Economy

Tinubu wants Fresh Court order to extend detention of Binance Officials

The Federal Government of Nigeria, under President Tinubu‘s administration, has sought an extension of the detention of two Binance officials.

The Economic and Financial Crimes Commission (EFCC) went to the magistrate’s court in Abuja seeking a new order to extend the detention of the US citizen Tigran Gambaryan and the British Kenyan Nadeem Anjarwalla. This is one of the developments in Nigeria’s wide crackdown on cryptocurrency platforms.

Gambaryan and Anjarwalla have been in custody for the last fortnight. The EFCC seeks further remand of the individuals while investigations are in progress. The first court decree permitting their confinement expired on Tuesday. When contacted, the EFCC spokesman, Dele Oyewale, declined to comment on the issue.

Nigeria’s government has also stepped up efforts to control the cryptocurrency market. It claims that platforms such as Binance enable currency speculation. As a result, the national economy suffers. Nigerian users have been denied access to Binance’s website as part of these regulatory measures.

The Governor of the Central Bank of Nigeria, Olayemi Cardoso, noted that over 26 billion dollars went through Binance in the last year. The media aide Bayo Onanuga has stated that the cryptocurrency platforms are engaged in rate manipulation and economic sabotage. In the wake of the government’s crackdown and the arrest of its officials, Binance declared that it is stopping naira transactions. It also left the Nigerian market.

The long detention of Gambaryan and Anjarwalla has caused much suffering to their families. Gambaryan’s wife has mentioned the trouble this poses for the family, especially the children, who almost daily ask when their father will be home. The cryptocurrency platform that employs these arrested officials is Binance, and they have said they are collaborating with the Nigerian authorities to free them. Nonetheless, it has avoided giving any details about the case itself.

Additionally, Nigeria’s Securities and Exchange Commission (SEC) has suggested a considerable raise in the minimum paid-up capital for crypto exchange registration. The current minimum of ₦500 million ($314,000) will increase to ₦1 billion ($628,000).

This proposal is designed to enhance supervision and reduce risks in the cryptocurrency industry. The SEC’s move is part of a general drive to improve the criteria of the registered crypto exchange within the dynamic digital currency world.

Economy

Guinness loss widens to N54.76bn as finance cost spikes by over 100%

Guinness Nigeria Plc has released its audited financial statements for the year ended June 30, 2024.

Guinness Nigeria Plc loss for the year came in higher at N54.766billion, from loss of N18.168billion in 2023, representing 201percent increase.

The company’s net finance costs rose by 117.79 percent to N99.087billion in 2024, from N45.496billion in 2023. Its loss before income tax (LBT) rose to N73.679billion from N22.138billion loss before tax in 2023 financial year.

The brewer’s full year revenue of N299.489billion as against N229.440billion represents 31percent increase. Its profit from operating activities printed at N25.407billion in 2024, from N23.357billion in 2023, up 9percent.

The brewer’s full year revenue of N299.489billion as against N229.440billion represents 31percent increase. Its profit from operating activities printed at N25.407billion in 2024, from N23.357billion in 2023, up 9percent.

Economy

Windfall tax: FG insists on sanctions for defaulting bank chiefs

The Federal Government has reiterated that the principal officers of banks who refuse to comply with the law on the windfall tax on banks’ foreign exchange profits will be sanctioned.

The government’s position was reiterated on Monday at the National Assembly when the Minister of Finance, Wale Edun, and the Chairman of the Federal Inland Revenue Service, Zack Adediji, met with the finance committees of both chambers on the Amendment of the Finance Bill, 2024.

Last week Wednesday, the Senate gave expeditious passage to President Bola Tinubu’s request to amend the Finance Act to impose a one-time windfall tax on banks’ foreign exchange profits in 2023.

A windfall tax is a higher tax levied by the government on sectors or businesses that have disproportionately benefited from favourable market conditions.

The President said the money would be part of the revenue used to fund the additional N6.2tn added to the 2024 budget.

The bill which has passed the second reading states, “The Federal Inland Revenue shall assess the realised profits, collect, account, and enforce payment of levy payable under section 30 in accordance with the powers of the Service under the Federal Inland Revenue Service (Establishment) Act 2007; and in the exercise of its functions in 32(a) above, may enter into a deferred payment agreement with the assessed banks, provided that such deferred payment agreement is executed on or before December 31, 2024.

