should be graciously dropped from the three pending charges.

He submitted: “That a fresh charge be discretionally filed against the first defendant upon which he will plead guilty and serve 14 years imprisonment If approved.

“That the 14 years imprisonment that may be imposed in the new charge be made to run concurrently with other sentences that might have been given in his other cases listed above.

“Our authority for bringing this application is attached as Appendix 6 and this application supersedes and overrides any previous application made by or on behalf of Mr Onwuamadike for plea bargain.

Speaking further Cheif Otudo told the court that there are five criminal cases against Evans and Lagos state has been prosecuting him for those cases and have gained conviction in two.

He said during the cause of the prosecution Evans has been incarcerated for about eight years.

“While in prison, the Federal Government offered the first defendant and other inmates a second chance and offered them opportunity to to go to school.

“The first defendant (Evans) accepted offer to be educated as they were given scholarship by Federal Government. He has now earned an NCE teaching certificate in Economics.

“He is now a teacher and no longer a criminal. Copy of his NCE certificate and the project he did are attached as appendix 1 & 2.

“Mr Chukwudumeme Onwuamadike was also given admission in the National Open University of Nigeria under the scholarship granted by the Federal Government.

“He is now in 200 level in National Open University of Nigeria offering political Science. Copy of his admission letter is attached as appendix 3. And copy of his ID Card in National Open University of Nigeria is attached as appendix

4.

“Mr Onwuamadike has also learnt technology under the Federal Ministry of Labour and Productivity; to wit, welding and metal fabrication and passed all tests. Copy of the test by Ministry of Labour and Productivity is attached as appendix 5.

Justice Coker told both the Prosecuting lawyer, Mr A. Y. Sule and Chief Otudo representing both parties to wait till March 20, when decision of the committee set up by the Lagos State government on Evans’ application would have been released.

-

News21 hours ago

News21 hours agoNew palaver in Afenifere over Dele Farotimi’s Appointment

-

News24 hours ago

News24 hours agoUK appoints British-Nigerian as trade envoy to Nigeria

-

Economy10 hours ago

Economy10 hours agoSEE Current Black Market Dollar (USD) To Naira (NGN) Exchange Rate

-

News10 hours ago

News10 hours agoBREAKING! Trump’s order on stopping aids for HIV/AIDS affects Nigeria as National Lab for samples allegedly shuts down

-

News23 hours ago

News23 hours agoJudge orders Nigerian professor’s arrest over electoral fraud

-

News10 hours ago

News10 hours agoEFCC nabs ex- NHIS Executive Secretary, Professor Usman Yusuf

-

News10 hours ago

News10 hours agoDaring Sowore Says I’ll Still Reject That Stupid Bail Condition Even If Tinubu Appears As My Surety

-

News9 hours ago

News9 hours agoDistribution of HIV drugs in poor countries stopped as Trump freezes foreign aid