News

Deadline on NIN/account linkage: Most banks yet to implement directive

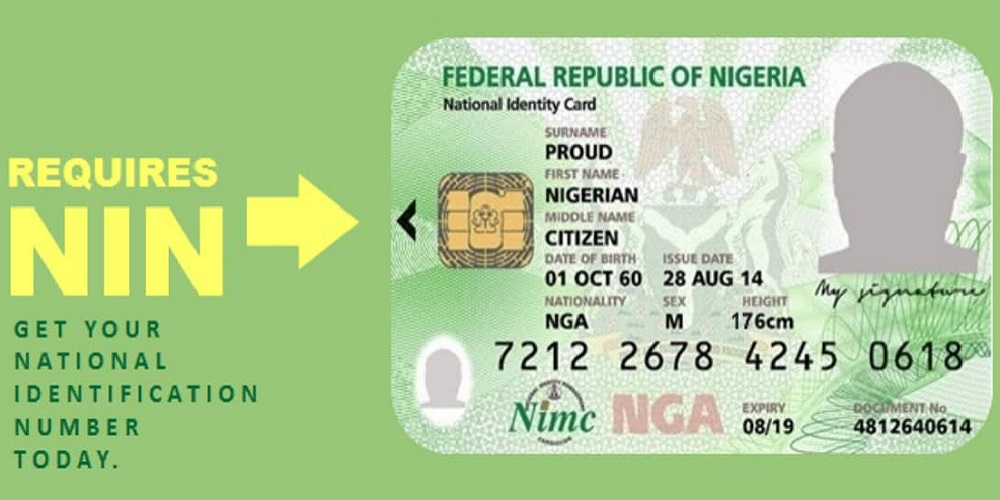

As the deadline given to banks to link all bank accounts to NIN elapsed last Thursday, many banks in the country are yet to implement the directive.

Recall that the Central Bank of Nigeria, CBN had issued a directive to all commercial banks in the country last year to restrict tier-1 accounts without proper Biometric Verification Number, BVN and National Identity Number, NIN link by Thursday, March 1st, 2024. And as at that date, approximately 91 million bank accounts faced the risk of being frozen by their respective banks.

Vanguards’ investigation has revealed that against expectations that banks will start blocking accounts not linked to NIN/BVN, few banks were only focused on blocking accounts without BVN but allowed customers that are yet to link their NIN unhindered access to their accounts.

Further investigation also revealed that some customers that have not linked their SIM cards to their NIN were barred by their network providers from using the SIM cards, which consequently affected the mobile transactions of such customers.

Vanguard’s visit to some of the new generation banks around Old Ojo Road at Abulado axis in Lagos State showed partial compliance to the CBN’s directive.

Out of the four banks (Zenith Bank, Ecobank, Access Bank, and Stanbic IBTC Bank) visited by Vanguard only Zenith Bank has started implementation of the directive.

When Vanguard visited Zenith Bank branch around the axis, some customers who visited the bank to rectify blockage were seen trying to fill NIN update form in order to have their accounts unblocked.

An official of the bank told our correspondent that several accounts have been blocked as a result of non-linkage of customers’ account to NIN.

“Several accounts that are not linked to NIN, especially corporate accounts, have been blocked. People who are affected have been coming in to sort it out. Once you fill the NIN update form and submit, the account will be unblocked,” he said.

A customer of Zenith Bank, who simply identified herself as Ngozi, told Vanguard that two separate transfers she made did not go through even though she was debited.

“When I came to the bank to find out what happened, they said that I have to link my NIN to my account,” she said.

However, a customer relations staff at Stanbic IBTC Bank told Vanguard that no account has been blocked in the bank due to non-compliance.

“I am not aware of any customer’s that has been as a result of failure to link their account to NIN. Nobody has complained about it today” she said.

Our findings also revealed that Ecobank has not started implementation of the directive as well. An official of the bank, who spoke with our correspondent, simply said that no account has been blocked and she isn’t aware of when the bank would start implementing the directive.

The story was the same at Access Bank where customers have full access to their accounts without any form of hindrance.

A customer relations officer at the bank told our correspondent that only accounts without BVN are being denied access.

Meanwhile, a visit to GT Bank located along Lasu-Igando road showed that the bank is yet to commence implementation.

Speaking on the development, Mrs Ibekwe Onyedikachi, a customer of GT Bank said: “The reason I came to the bank for assistance is not because my GTB account was blocked but because my sister’s GTB account in Nigeria was affected. She cannot carry out any bank transactions because her Nigeria phone number has been barred due to her not linking NIN to her SIM.

Also speaking, Mr Babs who banks with First Bank said: “For some time now I have been receiving messages from my network company that I should link my NIN to my SIM, I have linked my NIN and SIM before, but when the messages kept coming often and often, I decided to go and link my SIM and that was successful.

“It was hectic, trying to link or do anything in Nigeria is always stressing, you will go through hassles to achieve what you would have achieved ordinarily. But I have a First Bank account that I am using, but I cannot use the account for any transaction for now because when I wanted to do a transaction they instructed me to go and link because that account has been barred.”

Meanwhile, a visit to Fidelity Bank in Alaba International Market shows that the bank is yet to implement the directive to block bank accounts that are not linked to NIN.

However, a staff of the bank told Vanguard that the Bank could commence implementation of the directive by the middle of March.

Speaking on the condition of anonymity she said: “For now, our customers are still carrying out their banking transactions without hassles as we are yet to implement the directive. However, information reaching us is that our bank can commence in the middle of the month.”

Also the Alaba International branch of Union Bank is also yet to implement the directive as the bank customers were seen going about their banking transactions unhindered.