“Any bank that fails to pay the windfall profit levy to the service and has not executed a deferred payment agreement before December 31, 2024, commits an offence and shall, upon conviction, be liable to pay the windfall profit levy withheld or not remitted in addition to a penalty of 10 per cent of the levy withheld or not remitted per annum and interest at the prevailing Central Bank of Nigeria minimum rediscount rate and imprisonment of its principal officers for a period of not more than three years.

“Financial year means either the year commencing from January 1, 2023 to December 31, 2023, or any period within the financial year not aligned with the calendar year comprising twelve calendar months of the bank’s financial activity,” it added.

Speaking at the meeting, Edun said, the “bank windfall” profit levy, though small still constituted an important contribution to government finances at a time when revenues had substantially increased despite minimising taxes.

In his explanation, the FIRS chairman explained that the windfall tax was not a new tax imposed on banks.

Adedeji said, “These are the gains that you have without any contribution from you, without any value addition. They result from the effect of an adverse activity on others. And who are these others? If you look at the report of all manufacturing entities in the last one and a half years, you will discover that a lot of registered companies recorded huge losses from exchange transactions.

“Anywhere in the world, your duty as the government is to redistribute the wealth to sustain the progress and prosperity of the nation.

“So the loss suffered by manufacturing, as a result of these foreign gains, which is being recorded in the bank is what the government seeks to redistribute. And that is why we have this levy.

“So we seek your permission and your understanding in balancing this economic inequality that has occasioned due to the circumstances that we find ourselves.”

Speaking on the sharing formula, the FIRS chairman proposed that it be distributed 50/50 between banks and the government.

He said, “These gains that are realised, the levy proposal today is 50 (per cent) for the bank and 50 (per cent) for the government.”

Raising the issue of penalty as stated in the bill, Senator Isah Jibrin ( APC, Kogi East), asked that the bill be more explicit.

He said, “My area of worry is concerning the penalty, we need to be very explicit on it.

“On the issue of penalty, here it is stated, 10 per cent of the tax withheld or not remitted per annum and interest at the prevailing Central Bank of Nigeria MRR. So what are we going to do? 10 per cent is like coming from nowhere, so I would suggest that we align the MRR.”

“Then at what point does the issue of imprisonment of the officials come in? At what point do we now say, okay, enough is enough and the officials should be arrested after default, is it after a month, a year, two years, or three years.”

Responding to this, Edun said it was unlikely that banks would defy the government, but noted there were penalties for those who defaulted.

The finance minister said, “To be fair to the banks there is no reason to assume that’s what they trying to do. Let us give the benefit of the doubt to one another.

“Well there has to be, there has to be something that will serve as a deterrent. The penalties have to be there. And at the end of the day, tax evasion is a criminal offence.

“For underreporting of profits by the bank, we have enough technical ability to look at what the bank’s audited accounts say and track the level of foreign exchange and the profits therefrom.”

Adedeji also allayed fears regarding possible cases of underreporting.

He noted that the CBN in a memo in September 2023 and March this year had directed commercial banks in the country not to touch or spend the profits they made from foreign exchange transactions.

