News

Just in: FBNH, UBA, GTCO, Access Bank, drop out of trillion market cap club

By Kayode Sanni-Arewa

Nigerian banks experienced a challenging April, as all major banking stocks posted losses month-to-date.

This downturn coincided with the first month-to-date decline in the NGX All Share Index of the year, which lost 6% in April this year.

The most impacted were the FUGAZ banks—First Bank, UBA, GTCO, Access Bank, and Zenith—although Zenith was the only one to maintain its position in the SWOOT (Stocks Worth Over One Trillion Naira) index.

As of December 2023, Nigeria’s largest banks had a total net asset value of N9.7 trillion but only a combined market capitalization of N4.2 trillion ($ billion), translating to a price-to-book ratio of 0.43, or 43%.

This indicates that investors significantly undervalue banks compared to their book values.

Amid this, challenger banks like Opay and Kuda Bank are valued above $1 billion, despite their smaller operational scales.

According to the Nairametrics SWOOT Index, as of April, FBN Holdings, UBA, GTCO, and Access Bank each fell below the trillion naira market cap, a level they last exceeded in January when they briefly hit this milestone.

Access Bank: Since January, these banks have seen substantial declines in market capitalization.

For instance, Access Bank, Nigeria’s largest bank by assets, last reached the N1 trillion mark in late January.

By the end of April, its market cap had fallen to about N598.9 billion, despite having over N32 trillion in total assets and N2.5 trillion in net assets.

Similarly, UBA, with total assets and net assets of N20.6 trillion and N2 trillion respectively, saw its market cap drop from over N1 trillion in January to N817.3 billion at April’s end.

FBN Holdings, Nigeria’s oldest bank, saw its market cap peak just above N1 trillion in early April but fell to N857.8 billion by April 30th, 2024.

GTCO also experienced a dip; valued above N1 trillion as recently as April 26th, it ended the month with a market capitalization of N962.3 billion.

Zenith Bank, however, remained in the SWOOT, though it risks dropping below if the sell-offs continue into May 2024. It has total and net assets of N20.3 trillion and N2.3 trillion, respectively

Why Nigerian banks are undervalued

Several factors contribute to these low valuations relative to net assets, despite consistent dividend payouts.

Some analysts attribute it to the high liquidity of bank stocks, while others point to a general disinterest in the Nigerian stock market, suggesting that intrinsic stock values are seldom reached.

A more recent factor is the banking recapitalization announcement by the apex bank, which requires banks to raise over N4 trillion in new capital.

This has likely prompted a sell-off, as lower share prices benefit bank shareholders when the capital increase is through a rights issue.

News

Christmas in Naija: How We Dey Manage Celebrate Despite Wahala

News

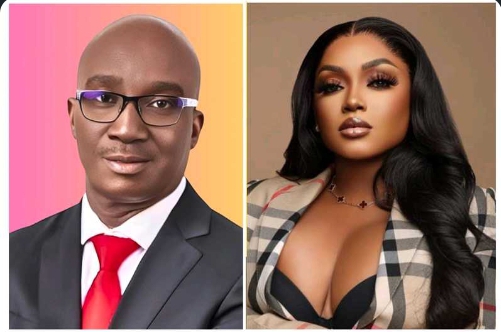

Edo To Get First Lady As Gov Okpebholo Reportedly Set To Quit Bachelorhood

By Kayode Sanni-Arewa

December 24, (THEWILL) – Barring any last minute change of heart, the governor of Edo State, Monday Okpebholo, is allegedly set to marry his side chick, a California-based lady, Jennifer, the daughter of Sharon Ogaga, who is a native of Auchi and is believed to be in her 30s.

THEWILL reports that the marriage is scheduled to be held in Potter Ranch, California, in January 2024, while Aso ebi for the event is being distributed to friends of the bride for a fee around America, Europe and Africa, the letter of invitation only identifies Jennifer, but does not mention the identity of the husband-to-be, in what appears to be a deliberate attempt to mask governor Okpebolo’s identity and shield him from the controversial move.

What is weird is that Jennifer and her family are being coy with the identity of the man she is marrying.

One of THEWILL’s sources, however, has a direct confirmation that Governor Okpebholo is the “husband-in-waiting.”

“They are only telling people that Jennifer is getting married. They are not revealing the identity of the man. It is obvious they are hiding something, probably they don’t want distractions to taint the ceremony,” one of the sources said.

THEWILL does not know the status of Okpebholo’s current marriage to Blessing Okpabi Okpebholo, the mother of his two daughters, who was a no-show during his inauguration as governor.

It, however, appears that their marriage is over because it is illegal to be married to more than one person under the laws of the United States.

According to one of our sources, Senator Adams Oshiomhole allegedly hooked Jennifer up with the governor.

The governor’s Special Adviser on Media, Osiobughie Okhuemoi, said he was unaware of the development when THEWILL contacted him for comments a few days ago.

THE WILL

News

WATCH moment Tinubu hails FCT minister for his doggedness, sterling performance

President Bola Tinubu has described the Federal Capital Territory, FCT, minister Nyesom Wike as a performing and dogged technocrat.

Naijablitznews reports Tinubu made this assertion during his maiden presidential chat on Monday.

The president rounded up by saying “I doff my hat for the performing minister.

Watch clip below:

-

Metro19 hours ago

Metro19 hours agoAppeal Court Affirms 12-Year Jail Term for Businessman Over $1.4 Million Fraud

-

News19 hours ago

News19 hours agoAgain, Senator Manu shares 10,000 bags of rice, 15,000 cartons of spaghetti, transport fares to constituents (Photos/Video)

-

Sports19 hours ago

Sports19 hours agoAlex Iwobi Spreads Holiday Cheer with Free Food Donations in East London

-

Entertainment19 hours ago

Entertainment19 hours agoPortable’s Baby Mama Honey Berry and New Man Dance Romantically to Singer’s Song, Tag Him to Post

-

News18 hours ago

News18 hours agoFG gives banks, telcos six-month ultimatum on N250bn USSD debt

-

News18 hours ago

News18 hours agoCDS Musa sets high bar for newly-decorated Major Generals

-

News18 hours ago

News18 hours agoOutcry against Tax Reform Bills misplaced, says Senator Umeh

-

News18 hours ago

News18 hours agoCourts convict 742 terrorists, free 888