Although, the customer care section was crowded with customers wanting to link their NIN to their bank accounts.

Meanwhile in Abuja, some commercial banks have begun implementation of the policy of freezing defaulting accounts.

Checks by Vanguard revealed that some of the banks have already commenced the implementation of the policy, restricting noncompliant customers from accessing their accounts.

When our reporter visited Fidelity bank branch at Federal Housing Estate, FHA, Lugbe, Abuja, staff of the bank confirmed that the policy had commenced and that affected customers were being directed to provide all the necessary information before their accounts could be defrozen.

The banker who pleaded for anonymity said, “Yes we have started implementing the policy, we freeze any account not linked to BVN and NIN, and for us to defreeze such account, the affected customers have to present their NIN, evidence of birth certificate, and make sure that the same names in BVN is what is on the NIN.”

When our reporter visited Wema Bank also in FHA, Lugbe, the story was the same. The bank officials who spoke to our reporter said, “We have started since last week to freeze accounts that were not linked to BVN and NIN. We are a responsible bank and we try as much as possible to follow the CBN directives.”

When asked on the remedy for the affected customers, the banker said, “We have two options for them, either they come to us with their valid identity cards, that is NIN to link their account to BVN or they download the available app and link their NIN to their BVN on their own, they do not necessarily need to come to the bank.”

Some of the bank customers, who spoke to our reporter, confirmed the implementation of the policy by the bank. One of them, Janet Agbo said, “Yes, they have started blocking accounts, they have frozen my own account, I tried to access it few minutes ago and I could not.”

Another bank customer, Uchenna Ekele, who also spoke to our reporter said his account had been frozen but he was going to provide them with all the needed documents to unfreeze it.

Another visit to UBA in the same vicinity showed that the bank is yet to commence the implementation. The head of Customer Care Unit, who spoke to our reporter said, we have not started blocking any account because we have not been given such directive. I am aware that the deadline was last Thursday but we have to be instructed before we can take action on that policy.”

When we paid a similar visit to Polaris bank, the bank officials said, “We have not been given directive to start freezing customers’ accounts that have not been linked to BVN and NIN. We are still receiving customers willing to link their accounts to their BVN and NIN. Until we receive an instruction from the authorities we cannot do otherwise.”

Meanwhile, the World United Consumer Organisation, WUCO, has urged the Central Bank of Nigeria, CBN, to create remote access methods and alternative procedures for Nigerians in diaspora to be able to link their National Identity Number, NIN, and Bank Verification Number, BVN.

The global advocacy group which is dedicated to ensuring equitable access to essential services for consumers worldwide, equally urged the apex bank to reconsider its deadline for NIN/BVN linkage.

In a statement issued on Tuesday, WUCO, through its President and human rights lawyer, Mr. Clement Osuya, stressed that though the CBN’s directive may be well intentioned, “It fails to consider the unique challenges Nigerians living abroad face.”

Credit: Vanguard

News

Finally, IGP approves hunger protests across Nigeria

The Nigerian police has finally approved the planned nationwide protests and outlined conditions for participants.

The Inspector General of Police, Kayode Egbetokun, revealed this on Friday while addressing journalists in Abuja.

He urged all groups planning to participate in the proposed nationwide protest to submit their details to the Commissioners of Police in their respective states.

The police boss said this was to ensure the protest was peaceful.

Egbetokun said, “We acknowledge the constitutional right of Nigerian citizens to peaceful assembly and protest.

“However, in the interest of public safety and order, we urge all groups planning to protest to provide necessary details to the Commissioner of Police in the state where the protest is intended to take place.

“To facilitate a successful and incident-free protest, they should please provide the following information: state the proposed protest routes and assembly points; expected duration of the protest; and names and contact details of protest leaders and organisers.”

The police boss said the information expected from the organisers also include measures to prevent hijacking by criminal elements, as well as key identifiers for possible isolation of potential troublemakers.

By providing the information, he said, the police will be able to deploy adequate personnel and resources to ensure public safety.

He said the police needed to know the specific routes and areas for the protest to avoid conflicts with other events or activities.

Mr Egbetokun said the police will “establish clear communication channels with protest leaders to address any concerns or issues that may arise; minimise the risk of violence, property damage, or other criminal activity.

“We encourage all protesters to cooperate with the police, obey the law, and adhere to global best practices for peaceful assembly to guarantee a safe and successful exercise of their rights.

News

Reps North-West Caucus Beg Youths, Citizens In The Region Not To Join Planned Protest

News

Reps Applaud FCT Minister, Wike On AICL Improved Revenue, Infrastructure

-

News23 hours ago

News23 hours agoIwuanyanwu was a Heavyweight in all ramifications-Abaribe

-

News22 hours ago

News22 hours agoTinubu, Southern Govs Mourn Iwuanyanwu

-

News22 hours ago

News22 hours agoSokoto Governor, Aliyu’s Wife Holds Lavish Birthday As Guests Spray Dollar Notes On Her Amid Hunger, Hardship

-

News22 hours ago

News22 hours agoProtest: President Tinubu In Closed-door Meeting With Traditional Rulers (Video)

-

News23 hours ago

News23 hours agoTinubu’s Presidency Is Failing Nigerians – Afenifere

-

News18 hours ago

News18 hours agoNationwide protest: ‘Airport Is Filled Up, Govs, Senators, Reps, Ministers Traveling Abroad’ — Fayose

-

News23 hours ago

News23 hours agoIGP Orders DPOs, Their Men To Storm Vulcanizer Shops Ahead Of Planned Nationwide Protest

-

Metro22 hours ago

Metro22 hours ago8 School Children Rescued In Lokoja Auto Crash