Economy

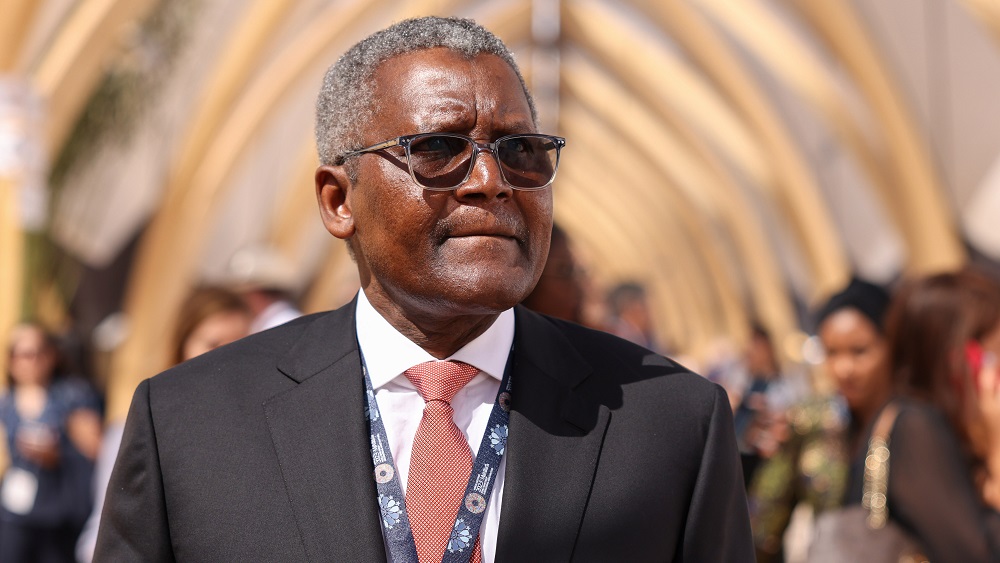

Dangote to scrap steel investment plan in Nigeria over allegations of monopoly

The President and Chief Executive Officer (CEO) of Dangote Group, Aliko Dangote, has announced that the company will abandon its plans to enter Nigeria’s steel industry to avoid being branded a monopoly.

Dangote made this disclosure in a statement on Saturday while addressing journalists at his refinery in Lagos.

The business tycoon explained that the company’s board decided to avoid the steel industry to prevent accusations of attempting to monopolize it.

Furthermore, he noted that pursuing this venture would involve encouraging the importation of raw materials from overseas, which contradicts the firm’s core mandate.

“You know, about doing a new business which we announced, that is, the steel.

“Actually, our own board has decided that we shouldn’t do the steel because if we do the steel business, we will be called all sorts of names like monopoly. And then also, imports will be encouraged. So we don’t want to go into that,” he said.

Dangote, however, urged other Nigerians to invest in the industry to help boost the country’s economy.

“Let other Nigerians go and do it. We are not the only Nigerians here. There are some Nigerians with more cash than us. They should bring that money from Dubai and other parts of the world and invest in our own fatherland,” the CEO added.

In June, Nairametrics reported that Aliko Dangote said his company plans to delve into steel production in the near future stating that he wants to ensure that every steel used in West Africa comes from Nigeria.

He noted that the next venture after the refinery project would be in steel manufacturing and ensure that all steel products used in West Africa come from Nigeria.

“I don’t like people coming to take our solid minerals to process and bring the finished product. We should try and industrialise our continent and take it to the next level.

“I told somebody we are not going to take any break. What we are trying to do is to make sure at least in West Africa, we want to make sure that every single steel that we use will come from Nigeria”, Dangote said at that time.

Nigeria has tried unsuccessfully to become a leader in the steel manufacturing industry with a handful of failed projects like the Ajaokuta steel plant, Delta Steel Company, Osogbo and Jos rolling mills even under government and private ownership.

Like the oil refineries, the federal government under different administrations has spent billions trying to put the local steel plants to work but has been unsuccessful.

The administration of President Bola Tinubu had promised during the campaigns to ensure steel production starts in the multi-billion-dollar Ajaokuta steel complex.

Dangote investment in the industry might have been a game changer, attracting more capital and economic opportunity to the sector.

However, with the recent revelation and decision from the African richest man, the steel industry may still linger in the shadow of under investment for years to come.

-

News23 hours ago

News23 hours agoTinubu, Southern Govs Mourn Iwuanyanwu

-

News23 hours ago

News23 hours agoSokoto Governor, Aliyu’s Wife Holds Lavish Birthday As Guests Spray Dollar Notes On Her Amid Hunger, Hardship

-

News23 hours ago

News23 hours agoProtest: President Tinubu In Closed-door Meeting With Traditional Rulers (Video)

-

News20 hours ago

News20 hours agoNationwide protest: ‘Airport Is Filled Up, Govs, Senators, Reps, Ministers Traveling Abroad’ — Fayose

-

News24 hours ago

News24 hours agoCourt fixes date to hear suit challenging Shaibu’s reinstatement

-

Metro24 hours ago

Metro24 hours ago8 School Children Rescued In Lokoja Auto Crash

-

Politics12 hours ago

Politics12 hours agoBreaking! LP crisis takes fresh twist as ‘new’ chairman emergesl

-

Sports24 hours ago

Sports24 hours agoOLYMPICS; Brazil hammer Super Falcons in opening match